概述

该策略基于相对强弱指数(RSI)指标,通过分析 RSI 值与预设的超买和超卖阈值,在 XAUUSD 上生成交易信号。当 RSI 值跌破超卖阈值时开多头仓位,当 RSI 值突破超买阈值时开空头仓位。该策略还采用了追踪止损和基于账户权益比例的仓位管理,以控制风险。

策略原理

- 计算给定周期的 RSI 值。

- 比较 RSI 值与预设的超买和超卖阈值:

- 当 RSI 值跌破超卖阈值时,开多头仓位。

- 当 RSI 值突破超买阈值时,开空头仓位。

- 基于账户权益的一定比例和预设的止损点数,计算每次交易的仓位大小。

- 对于多头仓位,设置向下的追踪止损;对于空头仓位,设置向上的追踪止损。

- 当价格触及追踪止损或固定止损点位时,平仓。

优势分析

- RSI 指标能够有效捕捉市场的超买和超卖状态,为交易提供良好的入场时机。

- 追踪止损机制能够在价格朝不利方向运行时自动调整止损位置,从而最大限度地保护利润。

- 基于账户权益比例的仓位管理,能够根据当前的账户规模合理分配资金,控制单次交易的风险敞口。

- 策略逻辑清晰,易于理解和实现,适合初学者学习和应用。

风险分析

- RSI 指标在震荡市场中可能会发出频繁且无效的交易信号,导致过度交易和手续费损失。

- 固定的 RSI 超买和超卖阈值可能无法适应不同的市场状态,需要根据市场特点进行优化调整。

- 追踪止损可能会在市场短期波动时被提前触发,导致本可盈利的交易被过早平仓。

- 仓位管理仅考虑了账户权益和固定止损点数,并未考虑价格波动率等其他风险因素,在高波动市场中可能会带来额外风险。

优化方向

- 结合其他技术指标或市场状态判断,对 RSI 信号进行二次确认,以过滤掉无效信号,提高交易质量。

- 对 RSI 超买和超卖阈值进行自适应优化,根据近期市场波动特征动态调整阈值,以适应不同市场状态。

- 优化追踪止损的触发条件和止损幅度,例如根据 ATR 指标设置动态止损,或采用更为灵活的止损策略,如时间止损或走势止损等。

- 在仓位管理中引入更多风险控制因素,如考虑价格波动率、交易频率等,动态调整每次交易的风险敞口,实现更为全面的风险管理。

总结

该策略基于 RSI 指标,通过捕捉超买和超卖状态,在 XAUUSD 上生成交易信号。虽然策略逻辑简单明了,易于实现,但在实际应用中仍需考虑优化交易信号、动态调整参数、完善止损机制和风险管理等方面,以提升策略的稳健性和盈利能力。通过不断的优化和改进,该策略可以成为一个值得参考和学习的量化交易策略。

策略源码

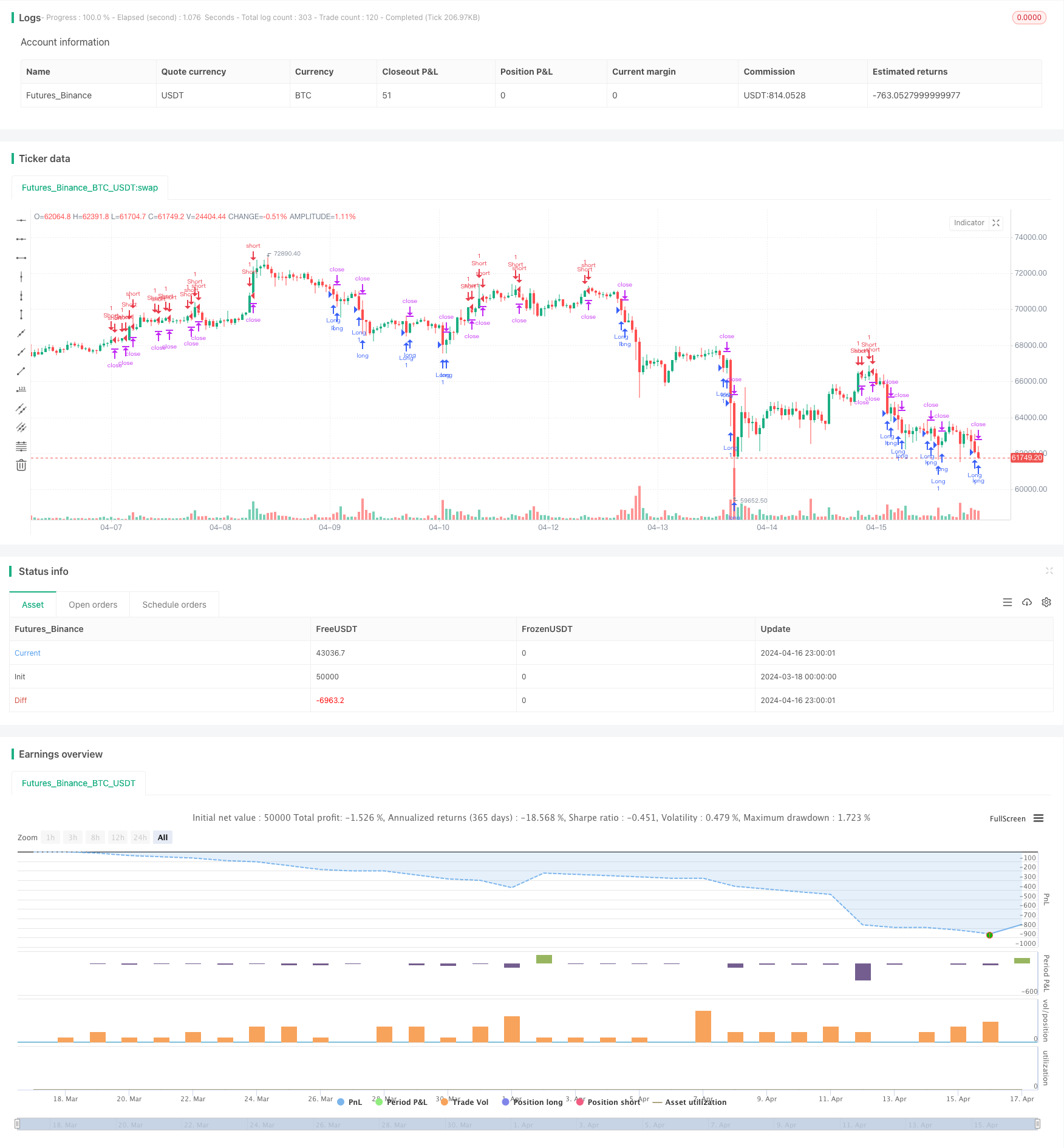

/*backtest

start: 2024-03-18 00:00:00

end: 2024-04-17 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Ds_investimento", overlay=true)

// Parâmetros do RSI

rsi_length = input(7, title="Período do RSI")

rsi_overbought = input(70, title="Overbought (RSI)")

rsi_oversold = input(30, title="Oversold (RSI)")

// Parâmetros do Trailing Stop

trail_offset = input(0.005, title="Trailing Stop Offset")

stop_loss_points = input(10, title="Pontos do Stop Loss")

// Porcentagem da banca a ser arriscada por entrada

risk_percent = input(1, title="Porcentagem de Risco (%)")

// Calcula o tamanho da posição com base na porcentagem de risco, tamanho da banca e pontos de stop loss

equity = strategy.equity

risk_amount = (equity * risk_percent) / 100

lot_size = risk_amount / stop_loss_points

// Calcula o RSI

rsi_value = rsi(close, rsi_length)

// Condições de entrada e saída

long_condition = crossunder(rsi_value, rsi_oversold)

short_condition = crossover(rsi_value, rsi_overbought)

if (long_condition)

strategy.entry("Long", strategy.long, 1)

if (short_condition)

strategy.entry("Short", strategy.short, 1)

// Calcula o Trailing Stop para saída

trail_price_long = close * (1 - trail_offset)

trail_price_short = close * (1 + trail_offset)

// Saída Long/Trailing

strategy.exit("Exit Long/Trailing", from_entry="Long", trail_offset=trail_offset, trail_price=trail_price_long, stop=stop_loss_points)

// Saída Short/Trailing

strategy.exit("Exit Short/Trailing", from_entry="Short", trail_offset=trail_offset, trail_price=trail_price_short, stop=stop_loss_points)

相关推荐