概述

该策略使用多个移动平均线(MA)作为主要的交易信号,并结合平均方向指数(ADX)作为过滤器。策略的主要思路是通过比较快速MA、慢速MA和平均MA的关系,识别潜在的多头和空头机会。同时,使用ADX指标过滤出趋势强度足够的市场环境,以提高交易信号的可靠性。

策略原理

- 计算快速MA、慢速MA和平均MA。

- 通过比较收盘价与慢速MA的关系,识别潜在的多头和空头水平。

- 通过比较收盘价与快速MA的关系,确认多头和空头水平。

- 手动计算ADX指标,用于衡量趋势强度。

- 当快速MA向上穿越平均MA,ADX大于设定阈值,且确认了多头水平时,产生多头进场信号。

- 当快速MA向下穿越平均MA,ADX大于设定阈值,且确认了空头水平时,产生空头进场信号。

- 当收盘价向下穿越慢速MA时,产生多头出场信号;当收盘价向上穿越慢速MA时,产生空头出场信号。

策略优势

- 使用多个MA可以更全面地捕捉市场趋势和动量的变化。

- 通过比较快速MA、慢速MA和平均MA的关系,可以识别出潜在的交易机会。

- 使用ADX指标作为过滤器,可以避免在震荡市场中产生过多的假信号,提高交易信号的可靠性。

- 策略逻辑清晰,易于理解和实现。

策略风险

- 在趋势不明显或市场震荡的情况下,该策略可能会产生较多的假信号,导致频繁交易和损失。

- 策略依赖于MA和ADX等滞后指标,可能会错过一些早期的趋势形成机会。

- 策略的参数设置(如MA长度和ADX阈值)对策略性能有较大影响,需要根据不同市场和品种进行优化。

策略优化方向

- 考虑引入其他技术指标,如RSI、MACD等,以提高交易信号的可靠性和多样性。

- 对于不同的市场环境,可以设置不同的参数组合,以适应市场的变化。

- 引入风险管理措施,如止损和仓位管理,以控制潜在的损失。

- 结合基本面分析,如经济数据、政策变动等,以获得更全面的市场视角。

总结

基于平均方向指数过滤器的均线拒绝策略利用多个MA和ADX指标,识别潜在的交易机会并过滤掉低质量的交易信号。该策略逻辑清晰,易于理解和实现,但在实际应用中需要注意市场环境的变化,并结合其他技术指标和风险管理措施进行优化。

策略源码

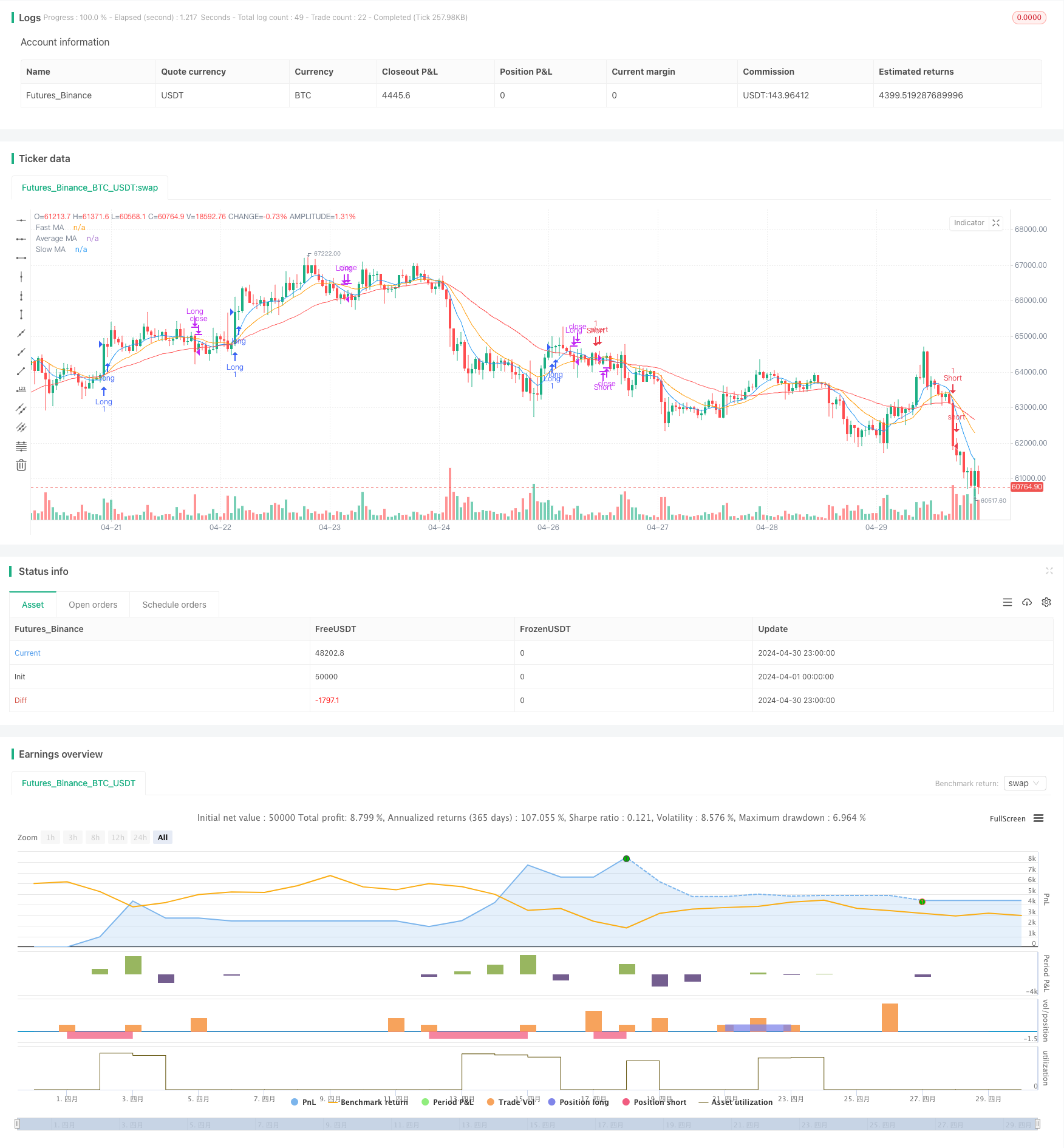

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gavinc745

//@version=5

strategy("MA Rejection Strategy with ADX Filter", overlay=true)

// Input parameters

fastMALength = input.int(10, title="Fast MA Length", minval=1)

slowMALength = input.int(50, title="Slow MA Length", minval=1)

averageMALength = input.int(20, title="Average MA Length", minval=1)

adxLength = input.int(14, title="ADX Length", minval=1)

adxThreshold = input.int(20, title="ADX Threshold", minval=1)

// Calculate moving averages

fastMA = ta.wma(close, fastMALength)

slowMA = ta.wma(close, slowMALength)

averageMA = ta.wma(close, averageMALength)

// Calculate ADX manually

dmPlus = high - high[1]

dmMinus = low[1] - low

trueRange = ta.tr

dmPlusSmoothed = ta.wma(dmPlus > 0 and dmPlus > dmMinus ? dmPlus : 0, adxLength)

dmMinusSmoothed = ta.wma(dmMinus > 0 and dmMinus > dmPlus ? dmMinus : 0, adxLength)

trSmoothed = ta.wma(trueRange, adxLength)

diPlus = dmPlusSmoothed / trSmoothed * 100

diMinus = dmMinusSmoothed / trSmoothed * 100

adx = ta.wma(math.abs(diPlus - diMinus) / (diPlus + diMinus) * 100, adxLength)

// Identify potential levels

potentialLongLevel = low < slowMA and close > slowMA

potentialShortLevel = high > slowMA and close < slowMA

// Confirm levels

confirmedLongLevel = potentialLongLevel and close > fastMA

confirmedShortLevel = potentialShortLevel and close < fastMA

// Entry signals

longEntry = confirmedLongLevel and ta.crossover(fastMA, averageMA) and adx > adxThreshold

shortEntry = confirmedShortLevel and ta.crossunder(fastMA, averageMA) and adx > adxThreshold

// Exit signals

longExit = ta.crossunder(close, slowMA)

shortExit = ta.crossover(close, slowMA)

// Plot signals

plotshape(longEntry, title="Long Entry", location=location.belowbar, style=shape.triangleup, size=size.small, color=color.green)

plotshape(shortEntry, title="Short Entry", location=location.abovebar, style=shape.triangledown, size=size.small, color=color.red)

// Plot moving averages and ADX

plot(fastMA, title="Fast MA", color=color.blue)

plot(slowMA, title="Slow MA", color=color.red)

plot(averageMA, title="Average MA", color=color.orange)

// plot(adx, title="ADX", color=color.purple)

// hline(adxThreshold, title="ADX Threshold", color=color.gray, linestyle=hline.style_dashed)

// Execute trades

if longEntry

strategy.entry("Long", strategy.long)

else if longExit

strategy.close("Long")

if shortEntry

strategy.entry("Short", strategy.short)

else if shortExit

strategy.close("Short")

相关推荐