概述

这是一个基于平均趋向指标(ADX)和价格突破的量化交易策略。该策略主要通过监控ADX指标数值来判断市场趋势强度,并结合价格突破信号来捕捉市场动量。策略设定在特定交易时段内运行,并通过止损和每日交易次数限制来实现风险管理。

策略原理

策略的核心逻辑包含以下几个关键要素: 1. ADX指标监控:使用ADX指标来评估市场趋势强度,当ADX值低于17.5时表明市场可能即将形成新趋势。 2. 价格突破判断:策略会跟踪过去34个周期的最高收盘价,当当前价格突破该阻力位时触发交易信号。 3. 交易时段管理:策略仅在指定的交易时段(0730-1430)内运行,以避免低流动性时段的风险。 4. 风险控制机制: - 设置固定美元止损来限制单笔交易损失 - 限制每个交易时段最多3笔交易 - 交易时段结束时自动平仓所有持仓

策略优势

- 趋势捕捉能力:通过ADX指标和价格突破相结合,能够有效识别市场趋势初期阶段。

- 风险管理完善:包含多层次风险控制措施,如固定止损、交易次数限制和自动收盘机制。

- 自动化程度高:策略逻辑清晰,完全实现自动化交易,无需人工干预。

- 适应性强:可根据不同市场情况调整参数,如止损金额、回溯周期等。

策略风险

- 假突破风险:在震荡市场中可能出现false breakout导致连续止损。

- 参数依赖性:策略效果严重依赖于ADX阈值和回溯周期的设置。

- 时段限制:仅在特定时段交易可能错过其他时段的机会。

- 止损设置:固定美元止损可能在不同波动率环境下不够灵活。

策略优化方向

- 动态止损:建议将固定美元止损改为基于ATR的动态止损,以适应不同的市场波动环境。

- 市场环境过滤:增加波动率过滤器,在高波动率环境下调整或暂停交易。

- 入场优化:可以考虑增加成交量确认,提高突破信号的可靠性。

- 动态参数调整:实现ADX阈值和回溯周期的自适应调整机制。

总结

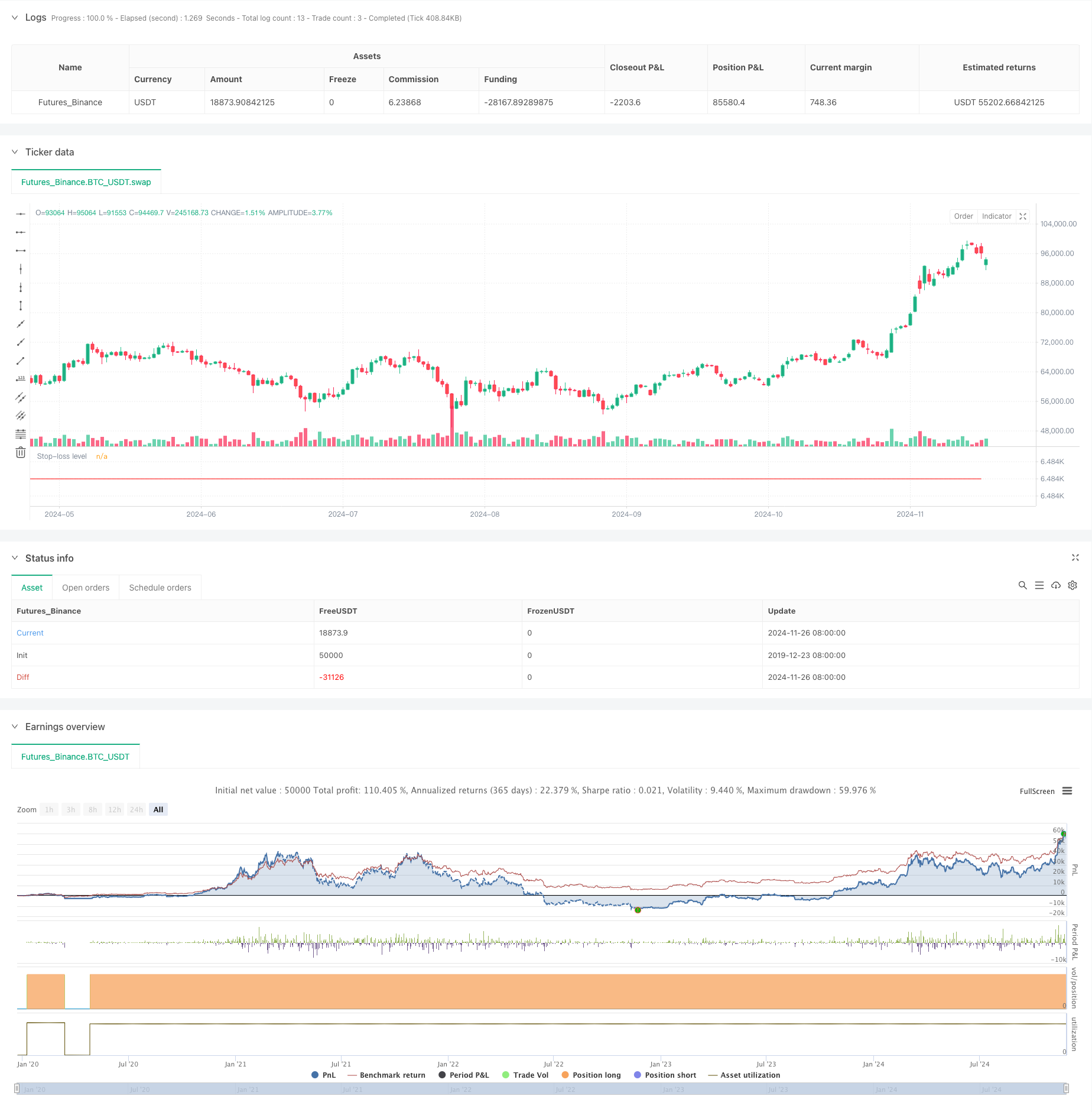

这是一个结构完整、逻辑清晰的趋势跟踪策略。通过将ADX指标与价格突破相结合,在有效的风险管理框架下捕捉市场趋势机会。虽然存在一些优化空间,但策略的基础框架稳健,适合作为量化交易系统的基础组件。建议交易者在实盘之前进行充分的回测和参数优化,并结合市场具体情况进行针对性改进。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © HuntGatherTrade

// ========================

// NQ 30 minute, ES 30 minute

//@version=5

strategy("ADX Breakout", overlay=false, initial_capital=25000, default_qty_value=1)

// ===============================

// Input parameters

// ===============================

stopLoss = input(1000.0, title="Stop Loss ($)", group="Exits")

session = input("0730-1430:1234567", group="Trade Session")

highestLB = input(34, title="Highest lookback window", group="Indicator values")

// ===============================

// Trade Session Handling

// ===============================

t = time(timeframe.period, session)

// Reset numTrades at the start of each session

var int numTrades = 0

is_new_session = ta.change(time("D")) != 0

if is_new_session

numTrades := 0

// ===============================

// Entry Conditions

// ===============================

[plusDI, minusDI, adxValue] = ta.dmi(50, 14)

entryCondition = (close >= ta.highest(close, highestLB)[1]) and (adxValue < 17.5) and (strategy.position_size == 0) and (numTrades < 3) and not na(t)

// ===============================

// 7. Execute Entry

// ===============================

var float stopPricePlot = na

if entryCondition

entryPrice = close + syminfo.mintick

strategy.entry("Long Entry", strategy.long, stop=entryPrice)

//stopPrice = strategy.position_avg_price - (stopLoss / syminfo.pointvalue)

//strategy.exit("Stop Loss", "Long Entry", stop=stopPrice)

numTrades += 1

if (strategy.position_size > 0) and (strategy.position_size[1] == 0)

stopPoints = stopLoss / syminfo.pointvalue

stopPrice = strategy.position_avg_price - stopPoints

stopPrice := math.round(stopPrice / syminfo.mintick) * syminfo.mintick

strategy.exit("Stop Loss", from_entry="Long Entry", stop=stopPrice)

if ta.change(strategy.opentrades) == 1

float entryPrice = strategy.opentrades.entry_price(0)

stopPricePlot := entryPrice - (stopLoss / syminfo.pointvalue)

if ta.change(strategy.closedtrades) == 1

stopPricePlot := na

plot(stopPricePlot, "Stop-loss level", color.red, 1, plot.style_linebr)

// ===============================

// Exit at End of Session

// ===============================

if na(t) and strategy.position_size != 0

strategy.close_all(comment="End of Day Exit")

相关推荐