概述

该策略是一个基于多重技术指标的量化交易系统,整合了指数移动平均线(EMA)、相对强弱指标(RSI)和平均趋向指标(ADX)三大技术指标。策略通过EMA快慢线的交叉信号作为主要入场依据,同时结合RSI指标进行过度买卖的确认,并利用ADX指标判断市场趋势强度,从而形成一个完整的交易决策体系。策略还包含了风险管理模块,通过设定风险收益比来控制每笔交易的止损和止盈位置。

策略原理

策略的核心逻辑基于以下几个关键组成部分: 1. 使用9周期和21周期的EMA作为主要信号系统,通过快线向上穿越慢线产生买入信号,快线向下穿越慢线产生卖出信号 2. 引入RSI作为过滤器,买入信号要求RSI低于60,避免在超买区域入场;卖出信号要求RSI高于40,避免在超卖区域平仓 3. 利用ADX指标确认趋势强度,只有当ADX大于20时才执行交易,确保在明确的趋势中入场 4. 在资金管理方面,策略采用2.0的风险收益比进行止盈止损设置

策略优势

- 多重技术指标的整合提高了信号的可靠性,降低了虚假信号的影响

- EMA交叉系统能够有效捕捉趋势的转折点

- RSI过滤器有效避免了在极端区域的不利入场

- ADX的引入确保了只在明确趋势中交易,提高了胜率

- 固定的风险收益比设置有助于长期稳定的资金增长

- 策略设计了清晰的图形界面,包括交易信号标记和价格标签

策略风险

- 多重指标可能导致信号滞后,影响入场时机

- 在震荡市场中可能产生频繁的交叉信号,增加交易成本

- 固定的RSI和ADX阈值可能不适用于所有市场环境

- 预设的风险收益比可能不适合所有市场阶段

- 没有考虑成交量因素,可能影响信号的可靠性

策略优化方向

- 引入自适应的指标参数,根据市场波动性动态调整EMA周期

- 添加成交量确认机制,提高信号可靠性

- 开发动态的RSI和ADX阈值,适应不同的市场环境

- 根据市场波动率动态调整风险收益比

- 增加时间过滤器,避免在不利时段交易

- 添加市场环境识别模块,在不同市场状态下使用不同的参数设置

总结

这是一个设计合理、逻辑完整的多重技术指标交易策略。通过整合EMA、RSI和ADX三个经典技术指标,策略在趋势跟踪和风险控制方面都有良好的表现。虽然存在一些需要优化的地方,但总体而言该策略具有良好的实用价值和扩展空间。通过建议的优化方向,策略的性能还可以得到进一步提升。

策略源码

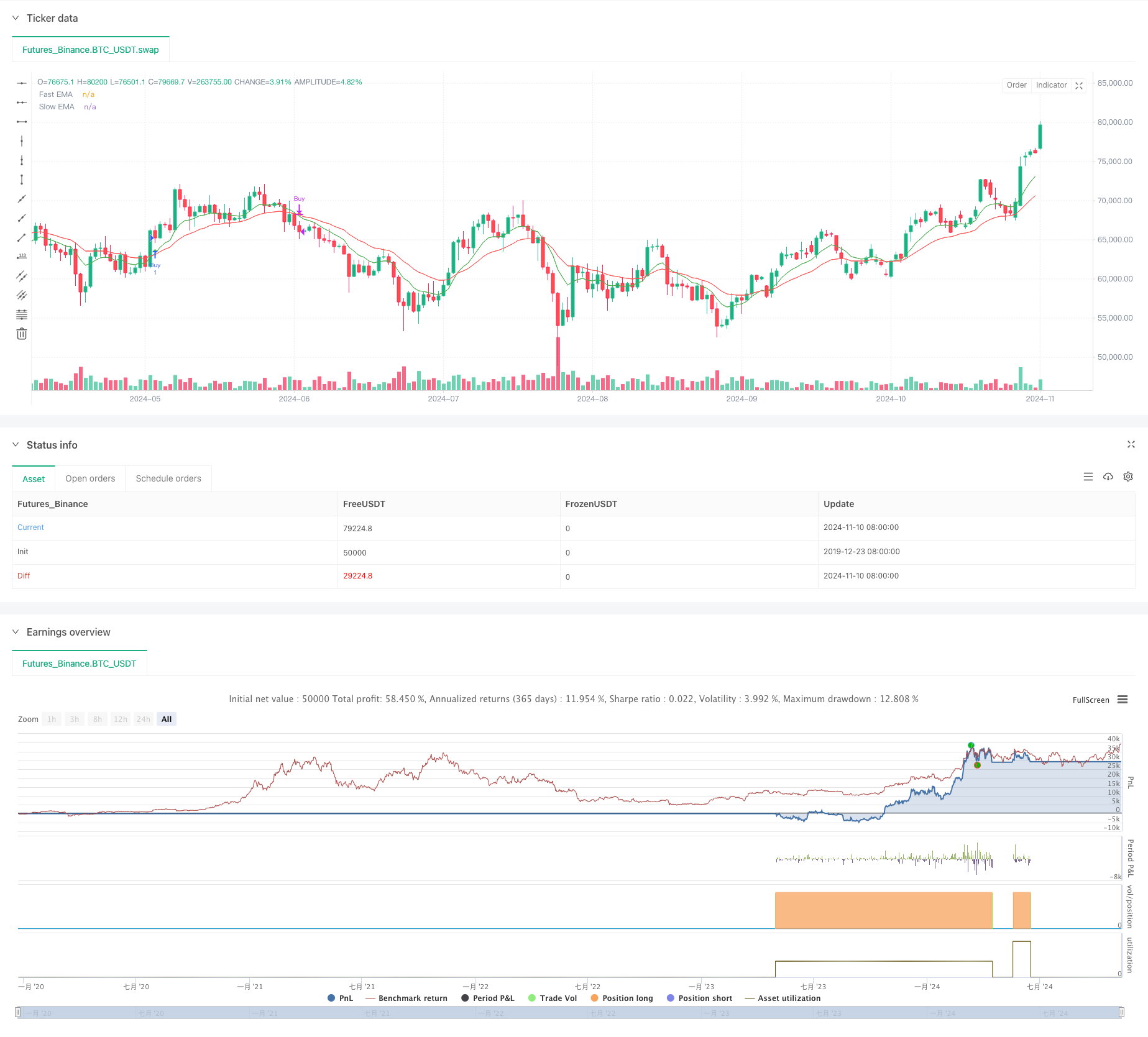

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Enhanced EMA + RSI + ADX Strategy", overlay=true)

// Input parameters

lenFast = input.int(9, title="Fast EMA Length", minval=1)

lenSlow = input.int(21, title="Slow EMA Length", minval=1)

rsiPeriod = input.int(14, title="RSI Period")

adxPeriod = input.int(14, title="ADX Period")

adxSmoothing = input.int(1, title="ADX Smoothing")

adxThreshold = input.int(20, title="ADX Threshold")

riskRewardRatio = input.float(2.0, title="Risk/Reward Ratio")

// EMA Calculations

fastEMA = ta.ema(close, lenFast)

slowEMA = ta.ema(close, lenSlow)

// RSI Calculation

rsiValue = ta.rsi(close, rsiPeriod)

// ADX Calculation

[plusDI, minusDI, adxValue] = ta.dmi(adxPeriod, adxSmoothing)

// Entry Conditions

buyCondition = ta.crossover(fastEMA, slowEMA) and rsiValue < 60 and adxValue > adxThreshold

sellCondition = ta.crossunder(fastEMA, slowEMA) and rsiValue > 40 and adxValue > adxThreshold

// Entry logic

if (buyCondition)

strategy.entry("Buy", strategy.long)

strategy.exit("Sell", from_entry="Buy", limit=close + (close - strategy.position_avg_price) * riskRewardRatio, stop=close - (close - strategy.position_avg_price))

if (sellCondition)

strategy.close("Buy")

// Plotting EMAs (thinner lines)

plot(fastEMA, color=color.new(color.green, 0), title="Fast EMA", linewidth=1)

plot(slowEMA, color=color.new(color.red, 0), title="Slow EMA", linewidth=1)

// Entry and exit markers (larger shapes)

plotshape(series=buyCondition, style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), size=size.normal, title="Buy Signal")

plotshape(series=sellCondition, style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), size=size.normal, title="Sell Signal")

// Displaying price labels for buy/sell signals

if (buyCondition)

label.new(bar_index, low, text="Buy\n" + str.tostring(close), color=color.new(color.green, 0), style=label.style_label_down, textcolor=color.white)

if (sellCondition)

label.new(bar_index, high, text="Sell\n" + str.tostring(close), color=color.new(color.red, 0), style=label.style_label_up, textcolor=color.white)

// Optional: Add alerts for entry signals

alertcondition(buyCondition, title="Buy Alert", message="Buy signal triggered")

alertcondition(sellCondition, title="Sell Alert", message="Sell signal triggered")

相关推荐