概述

该策略利用随机振荡指标(Stochastic Oscillator)来识别市场的超买和超卖状态,在预定义的风险和回报参数下触发交易,以期在波动的交易区间内获利。该策略的主要思路是在交易区间的低点买入,在交易区间的高点卖出,同时严格控制风险。

策略原理

- 当随机振荡指标跌破超卖水平(20)时,策略开仓做多;当随机振荡指标突破超买水平(80)时,策略开仓做空。

- 止损和止盈水平根据平均真实波幅(ATR)的2倍来设置,同时每笔交易的风险控制在账户权益的1%。

- 为了防止过度交易,策略强制每笔交易之间至少间隔20根K线,以留出冷却期并避免波动。

策略优势

- 该策略能够在波动的交易区间内捕捉价格波动,在低点买入,在高点卖出,以期获得利润。

- 策略采用严格的风险管理措施,包括基于ATR的止损和止盈以及每笔交易1%的固定风险,有助于控制回撤和单笔交易损失。

- 通过在交易之间设置最小间隔(20根K线),策略避免了频繁交易和被市场噪音所欺骗。

- 该策略逻辑清晰,易于理解和实施,适合在各种市场环境下应用。

策略风险

- 策略的成功很大程度上取决于正确识别交易区间,如果交易区间识别不准确,可能导致亏损交易。

- 如果市场突破交易区间并形成趋势,该策略可能错失趋势交易机会。

- 尽管策略采取了风险管理措施,但在极端市场条件下,仍可能发生超出预期的损失。

- 策略参数(如超买/超卖水平、ATR倍数等)需要根据不同的市场条件进行优化,不恰当的参数可能导致表现不佳。

策略优化方向

- 考虑结合其他技术指标(如MACD、RSI等)来确认交易信号,提高信号可靠性。

- 引入动态止损和止盈机制,例如随着价格向有利方向移动而调整止损位,以期获得更高的收益率。

- 对于交易区间的识别,可以探索使用更先进的技术,如机器学习算法,以提高准确性。

- 在趋势市场中,可以考虑引入趋势过滤器,以避免在趋势市场中交易。

总结

基于随机振荡指标的波动区间交易策略试图在预先确定的交易区间内,利用随机指标的超买和超卖信号来触发交易。该策略通过严格的风险管理和交易间隔来控制风险。尽管该策略有一定的优势,但其成功很大程度上取决于正确识别交易区间。未来的优化方向包括结合其他技术指标、引入动态止损止盈、使用更先进的区间识别技术以及添加趋势过滤器。在实际应用中,务必根据个人偏好和风险承受能力来调整策略参数和风险管理规则。

策略源码

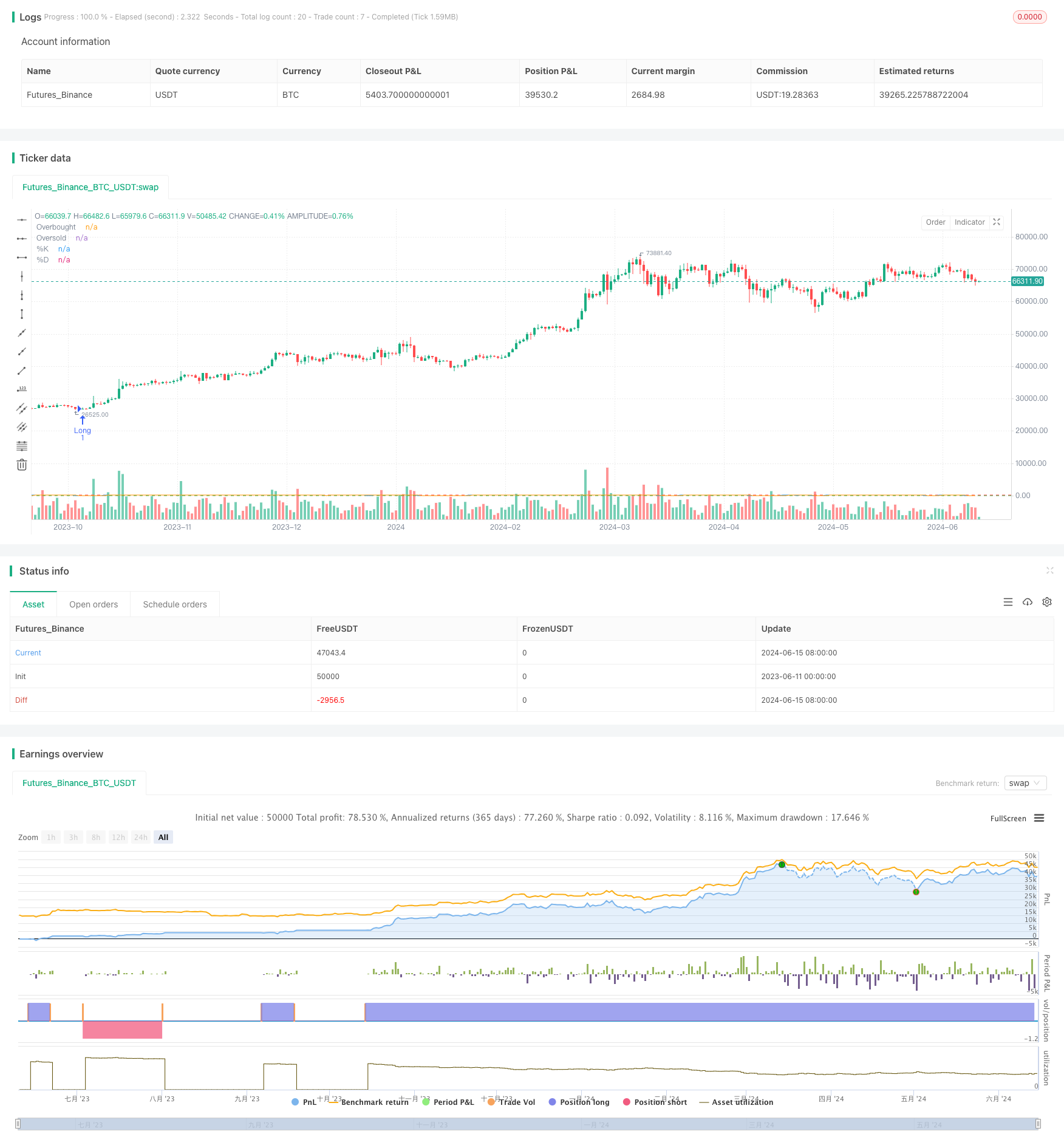

/*backtest

start: 2023-06-11 00:00:00

end: 2024-06-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Range Trading with Stochastic", overlay=true)

// Input Parameters

overboughtLevel = input.int(80, title="Overbought Level", minval=1, maxval=100)

oversoldLevel = input.int(20, title="Oversold Level", minval=1, maxval=100)

stochLength = input.int(14, title="Stochastic Length", minval=1)

riskPerTrade = input.float(0.01, title="Risk per Trade (%)", minval=0.01, maxval=100, step=0.01)

barsBetweenTrades = input.int(20, title="Bars Between Trades", minval=1)

// Calculate Stochastic Oscillator

k = ta.sma(ta.stoch(close, high, low, stochLength), 3)

d = ta.sma(k, 3)

// Variables to Track Time Since Last Trade

var lastTradeBar = 0

barsSinceLastTrade = bar_index - lastTradeBar

// Risk Management

atr = ta.atr(14)

stopLoss = 2 * atr

takeProfit = 2 * atr

riskAmount = strategy.equity * riskPerTrade / 100

positionSize = 1

// Entry Conditions

longCondition = k < oversoldLevel and strategy.position_size == 0 and barsSinceLastTrade >= barsBetweenTrades

shortCondition = k > overboughtLevel and strategy.position_size == 0 and barsSinceLastTrade >= barsBetweenTrades

// Entry/Exit Orders

if longCondition

strategy.entry("Long", strategy.long, qty=positionSize)

strategy.exit("Long Exit", "Long", stop=close - stopLoss, limit=close + takeProfit)

lastTradeBar := bar_index // Update last trade bar

if shortCondition

strategy.entry("Short", strategy.short, qty=positionSize)

strategy.exit("Short Exit", "Short", stop=close + stopLoss, limit=close - takeProfit)

lastTradeBar := bar_index // Update last trade bar

// Plot Stochastic

plot(k, color=color.blue, title="%K")

plot(d, color=color.orange, title="%D")

hline(overboughtLevel, color=color.red, title="Overbought")

hline(oversoldLevel, color=color.green, title="Oversold")

相关推荐