概述

这个策略使用Supertrend指标来确定交易的入场和出场时机。Supertrend是一个趋势跟踪指标,它结合了动态支撑阻力和价格突破的概念。该策略旨在捕捉强劲的上升趋势,同时严格控制风险,并以1:5的风险回报比进行交易。当价格突破Supertrend上轨时开仓做多,并根据预设的风险回报比设置止损和止盈价格。一旦价格跌破Supertrend下轨,策略就会平掉多头仓位。

策略原理

- 计算Supertrend指标的上轨和下轨。Supertrend使用ATR(平均真实波幅)和因子来计算动态支撑位和阻力位。

- 检查多头开仓条件:当收盘价突破Supertrend上轨时,开仓做多。

- 计算止损和止盈价格:基于当前收盘价和预设的风险回报比(如1:5),计算止损价和止盈价。

- 提交多头订单:以计算出的止损价和止盈价,开仓做多。

- 检查多头平仓条件:当收盘价跌破Supertrend下轨时,平掉多头仓位。

优势分析

- 趋势跟踪:Supertrend指标可以有效地捕捉强劲的趋势,帮助策略在上升趋势中获利。

- 动态止损:通过使用ATR计算动态支撑位和阻力位,Supertrend为策略提供了动态止损位,以控制风险。

- 风险回报控制:该策略允许用户预设风险回报比(如1:5),以控制每笔交易的风险和潜在回报。

- 简单易用:策略逻辑清晰,易于理解和实现。

风险分析

- 趋势反转:在突然的趋势反转中,该策略可能会遭受损失,因为它依赖于趋势持续性。

- 参数敏感性:策略的表现可能对Supertrend的参数(如ATR因子和ATR长度)敏感。不恰当的参数可能导致虚假信号。

- 缺乏波动性:在波动性低的市场环境中,该策略可能效果不佳,因为价格可能在上轨和下轨间波动,导致频繁的交易和手续费损失。

优化方向

- 动态参数优化:实施参数优化程序,以根据不同的市场状况动态调整Supertrend参数。这可以提高策略的适应性和鲁棒性。

- 结合其他指标:结合其他技术指标,如RSI或MACD,以确认趋势强度并过滤虚假信号。

- 市场环境适应:开发逻辑以识别不同的市场状况(如趋势、震荡),并相应地调整策略参数或禁用策略。

- 资金管理优化:优化头寸规模和风险管理规则,以提高策略的风险调整后回报。

总结

该策略利用Supertrend指标来跟踪强劲的上升趋势,同时严格控制风险。它提供了一个简单而有效的框架,可以捕捉趋势性机会。然而,策略可能面临趋势反转和参数敏感性等风险。通过动态参数优化、结合其他指标、适应市场环境和优化资金管理,可以进一步改进该策略。总体而言,这个Supertrend策略为趋势追踪交易提供了一个坚实的基础。

策略源码

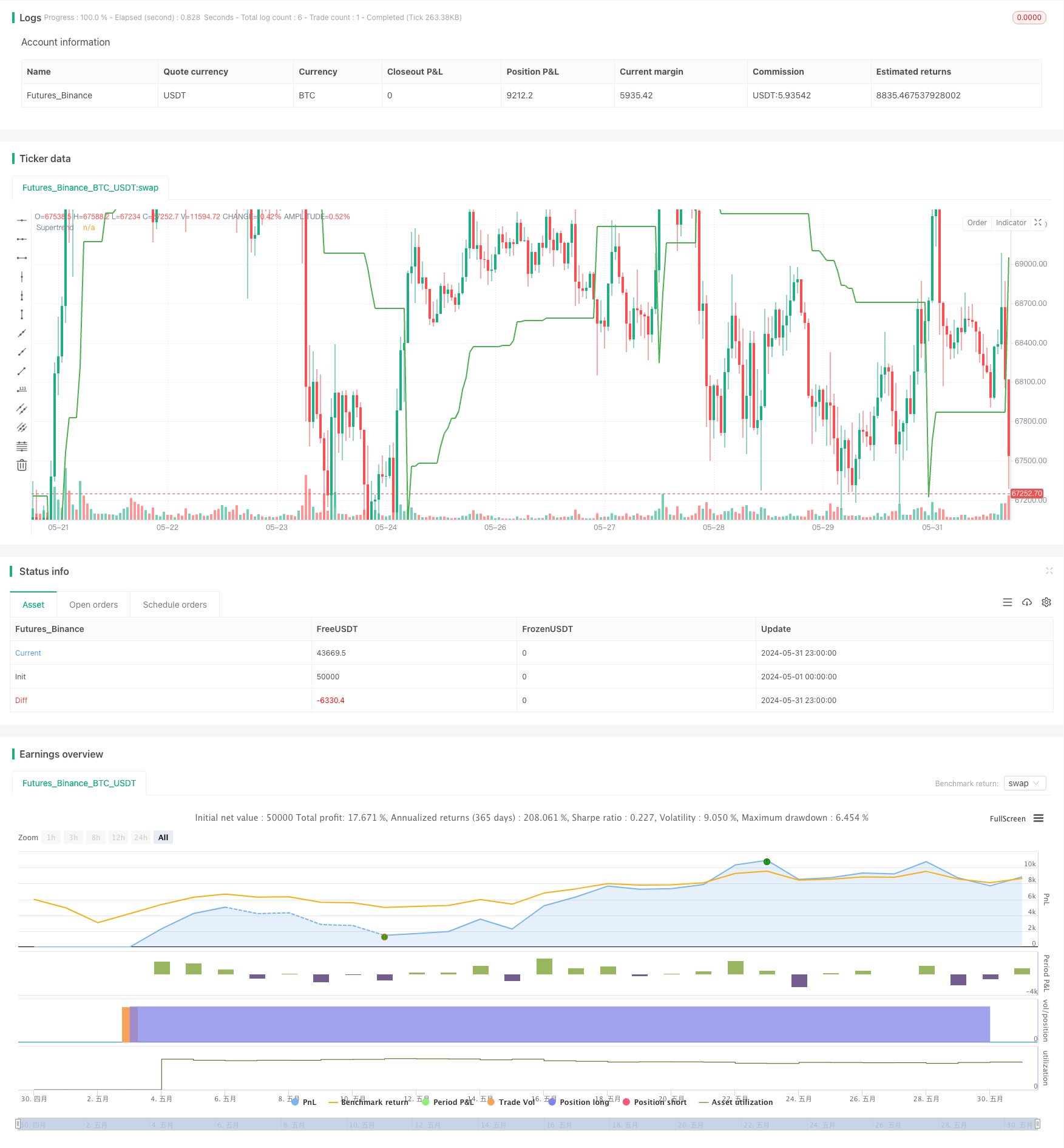

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Supertrend Strategy with 1:5 Risk Reward", overlay=true)

// Supertrend Indicator

factor = input(3.0, title="ATR Factor")

atrLength = input(10, title="ATR Length")

[supertrendUp, supertrendDown] = ta.supertrend(factor, atrLength)

supertrend = ta.crossover(ta.lowest(close, 1), supertrendDown) ? supertrendDown : supertrendUp

plot(supertrend, title="Supertrend", color=supertrend == supertrendUp ? color.green : color.red, linewidth=2, style=plot.style_line)

// Strategy parameters

risk = input(1.0, title="Risk in %")

reward = input(5.0, title="Reward in %")

riskRewardRatio = reward / risk

// Entry and exit conditions

longCondition = ta.crossover(close, supertrendUp)

if (longCondition)

// Calculate stop loss and take profit levels

stopLossPrice = close * (1 - (risk / 100))

takeProfitPrice = close * (1 + (reward / 100))

// Submit long order

strategy.entry("Long", strategy.long, stop=stopLossPrice, limit=takeProfitPrice)

// Exit conditions

shortCondition = ta.crossunder(close, supertrendDown)

if (shortCondition)

strategy.close("Long")

相关推荐