概述

交叉均线与平安蜡烛动量策略是一种结合了指数移动平均线(EMA)和平安蜡烛图的量化交易策略。该策略利用短期和长期EMA的交叉来识别趋势方向,同时结合平安蜡烛图的开盘和收盘价位来确认动量,从而捕捉市场的趋势性机会。这种方法旨在平滑市场噪音,提高交易信号的可靠性。

策略原理

该策略的核心是利用10周期和30周期EMA的交叉来确定趋势方向,并使用平安蜡烛图来确认动量。具体来说:

多头入场:当10周期EMA上穿30周期EMA,且平安蜡烛图的开盘价等于最低价时,表示上升动量已确立,此时进行多头开仓。

多头出场:当平安蜡烛图的最低价跌破开盘价时,表示上升动量可能减弱,此时平仓多头头寸。

空头入场:当10周期EMA下穿30周期EMA,且平安蜡烛图的开盘价等于最高价时,表示下降动量已确立,此时进行空头开仓。

空头出场:当平安蜡烛图的最高价突破开盘价时,表示下降动量可能减弱,此时平仓空头头寸。

策略确保任何时候只持有一个方向的头寸,所有交易均以市价执行。

策略优势

趋势跟踪:通过EMA交叉,策略能够有效捕捉中长期趋势,减少假突破带来的损失。

动量确认:平安蜡烛图的使用有助于确认价格动量,提高入场和出场的准确性。

噪音过滤:EMA和平安蜡烛图的组合能够有效平滑短期市场波动,降低假信号的影响。

风险管理:策略的设计确保了在任何时候只持有一个方向的头寸,有利于控制风险。

灵活性:策略参数(如EMA周期)可根据不同市场和交易品种进行调整,具有较好的适应性。

策略风险

趋势反转:在强烈的趋势反转时,策略可能反应较慢,导致一定的回撤。

震荡市场:在横盘震荡行情中,频繁的EMA交叉可能导致过度交易和亏损。

滑点风险:使用市价单可能在波动较大时面临显著滑点。

参数敏感性:EMA周期的选择对策略表现影响较大,不同市场可能需要不同的参数设置。

单一指标依赖:仅依赖EMA和平安蜡烛图可能忽视其他重要的市场信息。

策略优化方向

引入额外过滤器:可考虑增加如ATR或RSI等指标,以更好地识别市场状态和过滤假信号。

动态参数调整:实现EMA周期的自适应,以更好地适应不同的市场环境。

改进止损机制:引入追踪止损或基于波动率的止损,以更好地保护利润和控制风险。

多时间框架分析:结合更长期的趋势分析,以提高交易方向的准确性。

交易量分析:加入交易量指标,以验证价格动作的有效性和持续性。

总结

交叉均线与平安蜡烛动量策略是一种结合了技术分析经典工具的量化交易方法。通过EMA交叉和平安蜡烛图,策略能够有效捕捉市场趋势并确认动量,为交易决策提供可靠依据。尽管存在一些固有风险,但通过持续优化和风险管理,该策略有潜力成为一个稳健的交易系统。关键在于根据具体市场特征调整参数,并结合其他分析工具来增强策略的鲁棒性和适应性。

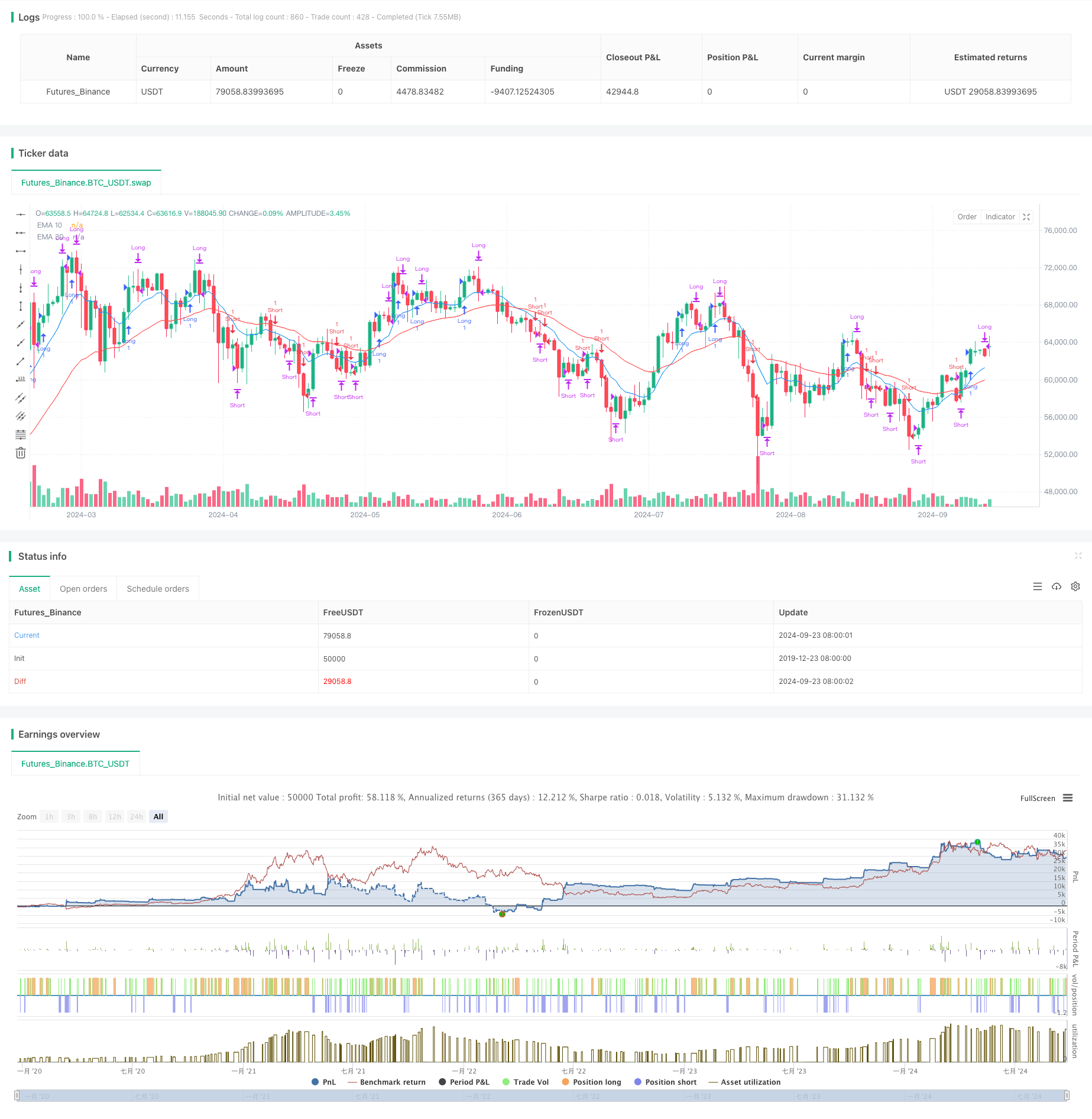

/*backtest

start: 2019-12-23 08:00:00

end: 2024-09-24 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Crossover with Heiken Ashi", overlay=true)

// Initialize Heiken Ashi variables

var float ha_open = na

var float ha_close = na

var float ha_high = na

var float ha_low = na

// Calculate Heiken Ashi candles manually

ha_close := (open + high + low + close) / 4

ha_open := na(ha_open[1]) ? (open + close) / 2 : (ha_open[1] + ha_close[1]) / 2

ha_high := math.max(high, math.max(ha_open, ha_close))

ha_low := math.min(low, math.min(ha_open, ha_close))

// Calculate EMAs

ema10 = ta.ema(close, 10)

ema30 = ta.ema(close, 30)

// Long Entry Condition

longCondition = (ema10 > ema30) and (ha_open == ha_low)

// Long Exit Condition

longExitCondition = ha_low < ha_open

// Short Entry Condition

shortCondition = (ema10 < ema30) and (ha_open == ha_high)

// Short Exit Condition

shortExitCondition = ha_high > ha_open

// Ensure only one open position at a time

hasOpenPosition = strategy.opentrades != 0

// Entry and Exit logic

if (longCondition and not hasOpenPosition)

strategy.entry("Long", strategy.long)

if (longExitCondition)

strategy.close("Long")

if (shortCondition and not hasOpenPosition)

strategy.entry("Short", strategy.short)

if (shortExitCondition)

strategy.close("Short")

// Plot EMAs

plot(ema10, title="EMA 10", color=color.blue)

plot(ema30, title="EMA 30", color=color.red)