概述

本策略是一个结合了经典双均线趋势跟踪和ATR动态风控的自适应交易系统。策略提供了两种交易模式:基础模式采用简单的双均线交叉进行趋势跟踪,高级模式增加了更高时间框架的趋势过滤和基于ATR的动态止损机制。策略通过简单的下拉菜单即可在两种模式间切换,既照顾到初学者的易用性,又满足资深交易者对风险控制的需求。

策略原理

策略1(基础模式)采用21日和49日双均线系统,当快速均线向上穿越慢速均线时产生做多信号。获利目标可以选择百分比或点数方式,同时提供可选的移动止损功能来锁定利润。策略2(高级模式)在双均线系统基础上增加了日线级别的趋势过滤,只有当价格处于更高时间框架均线之上时才允许入场。同时引入了基于14周期ATR的动态止损,止损距离随市场波动性自动调整,并提供部分获利了结功能保护既得利润。

策略优势

- 策略具有极强的适应性,可根据交易者经验水平和市场环境灵活切换

- 高级模式中的多时间框架分析提高了信号质量

- ATR动态止损能够适应不同市场波动条件

- 部分获利机制平衡了利润保护和趋势延续

- 参数配置灵活,便于根据不同市场特征优化

策略风险

- 双均线系统在震荡市可能产生频繁假信号

- 趋势过滤可能造成信号滞后,错过一些交易机会

- ATR止损在波动率突变时可能不够及时

- 部分获利可能过早减仓,影响大趋势利润

策略优化方向

- 可以增加成交量和波动率指标过滤假信号

- 考虑引入动态参数自适应机制,根据市场状态自动调整均线周期

- 对ATR计算周期进行优化,平衡灵敏度和稳定性

- 增加市场状态识别模块,自动选择最优策略模式

- 引入更多止损方案供选择,如追踪止损、时间止损等

总结

这是一个设计合理、功能完善的交易策略系统。通过双均线趋势跟踪和ATR风控的结合,既保证了策略的可靠性,又提供了良好的风险管理。双模式设计满足不同层次交易者需求,丰富的参数设置提供了充分的优化空间。建议交易者在实盘中从保守参数开始,逐步调整优化以达到最佳效果。

策略源码

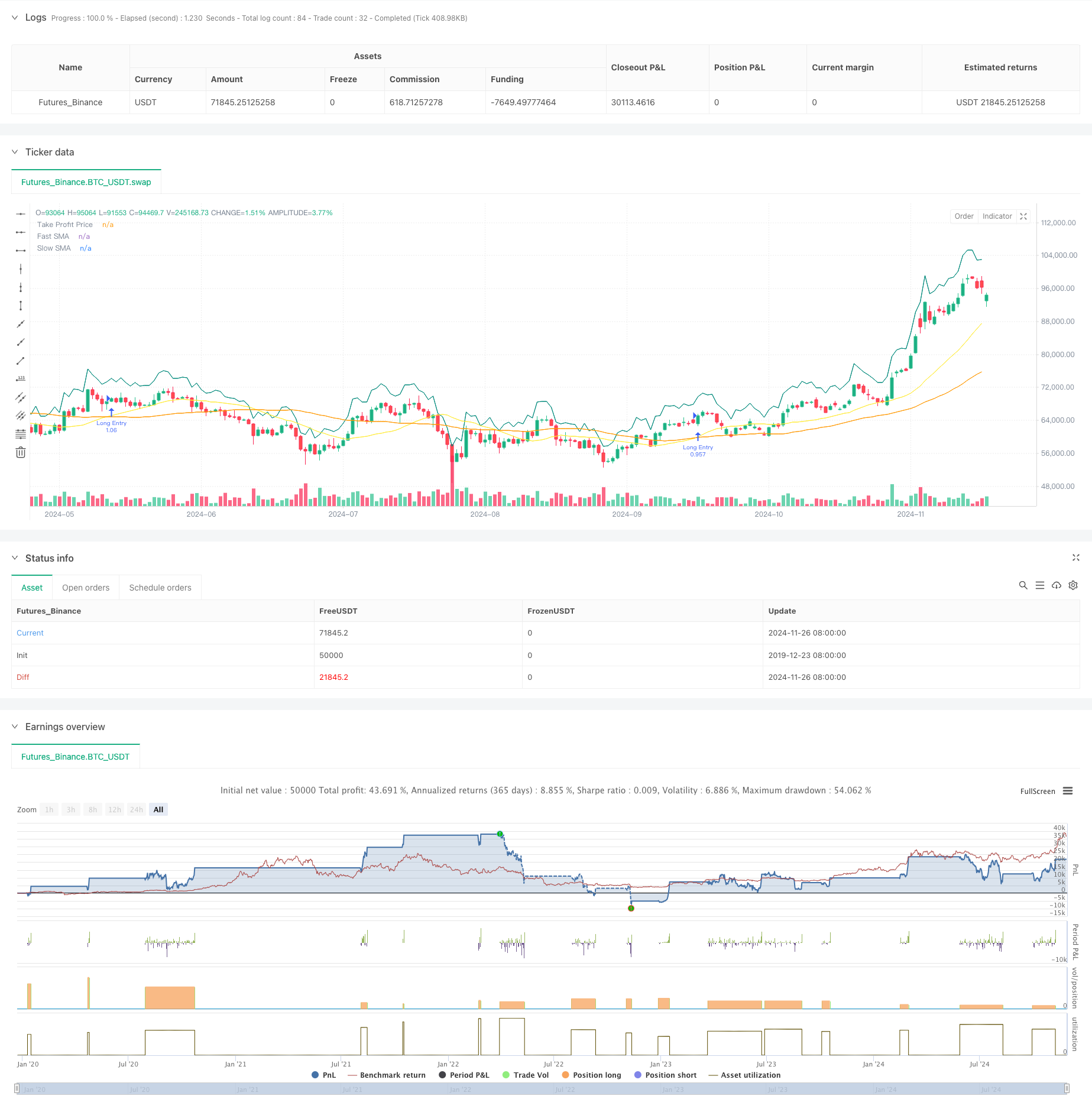

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © shaashish1

//@version=5

strategy("Dual Strategy Selector V2 - Cryptogyani", overlay=true, pyramiding=0,

default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=100000)

//#region STRATEGY SELECTION

strategyOptions = input.string(title="Select Strategy", defval="Strategy 1", options=["Strategy 1", "Strategy 2"], group="Strategy Selection")

//#endregion STRATEGY SELECTION

// ####################### STRATEGY 1: Original Logic ########################

//#region STRATEGY 1 INPUTS

s1_fastMALen = input.int(defval=21, title="Fast SMA Length (S1)", minval=1, group="Strategy 1 Settings", inline="S1 MA")

s1_slowMALen = input.int(defval=49, title="Slow SMA Length (S1)", minval=1, group="Strategy 1 Settings", inline="S1 MA")

s1_takeProfitMode = input.string(defval="Percentage", title="Take Profit Mode (S1)", options=["Percentage", "Pips"], group="Strategy 1 Settings")

s1_takeProfitPerc = input.float(defval=7.0, title="Take Profit % (S1)", minval=0.05, step=0.05, group="Strategy 1 Settings") / 100

s1_takeProfitPips = input.float(defval=50, title="Take Profit Pips (S1)", minval=1, step=1, group="Strategy 1 Settings")

s1_trailingTakeProfitEnabled = input.bool(defval=false, title="Enable Trailing (S1)", group="Strategy 1 Settings")

//#endregion STRATEGY 1 INPUTS

// ####################### STRATEGY 2: Enhanced with Recommendations ########################

//#region STRATEGY 2 INPUTS

s2_fastMALen = input.int(defval=20, title="Fast SMA Length (S2)", minval=1, group="Strategy 2 Settings", inline="S2 MA")

s2_slowMALen = input.int(defval=50, title="Slow SMA Length (S2)", minval=1, group="Strategy 2 Settings", inline="S2 MA")

s2_atrLength = input.int(defval=14, title="ATR Length (S2)", group="Strategy 2 Settings", inline="ATR")

s2_atrMultiplier = input.float(defval=1.5, title="ATR Multiplier for Stop-Loss (S2)", group="Strategy 2 Settings", inline="ATR")

s2_partialTakeProfitPerc = input.float(defval=50.0, title="Partial Take Profit % (S2)", minval=10, maxval=100, step=10, group="Strategy 2 Settings")

s2_timeframeTrend = input.timeframe(defval="1D", title="Higher Timeframe for Trend Filter (S2)", group="Strategy 2 Settings")

//#endregion STRATEGY 2 INPUTS

// ####################### GLOBAL VARIABLES ########################

var float takeProfitPrice = na

var float stopLossPrice = na

var float trailingStopPrice = na

var float fastMA = na

var float slowMA = na

var float higherTimeframeTrendMA = na

var bool validOpenLongPosition = false

// Precalculate higher timeframe values (global scope for Strategy 2)

higherTimeframeTrendMA := request.security(syminfo.tickerid, s2_timeframeTrend, ta.sma(close, s2_slowMALen))

// ####################### LOGIC ########################

if (strategyOptions == "Strategy 1")

// Strategy 1 Logic (Original Logic Preserved)

fastMA := ta.sma(close, s1_fastMALen)

slowMA := ta.sma(close, s1_slowMALen)

openLongPosition = ta.crossover(fastMA, slowMA)

validOpenLongPosition := openLongPosition and strategy.opentrades.size(strategy.opentrades - 1) == 0

// Take Profit Price

takeProfitPrice := if (s1_takeProfitMode == "Percentage")

close * (1 + s1_takeProfitPerc)

else

close + (s1_takeProfitPips * syminfo.mintick)

// Trailing Stop Price (if enabled)

if (strategy.position_size > 0 and s1_trailingTakeProfitEnabled)

trailingStopPrice := high - (s1_takeProfitPips * syminfo.mintick)

else

trailingStopPrice := na

else if (strategyOptions == "Strategy 2")

// Strategy 2 Logic with Recommendations

fastMA := ta.sma(close, s2_fastMALen)

slowMA := ta.sma(close, s2_slowMALen)

openLongPosition = ta.crossover(fastMA, slowMA) and close > higherTimeframeTrendMA

validOpenLongPosition := openLongPosition and strategy.opentrades.size(strategy.opentrades - 1) == 0

// ATR-Based Stop-Loss

atr = ta.atr(s2_atrLength)

stopLossPrice := close - (atr * s2_atrMultiplier)

// Partial Take Profit Logic

takeProfitPrice := close * (1 + (s2_partialTakeProfitPerc / 100))

//#endregion STRATEGY LOGIC

// ####################### PLOTTING ########################

plot(series=fastMA, title="Fast SMA", color=color.yellow, linewidth=1)

plot(series=slowMA, title="Slow SMA", color=color.orange, linewidth=1)

plot(series=takeProfitPrice, title="Take Profit Price", color=color.teal, linewidth=1, style=plot.style_linebr)

// Trailing Stop and ATR Stop-Loss Plots (Global Scope)

plot(series=(strategyOptions == "Strategy 1" and s1_trailingTakeProfitEnabled) ? trailingStopPrice : na, title="Trailing Stop", color=color.red, linewidth=1, style=plot.style_linebr)

plot(series=(strategyOptions == "Strategy 2") ? stopLossPrice : na, title="ATR Stop-Loss", color=color.red, linewidth=1, style=plot.style_linebr)

//#endregion PLOTTING

// ####################### POSITION ORDERS ########################

//#region POSITION ORDERS

if (validOpenLongPosition)

strategy.entry(id="Long Entry", direction=strategy.long)

if (strategyOptions == "Strategy 1")

if (strategy.position_size > 0)

if (s1_trailingTakeProfitEnabled)

strategy.exit(id="Trailing Take Profit", from_entry="Long Entry", stop=trailingStopPrice)

else

strategy.exit(id="Take Profit", from_entry="Long Entry", limit=takeProfitPrice)

else if (strategyOptions == "Strategy 2")

if (strategy.position_size > 0)

strategy.exit(id="Partial Take Profit", from_entry="Long Entry", qty_percent=s2_partialTakeProfitPerc, limit=takeProfitPrice)

strategy.exit(id="Stop Loss", from_entry="Long Entry", stop=stopLossPrice)

//#endregion POSITION ORDERS

相关推荐