概述

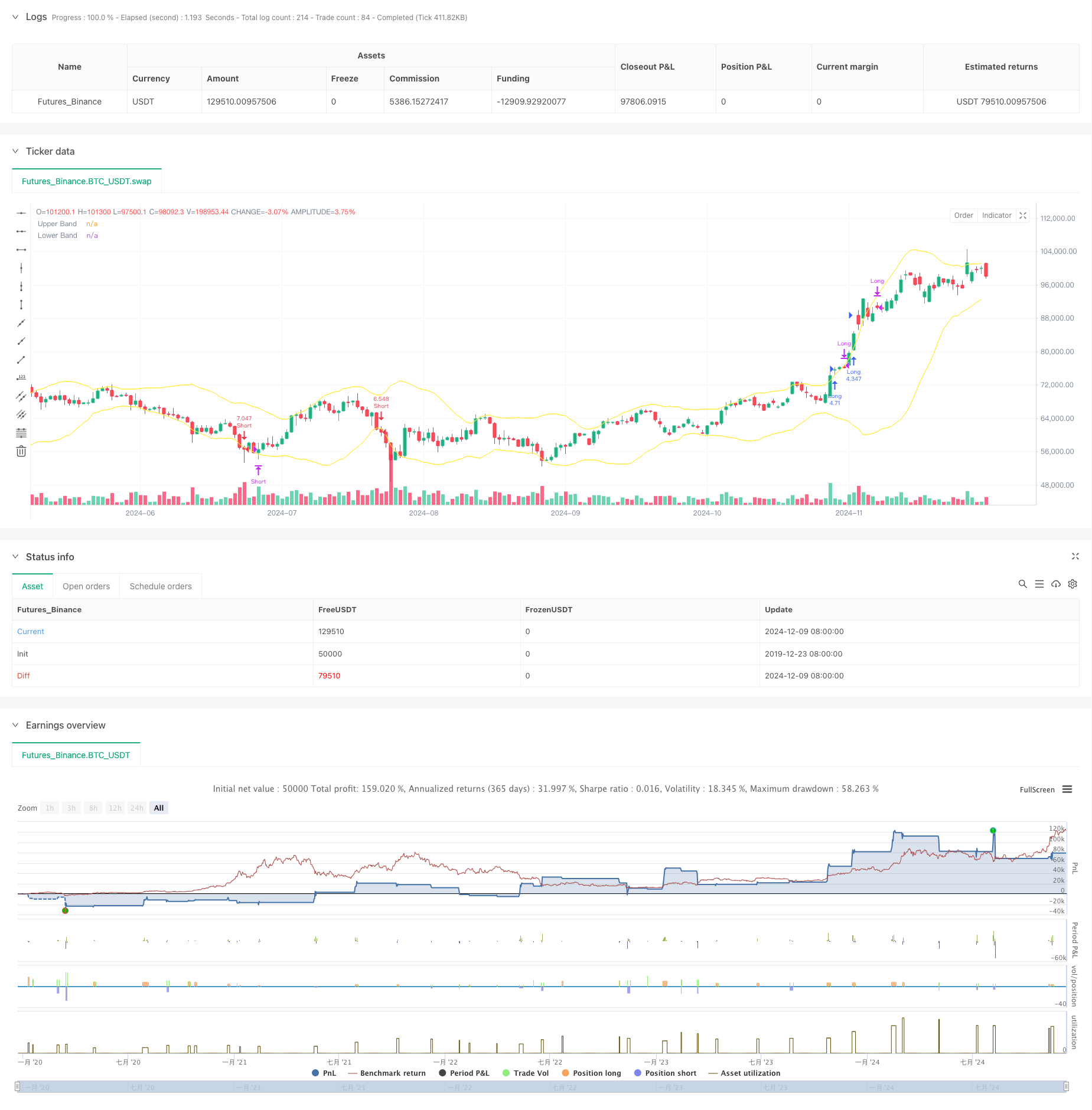

该策略是一个基于布林带指标的四小时级别量化交易系统,结合了趋势突破和均值回归的交易理念。策略通过布林带上下轨的突破来捕捉市场动量,同时利用价格回归均值的特性来进行获利了结,并通过止损控制风险。策略采用3倍杠杆,在保证收益的同时也充分考虑了风险控制。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 使用20周期的移动平均线作为布林带的中轨,并以2倍标准差作为波动区间 2. 开仓信号:当K线实体(开盘价和收盘价的均值)突破上轨时开多,突破下轨时开空 3. 平仓信号:多头持仓时,如果连续两根K线收盘价和开盘价都低于上轨且收盘价低于开盘价时平仓;空头持仓采用相反逻辑 4. 风险控制:建仓时以当前K线最高/最低点设置止损,确保单笔损失可控

策略优势

- 交易逻辑清晰:结合趋势和回归两种交易思路,能够在不同市场环境下都有良好表现

- 风险控制完善:设置了基于K线波动的动态止损,可以有效控制回撤

- 过滤伪信号:通过判断K线实体的位置而非仅靠收盘价来确认突破,减少假突破带来的损失

- 资金管理合理:基于账户权益动态调整持仓规模,既保证了收益又控制了风险

策略风险

- 震荡市场风险:在横盘震荡行情下可能频繁触发假突破信号,导致连续止损

- 杠杆风险:使用3倍杠杆在剧烈波动时可能带来较大损失

- 止损设置风险:以K线最高/最低点设置止损可能过于宽松,增加单笔损失

- 时间周期依赖:四小时级别在某些市场环境下可能反应过慢,错过行情

策略优化方向

- 引入趋势过滤器:可以添加更长周期的趋势判断指标,在主趋势方向上进行交易

- 优化止损方案:考虑使用ATR或布林带宽度来动态调整止损距离

- 增加仓位管理:根据波动率或趋势强度动态调整杠杆倍数

- 添加市场环境判断:引入成交量或波动率指标来识别当前市场状态,选择性开仓

总结

这是一个将布林带指标的趋势跟随和均值回归特性相结合的策略,通过严格的开平仓条件和风险控制措施,实现了在趋势和震荡市场中都能获得稳定收益的目标。策略的核心优势在于其清晰的交易逻辑和完善的风险控制体系,但仍需要注意杠杆使用和市场环境判断等方面的优化,以进一步提高策略的稳定性和收益能力。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger 4H Follow", overlay=true, initial_capital=300, commission_type=strategy.commission.percent, commission_value=0.04)

// StartYear = input(2022,"Backtest Start Year")

// StartMonth = input(1,"Backtest Start Month")

// StartDay = input(1,"Backtest Start Day")

// testStart = timestamp(StartYear,StartMonth,StartDay,0,0)

// EndYear = input(2023,"Backtest End Year")

// EndMonth = input(12,"Backtest End Month")

// EndDay = input(31,"Backtest End Day")

// testEnd = timestamp(EndYear,EndMonth,EndDay,0,0)

lev = 3

// Input parameters

length = input.int(20, title="Bollinger Band Length")

mult = input.float(2.0, title="Bollinger Band Multiplier")

// Bollinger Bands calculation

basis = ta.sma(close, length)

upperBand = basis + mult * ta.stdev(close, length)

lowerBand = basis - mult * ta.stdev(close, length)

// Conditions for Open Long

openLongCondition = strategy.position_size == 0 and close > open and (close + open) / 2 > upperBand

// Conditions for Open Short

openShortCondition = strategy.position_size == 0 and close < open and (close + open) / 2 < lowerBand

// Conditions for Close Long

closeLongCondition = strategy.position_size > 0 and strategy.position_size > 0 and (close < upperBand and open < upperBand and close < open)

// Conditions for Close Short

closeShortCondition = strategy.position_size < 0 and strategy.position_size < 0 and (close > lowerBand and open > lowerBand and close > open)

// Long entry

if openLongCondition

strategy.entry("Long", strategy.long, qty=strategy.equity * lev / close)

strategy.exit("Long SL", from_entry="Long", stop=low) // Set Stop-Loss

// Short entry

if openShortCondition

strategy.entry("Short", strategy.short, qty=strategy.equity * lev / close)

strategy.exit("Short SL", from_entry="Short", stop=high) // Set Stop-Loss

// Long exit

if closeLongCondition

strategy.close("Long", comment = "TP")

// Short exit

if closeShortCondition

strategy.close("Short", comment = "TP")

// Plot Bollinger Bands

plot(upperBand, color=color.yellow, title="Upper Band")

plot(lowerBand, color=color.yellow, title="Lower Band")

相关推荐