概述

这是一个结合了多个技术指标的趋势跟踪与波动突破策略。该策略通过整合均线系统(EMA)、趋势强度指标(ADX)、市场波动指标(ATR)、量价分析(OBV)以及一些辅助指标如Ichimoku云图和随机指标(Stochastic)来捕捉市场趋势和突破机会。策略设置了严格的时间过滤器,仅在特定交易时段内运行,以提高交易效率。

策略原理

策略的核心逻辑基于多层技术指标的综合判断: 1. 使用50周期和200周期EMA构建趋势跟踪系统 2. 通过ADX指标确认趋势强度 3. 利用Ichimoku云图提供额外的趋势确认 4. 结合Stochastic指标识别超买超卖区域 5. 使用ATR动态设置止损和获利目标 6. 通过OBV验证成交量支持度

策略在满足以下条件时发出买入信号: - 处于允许交易时间段内 - 价格位于短期EMA之上 - 短期EMA位于长期EMA之上 - ADX高于设定阈值 - 价格位于云图上方 - Stochastic指标处于超卖区域

策略优势

- 多层技术指标交叉验证,提高信号可靠性

- 结合趋势跟踪和波动突破,增加策略适应性

- 通过时间过滤器避免低效交易时段

- 动态止损和获利目标设置,适应市场波动

- 量价结合分析,提供更全面的市场视角

- 系统化的进出场规则,减少主观判断

策略风险

- 多指标系统可能导致信号滞后

- 在横盘市场中可能产生过多假信号

- 参数优化难度较大,过度优化风险高

- 交易时间限制可能错过重要行情

- 止损设置过大可能导致单笔损失较高

风险控制建议: - 定期检查并优化参数设置 - 考虑加入波动率过滤器 - 实施更严格的资金管理规则 - 增加趋势确认的辅助指标

策略优化方向

- 引入自适应参数系统,根据市场状态动态调整指标参数

- 增加市场状态分类机制,在不同市场环境下使用不同的信号生成规则

- 优化时间过滤器设置,根据历史数据分析最佳交易时段

- 改进止损策略,考虑使用跟踪止损

- 加入市场情绪指标,提高信号质量

总结

该策略通过综合运用多个技术指标,构建了一个完整的交易系统。策略的优势在于多层指标交叉验证和严格的风险控制,但同时也面临参数优化和信号滞后等挑战。通过持续优化和改进,策略有望在不同市场环境下保持稳定表现。

策略源码

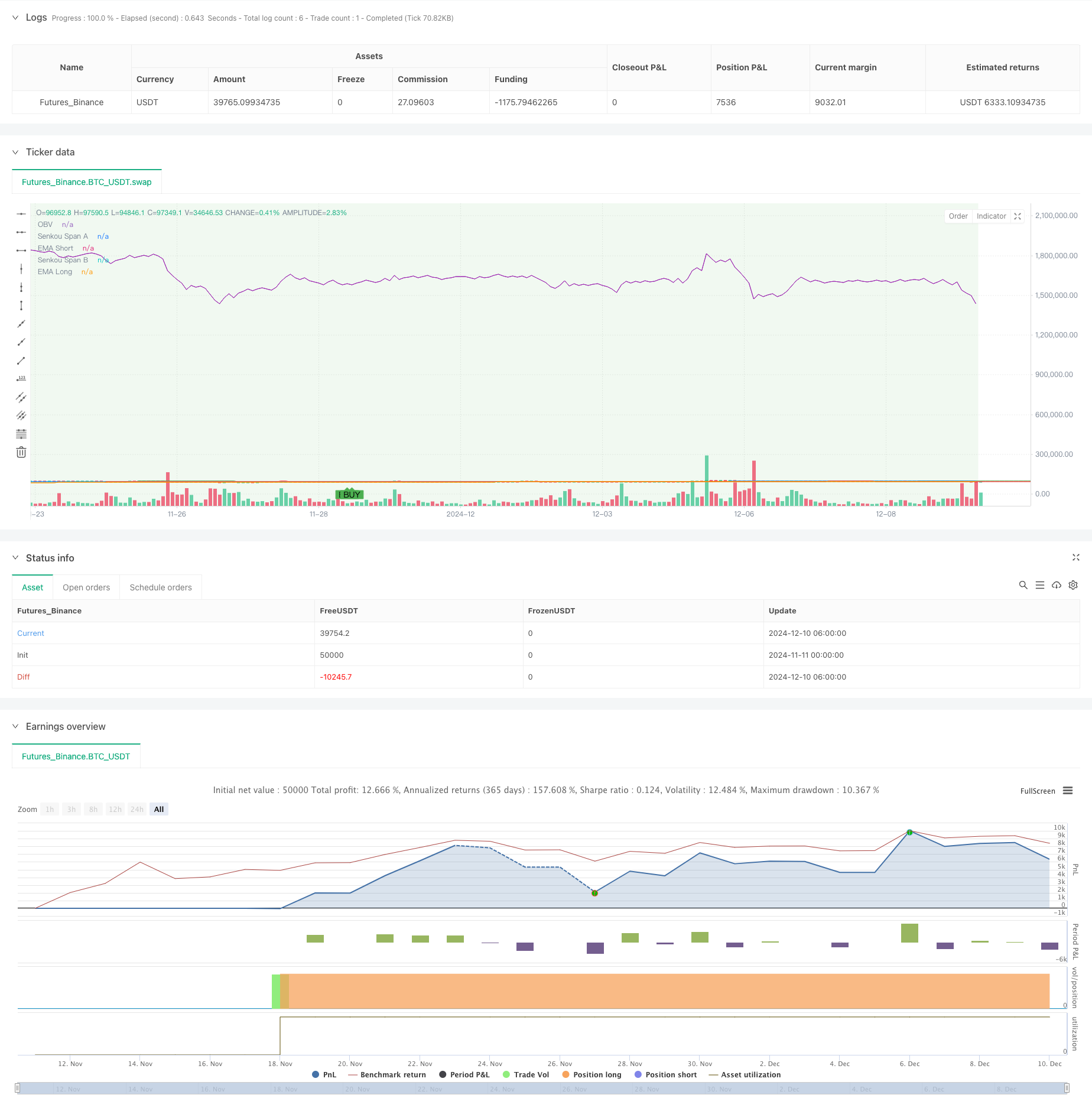

/*backtest

start: 2024-11-11 00:00:00

end: 2024-12-10 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Khaleq Strategy Pro - Fixed Version", overlay=true)

// === Input Settings ===

ema_short = input.int(50, "EMA Short", minval=1)

ema_long = input.int(200, "EMA Long", minval=1)

adx_threshold = input.int(25, "ADX Threshold", minval=1)

atr_multiplier = input.float(2.0, "ATR Multiplier", minval=0.1)

time_filter_start = input(timestamp("0000-01-01 09:00:00"), "Trading Start Time", group="Time Filter")

time_filter_end = input(timestamp("0000-01-01 17:00:00"), "Trading End Time", group="Time Filter")

// === Ichimoku Settings ===

tenkan_len = 9

kijun_len = 26

senkou_span_b_len = 52

displacement = 26

// === Calculations ===

// Ichimoku Components

tenkan_sen = (ta.highest(high, tenkan_len) + ta.lowest(low, tenkan_len)) / 2

kijun_sen = (ta.highest(high, kijun_len) + ta.lowest(low, kijun_len)) / 2

senkou_span_a = (tenkan_sen + kijun_sen) / 2

senkou_span_b = (ta.highest(high, senkou_span_b_len) + ta.lowest(low, senkou_span_b_len)) / 2

// EMA Calculations

ema_short_val = ta.ema(close, ema_short)

ema_long_val = ta.ema(close, ema_long)

// Manual ADX Calculation

length = 14

dm_plus = math.max(ta.change(high), 0)

dm_minus = math.max(-ta.change(low), 0)

tr = math.max(high - low, math.max(math.abs(high - close[1]), math.abs(low - close[1])))

tr14 = ta.sma(tr, length)

dm_plus14 = ta.sma(dm_plus, length)

dm_minus14 = ta.sma(dm_minus, length)

di_plus = (dm_plus14 / tr14) * 100

di_minus = (dm_minus14 / tr14) * 100

dx = math.abs(di_plus - di_minus) / (di_plus + di_minus) * 100

adx_val = ta.sma(dx, length)

// ATR Calculation

atr_val = ta.atr(14)

// Stochastic RSI Calculation

k = ta.stoch(close, high, low, 14)

d = ta.sma(k, 3)

// Time Filter

is_within_time = true

// Support and Resistance (High and Low Levels)

resistance_level = ta.highest(high, 20)

support_level = ta.lowest(low, 20)

// Volume Analysis (On-Balance Volume)

vol_change = ta.change(close)

obv = ta.cum(vol_change > 0 ? volume : vol_change < 0 ? -volume : 0)

// === Signal Conditions ===

buy_signal = is_within_time and

(close > ema_short_val) and

(ema_short_val > ema_long_val) and

(adx_val > adx_threshold) and

(close > senkou_span_a) and

(k < 20) // Stochastic oversold

sell_signal = is_within_time and

(close < ema_short_val) and

(ema_short_val < ema_long_val) and

(adx_val > adx_threshold) and

(close < senkou_span_b) and

(k > 80) // Stochastic overbought

// === Plotting ===

// Plot Buy and Sell Signals

plotshape(buy_signal, color=color.green, style=shape.labelup, title="Buy Signal", location=location.belowbar, text="BUY")

plotshape(sell_signal, color=color.red, style=shape.labeldown, title="Sell Signal", location=location.abovebar, text="SELL")

// Plot EMAs

plot(ema_short_val, color=color.blue, title="EMA Short")

plot(ema_long_val, color=color.orange, title="EMA Long")

// Plot Ichimoku Components

plot(senkou_span_a, color=color.green, title="Senkou Span A", offset=displacement)

plot(senkou_span_b, color=color.red, title="Senkou Span B", offset=displacement)

// // Plot Support and Resistance using lines

// var line resistance_line = na

// var line support_line = na

// if bar_index > 1

// line.delete(resistance_line)

// line.delete(support_line)

// resistance_line := line.new(x1=bar_index - 1, y1=resistance_level, x2=bar_index, y2=resistance_level, color=color.red, width=1, style=line.style_dotted)

// support_line := line.new(x1=bar_index - 1, y1=support_level, x2=bar_index, y2=support_level, color=color.green, width=1, style=line.style_dotted)

// Plot OBV

plot(obv, color=color.purple, title="OBV")

// Plot Background for Trend (Bullish/Bearish)

bgcolor(close > ema_long_val ? color.new(color.green, 90) : color.new(color.red, 90), title="Trend Background")

// === Alerts ===

alertcondition(buy_signal, title="Buy Alert", message="Buy Signal Triggered")

alertcondition(sell_signal, title="Sell Alert", message="Sell Signal Triggered")

// === Strategy Execution ===

if buy_signal

strategy.entry("Buy", strategy.long)

if sell_signal

strategy.close("Buy")

strategy.exit("Sell", "Buy", stop=close - atr_multiplier * atr_val, limit=close + atr_multiplier * atr_val)

相关推荐