概述

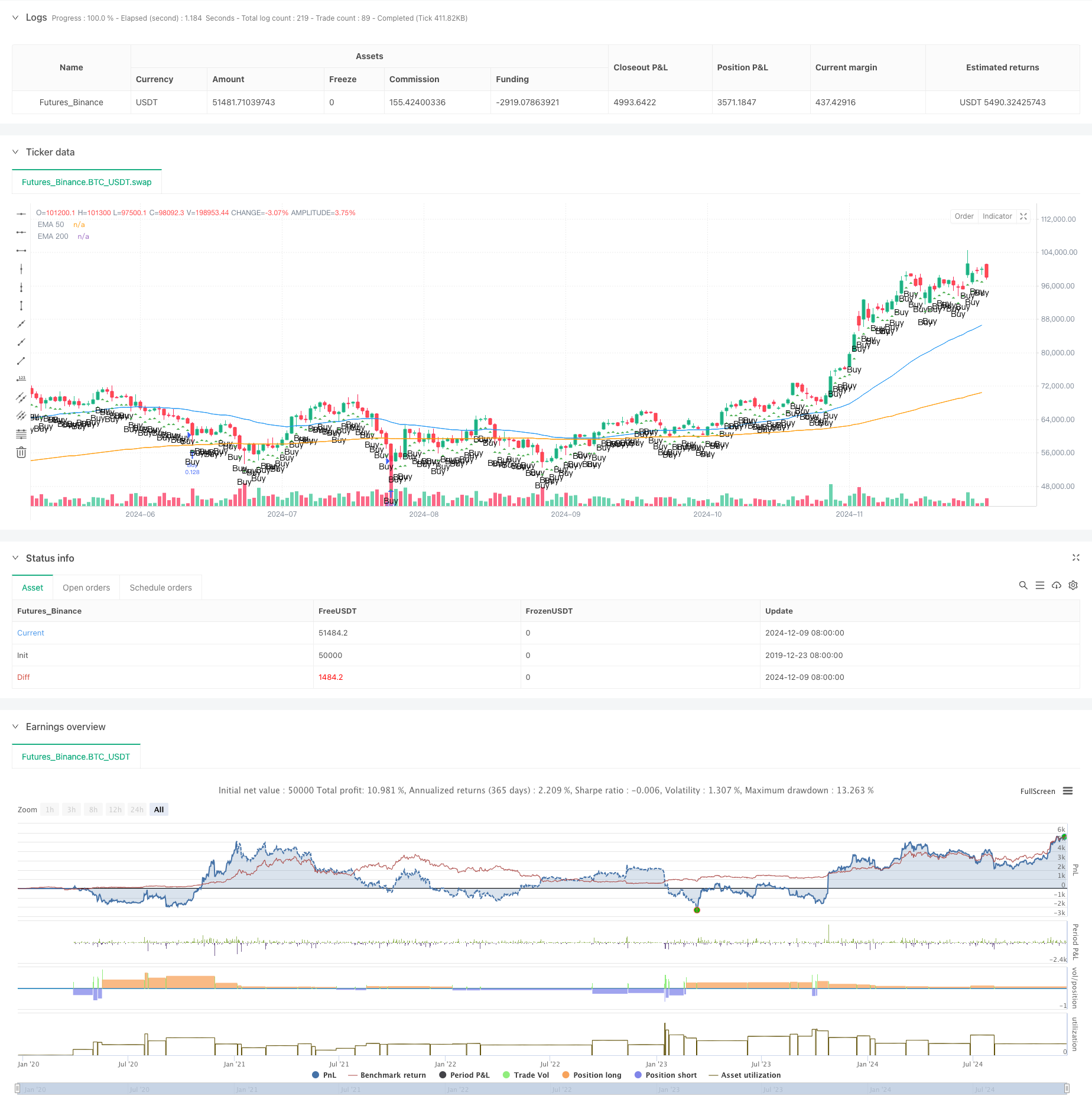

这是一个基于支撑位突破的动态ATR趋势跟踪策略。该策略综合运用了EMA均线系统、ATR波动率指标以及智能资金概念(SMC)来捕捉市场趋势。策略通过动态计算仓位大小和止损止盈位置,实现了良好的风险管理。

策略原理

策略主要基于以下几个核心组件构建: 1. 使用50和200周期的EMA均线系统来确认市场趋势方向 2. 利用ATR指标动态调整止损和获利目标 3. 通过订单块(Order Block)和失衡区域(Imbalance Zone)分析来寻找最佳入场点 4. 基于账户风险百分比自动计算开仓量 5. 通过观察近20根K线的波动范围来判断市场是否处于盘整状态

策略优势

- 风险管理完善,通过动态计算保证每笔交易风险可控

- 趋势判断系统可靠,避免在盘整市场交易

- 止损止盈设置合理,风险收益比为1:3

- 充分考虑市场波动性,能适应不同市场环境

- 代码结构清晰,易于维护和优化

策略风险

- EMA指标具有滞后性,可能导致入场时机延迟

- 在剧烈波动市场中可能触发虚假信号

- 策略依赖趋势持续性,在震荡市场表现可能欠佳

- 止损位置较宽,在某些情况下可能承受较大损失

策略优化方向

- 可以引入量价关系分析,提高趋势判断准确性

- 可以增加市场情绪指标,优化入场时机

- 考虑加入多时间周期分析,提高系统稳定性

- 可以细化订单块和失衡区域的判断标准

- 优化止损方式,考虑采用移动止损

总结

该策略是一个较为完整的趋势跟踪系统,通过合理的风险管理和多重信号确认来提高交易的稳定性。虽然存在一定的滞后性,但整体而言是一个可靠的交易系统。建议在实盘使用前进行充分的回测验证,并根据具体交易品种和市场环境进行参数优化。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// TradingView Pine Script strategy for Smart Money Concept (SMC)

//@version=5

strategy("Smart Money Concept Strategy", overlay=true, default_qty_type=strategy.fixed, default_qty_value=100)

// === Input Parameters ===

input_risk_percentage = input.float(1, title="Risk Percentage", step=0.1)

input_atr_length = input.int(14, title="ATR Length")

input_ema_short = input.int(50, title="EMA Short")

input_ema_long = input.int(200, title="EMA Long")

// === Calculations ===

atr = ta.atr(input_atr_length)

ema_short = ta.ema(close, input_ema_short)

ema_long = ta.ema(close, input_ema_long)

// === Utility Functions ===

// Identify Order Blocks

is_order_block(price, direction) =>

((high[1] > high[2] and low[1] > low[2] and direction == 1) or (high[1] < high[2] and low[1] < low[2] and direction == -1))

// Identify Imbalance Zones

is_imbalance() =>

range_high = high[1]

range_low = low[1]

range_high > close and range_low < close

// Calculate Lot Size Based on Risk

calculate_lot_size(stop_loss_points, account_balance) =>

risk_amount = account_balance * (input_risk_percentage / 100)

lot_size = risk_amount / (stop_loss_points * syminfo.pointvalue)

lot_size

// Determine if Market is Consolidating

is_consolidating() =>

(ta.highest(high, 20) - ta.lowest(low, 20)) / atr < 2

// === Visual Enhancements ===

// Plot Order Blocks

// if is_order_block(close, 1)

// line.new(x1=bar_index[1], y1=low[1], x2=bar_index, y2=low[1], color=color.green, width=2, extend=extend.right)

// if is_order_block(close, -1)

// line.new(x1=bar_index[1], y1=high[1], x2=bar_index, y2=high[1], color=color.red, width=2, extend=extend.right)

// Highlight Imbalance Zones

// if is_imbalance()

// box.new(left=bar_index[1], top=high[1], right=bar_index, bottom=low[1], bgcolor=color.new(color.orange, 80))

// === Logic for Trend Confirmation ===

is_bullish_trend = ema_short > ema_long

is_bearish_trend = ema_short < ema_long

// === Entry Logic ===

account_balance = strategy.equity

if not is_consolidating()

if is_bullish_trend

stop_loss = close - atr * 2

take_profit = close + (math.abs(close - (close - atr * 2)) * 3)

stop_loss_points = math.abs(close - stop_loss) / syminfo.pointvalue

lot_size = calculate_lot_size(stop_loss_points, account_balance)

strategy.entry("Buy", strategy.long, qty=lot_size)

strategy.exit("TP/SL", "Buy", stop=stop_loss, limit=take_profit)

if is_bearish_trend

stop_loss = close + atr * 2

take_profit = close - (math.abs(close - (close + atr * 2)) * 3)

stop_loss_points = math.abs(close - stop_loss) / syminfo.pointvalue

lot_size = calculate_lot_size(stop_loss_points, account_balance)

strategy.entry("Sell", strategy.short, qty=lot_size)

strategy.exit("TP/SL", "Sell", stop=stop_loss, limit=take_profit)

// === Plotting Indicators ===

plot(ema_short, color=color.blue, title="EMA 50")

plot(ema_long, color=color.orange, title="EMA 200")

plotshape(series=is_bullish_trend and not is_consolidating(), style=shape.triangleup, location=location.belowbar, color=color.green, text="Buy")

plotshape(series=is_bearish_trend and not is_consolidating(), style=shape.triangledown, location=location.abovebar, color=color.red, text="Sell")

相关推荐