概述

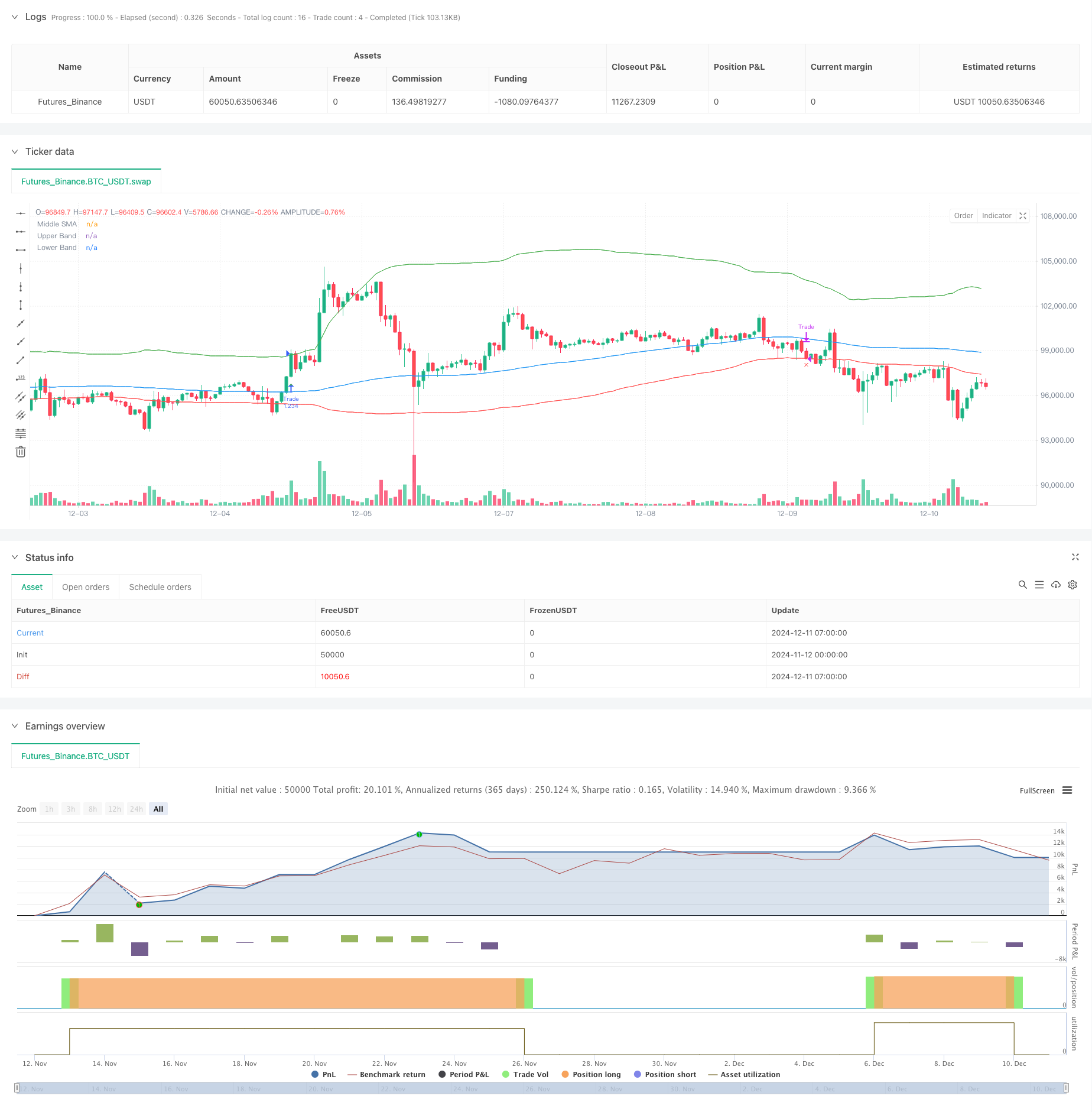

本策略是一个基于布林带突破的量化交易策略,采用了3倍标准差的上轨和1倍标准差的下轨,同时结合了100日移动平均线作为中轨。该策略主要通过检测价格突破上轨来捕捉长期趋势,并使用下轨作为止损信号。策略的核心思想是在强势突破时入场,在价格跌破下轨时及时止损,从而实现风险可控的趋势跟踪。

策略原理

策略的核心原理是基于布林带的统计学特性。上轨采用3倍标准差,这意味着在正态分布假设下,价格突破上轨的概率仅为0.15%,因此当出现突破时,往往预示着显著的趋势形成。中轨采用100日移动平均线,这个周期足够长,能够有效过滤短期市场噪音。下轨采用1倍标准差,作为止损线,这个设置相对保守,有助于及时止损。策略在价格突破上轨时发出做多信号,在价格跌破下轨时平仓出场。

策略优势

- 趋势把握能力强:通过3倍标准差的设置,能够有效捕捉重要的趋势突破机会。

- 风险控制合理:采用1倍标准差作为止损线,在风险控制上较为保守。

- 参数可调性强:上下轨的标准差倍数和移动平均线周期都可以根据不同市场特征进行调整。

- 系统性强:策略逻辑清晰,回测功能完善,可以准确统计交易表现。

- 适应性广:可以应用于股票市场和加密货币市场等多个领域。

策略风险

- 假突破风险:市场可能出现短期突破后的快速回落,导致虚假信号。

- 回撤较大:在剧烈波动的市场中可能出现较大回撤。

- 滞后性风险:100日均线具有一定滞后性,可能错过一些快速行情。

- 市场环境依赖:在震荡市场中可能频繁进出,产生过多交易成本。

策略优化方向

- 引入成交量确认:可以添加成交量突破确认机制,提高信号可靠性。

- 优化止损机制:可以考虑引入追踪止损或ATR动态止损,提高止损的灵活性。

- 增加趋势过滤:可以添加长期趋势判断指标,只在主趋势方向交易。

- 优化仓位管理:可以根据突破强度动态调整仓位大小。

- 添加时间过滤:可以避开一些特定的市场时段进行交易。

总结

这是一个设计合理、逻辑清晰的趋势跟踪策略。通过布林带的统计学特性和移动平均线的趋势跟踪特性,能够有效捕捉市场的重要突破机会。虽然存在一定的回撤风险,但通过合理的止损设置和风险控制,仍然具有较好的实用价值。进一步优化空间主要在于信号确认、止损机制和仓位管理等方面。

策略源码

/*backtest

start: 2024-11-12 00:00:00

end: 2024-12-11 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MounirTrades007

// @version=6

strategy("Bollinger Bands", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=200)

// Get user input

var g_bb = "Bollinger Band Settings"

upperBandSD = input.float(title="Upper Band Std Dev", defval=3.0, tooltip="Upper band's standard deviation multiplier", group=g_bb)

lowerBandSD = input.float(title="Lower Band Std Dev", defval=1.0, tooltip="Lower band's standard deviation multiplier", group=g_bb)

maPeriod = input.int(title="Middle Band MA Length", defval=100, tooltip="Middle band's SMA period length", group=g_bb)

var g_tester = "Backtester Settings"

drawTester = input.bool(title="Draw Backtester", defval=true, group=g_tester, tooltip="Turn on/off inbuilt backtester display")

// Get Bollinger Bands

[bbIgnore1, bbHigh, bbIgnore2] = ta.bb(close, maPeriod, upperBandSD)

[bbMid, bbIgnore3, bbLow] = ta.bb(close, maPeriod, lowerBandSD)

// Prepare trade persistent variables

drawEntry = false

drawExit = false

// Detect bollinger breakout

if close > bbHigh and barstate.isconfirmed and strategy.position_size == 0

drawEntry := true

strategy.entry(id="Trade", direction=strategy.long)

alert("Bollinger Breakout Detected for " + syminfo.ticker, alert.freq_once_per_bar_close)

// Detect bollinger sell signal

if close < bbLow and barstate.isconfirmed and strategy.position_size != 0

drawExit := true

strategy.close(id="Trade")

alert("Bollinger Exit detected for " + syminfo.ticker, alert.freq_once_per_bar_close)

// Draw bollinger bands

plot(bbMid, color=color.blue, title="Middle SMA")

plot(bbHigh, color=color.green, title="Upper Band")

plot(bbLow, color=color.red, title="Lower Band")

// Draw signals

plotshape(drawEntry, style=shape.triangleup, color=color.green, location=location.belowbar, size=size.normal, title="Buy Signal")

plotshape(drawExit, style=shape.xcross, color=color.red, location=location.belowbar, size=size.normal, title="Sell Signal")

// // =============================================================================

// // START BACKTEST CODE

// // =============================================================================

// // Prepare stats table

// var table testTable = table.new(position.top_right, 2, 2, border_width=1)

// f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

// _cellText = _title + "\n" + _value

// table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor)

// // Draw stats table

// var bgcolor = color.black

// if barstate.islastconfirmedhistory

// if drawTester

// dollarReturn = strategy.equity - strategy.initial_capital

// f_fillCell(testTable, 0, 0, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

// f_fillCell(testTable, 0, 1, "Win Rate:", str.tostring(strategy.wintrades / strategy.closedtrades * 100, "##.##") + "%", bgcolor, color.white)

// f_fillCell(testTable, 1, 0, "Equity:", "$" + str.tostring(strategy.equity, "###,###.##"), bgcolor, color.white)

// f_fillCell(testTable, 1, 1, "Return:", str.tostring((strategy.netprofit / strategy.initial_capital) * 100, "##.##") + "%", dollarReturn > 0 ? color.green : color.red, color.white)

// // =============================================================================

// // END BACKTEST CODE

// // =============================================================================

相关推荐