概述

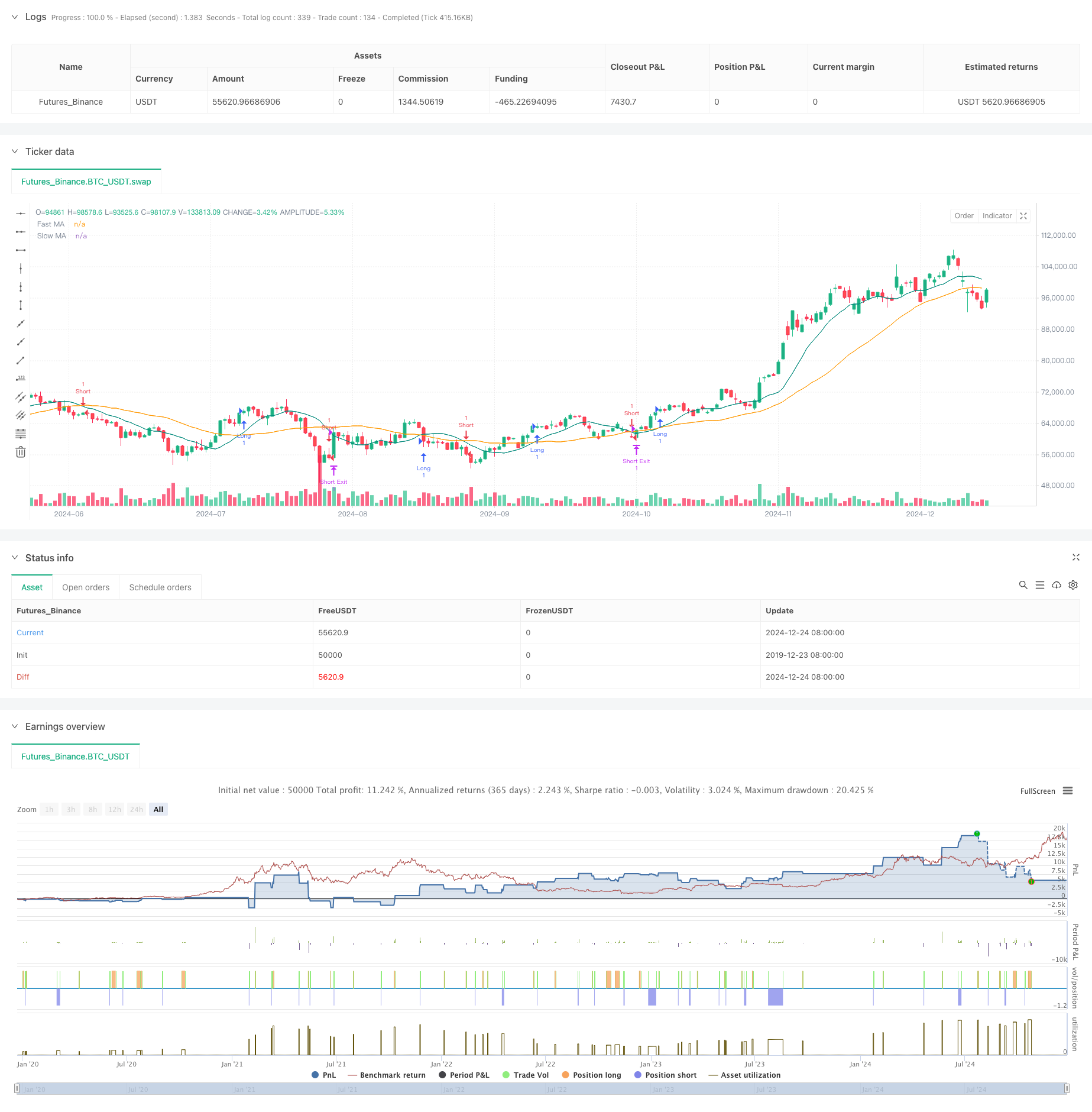

本策略是一个基于移动平均线交叉信号的自动化交易系统,通过设定固定的风险收益比来优化交易表现。策略采用快速移动平均线(Fast MA)和慢速移动平均线(Slow MA)的交叉来确定市场趋势方向,并结合预设的止损点和获利目标来管理持仓风险。

策略原理

策略的核心逻辑基于两条不同周期的移动平均线(10周期和30周期)产生的交叉信号。当快线上穿慢线时,系统产生做多信号;当快线下穿慢线时,系统产生做空信号。每次开仓后,系统会根据预设的2%止损比例自动计算止损位置,并按照2.5倍风险收益比设定获利目标。这种方式确保了每笔交易都具有固定的风险收益特征。

策略优势

- 风险管理系统化:通过固定的止损比例和风险收益比,实现了规范化的资金管理

- 交易机制客观:基于移动平均线交叉的信号系统,避免了主观判断带来的偏差

- 参数可调整性强:止损比例、风险收益比等关键参数都可以根据市场情况灵活调整

- 执行自动化程度高:从信号生成到仓位管理都实现了自动化,减少了人为操作失误

策略风险

- 震荡市场风险:在横盘震荡市场中,移动平均线交叉信号可能产生频繁的假突破

- 滑点风险:在快速行情中,实际成交价格可能与信号价格产生较大偏差

- 固定止损风险:单一的止损比例可能不适合所有市场环境

- 佣金成本:频繁交易可能带来较高的交易成本

策略优化方向

- 引入趋势过滤器:可以添加更长周期的移动平均线或其他趋势指标来过滤假信号

- 动态止损机制:根据市场波动率动态调整止损比例,提高策略适应性

- 增加成交量确认:结合成交量指标来验证突破的有效性

- 优化开仓时机:可以在移动平均线交叉后等待回调再入场,提高入场价格的效率

总结

该策略通过结合经典的技术分析方法和现代化的风险管理理念,构建了一个完整的交易系统。虽然存在一定的局限性,但通过持续优化和改进,策略有望在不同市场环境下保持稳定的表现。关键在于根据实际交易效果,不断调整参数设置,找到最适合当前市场环境的配置。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SOL 15m 2.5 R:R Strategy", overlay=true, margin_long=100, margin_short=100, initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.1)

//---------------------------------------------------

// User Inputs

//---------------------------------------------------

// sym = input.symbol("swap", "Symbol")

timeframe = input.timeframe("15", "Timeframe")

fastLength = input.int(10, "Fast MA Length")

slowLength = input.int(30, "Slow MA Length")

stopLossPerc = input.float(2.0, "Stop Loss %", step=0.1) // This is an example; adjust to achieve ~45% win rate

RR = input.float(2.5, "Risk to Reward Ratio", step=0.1)

//---------------------------------------------------

// Data Sources

//---------------------------------------------------

price = request.security("swap", timeframe, close)

// Compute moving averages

fastMA = ta.sma(price, fastLength)

slowMA = ta.sma(price, slowLength)

// Entry Conditions

longCondition = ta.crossover(fastMA, slowMA)

shortCondition = ta.crossunder(fastMA, slowMA)

//---------------------------------------------------

// Stop Loss and Take Profit Calculation

//---------------------------------------------------

var entryPrice = 0.0

if (strategy.position_size == 0) // not in a position

if longCondition

// Long entry

entryPrice := price

strategy.entry("Long", strategy.long)

if shortCondition

// Short entry

entryPrice := price

strategy.entry("Short", strategy.short)

if strategy.position_size > 0

// We are in a long position

if strategy.position_avg_price > 0 and strategy.position_size > 0

longStop = strategy.position_avg_price * (1 - stopLossPerc/100)

longTarget = strategy.position_avg_price * (1 + (stopLossPerc/100)*RR)

strategy.exit("Long Exit", "Long", stop=longStop, limit=longTarget)

if strategy.position_size < 0

// We are in a short position

if strategy.position_avg_price > 0 and strategy.position_size < 0

shortStop = strategy.position_avg_price * (1 + stopLossPerc/100)

shortTarget = strategy.position_avg_price * (1 - (stopLossPerc/100)*RR)

strategy.exit("Short Exit", "Short", stop=shortStop, limit=shortTarget)

//---------------------------------------------------

// Plotting

//---------------------------------------------------

plot(fastMA, color=color.new(color.teal, 0), title="Fast MA")

plot(slowMA, color=color.new(color.orange, 0), title="Slow MA")

相关推荐