概述

这是一个基于唐奇安通道(Donchian Channel)的动量突破交易策略,结合了价格突破和交易量确认两个关键条件。该策略通过观察价格是否突破预定义的价格区间,并且要求成交量支撑,来捕捉市场的上涨趋势。策略采用了滞后参数来提高通道的稳定性,并提供了灵活的退出条件选择。

策略原理

策略的核心逻辑包含以下几个关键部分: 1. 使用滞后型唐奇安通道作为主要技术指标,通过计算过去27个周期的最高价和最低价来构建上轨、中轨和下轨。 2. 入场条件需同时满足: - 收盘价突破唐奇安通道上轨 - 当前成交量大于过去27个周期平均成交量的1.4倍 3. 出场条件灵活可选: - 可选择在价格跌破上轨、中轨或下轨时退出 - 默认使用中轨作为退出信号 4. 通过10个周期的滞后参数来提高通道的稳定性,减少假突破。

策略优势

- 多重确认机制:结合价格突破和成交量确认,大大降低了虚假信号的风险。

- 适应性强:通过参数化设计,策略可以适应不同的市场环境。

- 风险控制完善:提供了多种退出条件选择,便于根据不同的风险偏好进行调整。

- 执行明确:入场和出场条件清晰,不存在模糊地带。

- 易于实现:策略逻辑简单直接,便于实盘操作。

策略风险

- 市场波动风险:在震荡市场中可能产生频繁的假突破信号。

- 滑点风险:突破时刻的交易量往往较大,可能面临较大滑点。

- 趋势反转风险:如果市场突然反转,可能来不及及时出场。

- 参数敏感性:策略效果对参数设置较为敏感,需要careful优化。

策略优化方向

- 增加趋势过滤器:可以添加额外的趋势判断指标,如移动平均线系统。

- 优化成交量指标:可以考虑使用更复杂的成交量分析方法,如OBV或资金流量指标。

- 完善止损机制:增加追踪止损或固定止损功能。

- 增加时间过滤:可以添加日内时间过滤,避免在波动较大的开盘和收盘时段交易。

- 引入波动率适应:根据市场波动率自动调整参数,提高策略的适应性。

总结

这是一个设计合理、逻辑清晰的趋势跟踪策略。通过结合价格突破和成交量确认,策略在保证可靠性的同时也保持了较好的灵活性。策略的参数化设计使其具有良好的适应性,但同时也需要投资者根据具体市场情况进行优化调整。整体而言,这是一个值得进一步优化和实践的策略框架。

策略源码

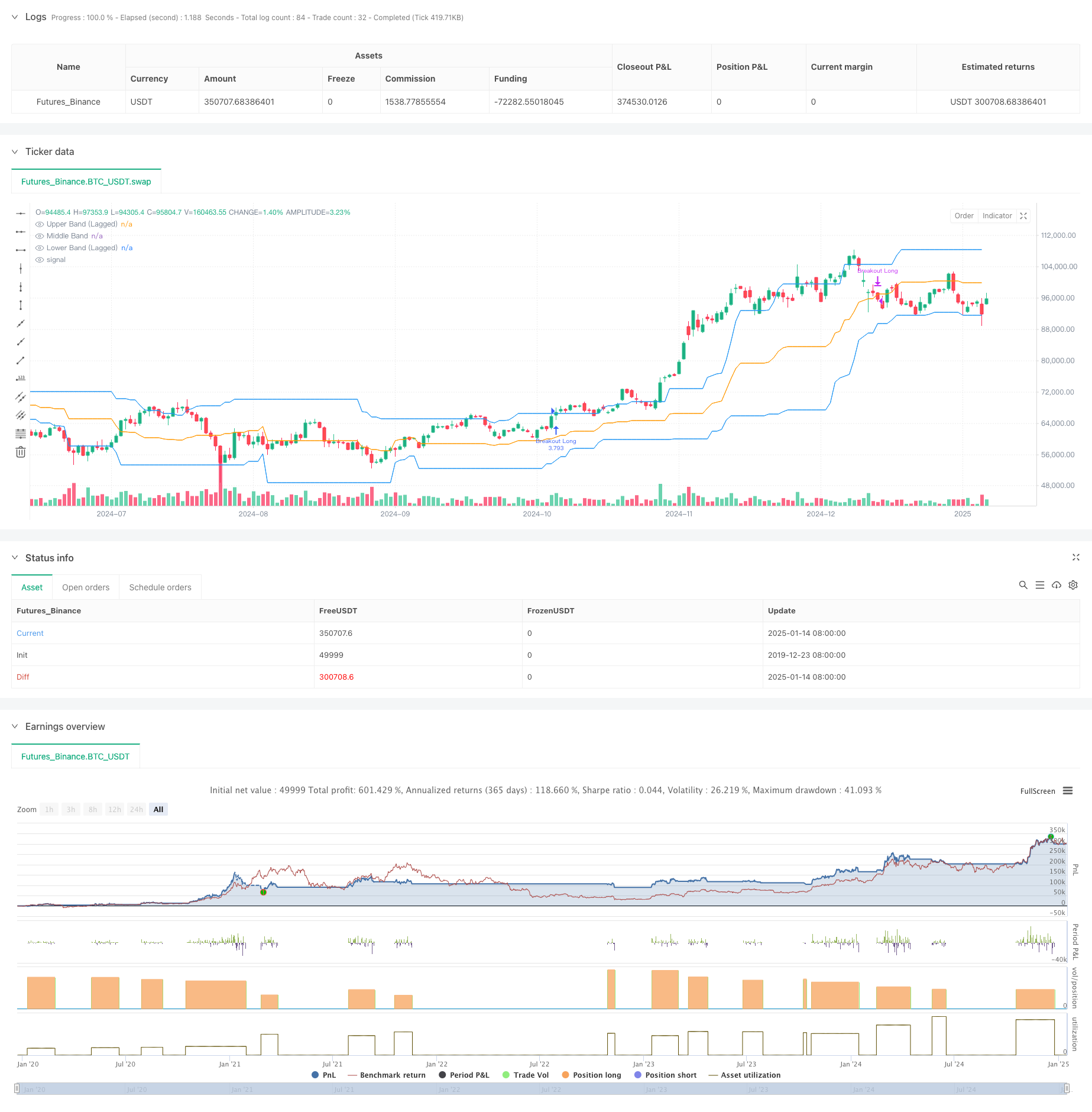

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-15 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=6

strategy("Breakout Strategy", overlay=true, calc_on_every_tick=false, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.1, pyramiding=1, fill_orders_on_standard_ohlc=true)

// Input Parameters

start_date = input(timestamp("2018-01-01 00:00"), "Start Date")

end_date = input(timestamp("2060-01-01 00:00"), "End Date")

in_time_range = true

length = input.int(27, title="Donchian Channel Length", minval=1, tooltip="Number of bars used to calculate the Donchian channel.")

lag = input.int(10, title="Donchian Channel Offset", minval=1, tooltip = "Offset to delay the Donchian channel, enhancing stability.")

volume_mult = input.float(1.4, title="Volume Multiplier", minval=0.1, step=0.1, tooltip="Multiplier for the average volume to filter breakout conditions.")

closing_condition = input.string("Mid", title="Trade Closing Band", options= ["Upper","Lower","Mid"], tooltip = "Donchian Channel Band to use for exiting trades: Upper, Lower, or Middle.") //

// Donchian Channel (Lagged for Stability)

upper_band = ta.highest(high[lag], length)

lower_band = ta.lowest(low[lag], length)

middle_band = (upper_band + lower_band) / 2

plot(upper_band, color=color.blue, title="Upper Band (Lagged)")

plot(middle_band, color=color.orange, title="Middle Band")

plot(lower_band, color=color.blue, title="Lower Band (Lagged)")

// Volume Filter

avg_volume = ta.sma(volume, length)

volume_condition = volume > avg_volume * volume_mult

// Long Breakout Condition

long_condition = close > upper_band and volume_condition

bool reverse_exit_condition = false

// Exit Condition (Close below the middle line)

if closing_condition == "Lower"

reverse_exit_condition := close < lower_band

else if closing_condition == "Upper"

reverse_exit_condition := close < upper_band

else

reverse_exit_condition := close < middle_band

// Long Strategy: Entry and Exit

if in_time_range and long_condition

strategy.entry("Breakout Long", strategy.long)

// Exit on Reverse Signal

if in_time_range and reverse_exit_condition

strategy.close("Breakout Long", comment="Reverse Exit")

相关推荐