概述

这是一个基于凯特纳通道(Keltner Channel)的灵活交易策略。该策略支持多空双向交易,通过对价格突破通道上下轨的监控来进行交易。策略的核心在于使用移动平均线(MA)构建价格通道,并结合真实波幅(ATR)来动态调整通道宽度,从而在不同市场环境下保持策略的适应性。

策略原理

策略主要基于以下几个核心原理: 1. 通过EMA或SMA计算价格的中心趋势,形成通道中轨 2. 利用ATR、TR或Range计算波动率,构建通道上下轨 3. 当价格突破上轨时触发做多信号,突破下轨时触发做空信号 4. 采用止损委托单机制进行入场和出场,提高交易执行的可靠性 5. 支持灵活的交易模式选择:仅做多、仅做空或双向交易

策略优势

- 适应性强 - 通过ATR动态调整通道宽度,使策略能够适应不同的市场波动环境

- 风险控制完善 - 使用止损委托单机制进行交易,有效控制风险

- 操作灵活 - 支持多种交易模式,可根据市场特点和交易偏好进行调整

- 验证有效 - 在加密货币和股票市场表现良好,特别是在波动性较大的市场中

- 可视化清晰 - 提供交易信号和持仓状态的直观显示

策略风险

- 震荡市场风险 - 在横盘震荡市场可能产生频繁的假突破信号

- 滑点风险 - 在流动性不足的市场中,止损委托单可能面临较大滑点

- 趋势反转风险 - 在趋势突然反转时可能承受较大损失

- 参数敏感性 - 通道参数的选择对策略表现有重要影响

策略优化方向

- 引入趋势过滤器 - 通过添加趋势判断指标来减少假突破信号

- 动态参数优化 - 根据市场波动状况动态调整通道参数

- 完善止损机制 - 增加移动止损功能以更好地保护利润

- 增加成交量确认 - 结合成交量指标来提高信号可靠性

- 优化持仓管理 - 引入动态仓位管理以更好地控制风险

总结

该策略是一个设计完善、逻辑清晰的交易系统,通过灵活运用凯特纳通道和多种技术指标,实现了对市场机会的有效捕捉。策略的可定制性强,适合不同风险偏好的交易者使用。通过持续优化和改进,该策略有望在各类市场环境下保持稳定的表现。

策略源码

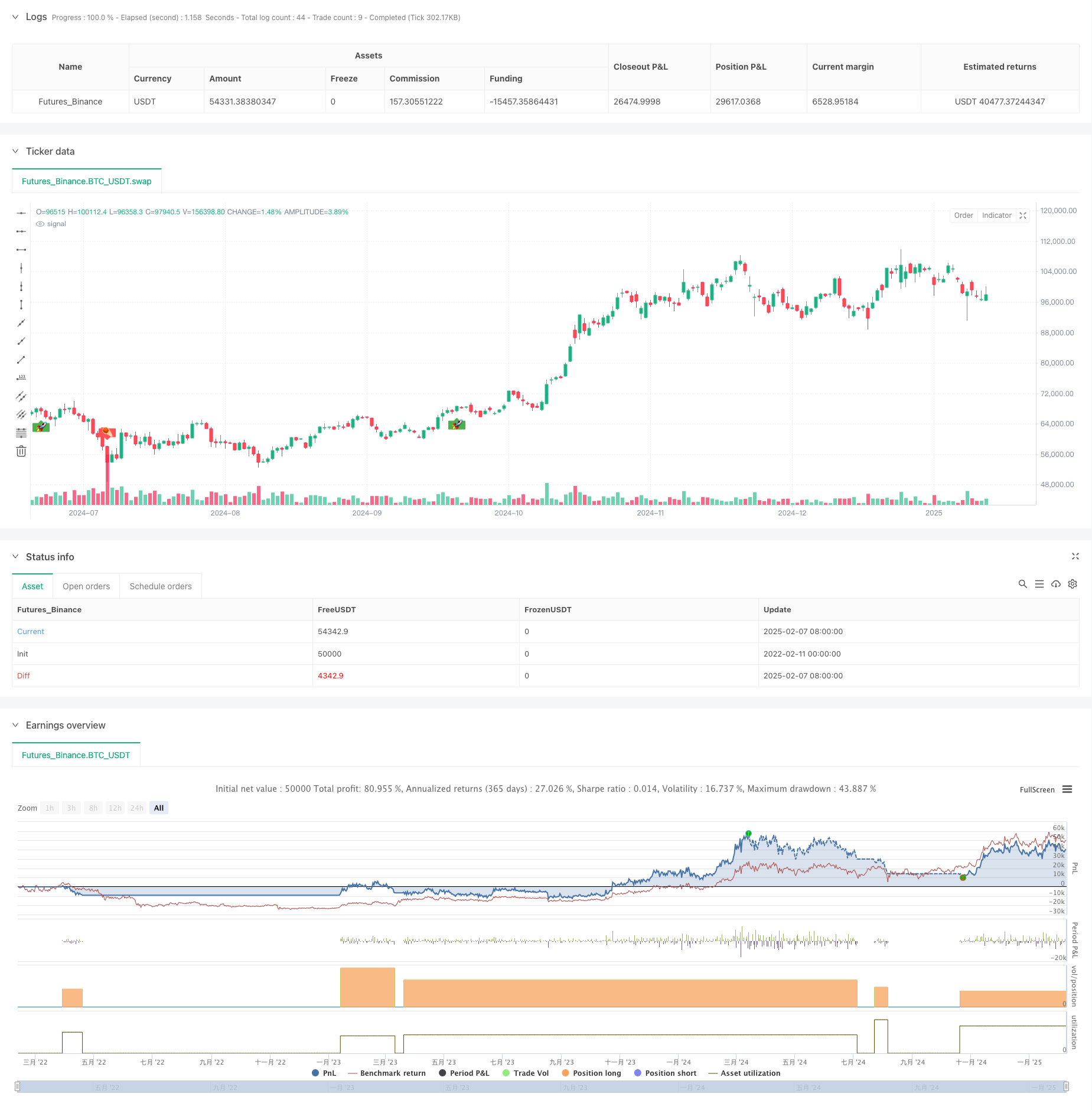

/*backtest

start: 2022-02-11 00:00:00

end: 2025-02-08 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy(title = "Jaakko's Keltner Strategy", overlay = true, initial_capital = 10000, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

// ──────────────────────────────────────────────────────────────────────────────

// ─── USER INPUTS ─────────────────────────────────────────────────────────────

// ──────────────────────────────────────────────────────────────────────────────

length = input.int(20, minval=1, title="Keltner MA Length")

mult = input.float(2.0, title="Multiplier")

src = input(close, title="Keltner Source")

useEma = input.bool(true, title="Use Exponential MA")

BandsStyle = input.string(title = "Bands Style", defval = "Average True Range", options = ["Average True Range", "True Range", "Range"])

atrLength = input.int(10, title="ATR Length")

// Choose which side(s) to trade

tradeMode = input.string(title = "Trade Mode", defval = "Long Only", options = ["Long Only", "Short Only", "Both"])

// ──────────────────────────────────────────────────────────────────────────────

// ─── KELTNER MA & BANDS ───────────────────────────────────────────────────────

// ──────────────────────────────────────────────────────────────────────────────

f_ma(source, length, emaMode) =>

maSma = ta.sma(source, length)

maEma = ta.ema(source, length)

emaMode ? maEma : maSma

ma = f_ma(src, length, useEma)

rangeMa = BandsStyle == "True Range" ? ta.tr(true) : BandsStyle == "Average True Range" ? ta.atr(atrLength) : ta.rma(high - low, length)

upper = ma + rangeMa * mult

lower = ma - rangeMa * mult

// ──────────────────────────────────────────────────────────────────────────────

// ─── CROSS CONDITIONS ─────────────────────────────────────────────────────────

// ──────────────────────────────────────────────────────────────────────────────

crossUpper = ta.crossover(src, upper) // potential long signal

crossLower = ta.crossunder(src, lower) // potential short signal

// ──────────────────────────────────────────────────────────────────────────────

// ─── PRICE LEVELS FOR STOP ENTRY (LONG) & STOP ENTRY (SHORT) ─────────────────

// ──────────────────────────────────────────────────────────────────────────────

bprice = 0.0

bprice := crossUpper ? high + syminfo.mintick : nz(bprice[1])

sprice = 0.0

sprice := crossLower ? low - syminfo.mintick : nz(sprice[1])

// ──────────────────────────────────────────────────────────────────────────────

// ─── BOOLEAN FLAGS FOR PENDING LONG/SHORT ─────────────────────────────────────

// ──────────────────────────────────────────────────────────────────────────────

crossBcond = false

crossBcond := crossUpper ? true : crossBcond[1]

crossScond = false

crossScond := crossLower ? true : crossScond[1]

// Cancel logic for unfilled orders (same as original)

cancelBcond = crossBcond and (src < ma or high >= bprice)

cancelScond = crossScond and (src > ma or low <= sprice)

// ──────────────────────────────────────────────────────────────────────────────

// ─── LONG SIDE ────────────────────────────────────────────────────────────────

// ──────────────────────────────────────────────────────────────────────────────

if (tradeMode == "Long Only" or tradeMode == "Both") // Only run if mode is long or both

// Cancel unfilled long if invalid

if cancelBcond

strategy.cancel("KltChLE")

// Place long entry

if crossUpper

strategy.entry("KltChLE", strategy.long, stop=bprice, comment="Long Entry")

// If we are also using “Both,” we rely on short side to flatten the long.

// But if “Long Only,” we can exit on crossLower or do nothing.

// Let’s do a "stop exit" if in "Long Only" (like the improved version).

if tradeMode == "Long Only"

// Cancel unfilled exit

if cancelScond

strategy.cancel("KltChLX")

// Place exit if crossLower

if crossLower

strategy.exit("KltChLX", from_entry="KltChLE", stop=sprice, comment="Long Exit")

// ──────────────────────────────────────────────────────────────────────────────

// ─── SHORT SIDE ───────────────────────────────────────────────────────────────

// ──────────────────────────────────────────────────────────────────────────────

if (tradeMode == "Short Only" or tradeMode == "Both") // Only run if mode is short or both

// Cancel unfilled short if invalid

if cancelScond

strategy.cancel("KltChSE")

// Place short entry

if crossLower

strategy.entry("KltChSE", strategy.short, stop=sprice, comment="Short Entry")

// If “Short Only,” we might do a symmetrical exit approach for crossUpper

// Or if "Both," going long automatically flattens the short in a no-hedge account.

// Let's replicate "stop exit" for short side if "Short Only" is chosen:

if tradeMode == "Short Only"

// Cancel unfilled exit

if cancelBcond

strategy.cancel("KltChSX")

// Place exit if crossUpper

if crossUpper

strategy.exit("KltChSX", from_entry="KltChSE", stop=bprice, comment="Short Exit")

// ──────────────────────────────────────────────────────────────────────────────

// ─── OPTIONAL VISUALS ─────────────────────────────────────────────────────────

// ──────────────────────────────────────────────────────────────────────────────

barcolor(strategy.position_size > 0 ? color.green : strategy.position_size < 0 ? color.red : na)

plotshape( strategy.position_size > 0 and strategy.position_size[1] <= 0, title = "BUY", text = '🚀', style = shape.labelup, location = location.belowbar, color = color.green, textcolor = color.white, size = size.small)

plotshape( strategy.position_size <= 0 and strategy.position_size[1] > 0, title = "SELL", text = '☄️', style = shape.labeldown, location = location.abovebar, color = color.red, textcolor = color.white, size = size.small)

plotshape(crossLower, style=shape.triangledown, color=color.red, location=location.abovebar, title="CrossLower Trigger")

相关推荐