概述

该策略是一个基于价格动量和成交量的交易系统,专注于识别强势上涨后的微小回调机会。策略通过监测大幅上涨的绿色蜡烛线后的短期回调,在价格出现反转信号时进场交易。系统采用了多重过滤条件,包括成交量、ATR波动率以及回调幅度的限制,以提高交易的准确性。

策略原理

策略的核心逻辑基于市场动量延续的原理,主要包含以下关键要素: 1. 通过成交量和ATR倍数识别强势上涨蜡烛,要求成交量超过均量的1.5倍且大于20万 2. 监控上涨后的回调过程,限制最大连续红蜡烛数量为3根 3. 设置最大回调幅度为50%,超过则放弃该交易机会 4. 在回调企稳后,价格突破前期高点时触发做多信号 5. 采用OCO订单组合管理持仓,包含止损和获利目标 6. 止损设置在回调低点下方,获利目标为风险的2倍

策略优势

- 结合了价格动量和成交量的双重确认,提高了信号的可靠性

- 通过严格的回调条件过滤,避免假突破陷阱

- 采用客观的技术指标,降低了主观判断的影响

- 清晰的风险控制机制,固定的风险收益比设置

- 系统自动化程度高,适合批量交易多个品种

- 具有良好的可扩展性,易于添加新的过滤条件

策略风险

- 在市场剧烈波动时可能频繁触发假信号

- 高位强势股回调幅度可能超过预设限制

- 成交量条件在不同市场环境下需要动态调整

- 止损位设置较近,可能被市场噪音触及

- 获利目标可能过于激进,难以完全达成

- 需要较大的样本量来验证策略的稳定性

策略优化方向

- 引入趋势过滤器,如均线系统或趋势指标,确保在主趋势方向交易

- 动态调整成交量阈值,适应不同市场周期

- 优化止损位置设置,可考虑使用ATR的倍数

- 添加时间过滤器,避开市场开盘和收盘波动

- 引入多时间周期确认,提高信号可靠性

- 开发自适应参数系统,根据市场状态调整策略参数

总结

这是一个设计合理的趋势跟踪策略,通过严格的条件筛选和风险管理,能够捕捉市场中的优质交易机会。策略的成功关键在于参数的优化和市场环境的适应性调整。建议在实盘交易前进行充分的回测验证,并根据具体交易品种特点进行参数调整。

策略源码

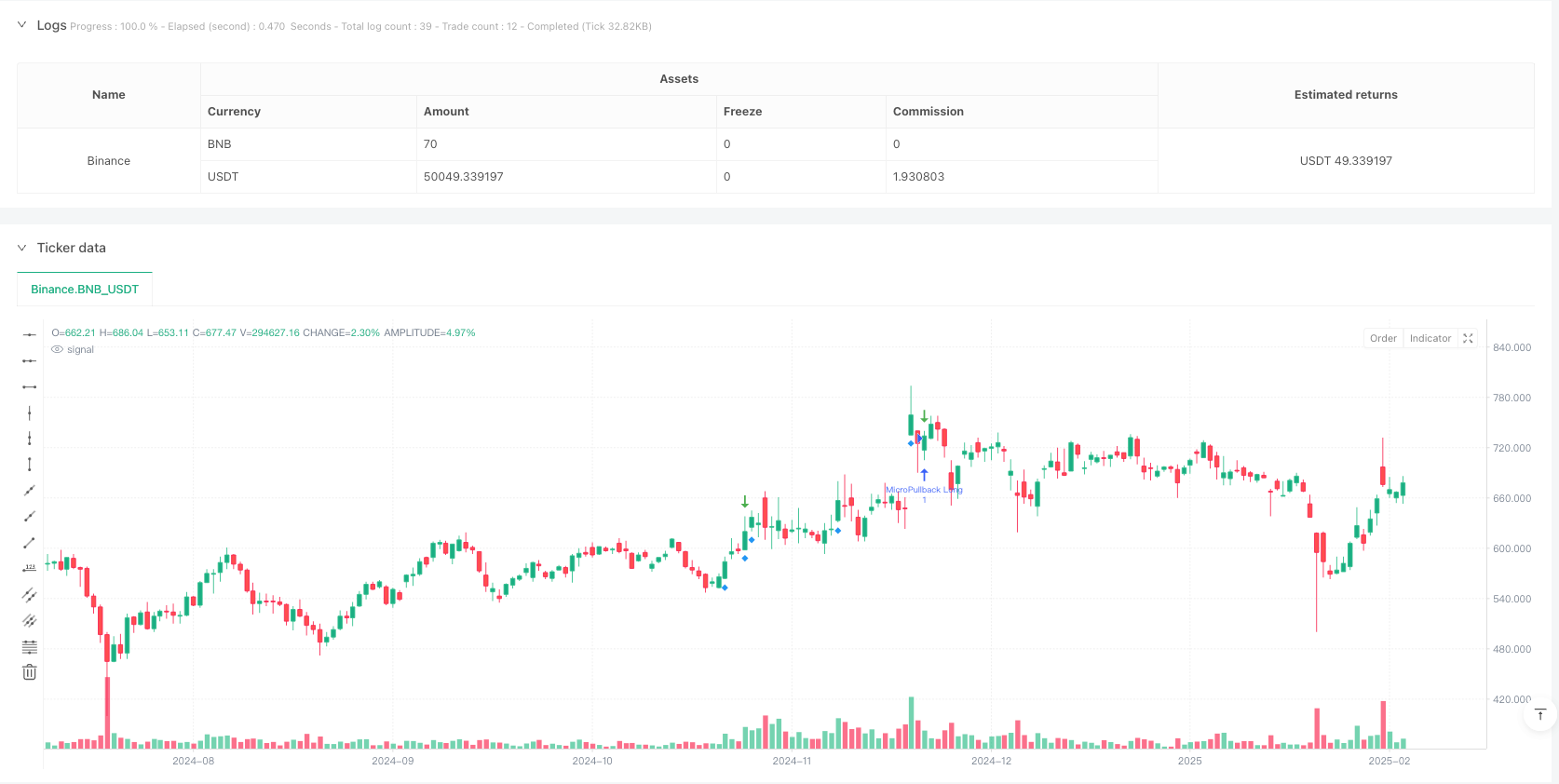

/*backtest

start: 2024-02-19 00:00:00

end: 2025-02-17 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BNB_USDT"}]

*/

//@version=6

strategy(title="Micropullback Detector w/ Stop Buy & Exits", shorttitle="MicroPB Det+Exits", overlay=true)

// USER INPUTS

volLookback = input.int(20, "Volume SMA Period", minval=1)

volMultiplier = input.float(1.5, "Volume Multiplier for High Volume", minval=1.0)

largeCandleATR = input.float(0.5, "Fraction of ATR to define 'Large Candle'", minval=0.1)

maxRedPullback = input.int(3, "Max Consecutive Red Candles in Pullback")

maxRetracementPc = input.float(50, "Max Retracement % for pullback", minval=1.0, maxval=100.0)

// CALCULATIONS

fastAtr = ta.atr(14)

avgVolume = ta.sma(volume, volLookback)

isLargeGreenCandle = (close > open) and ((close - open) > fastAtr * largeCandleATR) and (volume > avgVolume * volMultiplier) and (volume > 200000)

// HELPER FLAGS

isGreen = close >= open

isRed = close < open

// STATE VARIABLES

var int state = 0

var float waveStartPrice = na

var float waveHighestPrice = na

var float largestGreenVol = na

var int consecutiveRedPulls = 0

var bool triggerSignal = false

var float wavePullbackLow = na

if barstate.isnew

triggerSignal:=false

if state==0

wavePullbackLow:=na

if isLargeGreenCandle

state:=1

waveStartPrice:=open

waveHighestPrice:=high

largestGreenVol:=volume

consecutiveRedPulls:=0

else if state==1

if isGreen

waveHighestPrice:=math.max(waveHighestPrice,high)

if volume>largestGreenVol

largestGreenVol:=volume

else

state:=2

consecutiveRedPulls:=1

wavePullbackLow:=low

else if state==2

if isRed

if volume>largestGreenVol

state:=0

consecutiveRedPulls+=1

if consecutiveRedPulls>=maxRedPullback+1

state:=0

retracementLevel=waveStartPrice+(maxRetracementPc/100.0)*(waveHighestPrice-waveStartPrice)

wavePullbackLow:=math.min(wavePullbackLow,low)

if close<retracementLevel

state:=0

else

consecutiveRedPulls:=0

if high>high[1]

triggerSignal:=true

state:=3

else if state==3

state:=0

// Plot shapes for signals (last 1440 bars ~ 1 day at 1-min TF)

plotshape(isLargeGreenCandle, title="Large Green Candle", style=shape.diamond, location=location.belowbar, color=color.new(color.blue, 0), offset=0, size=size.small, show_last=1440)

plotshape(triggerSignal, title="MicroPB Entry", style=shape.arrowdown, location=location.abovebar, color=color.new(color.green, 0), offset=0, size=size.large, show_last=1440)

// ENTRY & EXITS

if triggerSignal

// Stop Buy above the previous bar's high

entryPrice = high[1]

strategy.order("MicroPullback Long", strategy.long, limit=entryPrice, oca_name="MicroPullback")

// Stoploss slightly below pullback low

stopPrice = wavePullbackLow - 2*syminfo.mintick

// Risk & take-profit calculations

risk = entryPrice - stopPrice

tpPrice = entryPrice + 2 * risk

// Exit: stop or TP

strategy.exit("SL+TP", "MicroPullback Long", stop=stopPrice, limit=tpPrice, qty_percent=100)

// ALERT

alertcondition(triggerSignal, title="MicroPullback LONG", message="Micropullback Long Signal Detected!")

相关推荐