概述

该策略是一个结合了多个技术指标的完整交易系统,主要基于Z分数来衡量交易量和K线实体大小的异常值,并使用ATR(平均真实波幅)来设置动态止损位。系统还整合了风险收益比(RR)来优化获利目标,通过多维度的技术分析提供可靠的交易信号。

策略原理

策略的核心逻辑基于以下几个关键组件: 1. Z分数分析:计算交易量和K线实体的标准差,识别市场异常活跃度 2. 趋势确认:通过分析相邻K线的高低点和收盘价来确认趋势方向 3. ATR止损:使用动态ATR值设置止损位置,提供更灵活的风险控制 4. 风险收益比:基于设定的RR比例自动计算获利目标 5. 可视化标记:在图表上标注交易信号和关键价格水平

策略优势

- 多维度信号确认:结合成交量、价格动量和趋势方向,提高交易信号的可靠性

- 动态风险管理:通过ATR实现自适应止损,better适应市场波动

- 灵活的参数配置:允许调整Z分数阈值、ATR倍数和风险收益比

- 精确的入场时机:使用Z分数异常值识别关键交易机会

- 清晰的可视化:在图表上明确标注入场点、止损位和获利目标

策略风险

- 参数敏感性:Z分数阈值和ATR倍数的设置直接影响交易频率和风险控制

- 市场环境依赖:在低波动率环境下可能产生较少的交易信号

- 计算复杂性:多重指标计算可能导致信号生成延迟

- 滑点风险:在快速市场中可能面临实际执行价格与信号价格的偏差

- 假突破风险:在盘整市场中可能触发错误的突破信号

策略优化方向

- 市场环境过滤:添加市场波动率过滤器,在不同市场环境下动态调整参数

- 信号确认机制:引入更多技术指标进行交叉验证,如RSI或MACD

- 仓位管理优化:基于波动率和账户风险实现动态仓位调整

- 多时间周期分析:整合更高时间周期的趋势确认,提高交易成功率

- 信号过滤优化:增加额外的过滤条件以减少假信号

总结

该策略通过结合Z分数分析、ATR止损和风险收益比优化,构建了一个完整的交易系统。系统的优势在于多维度的信号确认和灵活的风险管理,但仍需注意参数设置和市场环境的影响。通过建议的优化方向,策略可以进一步提升其稳定性和适应性。

策略源码

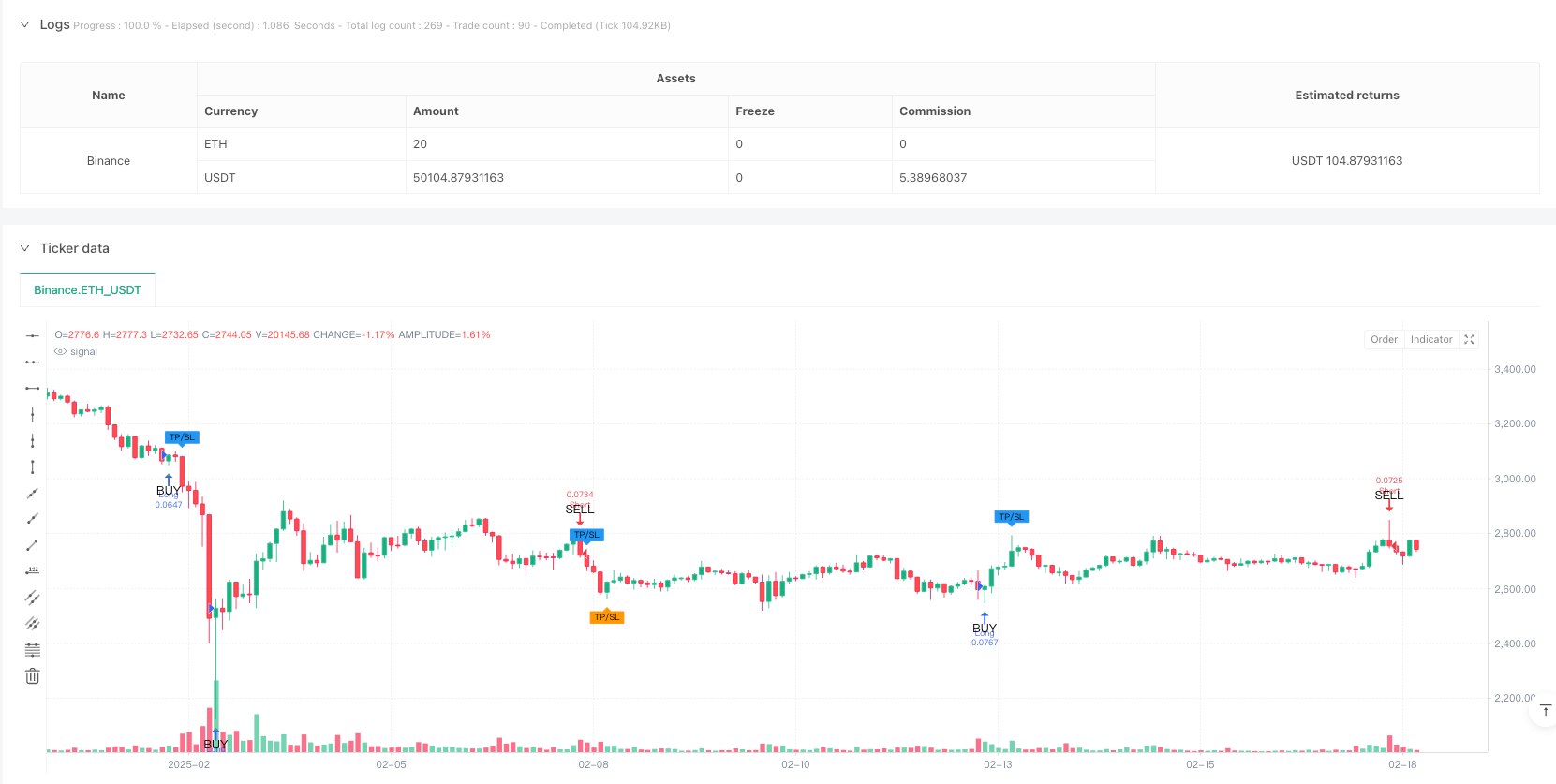

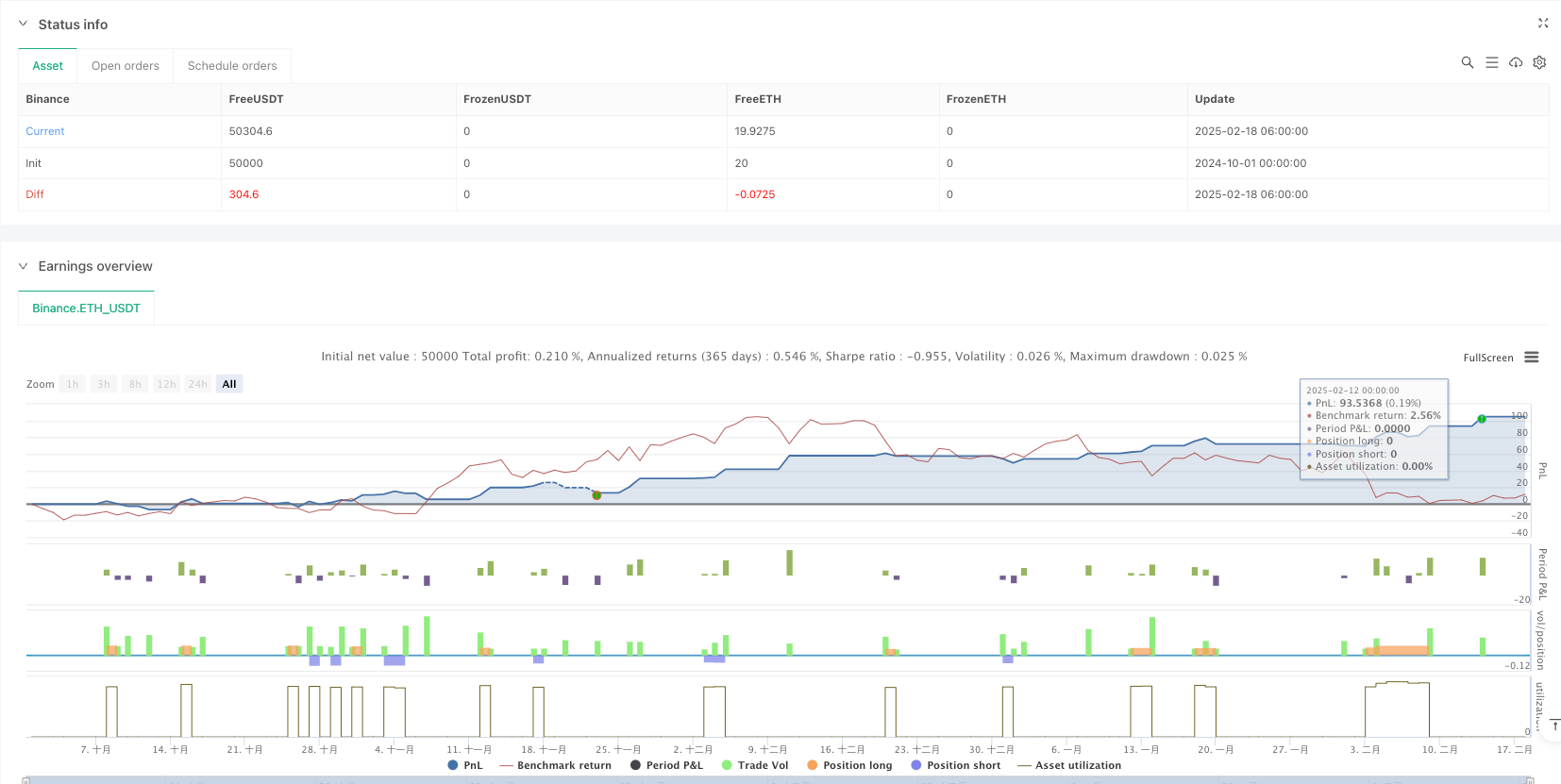

/*backtest

start: 2024-10-01 00:00:00

end: 2025-02-18 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("admbrk | Candle Color & Price Alarm with ATR Stop", overlay=true, initial_capital=50, default_qty_type=strategy.cash, default_qty_value=200, commission_type=strategy.commission.percent, commission_value=0.05, pyramiding=3)

// **Risk/Reward ratio (RR) as input**

rr = input.float(2.0, title="Risk/Reward Ratio (RR)", step=0.1)

// **Z-score calculation function**

f_zscore(src, len) =>

mean = ta.sma(src, len)

std = ta.stdev(src, len)

(src - mean) / std

// **Z-score calculations**

len = input(20, "Z-Score MA Length")

z1 = input.float(1.5, "Threshold z1", step=0.1)

z2 = input.float(2.5, "Threshold z2", step=0.1)

z_volume = f_zscore(volume, len)

z_body = f_zscore(math.abs(close - open), len)

i_src = input.string("Volume", title="Source", options=["Volume", "Body size", "Any", "All"])

float z = na

if i_src == "Volume"

z := z_volume

else if i_src == "Body size"

z := z_body

else if i_src == "Any"

z := math.max(z_volume, z_body)

else if i_src == "All"

z := math.min(z_volume, z_body)

// **Determine trend direction**

green = close >= open

red = close < open

// **Long and Short signals**

longSignal = barstate.isconfirmed and red[1] and low < low[1] and green

shortSignal = barstate.isconfirmed and green[1] and high > high[1] and red

long = longSignal and (z >= z1)

short = shortSignal and (z >= z1)

// **ATR calculation (for ATR Stop)**

atrLength = input.int(14, title="ATR Length")

atrMultiplier = input.float(1.5, title="ATR Stop Multiplier")

atrValue = ta.atr(atrLength)

// **ATR-based stop-loss calculation**

long_atr_stop = close - atrValue * atrMultiplier

short_atr_stop = close + atrValue * atrMultiplier

// **Stop-loss setting (set to the lowest/highest wick of the last two bars)**

long_sl = ta.lowest(low, 2) // Long stop-loss (lowest of the last 2 bars)

short_sl = ta.highest(high, 2) // Short stop-loss (highest of the last 2 bars)

// **Take-profit calculation (with RR)**

long_tp = close + (close - long_sl) * rr

short_tp = close - (short_sl - close) * rr

triggerAlarm(symbol)=>

status = close

var string message = na

alarmMessageJSON = syminfo.ticker + message +"\\n" + "Price: " + str.tostring(status)

if long

// Open Long position

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", stop=math.max(long_sl, long_atr_stop), limit=long_tp)

if short

// Open Short position

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", stop=math.min(short_sl, short_atr_stop), limit=short_tp)

// **Coloring the candles (BUY = Green, SELL = Red)**

barcolor(long ? color.green : short ? color.red : na)

// **Add entry/exit markers on the chart**

plotshape(long, title="BUY Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small, text="BUY")

plotshape(short, title="SELL Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small, text="SELL")

// **Plot TP and SL markers on exits**

exitLong = strategy.position_size < strategy.position_size[1] and strategy.position_size[1] > 0

exitShort = strategy.position_size > strategy.position_size[1] and strategy.position_size[1] < 0

plotshape(exitLong, title="Long Exit", location=location.abovebar, color=color.blue, style=shape.labeldown, size=size.tiny, text="TP/SL")

plotshape(exitShort, title="Short Exit", location=location.belowbar, color=color.orange, style=shape.labelup, size=size.tiny, text="TP/SL")

// **Add alerts**

alertcondition(long, title="Long Signal", message="Long signal triggered!")

alertcondition(short, title="Short Signal", message="Short signal triggered!")

相关推荐