概述

该策略是一个基于多重移动平均线和趋势强度的智能交易系统。它通过分析价格与不同周期移动平均线之间的偏离程度来衡量市场趋势强度,并结合ATR波动率指标进行仓位管理和风险控制。该策略具有高度的可定制性,可以根据不同市场环境和交易需求灵活调整参数。

策略原理

策略的核心逻辑基于以下几个方面: 1. 使用两条不同周期(快速和慢速)的移动平均线来识别趋势方向和交叉信号 2. 通过计算价格与移动平均线的偏离度(以点数计)来量化趋势强度 3. 结合K线形态(吞没、锤子、射击之星、十字星等)作为辅助确认信号 4. 使用ATR指标动态计算止损和获利目标 5. 采用部分获利和追踪止损的方式进行订单管理

策略优势

- 系统具有很强的适应性,可以通过参数调整适应不同市场环境

- 通过偏离度量化趋势强度,避免在趋势较弱时频繁交易

- 结合多重技术指标和形态确认,提高交易信号的可靠性

- 采用基于ATR的动态止损方式,合理控制风险

- 支持复利和固定仓位两种资金管理方式

- 具备部分获利和追踪止损功能,有效保护盈利

策略风险

- 在震荡市场中可能产生较多假信号,建议增加震荡指标过滤

- 多重指标组合可能导致错过一些交易机会

- 参数优化过度可能导致过拟合风险

- 在流动性较差的市场中,大额交易可能面临滑点风险

- 需要合理设置止损比例,避免单次损失过大

策略优化方向

- 可以添加成交量指标作为趋势确认的辅助指标

- 考虑引入市场波动率指标动态调整交易频率

- 基于不同时间周期的趋势一致性进行信号过滤

- 增加更多的止损方式选择,如时间止损等

- 开发自适应参数优化机制,提高策略适应性

总结

该策略通过结合移动平均线、趋势强度量化、K线形态和动态风险管理,构建了一个全面的交易系统。它既保持了策略逻辑的简洁性,又通过多重确认机制提高了交易的可靠性。策略的高度可定制性使其能够适应不同的交易风格和市场环境,但使用时需要注意参数优化和风险控制。

策略源码

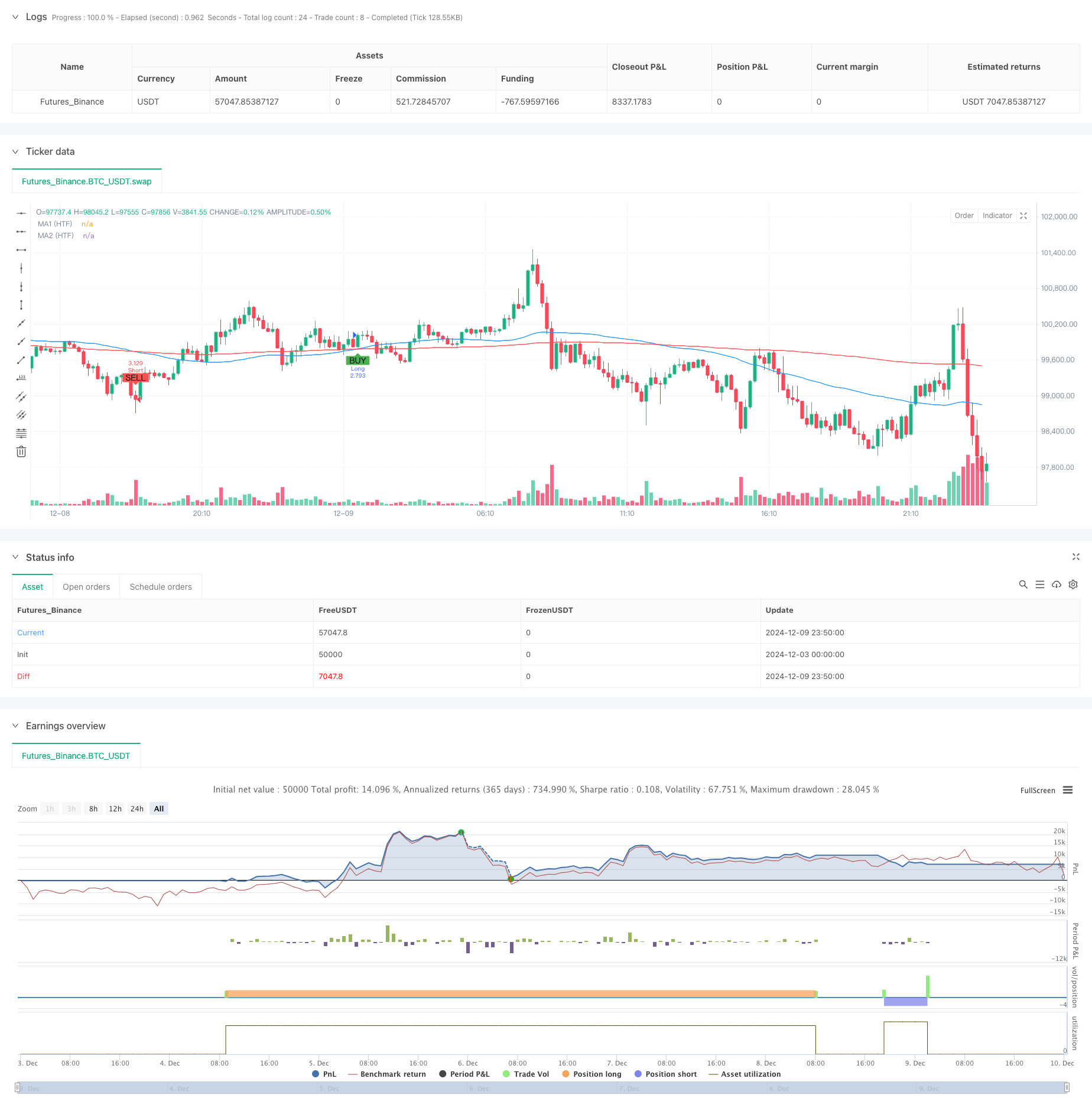

/*backtest

start: 2024-12-03 00:00:00

end: 2024-12-10 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Customizable Strategy with Signal Intensity Based on Pips Above/Below MAs", overlay=true)

// Customizable Inputs

// Account and Risk Management

account_size = input.int(100000, title="Account Size (USD)", minval=1)

compounded_results = input.bool(true, title="Compounded Results")

risk_per_trade = input.float(1.0, title="Risk per Trade (%)", minval=0.1, maxval=100) / 100

// Moving Averages Settings

ma1_length = input.int(50, title="Moving Average 1 Length", minval=1)

ma2_length = input.int(200, title="Moving Average 2 Length", minval=1)

// Higher Time Frame for Moving Averages

ma_htf = input.timeframe("D", title="Higher Time Frame for MA Delay")

// Signal Intensity Range based on pips

signal_intensity_min = input.int(0, title="Signal Intensity Start (Pips)", minval=0, maxval=1000)

signal_intensity_max = input.int(1000, title="Signal Intensity End (Pips)", minval=0, maxval=1000)

// ATR-Based Stop Loss and Take Profit

atr_length = input.int(14, title="ATR Length", minval=1)

atr_multiplier_stop = input.float(1.5, title="Stop Loss Size (ATR Multiplier)", minval=0.1)

atr_multiplier_take_profit = input.float(2.5, title="Take Profit Size (ATR Multiplier)", minval=0.1)

// Trailing Stop and Partial Profit

trailing_stop_rr = input.float(2.0, title="Trailing Stop (R:R)", minval=0)

partial_profit_percentage = input.float(50, title="Take Partial Profit (%)", minval=0, maxval=100)

// Trend Filter Settings

trend_filter_enabled = input.bool(true, title="Trend Filter Enabled")

trend_filter_sensitivity = input.float(50, title="Trend Filter Sensitivity", minval=0, maxval=100)

// Candle Pattern Type for Entry

entry_candle_type = input.string("Any", title="Entry Candle Type", options=["Any", "Engulfing", "Hammer", "Shooting Star", "Doji"])

// Moving Average Entry Conditions

ma_entry_condition = input.string("Both", title="MA Entry", options=["Fast Above Slow", "Fast Below Slow", "Both"])

// Trade Direction (Long, Short, or Both)

trade_direction = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"])

// ATR Calculation

atr_value = ta.atr(atr_length)

// Moving Average Calculations (using Higher Time Frame)

ma1_htf = ta.sma(request.security(syminfo.tickerid, ma_htf, close), ma1_length)

ma2_htf = ta.sma(request.security(syminfo.tickerid, ma_htf, close), ma2_length)

// Candle Pattern Conditions

is_engulfing = close[1] < open[1] and close > open and high > high[1] and low < low[1]

is_hammer = (high - low) > 3 * (close - open) and (close > open) and (low == ta.lowest(low, 5))

is_shooting_star = (high - low) > 3 * (open - close) and (open > close) and (high == ta.highest(high, 5))

is_doji = (close - open) <= ((high - low) * 0.1)

// Apply the selected candle pattern

candle_condition = false

if entry_candle_type == "Any"

candle_condition := true

if entry_candle_type == "Engulfing"

candle_condition := is_engulfing

if entry_candle_type == "Hammer"

candle_condition := is_hammer

if entry_candle_type == "Shooting Star"

candle_condition := is_shooting_star

if entry_candle_type == "Doji"

candle_condition := is_doji

// Moving Average Entry Conditions

ma_cross_above = ta.crossover(ma1_htf, ma2_htf)

ma_cross_below = ta.crossunder(ma1_htf, ma2_htf)

// Calculate pips distance to MAs and normalize it for signal intensity

pip_size = syminfo.mintick * 10 // Assuming Forex; for other asset classes, modify as needed

// Calculate distances in pips between price and MAs

distance_to_ma1_pips = math.abs(close - ma1_htf) / pip_size

distance_to_ma2_pips = math.abs(close - ma2_htf) / pip_size

// Calculate signal intensity based on the pips distance

// Normalize the signal intensity between the user-specified min and max

signal_intensity = math.min(math.max((distance_to_ma1_pips + distance_to_ma2_pips), signal_intensity_min), signal_intensity_max)

// Trend Filter Condition (Optional)

trend_condition = false

if trend_filter_enabled

trend_condition := ta.sma(close, ma2_length) > ta.sma(close, ma2_length + int(trend_filter_sensitivity))

// Entry Conditions Based on MA, Candle Patterns, and Trade Direction

long_condition = (trade_direction == "Long" or trade_direction == "Both") and (ma_entry_condition == "Fast Above Slow" or ma_entry_condition == "Both") and ma_cross_above and candle_condition and (not trend_filter_enabled or trend_condition) and signal_intensity > signal_intensity_min

short_condition = (trade_direction == "Short" or trade_direction == "Both") and (ma_entry_condition == "Fast Below Slow" or ma_entry_condition == "Both") and ma_cross_below and candle_condition and (not trend_filter_enabled or not trend_condition) and signal_intensity > signal_intensity_min

// Position Sizing Based on Risk Per Trade and ATR for Stop Loss

risk_amount = account_size * risk_per_trade

stop_loss_atr = atr_multiplier_stop * atr_value

// Calculate the position size based on the risk amount and ATR stop loss

position_size = risk_amount / stop_loss_atr

// If compounded results are not enabled, adjust position size for non-compounded returns

if not compounded_results

position_size := position_size / account_size * 100000 // Adjust for non-compounded results

// Convert take profit and stop loss from ATR to USD

pip_value = syminfo.mintick * 10 // Assuming Forex; for other asset classes, modify as needed

take_profit_atr = atr_multiplier_take_profit * atr_value

take_profit_usd = (take_profit_atr * pip_value) * position_size

stop_loss_usd = (stop_loss_atr * pip_value) * position_size

// Trailing Stop

trail_stop_level = trailing_stop_rr * stop_loss_atr

// Initialize long_box_id and short_box_id as boxes (not ints)

var box long_box_id = na

var box short_box_id = na

// Track Monthly Profit

var float monthly_profit = 0.0

if (month(timenow) != month(timenow[1])) // New month

monthly_profit := 0

// Long Trade Management

if long_condition

strategy.entry("Long", strategy.long, qty=position_size)

// Partial Profit at 50% position close when 1:1 risk/reward

strategy.exit("Partial Profit", from_entry="Long", limit=strategy.position_avg_price + stop_loss_atr, qty_percent=partial_profit_percentage / 100)

// Full take profit and stop loss with trailing stop

strategy.exit("Take Profit Long", from_entry="Long", limit=strategy.position_avg_price + take_profit_atr, stop=strategy.position_avg_price - stop_loss_atr, trail_offset=trail_stop_level)

// Delete the old box if it exists

if not na(long_box_id)

box.delete(long_box_id)

// Plot Take Profit and Stop Loss for Long Positions

// long_box_id := box.new(left=bar_index - 1, top=strategy.position_avg_price + take_profit_atr, right=bar_index, bottom=strategy.position_avg_price - stop_loss_atr, bgcolor=color.new(color.green, 90), border_width=1, border_color=color.new(color.green, 0))

// Short Trade Management

if short_condition

strategy.entry("Short", strategy.short, qty=position_size)

// Partial Profit at 50% position close when 1:1 risk/reward

strategy.exit("Partial Profit", from_entry="Short", limit=strategy.position_avg_price - stop_loss_atr, qty_percent=partial_profit_percentage / 100)

// Full take profit and stop loss with trailing stop

strategy.exit("Take Profit Short", from_entry="Short", limit=strategy.position_avg_price - take_profit_atr, stop=strategy.position_avg_price + stop_loss_atr, trail_offset=trail_stop_level)

// Delete the old box if it exists

// if not na(short_box_id)

// box.delete(short_box_id)

// Plot Take Profit and Stop Loss for Short Positions

// short_box_id := box.new(left=bar_index - 1, top=strategy.position_avg_price + stop_loss_atr, right=bar_index, bottom=strategy.position_avg_price - take_profit_atr, bgcolor=color.new(color.red, 90), border_width=1, border_color=color.new(color.red, 0))

// Plot MAs and Signals

plot(ma1_htf, color=color.blue, title="MA1 (HTF)")

plot(ma2_htf, color=color.red, title="MA2 (HTF)")

plotshape(series=long_condition, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY")

plotshape(series=short_condition, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL")

相关推荐