概述

本策略是一个基于多周期趋势确认和动态风险控制的量化交易系统。该策略融合了VWAP、EMA、RSI等多个技术指标,通过日线和4小时线的周期共振来确认趋势方向,并结合成交量分析和动态风险管理,实现了一个完整的交易决策框架。

策略原理

策略采用自上而下的分析框架,首先在日线级别通过EMA20和ADX(14)确定主趋势方向。当ADX大于25且价格位于EMA20之上时,确认多头趋势;反之确认空头趋势。在主趋势方向确立后,策略转向4小时周期寻找具体入场机会。入场信号基于价格与VWAP的关系、RSI指标的变动以及成交量的变化来综合判断。同时,策略设计了完善的风险管理机制,包括基于ATR的动态止损、斐波那契位的分段止盈,以及基于账户净值的仓位控制系统。

策略优势

- 多周期共振分析提高了信号可靠性,有效降低了虚假信号的干扰

- VWAP与ATR结合构建的动态价格通道,提供了更具适应性的支撑阻力判断

- 基于成交量标准差的创新应用,能够更准确地判断趋势强度

- 完善的风险管理体系,包括动态止损、分段止盈和精确的仓位控制

- 引入LSTM模型进行波动率预测,增强了策略的预测能力

策略风险

- 多指标叠加可能导致信号滞后,在快速行情中可能错过理想入场点

- 参数优化存在过拟合风险,需要在不同市场环境下进行充分测试

- LSTM模型的预测结果存在不确定性,需要持续监控和调整

- 高频交易可能面临较高的手续费支出

- 市场突发事件可能导致止损失效,需要额外的风险控制措施

策略优化方向

- 开发自适应参数系统,根据市场环境动态调整各指标参数

- 增加市场情绪分析模块,结合社交媒体数据提供辅助判断

- 优化LSTM模型,引入更多特征变量提高预测准确度

- 开发智能资金管理系统,根据历史表现动态调整风险敞口

- 增加多品种相关性分析,实现更好的组合对冲效果

总结

该策略通过多周期趋势分析、动态风险控制和机器学习技术的融合,构建了一个较为完善的量化交易系统。策略的核心优势在于其完整的风险管理体系和多维度的信号确认机制,但同时也需要注意参数优化和市场适应性的问题。建议交易者在实盘运行前进行充分的回测,并根据具体市场特征进行针对性的优化。

策略源码

/*backtest

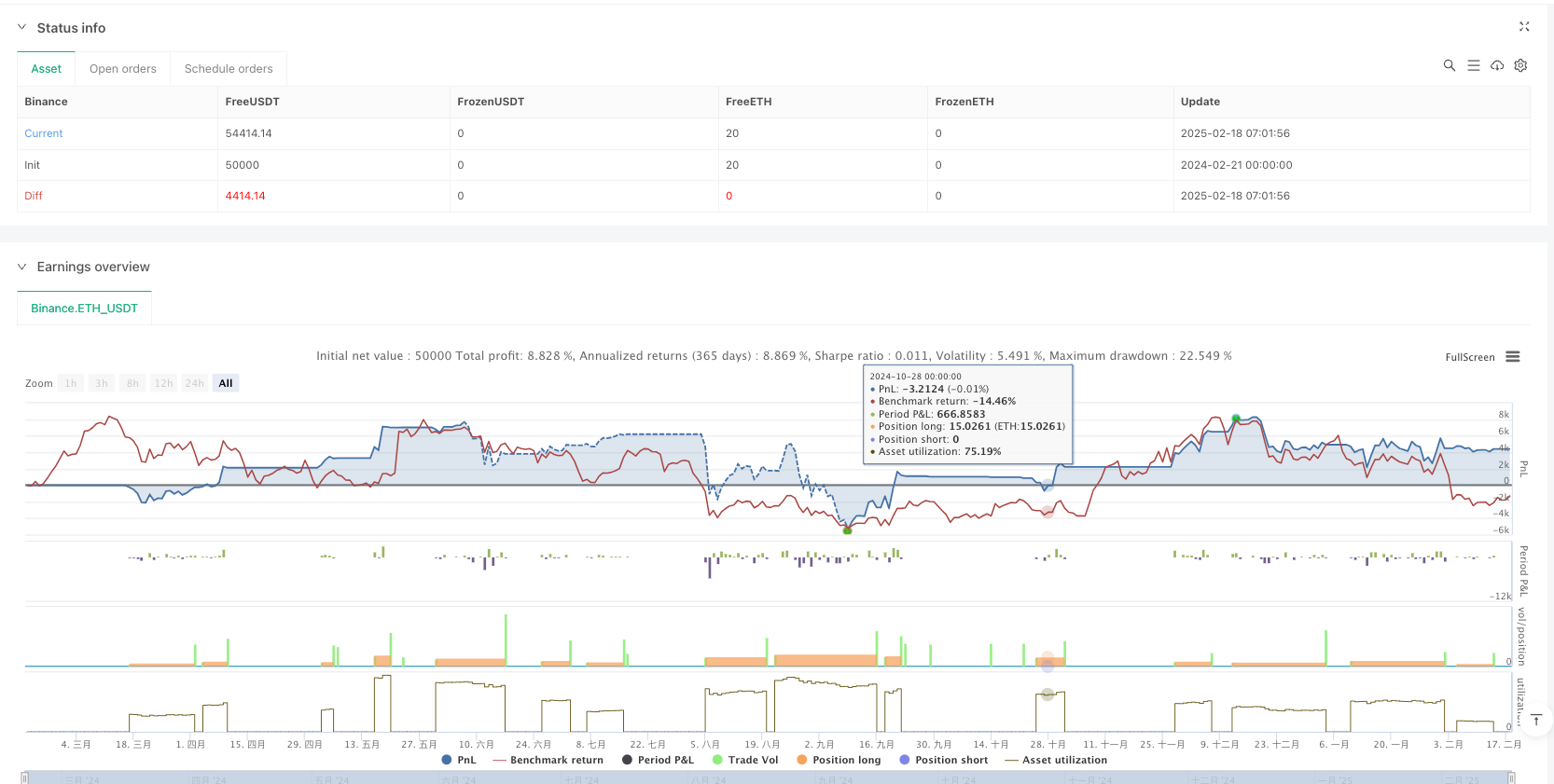

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("优化后策略框架", overlay=true)

// 输入参数

ema_length = input.int(20, title="EMA周期")

adx_length = input.int(14, title="ADX周期")

rsi_length = input.int(21, title="RSI周期")

atr_length = input.int(14, title="ATR周期")

volume_length = input.int(20, title="成交量均值周期")

fibonacci_level = 1.618 // 斐波那契扩展位161.8%

// 计算技术指标

ema = ta.ema(close, ema_length)

// 使用ta.dmi()来获取+DI, -DI 和 ADX

[dm_plus, dm_minus, adx] = ta.dmi(adx_length, adx_length)

// 计算RSI和ATR

rsi = ta.rsi(close, rsi_length)

atr = ta.atr(atr_length)

vwap = ta.vwap(close)

avg_volume = ta.sma(volume, volume_length)

// 定义趋势

bull_trend = close > ema and adx > 25

bear_trend = close < ema and adx > 25

range_market = adx < 25

// VWAP分层定位

upper_bound = vwap + 1.5 * atr

lower_bound = vwap - 1.5 * atr

// 计算4小时图的信号

four_hour_ema = request.security(syminfo.tickerid, "240", ta.ema(close, ema_length))

four_hour_vwap = request.security(syminfo.tickerid, "240", ta.vwap(close))

four_hour_rsi = request.security(syminfo.tickerid, "240", ta.rsi(close, rsi_length))

four_hour_volume = request.security(syminfo.tickerid, "240", ta.sma(volume, volume_length))

// 多头入场条件

long_condition = bull_trend and (close[1] < four_hour_ema or close[1] < four_hour_vwap) and rsi[1] < 45 and rsi[0] > 40 and volume < avg_volume * 0.7

// 空头入场条件

short_condition = bear_trend and (close[1] > four_hour_ema or close[1] > four_hour_vwap) and rsi[1] > 55 and rsi[0] < 60 and volume < avg_volume * 0.8

// 计算止损和止盈

long_stop = close - 1.5 * atr

short_stop = close + 1.5 * atr

long_target = vwap + atr // 第一目标,VWAP+1×ATR

short_target = vwap - atr // 第一目标,VWAP-1×ATR

fibonacci_target = close + (fibonacci_level * (high - low)) // 斐波那契161.8%目标

// 计算头寸规模(仓位控制)

risk_per_trade = 0.01 // 单笔风险为账户净值的1%

account_balance = strategy.equity

position_size = (account_balance * risk_per_trade) / (1.5 * atr)

// 绘制买卖信号

plotshape(series=long_condition, title="多头入场", location=location.belowbar, color=color.green, style=shape.triangleup, text="BUY")

plotshape(series=short_condition, title="空头入场", location=location.abovebar, color=color.red, style=shape.triangledown, text="SELL")

// 执行策略

if (long_condition)

strategy.entry("Long", strategy.long, qty=position_size)

if (short_condition)

strategy.entry("Short", strategy.short, qty=position_size)

strategy.exit("Take Profit/Stop Loss", "Long", stop=long_stop, limit=long_target)

strategy.exit("Take Profit/Stop Loss", "Long", stop=long_stop, limit=fibonacci_target)

strategy.exit("Take Profit/Stop Loss", "Short", stop=short_stop, limit=short_target)

strategy.exit("Take Profit/Stop Loss", "Short", stop=short_stop, limit=fibonacci_target)

// 绘制VWAP和超买超卖区

plot(vwap, title="VWAP", color=color.blue)

plot(upper_bound, title="超买区", color=color.red, linewidth=2, style=plot.style_line)

plot(lower_bound, title="超卖区", color=color.green, linewidth=2, style=plot.style_line)

相关推荐