概述

本策略是一个基于价格失衡区域(Fair Value Gap, FVG)的高频交易策略。通过结合50周期和200周期指数移动平均线(EMA)来确认趋势方向,同时利用成交量和价格波动等多重过滤指标来提高交易信号的可靠性。策略采用基于真实波动幅度(ATR)的动态止盈止损机制,在保证收益的同时严格控制风险。

策略原理

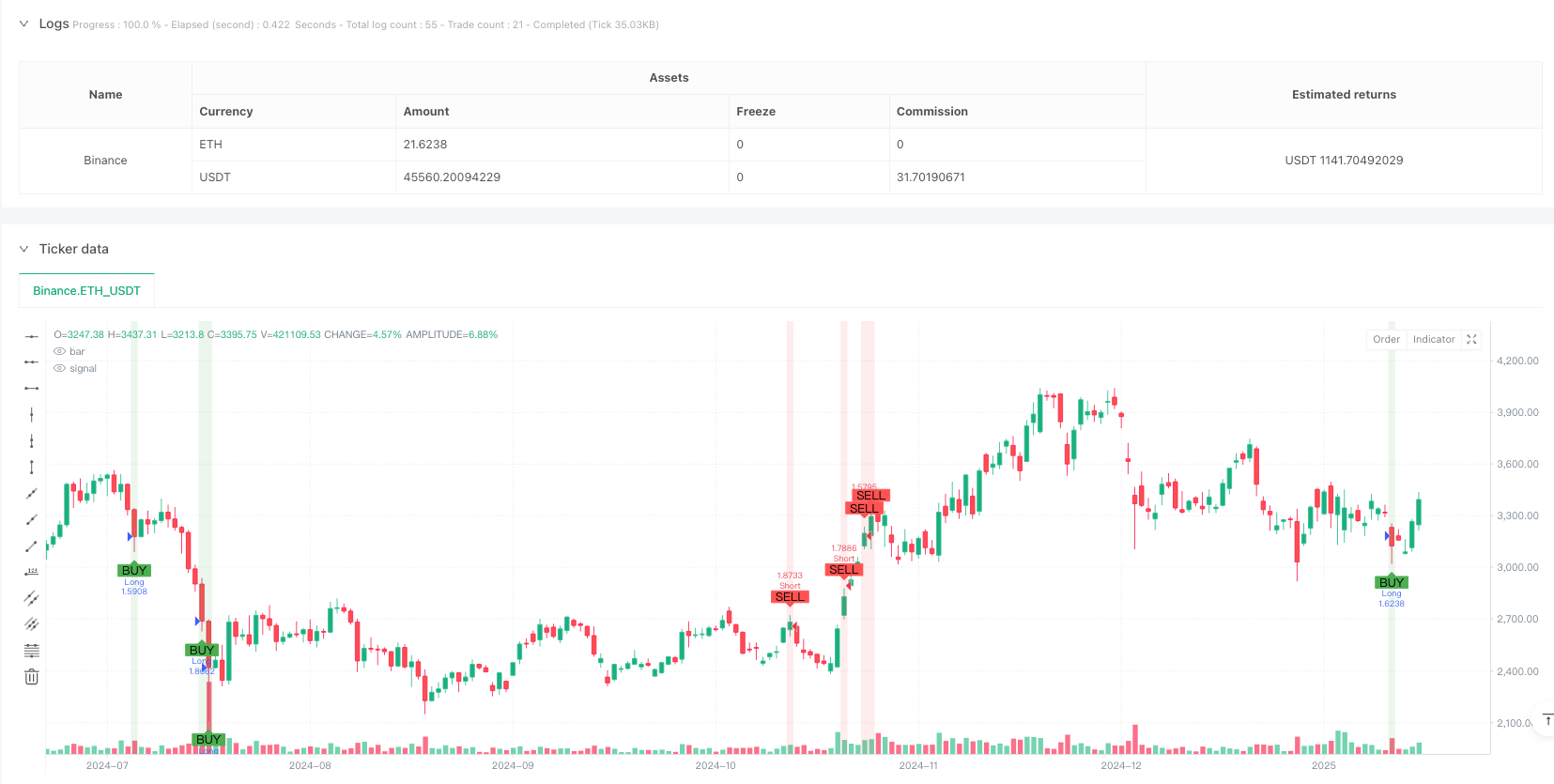

策略的核心是通过识别价格走势中的失衡区域(FVG)来捕捉潜在的交易机会。当价格在短期内出现显著跳空,且跳空方向与主趋势一致时,策略认为这种价格失衡预示着行情将向该方向继续发展。具体来说: 1. 通过EMA50和EMA200的位置关系判断整体趋势 2. 寻找成交量显著放大(高于20周期均值1.5倍)的区域 3. 确认价格波动幅度超过正常水平,表明市场存在较强烈的买卖意愿 4. 在上述条件同时满足时,如果出现与趋势方向一致的FVG,则开仓交易 5. 使用2倍ATR作为止盈位,1.2倍ATR作为止损位,实现风险收益比大约为1.67

策略优势

- 多重信号过滤机制显著提高了交易的准确性

- 动态止盈止损设置,适应不同市场环境

- 结合趋势跟踪和反转交易的特点,能够在不同市场状态下获利

- 充分考虑了交易量和价格波动等市场微观结构特征

- 适用于多个主要货币对和不同的时间周期

策略风险

- 在剧烈波动市场中可能会出现止损偏小的情况

- 对行情转折点的判断存在一定滞后性

- 在横盘整理阶段可能产生频繁的假信号

- 需要实时监控成交量变化,对数据质量要求较高 建议通过以下方式控制风险:

- 适当调整ATR倍数以匹配不同市场的波动特征

- 增加趋势过滤条件,避免在横盘市场交易

- 实时监控市场流动性变化

策略优化方向

- 引入更多的市场微观结构指标,如订单流数据

- 优化成交量过滤阈值,可考虑使用自适应阈值

- 完善止盈止损机制,引入移动止损

- 增加对市场状态的识别,在不同状态使用不同的参数设置

- 考虑加入时间过滤,避免在非活跃时段交易

总结

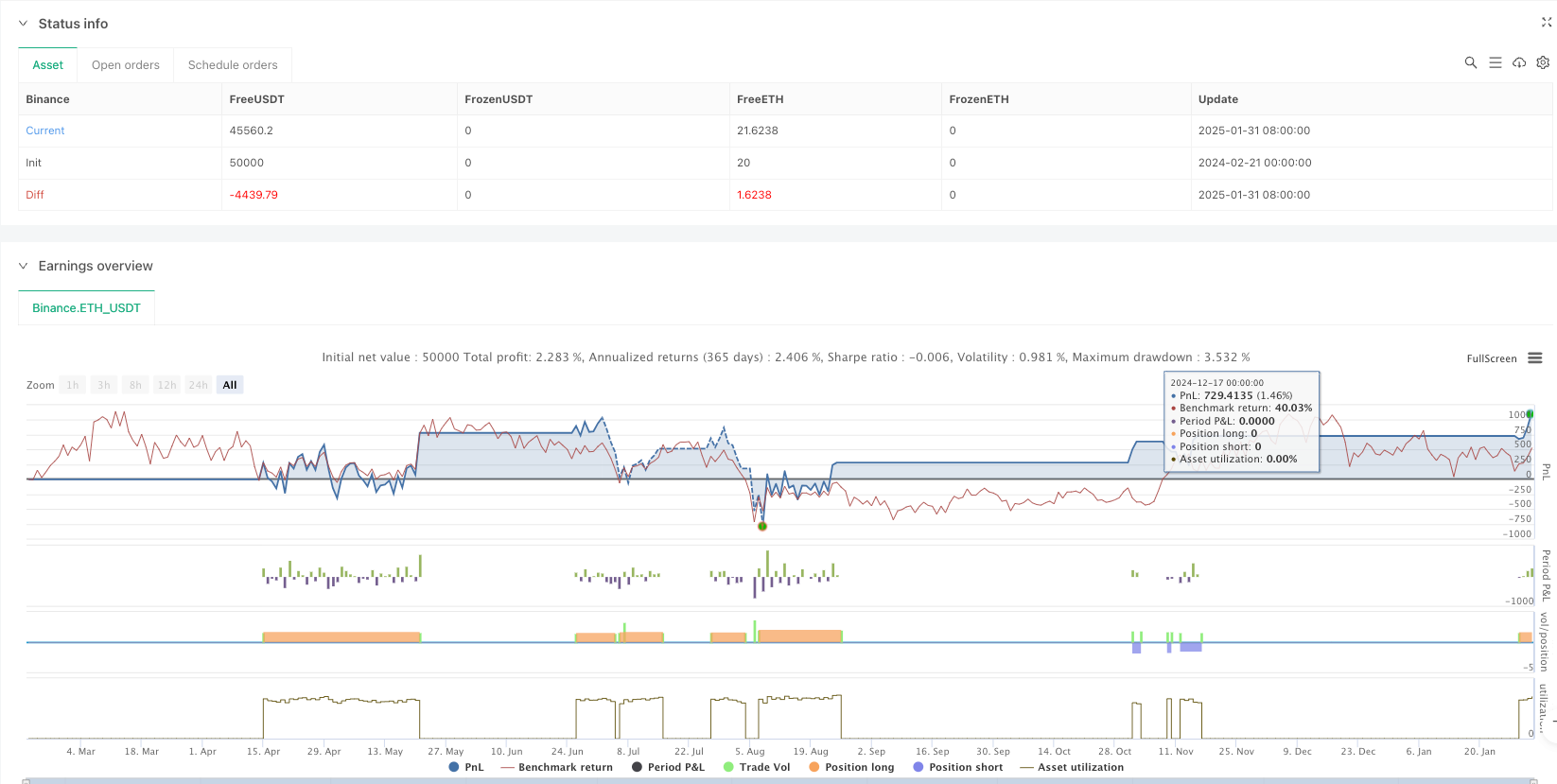

该策略通过综合运用技术分析和市场微观结构分析方法,构建了一个较为完整的交易系统。策略的核心优势在于多重信号确认机制和动态风险控制,但在实际应用中仍需要根据具体市场情况进行参数优化。通过持续改进和优化,策略有望在不同市场环境下都能保持稳定的表现。

策略源码

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-01 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Effective FVG Strategy - Forex", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Exponential Moving Averages for Faster Trend Detection ===

ema50 = ta.ema(close, 50)

ema200 = ta.ema(close, 200)

bullishTrend = ema50 > ema200

bearishTrend = ema50 < ema200

// === Volume & Imbalance Filters ===

highVolume = volume > ta.sma(volume, 20) * 1.5 // 1.5x higher than average volume

strongImbalance = math.abs(close - open) > ta.sma(math.abs(close - open), 20) // Large price movement

// === Fair Value Gap (FVG) Detection ===

fvgUp = low[2] > high[0] // Bullish FVG

fvgDown = high[2] < low[0] // Bearish FVG

// Effective FVGs with trend confirmation

validBullFVG = fvgUp and highVolume and strongImbalance and bullishTrend

validBearFVG = fvgDown and highVolume and strongImbalance and bearishTrend

// === ATR-based Take Profit & Stop Loss (Optimized for Forex) ===

atr = ta.atr(14)

longTP = close + (2 * atr) // TP = 2x ATR

longSL = close - (1.2 * atr) // SL = 1.2x ATR

shortTP = close - (2 * atr)

shortSL = close + (1.2 * atr)

// === Execute Trades ===

if validBullFVG

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", limit=longTP, stop=longSL)

if validBearFVG

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", limit=shortTP, stop=shortSL)

// === Plot Buy/Sell Signals ===

plotshape(series=validBullFVG, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY", title="BUY Signal")

plotshape(series=validBearFVG, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", title="SELL Signal")

// Highlight Significant FVGs

bgcolor(validBullFVG ? color.new(color.green, 85) : na)

bgcolor(validBearFVG ? color.new(color.red, 85) : na)

相关推荐