概述

这是一种创新的交易策略,结合了流动性区域分析和内部市场结构动态,旨在识别高概率入场点。该策略通过追踪价格与关键市场水平的互动,并利用内部市场转换触发交易,为交易者提供了一种灵活且精准的市场进入方法。

策略原理

策略的核心逻辑基于两个关键组件:流动性区域识别和内部市场转换。流动性区域通过分析局部高点和低点来动态确定,而内部市场转换则基于价格突破先前的bullish或bearish水平来判断市场方向变化。

策略具有以下核心特征: 1. 内部市场转换逻辑:不依赖传统蜡烛图形态,而是基于价格突破关键水平 2. 流动性区域追踪:动态识别关键流动性区域,防止在弱市条件下交易 3. 模式灵活性:提供”Both”、”Bullish Only”和”Bearish Only”三种交易模式 4. 风险管理:可自定义止损和止盈水平 5. 时间范围控制:可精确控制交易时间段

策略优势

- 动态适应性:策略能够快速响应市场结构变化

- 精确入场:通过结合流动性区域和内部市场转换,提高入场精确度

- 风险可控:内置止损和止盈机制

- 灵活性强:可根据不同市场条件选择交易模式

- 多维度分析:同时考虑价格行为、流动性和市场结构

策略风险

- 市场剧烈波动可能导致止损被触发

- 在震荡市场中,频繁的信号可能增加交易成本

- 参数设置不当可能影响策略表现

- 回测结果可能与实盘存在差异

策略优化方向

- 引入机器学习算法进行参数自适应优化

- 增加更多过滤条件,如交易量、波动率指标

- 开发多时间框架验证机制

- 优化止损和止盈算法,考虑市场波动率动态调整

总结

这是一种融合流动性分析和市场结构动态的创新交易策略。通过灵活的内部市场转换逻辑和精确的流动性区域追踪,为交易者提供了一个强大的交易工具。策略的关键在于其适应性和多维度分析能力,能够在不同市场条件下保持较高的执行效率。

策略源码

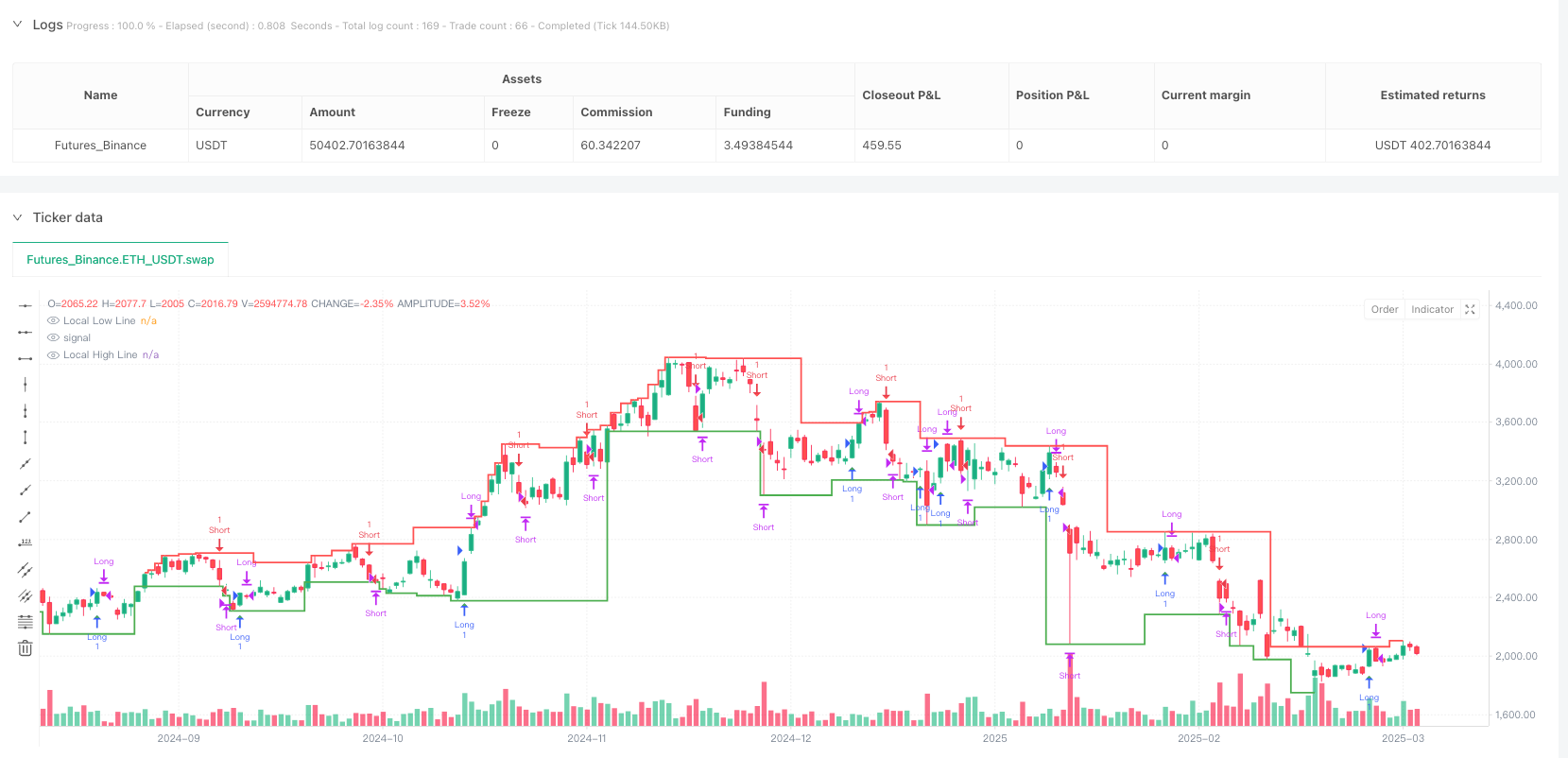

/*backtest

start: 2024-03-28 00:00:00

end: 2025-03-27 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Liquidity + Internal Market Shift Strategy", overlay=true)

// ======== Mode Selection ========

mode = input.string("Both", title="Mode", options=["Both", "Bullish Only", "Bearish Only"])

// ======== Stop-Loss and Take-Profit Input (in pips) ========

enableTakeProfit = input.bool(true, title="Enable Custom Take Profit") // Option to enable/disable take profit

stopLossPips = input.int(10, title="Stop Loss (in pips)", minval=1) // Stop loss in pips

takeProfitPips = input.int(20, title="Take Profit (in pips)", minval=1) // Take profit in pips

// ======== Internal Shift Logic ========

// Fixed number of consecutive candles to track (set to 1)

consecutiveBullishCount = 1

consecutiveBearishCount = 1

// Function to check for bullish and bearish candles

isBullish = close > open

isBearish = close < open

// Variables to track consecutive candles and mark lowest/highest

var int bullishCount = 0

var int bearishCount = 0

var float lowestBullishPrice = na

var float highestBearishPrice = na

var float previousBullishPrice = na // For the previous bullish lowest price

var float previousBearishPrice = na // For the previous bearish highest price

// Variables to track last internal shift type (1 = Bullish, -1 = Bearish, 0 = None)

var int lastInternalShift = 0

// Counting consecutive bullish and bearish candles

if isBullish

bullishCount := bullishCount + 1

bearishCount := 0

if bullishCount == 1 or low < lowestBullishPrice

lowestBullishPrice := low

else if isBearish

bearishCount := bearishCount + 1

bullishCount := 0

if bearishCount == 1 or high > highestBearishPrice

highestBearishPrice := high

else

bullishCount := 0

bearishCount := 0

lowestBullishPrice := na

highestBearishPrice := na

// Internal shift conditions

internalShiftBearish = close < previousBullishPrice and close < lowestBullishPrice

internalShiftBullish = close > previousBearishPrice and close > highestBearishPrice

// Condition to alternate internal shifts

allowInternalShiftBearish = internalShiftBearish and lastInternalShift != -1

allowInternalShiftBullish = internalShiftBullish and lastInternalShift != 1

// Tracking shifts

if bullishCount >= consecutiveBullishCount

previousBullishPrice := lowestBullishPrice

if bearishCount >= consecutiveBearishCount

previousBearishPrice := highestBearishPrice

// ======== Liquidity Seal-Off Points Logic ========

upperLiquidityLookback = input.int(10, title="Lookback Period for Upper Liquidity Line")

lowerLiquidityLookback = input.int(10, title="Lookback Period for Lower Liquidity Line")

isLocalHigh = high == ta.highest(high, upperLiquidityLookback)

isLocalLow = low == ta.lowest(low, lowerLiquidityLookback)

var bool touchedLowerLiquidityLine = false

var bool touchedUpperLiquidityLine = false

if (low <= ta.lowest(low, lowerLiquidityLookback))

touchedLowerLiquidityLine := true

if (high >= ta.highest(high, upperLiquidityLookback))

touchedUpperLiquidityLine := true

var bool lockedBullish = false

var bool lockedBearish = false

var int barSinceLiquidityTouch = na

// ======== Combined Signals ========

bullishSignal = allowInternalShiftBullish and touchedLowerLiquidityLine and not lockedBullish

bearishSignal = allowInternalShiftBearish and touchedUpperLiquidityLine and not lockedBearish

if bullishSignal

lockedBullish := true

touchedLowerLiquidityLine := false

barSinceLiquidityTouch := 0

if bearishSignal

lockedBearish := true

touchedUpperLiquidityLine := false

barSinceLiquidityTouch := 0

if not na(barSinceLiquidityTouch)

barSinceLiquidityTouch := barSinceLiquidityTouch + 1

if barSinceLiquidityTouch >= 3

lockedBullish := false

lockedBearish := false

if touchedLowerLiquidityLine

lockedBullish := false

if touchedUpperLiquidityLine

lockedBearish := false

// ======== Plot Combined Signals ========

plotshape(bullishSignal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny, title="Bullish Signal")

plotshape(bearishSignal, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny, title="Bearish Signal")

plot(isLocalHigh ? high : na, color=color.red, linewidth=2, style=plot.style_stepline, title="Local High Line")

plot(isLocalLow ? low : na, color=color.green, linewidth=2, style=plot.style_stepline, title="Local Low Line")

// ======== Track Entry and Opposing Signals ========

var float entryPrice = na

var int entryTime = na

var string positionSide = ""

// ======== Strategy Execution (Mode Logic) ========

if (mode == "Both")

// Short Entry Logic (Bearish Signal)

if (bearishSignal and na(entryPrice))

strategy.entry("Short", strategy.short)

entryPrice := close

entryTime := time

positionSide := "short"

// Long Entry Logic (Bullish Signal)

if (bullishSignal and na(entryPrice))

strategy.entry("Long", strategy.long)

entryPrice := close

entryTime := time

positionSide := "long"

// Exit Logic: Close on Opposing Signal (after the current signal is triggered)

if (positionSide == "short" and bullishSignal )

strategy.close("Short")

entryPrice := na

positionSide := ""

if (positionSide == "long" and bearishSignal)

strategy.close("Long")

entryPrice := na

positionSide := ""

// Stop-Loss and Take-Profit Logic (in pips)

stopLossPriceLong = entryPrice - stopLossPips * syminfo.mintick

takeProfitPriceLong = entryPrice + takeProfitPips * syminfo.mintick

stopLossPriceShort = entryPrice + stopLossPips * syminfo.mintick

takeProfitPriceShort = entryPrice - takeProfitPips * syminfo.mintick

// Long Stop-Loss and Take-Profit Conditions

if (positionSide == "long" and close <= stopLossPriceLong)

strategy.close("Long", comment="Stop Loss Triggered")

entryPrice := na

positionSide := ""

if (positionSide == "long" and enableTakeProfit and close >= takeProfitPriceLong)

strategy.close("Long", comment="Take Profit Triggered")

entryPrice := na

positionSide := ""

// Short Stop-Loss and Take-Profit Conditions

if (positionSide == "short" and close >= stopLossPriceShort)

strategy.close("Short", comment="Stop Loss Triggered")

entryPrice := na

positionSide := ""

if (positionSide == "short" and enableTakeProfit and close <= takeProfitPriceShort)

strategy.close("Short", comment="Take Profit Triggered")

entryPrice := na

positionSide := ""

if (mode == "Bullish Only")

if (bullishSignal and na(entryPrice))

strategy.entry("Long", strategy.long)

entryPrice := close

entryTime := time

positionSide := "long"

if (positionSide == "long" and bearishSignal)

strategy.close("Long")

entryPrice := na

positionSide := ""

// Stop-Loss and Take-Profit Logic (in pips)

stopLossPriceLong = entryPrice - stopLossPips * syminfo.mintick

takeProfitPriceLong = entryPrice + takeProfitPips * syminfo.mintick

if (positionSide == "long" and close <= stopLossPriceLong)

strategy.close("Long", comment="Stop Loss Triggered")

entryPrice := na

positionSide := ""

if (positionSide == "long" and enableTakeProfit and close >= takeProfitPriceLong)

strategy.close("Long", comment="Take Profit Triggered")

entryPrice := na

positionSide := ""

if (mode == "Bearish Only")

if (bearishSignal and na(entryPrice))

strategy.entry("Short", strategy.short)

entryPrice := close

entryTime := time

positionSide := "short"

if (positionSide == "short" and bullishSignal)

strategy.close("Short")

entryPrice := na

positionSide := ""

// Stop-Loss and Take-Profit Logic (in pips)

stopLossPriceShort = entryPrice + stopLossPips * syminfo.mintick

takeProfitPriceShort = entryPrice - takeProfitPips * syminfo.mintick

if (positionSide == "short" and close >= stopLossPriceShort)

strategy.close("Short", comment="Stop Loss Triggered")

entryPrice := na

positionSide := ""

if (positionSide == "short" and enableTakeProfit and close <= takeProfitPriceShort)

strategy.close("Short", comment="Take Profit Triggered")

entryPrice := na

positionSide := ""

相关推荐