策略概述

布林带与ATR动态趋势跟踪策略是一种先进的量化交易系统,它结合了布林带的突破信号和平均真实波动范围(ATR)的动态调整功能,通过”跟踪线”(Follow Line)机制识别并跟踪市场趋势。该策略特别引入了多时间框架(HTF)确认机制,能够根据更高时间框架的趋势方向过滤交易信号,显著提高策略的稳定性和盈利能力。系统还包含多项高级功能,如可选的交易时段过滤、ATR波动率自适应调整以及对HTF趋势变化的实时反应机制,形成了一个全面而灵活的量化交易解决方案。

策略原理

该策略的核心是”跟踪线”机制,它通过以下步骤动态识别和适应市场趋势:

布林带信号生成:系统首先计算标准布林带(Bollinger Bands),当价格突破上轨时产生看涨信号(1),突破下轨时产生看跌信号(-1),在带内时信号为中性(0)。

跟踪线计算:根据布林带信号和当前价格位置,系统计算临时跟踪线值。在看涨信号情况下,跟踪线设置为当前K线低点减去ATR值(启用ATR过滤时)或直接使用低点;在看跌信号情况下,跟踪线设置为当前K线高点加上ATR值或直接使用高点。

跟踪线锁定机制:策略采用”棘轮”逻辑来维持跟踪线——在上升趋势中,新的跟踪线值取为临时值与前一值中的较大者;在下降趋势中,取为临时值与前一值中的较小者。这确保了跟踪线只能在趋势方向上移动,形成一种动态支撑/阻力水平。

趋势确定:通过比较当前跟踪线与前一跟踪线值,系统确定趋势方向——上升表示多头趋势(1),下降表示空头趋势(-1),持平则保持之前趋势。

多时间框架分析:策略使用类似逻辑在更高时间框架上计算跟踪线和趋势状态,可通过自动或手动方式选择合适的更高时间框架(如1分钟自动对应15分钟HTF)。

入场条件:当交易时间框架趋势从中性或下降转为上升且HTF确认为上升趋势时,产生做多信号;反之产生做空信号。

出场条件:当交易时间框架趋势变为相反方向,或HTF趋势变为相反方向(v2.5版本新增)时,策略平仓现有头寸。

时间过滤:可选择只在特定交易时段内(如常规美股交易时间0930-1600)执行交易。

策略优势

自适应性强:跟踪线机制能够根据市场波动性自动调整,特别是启用ATR过滤时,为不同波动率环境提供了动态适应能力。

趋势确认机制:多时间框架确认功能有效过滤了”噪音”交易,只在HTF趋势方向一致时进行交易,大幅提高了信号质量。

灵活的配置选项:策略提供丰富的参数设置,包括布林带周期和偏差、ATR周期、时间过滤以及HTF选择方法等,可根据不同市场和交易品种进行优化。

高响应性:v2.5版本新增的HTF趋势变化反应机制使策略能够更快地对大趋势变化做出反应,及时止损并避免严重回撤。

可视化辅助:策略在图表上绘制交易时间框架和HTF的跟踪线,并可选择性地显示买卖信号标签,使交易逻辑直观明了。

持仓管理:通过pyramiding=0设置防止在同一方向多次入场,避免了不必要的风险累积。

策略风险

假突破风险:尽管使用了布林带和HTF确认,市场仍可能产生假突破,特别是在高波动率环境下。解决方法:可以增加布林带偏差值或延长确认周期,甚至增加额外的突破确认机制。

参数敏感性:策略性能对ATR周期、布林带设置等参数较为敏感。解决方法:应通过回测找到最适合特定交易品种的参数组合,避免过度优化导致的曲线拟合问题。

趋势变化滞后:跟踪线机制可能在趋势初始阶段反应较慢,导致入场稍晚。解决方法:可以考虑使用更小的ATR乘数或布林带周期来提高响应速度,但需平衡信号质量和响应性。

时间框架依赖:不当选择HTF可能导致过度过滤或信号冲突。解决方法:建议使用自动HTF选择功能,它根据当前图表时间框架自动选择合适的更高时间框架。

资金管理缺失:策略本身不包含完整的资金管理机制。解决方法:在实际应用中应结合适当的止损策略和头寸管理规则,如固定百分比风险或ATR倍数止损。

策略优化方向

增强信号过滤:可以考虑引入其他技术指标,如相对强弱指标(RSI)或随机指标(Stochastic)来确认入场信号,仅在指标显示超买/超卖状态时执行交易。这将进一步减少假突破信号,提高胜率。

动态参数调整:可以开发基于市场状态的自适应参数调整机制,例如在高波动率环境下自动增加布林带偏差值,在低波动率环境下减小偏差值,使策略能更好地适应不同市场条件。

优化HTF趋势判断:可以改进HTF趋势确认算法,如引入指数移动平均线交叉或其他趋势指标,而不仅依赖于跟踪线方向,以获得更稳定的趋势判断。

完善资金管理:集成一个全面的资金管理系统,根据市场波动性和账户规模动态调整头寸大小,设置基于ATR的止损水平和盈利目标,最大化风险调整后的回报。

增加市场状态分析:引入市场环境分类,区分趋势市和震荡市,并根据市场状态自动调整策略参数或交易规则,甚至在不适合该策略的市场环境中暂停交易。

多策略集成:将该策略作为一个组件,与其他互补性策略(如反转策略或突破确认策略)结合,形成一个完整的策略组合,平衡不同市场环境下的表现。

总结

布林带与ATR动态趋势跟踪策略是一个设计精巧的量化交易系统,它通过结合布林带、ATR和多时间框架分析,有效地识别和跟踪市场趋势。该策略的核心优势在于其自适应性和灵活性,能够根据市场状况动态调整,同时通过HTF确认机制提高信号质量和胜率。

尽管存在一些固有风险,如参数敏感性和假突破问题,但这些可以通过适当的参数优化和额外的过滤机制得到缓解。战略优化方向,如增强信号过滤、动态参数调整和完善资金管理,为进一步提升策略性能提供了明确路径。

总体而言,这种策略特别适合中长期趋势交易者,它提供了一个稳健的框架来识别趋势变化并在有利的市场条件下执行交易。通过合理的参数设置和适当的风险管理,该策略有潜力在各种市场环境中产生稳定的回报。

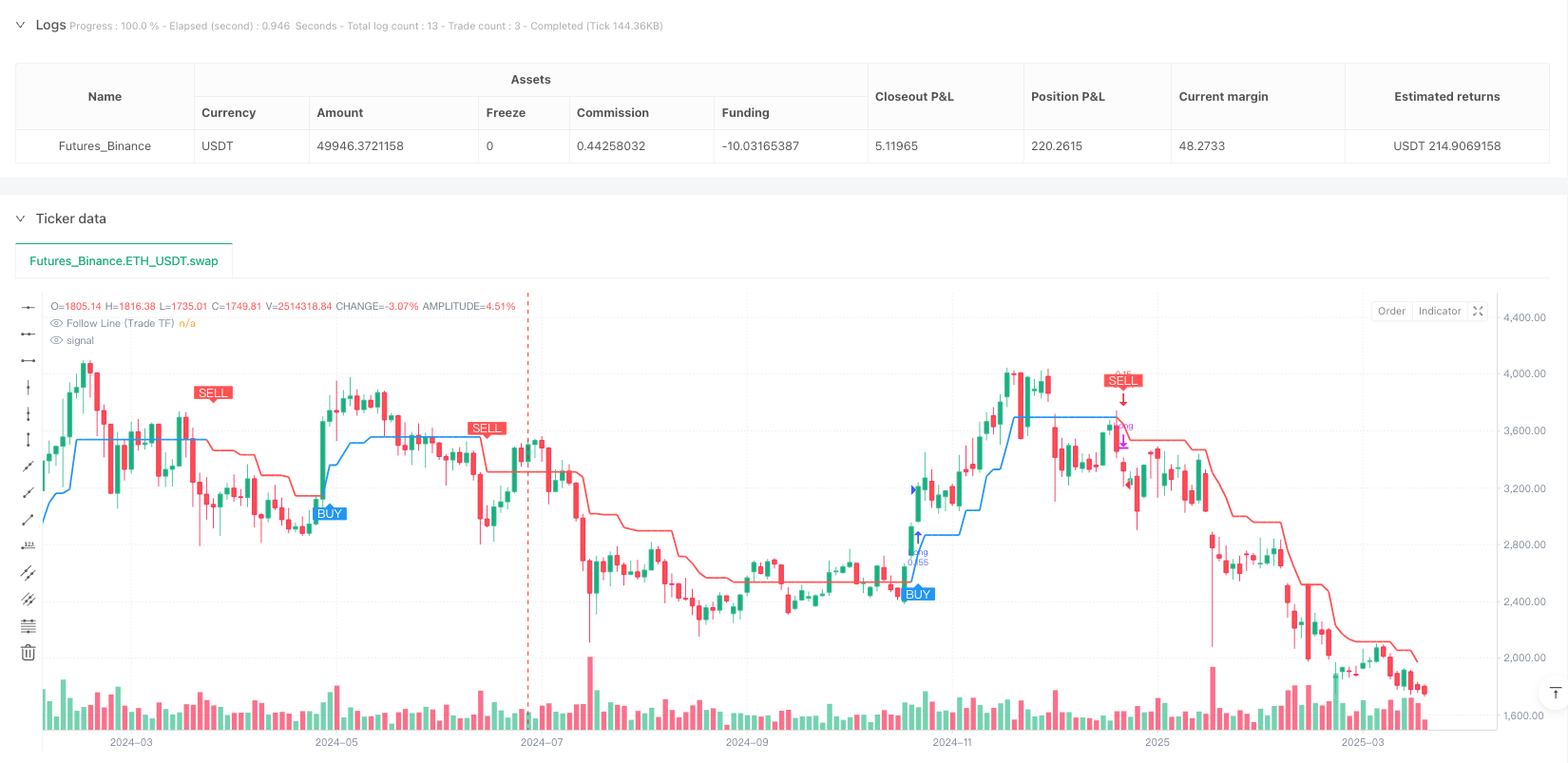

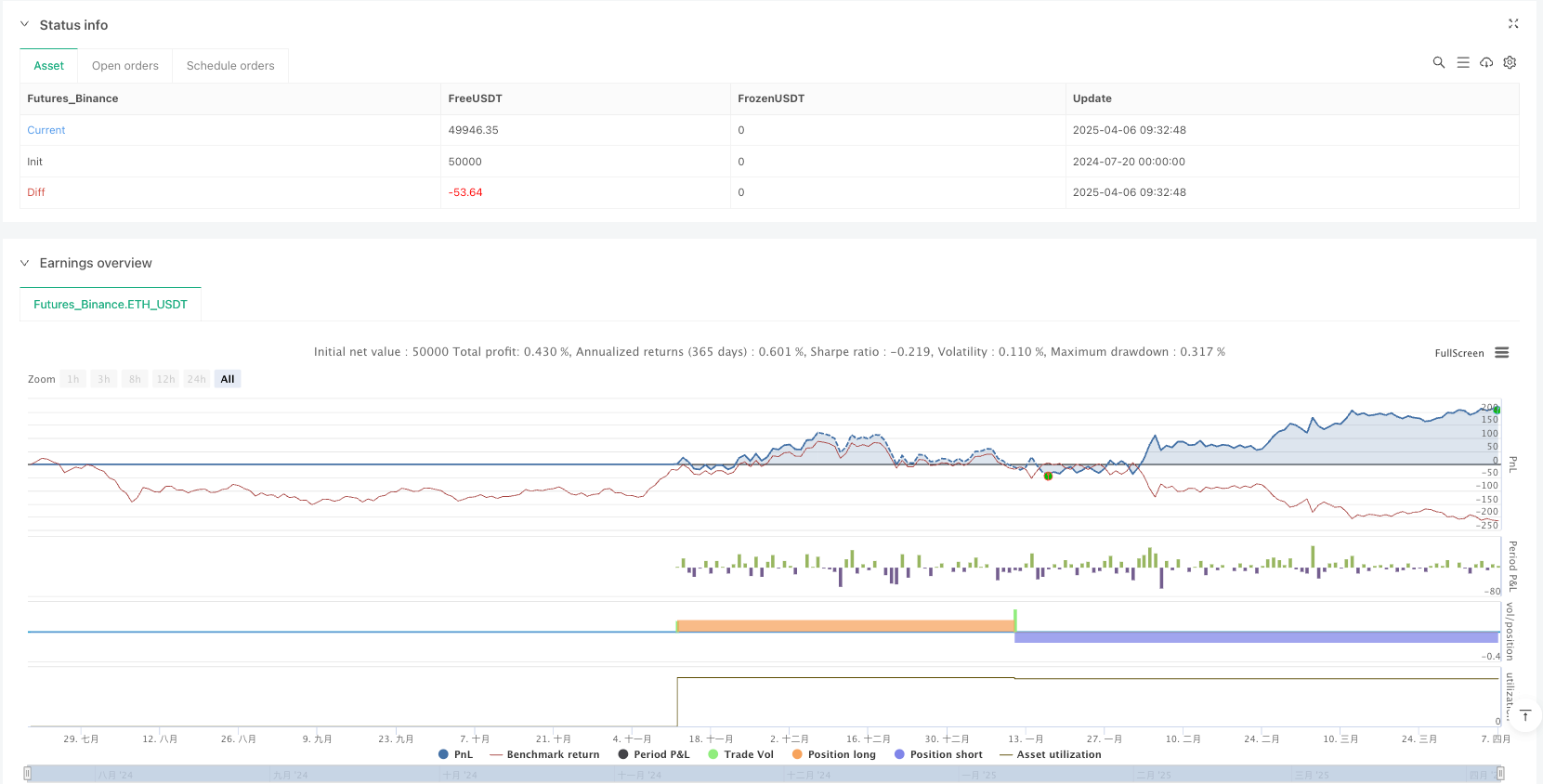

/*backtest

start: 2024-07-20 00:00:00

end: 2025-04-07 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

//@fenyesk

//Optional Working Hours and ATR based TP/SL removed

// Added Optional Higher Timeframe Confirmation with Auto/Manual Selection

// Revised for improved profitability: Trend-following Entries/Exits

// v2.5: React to HTF trend changes as well

strategy('Follow Line Strategy Version 2.5 (React HTF)', overlay = true, process_orders_on_close = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 1, pyramiding = 0) // Version bump overlay=true, process_orders_on_close=true, default_qty_type=strategy.percent_of_equity, default_qty_value=1, pyramiding=0) // Prevent multiple entries in the same direction )

// --- Settings ---

// Indicator Parameters

atrPeriodInput = input.int(defval = 5, title = 'ATR Period', minval = 1, group = 'Indicator Settings')

bbPeriodInput = input.int(defval = 21, title = 'Bollinger Bands Period', minval = 1, group = 'Indicator Settings')

bbDeviationInput = input.float(defval = 1.00, title = 'Bollinger Bands Deviation', minval = 0.1, step = 0.1, group = 'Indicator Settings')

useAtrFilterInput = input.bool(defval = true, title = 'Use ATR for Follow Line Offset?', group = 'Indicator Settings')

showSignalsInput = input.bool(title = 'Show Trade Signals on Chart?', defval = true, group = 'Indicator Settings')

// --- Higher Timeframe Confirmation ---

htf_group = 'Higher Timeframe Confirmation'

useHTFConfirmationInput = input.bool(false, title = 'Enable HTF Confirmation?', group = htf_group)

htfSelectionMethodInput = input.string('Auto', title = 'HTF Selection Method', options = ['Auto', 'Manual'], group = htf_group)

manualHTFInput = input.timeframe('240', title = 'Manual Higher Timeframe', group = htf_group) // Default to 4h if Manual

showHTFLineInput = input.bool(false, title = 'Show HTF Follow Line?', group = htf_group)

// --- Determine Higher Timeframe ---

// Revised function with explicit return variable

f_getAutoHTF() =>

string htfResult = 'D' // Initialize with a default value (e.g., Daily)

if timeframe.isintraday

if timeframe.multiplier <= 1 and timeframe.isminutes

htfResult := '15' // 1min -> 15min

htfResult

else if timeframe.multiplier <= 5 and timeframe.isminutes

htfResult := '240' // 5min -> 4h (240min)

htfResult

else if timeframe.multiplier <= 30 and timeframe.isminutes

htfResult := '240' // 15-30min -> 4h (240min)

htfResult

else if timeframe.multiplier == 60 and timeframe.isminutes // 1 hour

htfResult := 'D' // 1h -> 1 Day

htfResult

else if timeframe.multiplier <= 240 and timeframe.isminutes // Up to 4 hours

htfResult := 'W' // 4h -> 1 Week

htfResult

// else // The default "D" is already set if none of the above match

// htfResult := "D" // Default for other intraday -> 1 Day (already default)

else if timeframe.isdaily // Daily

htfResult := 'M' // 1 Day -> 1 Month

htfResult

else if timeframe.isweekly // Weekly

htfResult := 'M' // 1 Week -> 1 Month

htfResult

else // Monthly or higher (or unknown)

htfResult := '3M' // Default to 3 Months

htfResult

htfResult // Explicitly return the variable value

autoHTF = f_getAutoHTF()

selectedHTF = htfSelectionMethodInput == 'Auto' ? autoHTF : manualHTFInput

// --- Trade Timeframe Calculations ---

// Bollinger Bands calculation

bbMiddle_trade = ta.sma(close, bbPeriodInput)

bbStdDev_trade = ta.stdev(close, bbPeriodInput)

BBUpper_trade = bbMiddle_trade + bbStdDev_trade * bbDeviationInput

BBLower_trade = bbMiddle_trade - bbStdDev_trade * bbDeviationInput

// ATR calculation

atrValue_trade = ta.atr(atrPeriodInput)

// Signal initialization for Trade TF

var float followLine_trade = na

var int bbSignal_trade = 0

var int trend_trade = 0 // Renamed from iTrend

// Determine BB signal based on current close (Trade TF)

if close > BBUpper_trade

bbSignal_trade := 1

bbSignal_trade

else if close < BBLower_trade

bbSignal_trade := -1

bbSignal_trade

else

bbSignal_trade := 0 // Reset signal if price is within bands

bbSignal_trade

// Calculate potential new FollowLine value for the current bar (Trade TF)

float tempFollowLine_trade = na // Explicit type

if bbSignal_trade == 1

tempFollowLine_trade := useAtrFilterInput ? low - atrValue_trade : low

tempFollowLine_trade

else if bbSignal_trade == -1

tempFollowLine_trade := useAtrFilterInput ? high + atrValue_trade : high

tempFollowLine_trade

// Determine the final FollowLine for the current bar, applying the "ratchet" logic (Trade TF)

if bbSignal_trade == 1 // Price closed above upper BB

followLine_trade := na(followLine_trade[1]) ? tempFollowLine_trade : math.max(tempFollowLine_trade, nz(followLine_trade[1], tempFollowLine_trade))

followLine_trade

else if bbSignal_trade == -1 // Price closed below lower BB

followLine_trade := na(followLine_trade[1]) ? tempFollowLine_trade : math.min(tempFollowLine_trade, nz(followLine_trade[1], tempFollowLine_trade))

followLine_trade

else // Price closed within bands, FollowLine continues from previous bar

if not na(followLine_trade[1])

followLine_trade := followLine_trade[1]

followLine_trade

// else followLine_trade remains na if followLine_trade[1] was na

// Trend direction determination (Based on current FollowLine vs previous FollowLine - Trade TF)

if not na(followLine_trade) and not na(followLine_trade[1])

if followLine_trade > followLine_trade[1]

trend_trade := 1

trend_trade

else if followLine_trade < followLine_trade[1]

trend_trade := -1

trend_trade

else

trend_trade := nz(trend_trade[1], 0) // Maintain previous trend if line is flat but valid

trend_trade

else if not na(followLine_trade) and na(followLine_trade[1])

trend_trade := bbSignal_trade == 1 ? 1 : bbSignal_trade == -1 ? -1 : 0 // Use ternary for initial trend

trend_trade

else if na(followLine_trade)

trend_trade := 0 // Reset trend if FollowLine becomes invalid

trend_trade

// --- Higher Timeframe Calculations ---

// Function revised to return only one value (as float) based on parameter

f_calculateHTFData(htf_close, htf_high, htf_low, return_type) =>

// Explicitly type potentially 'na' indicator results

float htf_atrValue = ta.atr(atrPeriodInput)

float htf_bbMiddle = ta.sma(htf_close, bbPeriodInput)

float htf_bbStdDev = ta.stdev(htf_close, bbPeriodInput)

float htf_BBUpper = na

float htf_BBLower = na

// Calculate BBands only if middle/stdev are valid

if not na(htf_bbMiddle) and not na(htf_bbStdDev)

htf_BBUpper := htf_bbMiddle + htf_bbStdDev * bbDeviationInput

htf_BBLower := htf_bbMiddle - htf_bbStdDev * bbDeviationInput

htf_BBLower

// Determine BB signal (HTF) - Default to 0

int htf_bbSignal = 0

// Check if bands are valid before comparing

if not na(htf_BBUpper) and not na(htf_BBLower)

if htf_close > htf_BBUpper

htf_bbSignal := 1

htf_bbSignal

else if htf_close < htf_BBLower

htf_bbSignal := -1

htf_bbSignal

// Calculate potential new FollowLine (HTF)

float htf_tempFollowLine = na // Explicitly typed float

if htf_bbSignal == 1

htf_tempFollowLine := useAtrFilterInput and not na(htf_atrValue) ? htf_low - htf_atrValue : htf_low

htf_tempFollowLine

else if htf_bbSignal == -1

htf_tempFollowLine := useAtrFilterInput and not na(htf_atrValue) ? htf_high + htf_atrValue : htf_high

htf_tempFollowLine

// Maintain FollowLine state using 'var'

var float htf_followLine = na

var int htf_trend = 0

// Determine the final FollowLine (HTF)

if htf_bbSignal == 1

htf_followLine := na(htf_followLine[1]) ? htf_tempFollowLine : math.max(htf_tempFollowLine, nz(htf_followLine[1], htf_tempFollowLine))

htf_followLine

else if htf_bbSignal == -1

htf_followLine := na(htf_followLine[1]) ? htf_tempFollowLine : math.min(htf_tempFollowLine, nz(htf_followLine[1], htf_tempFollowLine))

htf_followLine

else

if not na(htf_followLine[1])

htf_followLine := htf_followLine[1]

htf_followLine

// else htf_followLine remains na if htf_followLine[1] was na (unless reset below)

// Reset FollowLine if it's based on invalid temp line

if na(htf_tempFollowLine) and htf_bbSignal != 0 // If the signal existed but calc failed (e.g., na ATR)

htf_followLine := na // Reset line

htf_followLine

// Determine Trend (HTF)

if not na(htf_followLine) and not na(htf_followLine[1])

if htf_followLine > htf_followLine[1]

htf_trend := 1

htf_trend

else if htf_followLine < htf_followLine[1]

htf_trend := -1

htf_trend

else

htf_trend := nz(htf_trend[1], 0)

htf_trend

else if not na(htf_followLine) and na(htf_followLine[1])

htf_trend := htf_bbSignal == 1 ? 1 : htf_bbSignal == -1 ? -1 : 0

htf_trend

else if na(htf_followLine) // Trend is 0 if line becomes (or is) na

htf_trend := 0

htf_trend

// Return the requested value as float type (or na)

float return_value = na

if return_type == 'line'

return_value := htf_followLine

return_value

else if return_type == 'trend'

return_value := float(htf_trend) // Convert int trend to float for consistent return type

return_value

return_value // Return the single calculated value

// Explicitly declare variables that will receive the security call result

float followLine_htf = na

int trend_htf = 0 // Initialize with a default value (0 for neutral)

// Request HTF data UNCONDITIONALLY

followLine_htf_result = request.security(syminfo.tickerid, selectedHTF, f_calculateHTFData(close, high, low, 'line'), lookahead = barmerge.lookahead_off)

trend_htf_result_float = request.security(syminfo.tickerid, selectedHTF, f_calculateHTFData(close, high, low, 'trend'), lookahead = barmerge.lookahead_off)

// Conditionally assign the results based on whether the HTF feature is enabled

if useHTFConfirmationInput or showHTFLineInput

// Assign results, handling potential 'na' values safely

followLine_htf := followLine_htf_result // Assign float/na directly

trend_htf := na(trend_htf_result_float) ? 0 : int(nz(trend_htf_result_float)) // Convert float result back to int, default to 0 if na

trend_htf

else // If HTF features are disabled, set variables to 'na'

followLine_htf := na

trend_htf := 0 // or na if preferred

trend_htf

// HTF Filter

// Use the potentially 'na' followLine_htf and the guaranteed non-'na' trend_htf

htfConfirmsLong = not useHTFConfirmationInput or useHTFConfirmationInput and trend_htf == 1

htfConfirmsShort = not useHTFConfirmationInput or useHTFConfirmationInput and trend_htf == -1

// --- Entry/Exit Conditions ---

// Buy & Sell Conditions (Based on Trade TF trend crossover)

longCondition_trade = nz(trend_trade[1]) <= 0 and trend_trade == 1

shortCondition_trade = nz(trend_trade[1]) >= 0 and trend_trade == -1

// Combined Entry Conditions with Filters

goLong = htfConfirmsLong and longCondition_trade and strategy.position_size <= 0 // Only enter long if flat or short & HTF confirms

goShort = htfConfirmsShort and shortCondition_trade and strategy.position_size >= 0 // Only enter short if flat or long & HTF confirms

// Exit conditions based on *either* TTF or HTF changing trend against the position

exitLong = trend_trade == -1 or trend_htf == -1 // TTF to short OR HTF to short

exitShort = trend_trade == 1 or trend_htf == 1 // TTF to long OR HTF to long

// --- Strategy Execution ---

if goLong

strategy.close('Short', comment = 'Close Short for Long')

strategy.entry('Long', strategy.long, comment = 'Enter Long')

if goShort

strategy.close('Long', comment = 'Close Long for Short')

strategy.entry('Short', strategy.short, comment = 'Enter Short')

if exitLong

strategy.close('Long', comment = 'Exit Long')

if exitShort

strategy.close('Short', comment = 'Exit Short')

// --- Alerts ---

// Alerts trigger on the same bar as the entry condition, respecting all filters

// NOTE: Removed dynamic HTF from message as alertcondition requires const string

alertcondition(goLong, title = 'FL Buy Signal', message = 'Follow Line Buy Signal - {{ticker}} {{interval}}')

alertcondition(goShort, title = 'FL Sell Signal', message = 'Follow Line Sell Signal - {{ticker}} {{interval}}')

alertcondition(goLong or goShort, title = 'FL Signal', message = 'Follow Line Signal - {{ticker}} {{interval}}')

// --- Plotting ---

// Plot the Trade Timeframe Follow Line

lineColor_trade = trend_trade > 0 ? color.new(color.blue, 0) : trend_trade < 0 ? color.new(color.red, 0) : color.new(color.gray, 0)

plot(followLine_trade, color = lineColor_trade, linewidth = 2, title = 'Follow Line (Trade TF)')

// Plot the Higher Timeframe Follow Line (optional)

// Use the potentially 'na' followLine_htf and the guaranteed non-'na' trend_htf for coloring

lineColor_htf = trend_htf > 0 ? color.new(color.aqua, 0) : trend_htf < 0 ? color.new(color.orange, 0) : color.new(color.gray, 70)

plot(showHTFLineInput and useHTFConfirmationInput ? followLine_htf : na, color = lineColor_htf, linewidth = 2, style = plot.style_circles, title = 'Follow Line (HTF)', offset = 0)

// Plot shapes on the bar the trade signal occurs (based on trade TF condition), placing them AT the calculated Trade TF price level.

// Use the original trade long/short conditions for plotting shapes for clarity, before plots

plotshape(longCondition_trade and showSignalsInput and not na(followLine_trade) and not na(atrValue_trade) ? followLine_trade - atrValue_trade : na, text = 'BUY', style = shape.labelup, location = location.absolute, color = color.new(color.blue, 0), textcolor = color.new(color.white, 0), offset = 0, size = size.auto)

plotshape(shortCondition_trade and showSignalsInput and not na(followLine_trade) and not na(atrValue_trade) ? followLine_trade + atrValue_trade : na, text = 'SELL', style = shape.labeldown, location = location.absolute, color = color.new(color.red, 0), textcolor = color.new(color.white, 0), offset = 0, size = size.auto)

// Plot BBands for reference if desired

// plot(BBUpper_trade, "Upper BB", color=color.gray)

// plot(BBLower_trade, "Lower BB", color=color.gray)