概述

该策略结合了支撑/阻力(S/R)突破/反转、成交量过滤和警报系统,旨在捕捉市场中的关键转折点。策略通过识别价格突破或反转信号,并结合异常成交量确认,以提高交易信号的可靠性。策略采用固定2%的止损和可调节的止盈比例(默认3%)来管理风险。

策略原理

- 支撑/阻力识别:使用

ta.pivothigh()和ta.pivotlow()函数在指定周期(pivotLen)内识别关键价格水平。当价格突破阻力位(上破1%)或从支撑位反弹(下探后收回)时触发信号。

- 成交量过滤:计算成交量的SMA(volSmaLength周期),当当前成交量超过SMA的volMultiplier倍(默认1.5倍)时视为有效确认。

- 多空逻辑:

- 多头条件:价格突破阻力区(close > resZone*1.01)且伴随高成交量,或价格接近支撑区(±1%范围内)出现”假跌破”(low ≤ supZone但收盘收回)且成交量放大。

- 空头条件:价格跌破支撑区(close < supZone*0.99)且伴随高成交量,或价格接近阻力区(±1%范围内)出现”假突破”(high ≥ resZone但收盘回落)且成交量放大。

- 多头条件:价格突破阻力区(close > resZone*1.01)且伴随高成交量,或价格接近支撑区(±1%范围内)出现”假跌破”(low ≤ supZone但收盘收回)且成交量放大。

- 风险管理:固定2%的止损和可调止盈(默认3%)通过

strategy.exit()实现。

优势分析

- 多因子验证:结合价格结构(S/R)、成交量和市场行为(假突破/假跌破),显著降低假信号概率。

- 动态适应:自动更新支撑/阻力位,适应市场变化。

- 风险控制严格:固定止损防止单笔交易过度亏损,止盈比例可调以适应不同波动性市场。

- 可视化强:实时绘制支撑/阻力线,交易信号标注清晰。

- 警报集成:可对接自动化交易系统,适合不同交易场景。

风险分析

- 震荡市风险:在无趋势市场中频繁触发假突破,导致多次止损。解决方法:增加趋势过滤指标如ADX或EMA。

- 参数敏感:pivotLen和volMultiplier需根据市场调整。解决方法:进行参数优化和Walk-Forward测试。

- 成交量滞后:异常成交量可能出现在价格波动之后。解决方法:结合盘口数据或缩短volSmaLength。

- 跳空风险:开盘跳空可能跳过止损位。解决方法:使用限价单或避开高波动时段。

优化方向

- 趋势过滤:加入ADX>25条件或200EMA方向过滤,避免逆势交易。

- 动态参数:根据市场波动率(如ATR)自动调整pivotLen和volMultiplier。

- 分级止盈:设置两档止盈(如2%平半仓,剩余追踪止损),提升盈亏比。

- 机器学习优化:使用历史数据训练模型优化volMultiplier和tpPerc参数。

- 跨周期验证:引入更高时间框架的S/R确认,增强信号质量。

总结

该策略通过三重验证(价格位置、成交量、价格行为)设计了一个高概率交易框架,特别适合趋势初期的捕捉。核心优势在于逻辑透明、风险可控,但需注意其在震荡市中的局限性。未来优化可聚焦于参数自适应和趋势过滤,以进一步提升稳定性。

策略源码

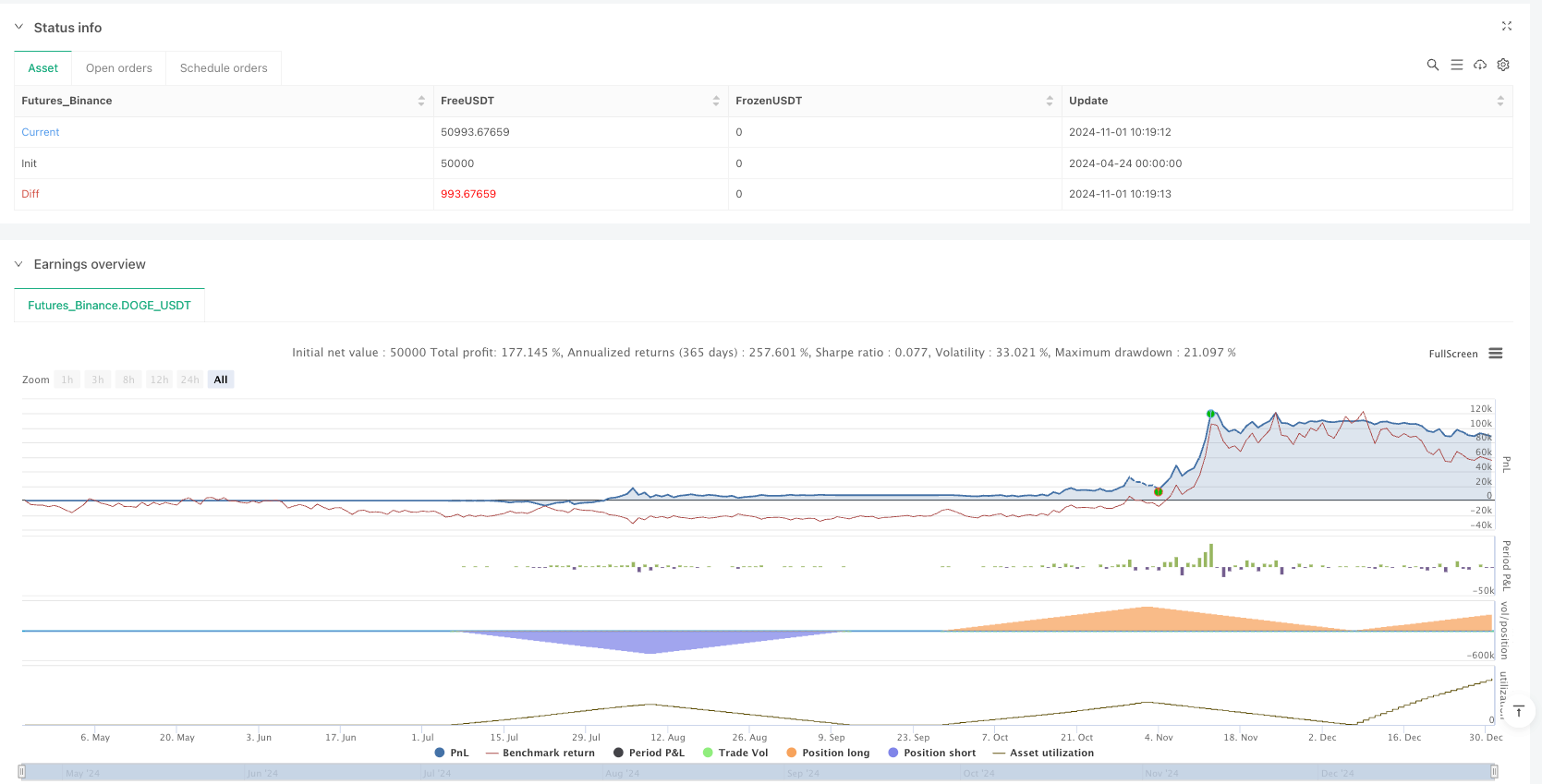

/*backtest

start: 2024-04-24 00:00:00

end: 2024-12-31 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"DOGE_USDT"}]

*/

//@version=5

strategy("S/R Breakout/Reversal + Volume + Alerts", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === INPUTS ===

pivotLen = input.int(10, "Pivot Lookback for S/R")

volSmaLength = input.int(20, "Volume SMA Length")

volMultiplier = input.float(1.5, "Volume Multiplier")

tpPerc = input.float(3.0, "Take Profit %", step=0.1)

slPerc = 2.0 // Stop Loss fixed at 2%

// === S/R ZONES ===

pivotHigh = ta.pivothigh(high, pivotLen, pivotLen)

pivotLow = ta.pivotlow(low, pivotLen, pivotLen)

var float resZone = na

var float supZone = na

if not na(pivotHigh)

resZone := pivotHigh

if not na(pivotLow)

supZone := pivotLow

plot(supZone, title="Support", color=color.green, linewidth=2, style=plot.style_linebr)

plot(resZone, title="Resistance", color=color.red, linewidth=2, style=plot.style_linebr)

// === VOLUME FILTER ===

volSma = ta.sma(volume, volSmaLength)

highVolume = volume > volSma * volMultiplier

// === LONG LOGIC ===

priceAboveRes = close > resZone * 1.01

nearSupport = close >= supZone * 0.99 and close <= supZone * 1.01

rejectSupport = low <= supZone and close > supZone

longBreakoutCond = priceAboveRes and highVolume

longReversalCond = nearSupport and rejectSupport and highVolume

longCondition = longBreakoutCond or longReversalCond

// === SHORT LOGIC ===

priceBelowSup = close < supZone * 0.99

nearResistance = close >= resZone * 0.99 and close <= resZone * 1.01

rejectResistance = high >= resZone and close < resZone

shortBreakoutCond = priceBelowSup and highVolume

shortReversalCond = nearResistance and rejectResistance and highVolume

shortCondition = shortBreakoutCond or shortReversalCond

// === ENTRIES WITH LABELS ===

if (longCondition)

strategy.entry("Long", strategy.long)

label.new(bar_index, low * 0.995, "BUY", style=label.style_label_up, color=color.green, textcolor=color.white)

if (shortCondition)

strategy.entry("Short", strategy.short)

label.new(bar_index, high * 1.005, "SELL", style=label.style_label_down, color=color.red, textcolor=color.white)

// === TP/SL ===

longTP = close * (1 + tpPerc / 100)

longSL = close * (1 - slPerc / 100)

shortTP = close * (1 - tpPerc / 100)

shortSL = close * (1 + slPerc / 100)

strategy.exit("Long TP/SL", from_entry="Long", limit=longTP, stop=longSL)

strategy.exit("Short TP/SL", from_entry="Short", limit=shortTP, stop=shortSL)

// === ALERT CONDITIONS ===

alertcondition(longCondition, title="Buy Alert", message="🔔 BUY signal: S/R + Volume breakout/reversal")

alertcondition(shortCondition, title="Sell Alert", message="🔔 SELL signal: S/R + Volume breakout/reversal")

相关推荐