多指标混合型RSI量化短线交易策略

RSI EMA VOLUME TREND DETECTION Price Action SCALPING Trailing Stop

概述

多指标混合型RSI量化短线交易策略是一个结合了多种技术指标的综合性交易系统,专为短线交易者设计。该策略融合了RSI指标、移动平均线、成交量分析和价格行为模式,形成了一个多维度的交易决策框架。策略的核心是通过不同灵敏度级别的信号过滤机制,使交易者能够根据自身风险偏好和市场状况调整交易频率和信号质量。该策略特别注重快速进场和精准出场,通过多重出场机制包括止盈、止损、追踪止损和快速退出功能,有效控制风险同时锁定利润。

策略原理

此策略的核心原理基于以下几个关键技术元素的协同作用:

RSI超买超卖信号:使用14周期RSI指标识别超买(>70)和超卖(<30)区域,作为主要的交易信号触发条件。

移动平均线趋势确认:策略结合9、21和50周期的EMA移动平均线构建趋势识别系统。通过观察这些均线之间的关系判断市场趋势方向和强度。当EMA9>EMA21>EMA50时,确认强势上升趋势;当EMA9

成交量验证:通过比较当前成交量与10周期平均成交量,确保交易发生在足够活跃的市场环境中,提高信号质量。

价格行为模式:分析蜡烛图形态,特别是强势看涨和看跌蜡烛,通过计算实体与影线的比例来衡量价格动能。

多级信号灵敏度:策略设计了四个不同级别的信号灵敏度(”ง่ายมาก”/“非常容易”、”อ่อน”/“容易”、”กลาง”/“中等”、”แรง”/“强烈”),允许交易者根据市场条件和风险偏好调整交易频率与精确度。

智能出场机制:策略实现了多重出场机制,包括固定止盈止损、RSI反转信号快速退出以及追踪止损功能,通过动态调整止损价格锁定已获利润。

日交易量限制:内置每日交易次数限制功能,防止过度交易,同时符合短线交易的风格特点。

策略优势

灵活的信号灵敏度调整:策略最大的优势在于其可调节的信号灵敏度系统,交易者可以从”非常容易”到”强烈”四个级别中选择,在交易频率和信号质量之间找到平衡点。这使得策略能够适应不同的市场环境和个人交易风格。

多重风险管理机制:策略整合了固定止损、追踪止损和基于RSI的快速退出等多种风险控制方法,提供了全面的风险管理框架。特别是追踪止损功能,能够在保持利润增长空间的同时逐步锁定已获收益。

全面的技术指标整合:通过结合RSI、EMA、成交量和价格行为分析,策略能够从多个维度评估市场状况,减少假信号的产生,提高交易精确度。

自动化交易执行:策略完全自动化,从信号生成、入场决策到出场管理,减少了人为情绪干扰,保证交易纪律的执行。

实时可视化反馈:通过内置的仪表板显示功能,交易者可以直观地监控策略表现、当前市场状况和交易状态,便于实时决策调整。

通讯集成能力:策略支持Telegram消息推送功能,实现远程交易监控和信号通知,提高了操作便利性。

策略风险

RSI指标局限性:RSI作为主要信号来源,存在滞后性和假信号风险,特别是在震荡市场中可能产生频繁的错误信号。解决方法是结合趋势过滤器和价格行为确认,或在横盘市场中调高信号灵敏度要求。

过度优化风险:策略参数众多,包括RSI阈值、EMA周期、止盈止损百分比等,容易导致过度优化。建议通过历史数据回测和前向测试来验证参数稳健性,避免仅适应历史数据的参数组合。

快速市场风险:在高波动性或市场跳空情况下,固定止损可能无法有效执行,导致实际损失超过预期。考虑使用波动率调整的止损水平或增加市场波动过滤条件来应对此风险。

交易频率风险:特别是在低灵敏度设置下,策略可能产生过多交易信号,增加交易成本。通过合理设置日交易限额和调整信号灵敏度来控制交易频率。

趋势反转不及时:依赖EMA判断趋势可能在趋势反转初期反应不够迅速。建议结合其他趋势确认指标如ADX或Parabolic SAR增强趋势识别能力。

策略优化方向

自适应参数调整:当前策略使用固定的RSI阈值和EMA周期,可以引入基于市场波动率的自适应参数体系。例如,在高波动市场中自动调整RSI的超买超卖阈值,或根据不同时间框架动态调整EMA周期长度,提高策略对不同市场环境的适应性。

增强信号过滤机制:可以引入更多维度的市场环境识别指标,如ATR(平均真实波幅)用于评估波动率,ADX(平均方向指数)用于确认趋势强度,或使用多时间框架分析提高信号质量。这些额外的过滤器能够减少假信号,提高交易成功率。

优化资金管理系统:当前策略的仓位管理相对简单,可以引入基于账户净值百分比的动态仓位调整或基于Kelly准则的资金分配方法。这样可以根据历史交易表现和当前市场状况自动调整每笔交易的风险敞口。

增加机器学习成分:可以利用机器学习算法分析历史交易数据,自动识别策略在不同市场环境下的最佳参数组合。通过监督学习或强化学习方法,建立能够预测信号可靠性的模型,进一步提升交易决策质量。

扩展市场状态分类:可以开发更细致的市场状态分类系统,如趋势、区间震荡、高波动等,并为每种市场状态定制相应的交易规则和参数。这种分层策略框架能够更好地应对不同的市场环境。

总结

多指标混合型RSI量化短线交易策略是一个全面而灵活的短线交易系统,通过整合RSI、移动平均线、成交量和价格行为分析,构建了一个多维度的交易决策框架。其最大优势在于灵活可调的信号灵敏度系统和多重风险管理机制,使交易者能够根据市场环境和个人风险偏好定制交易策略。

尽管存在RSI指标局限性和参数优化等潜在风险,但通过适当的风险管理和持续优化,这些风险可以得到有效控制。未来优化方向应着重于参数自适应化、信号过滤增强、资金管理优化以及引入机器学习等先进技术,进一步提升策略的稳健性和适应性。

总的来说,这是一个设计合理、结构完整的量化交易策略,具有较高的实用价值和灵活性。对于寻求短线交易机会、注重风险控制的交易者而言,这套系统提供了一个良好的起点,可以通过不断测试和调整,发展成为一个稳定可靠的交易工具。

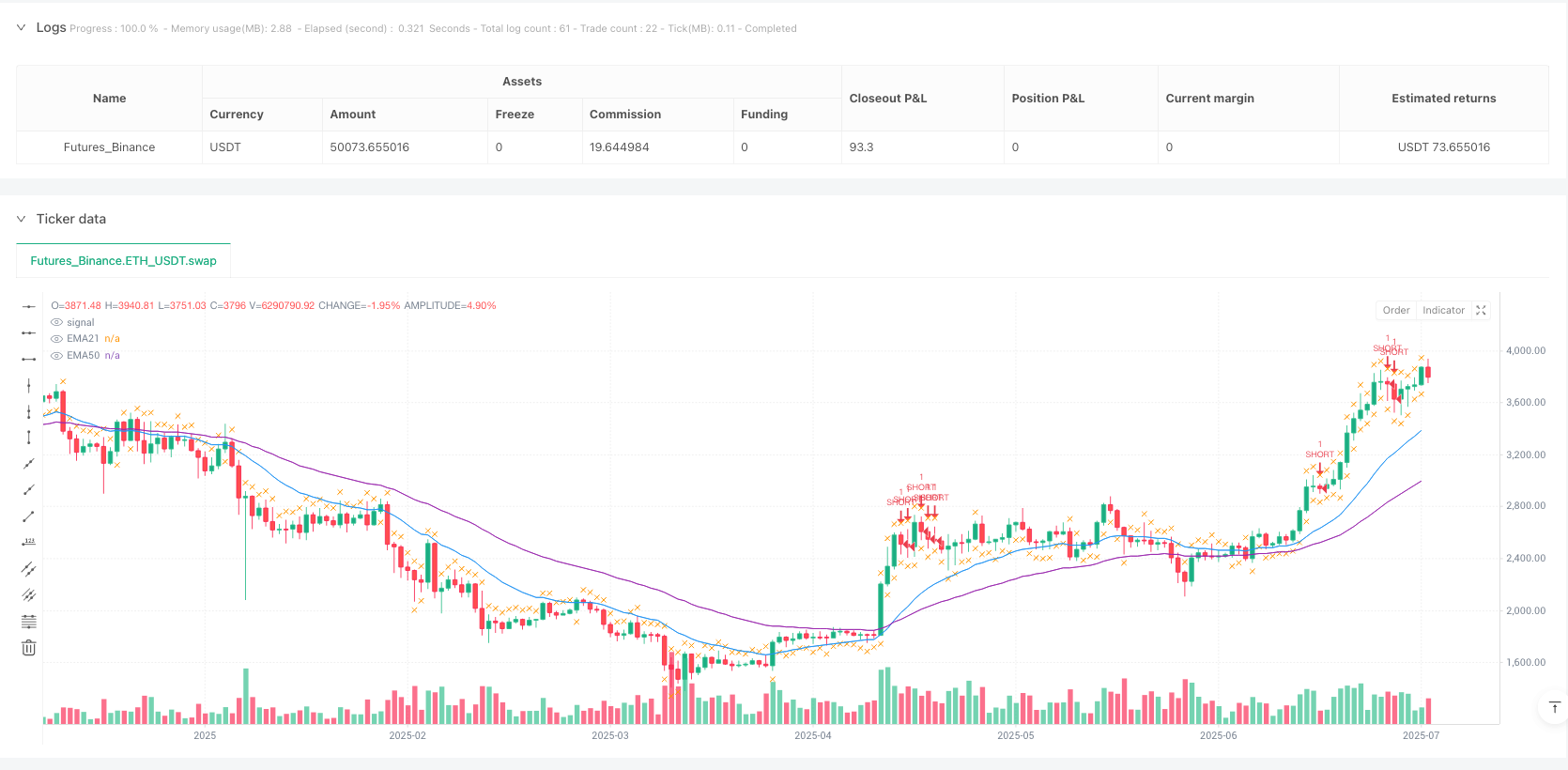

/*backtest

start: 2024-07-31 00:00:00

end: 2025-07-29 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("🔥 HYBRID SCALPING Bot - เข้าง่าย ออกแม่น", overlay=true, max_labels_count=50, calc_on_order_fills=false, process_orders_on_close=true, pyramiding=0)

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// 📋 การตั้งค่าแบบ Hybrid - รวมจุดเด่นทั้งสอง

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// การตั้งค่าเทรด - Scalping Style

group_trading = "⚡ การตั้งค่า Scalping"

daily_trade_limit = input.int(15, "ลิมิตเทรดต่อวัน", minval=5, maxval=50, tooltip="Scalping = เทรดบ่อย", group=group_trading)

tp_percent = input.float(0.8, "Take Profit %", minval=0.3, maxval=3.0, tooltip="เล็กแต่ชัวร์", group=group_trading)

sl_percent = input.float(0.6, "Stop Loss %", minval=0.3, maxval=2.0, tooltip="ตัดขาดทุนเร็ว", group=group_trading)

// การตั้งค่าการออกเทรด - จาก Scalping Bot

use_quick_exit = input.bool(true, "ออกเทรดเร็ว", tooltip="ออกเมื่อ RSI กลับตัว", group=group_trading)

use_trailing_stop = input.bool(true, "ใช้ Trailing Stop", tooltip="ล็อคกำไรเมื่อขึ้น", group=group_trading)

trailing_percent = input.float(0.4, "Trailing Stop %", minval=0.2, maxval=1.0, group=group_trading)

// ความยากง่ายในการเข้าเทรด - จาก Debug Bot

group_sensitivity = "🎯 ความยากง่ายการเข้าเทรด"

signal_sensitivity = input.string("อ่อน", "ระดับความรุนแรง", options=["ง่ายมาก", "อ่อน", "กลาง", "แรง"],

tooltip="ง่ายมาก=เข้าเทรดบ่อยสุด, แรง=แม่นยำสุด", group=group_sensitivity)

// ฟิลเตอร์เสริม - ปรับได้ตามระดับ

use_trend_filter = input.bool(true, "ใช้ฟิลเตอร์เทรนด์", tooltip="เทรดตามเทรนด์เท่านั้น", group=group_sensitivity)

use_volume_filter = input.bool(false, "ใช้ฟิลเตอร์ Volume", tooltip="ต้องมี Volume สูง", group=group_sensitivity)

// การแสดงผล

group_display = "🎨 การแสดงผล"

show_signals = input.bool(true, "แสดงสัญญาณ", group=group_display)

show_exit_signals = input.bool(true, "แสดงสัญญาณออก", group=group_display)

show_dashboard = input.bool(true, "แสดง Dashboard", group=group_display)

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// 📱 การตั้งค่า Telegram - แบบง่าย (จาก Debug Bot)

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

group_telegram = "📱 Telegram"

enable_telegram = input.bool(false, "เปิด Telegram", group=group_telegram)

telegram_bot_token = input.string("", "Bot Token", group=group_telegram)

telegram_chat_id = input.string("", "Chat ID", group=group_telegram)

send_test_message = input.bool(false, "ส่งข้อความทดสอบ", group=group_telegram)

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// 🧮 ตัวชี้วัดเทคนิค - Hybrid

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// RSI

rsi = ta.rsi(close, 14)

rsi_oversold = 30

rsi_overbought = 70

// Moving Averages

ema9 = ta.ema(close, 9)

ema21 = ta.ema(close, 21)

ema50 = ta.ema(close, 50)

// Trend

uptrend = ema21 > ema50

downtrend = ema21 < ema50

strong_uptrend = ema9 > ema21 and ema21 > ema50

strong_downtrend = ema9 < ema21 and ema21 < ema50

// Volume

avg_volume = ta.sma(volume, 10)

high_volume = volume > avg_volume * 1.2

volume_ok = use_volume_filter ? high_volume : true

// Price Action

bullish_candle = close > open

bearish_candle = close < open

strong_bullish_candle = close > open and (close - open) / (high - low) > 0.6

strong_bearish_candle = close < open and (open - close) / (high - low) > 0.6

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// 🎯 ระบบสัญญาณแบบ Hybrid

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// ระดับ "ง่ายมาก" - เข้าเทรดง่ายสุด

very_easy_buy = rsi < 60 and bullish_candle

very_easy_sell = rsi > 40 and bearish_candle

// ระดับ "อ่อน" - ใช้ RSI หลัก

easy_buy = rsi < rsi_oversold and bullish_candle

easy_sell = rsi > rsi_overbought and bearish_candle

// ระดับ "กลาง" - เพิ่มเงื่อนไข Trend

medium_buy = rsi < rsi_oversold and bullish_candle and (use_trend_filter ? uptrend : true)

medium_sell = rsi > rsi_overbought and bearish_candle and (use_trend_filter ? downtrend : true)

// ระดับ "แรง" - เงื่อนไขครบ (เหมือน Scalping Bot เดิม)

strong_buy = rsi < rsi_oversold and

strong_bullish_candle and

(use_trend_filter ? strong_uptrend : true) and

volume_ok and

close > ema21

strong_sell = rsi > rsi_overbought and

strong_bearish_candle and

(use_trend_filter ? strong_downtrend : true) and

volume_ok and

close < ema21

// เลือกสัญญาณตามระดับที่ตั้งค่า

buy_signal = signal_sensitivity == "ง่ายมาก" ? very_easy_buy :

signal_sensitivity == "อ่อน" ? easy_buy :

signal_sensitivity == "กลาง" ? medium_buy :

strong_buy

sell_signal = signal_sensitivity == "ง่ายมาก" ? very_easy_sell :

signal_sensitivity == "อ่อน" ? easy_sell :

signal_sensitivity == "กลาง" ? medium_sell :

strong_sell

// Exit Signals - ใช้จาก Scalping Bot

rsi_exit_long = rsi > 70 or rsi < 25

rsi_exit_short = rsi < 30 or rsi > 75

quick_exit_long = use_quick_exit and (rsi_exit_long or close < ema21)

quick_exit_short = use_quick_exit and (rsi_exit_short or close > ema21)

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// 📊 การจัดการเทรด

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

var int trades_today = 0

var bool test_sent = false

// รีเซ็ตทุกวัน

if dayofweek != dayofweek[1]

trades_today := 0

can_trade = trades_today < daily_trade_limit and strategy.position_size == 0

// ส่งข้อความทดสอบ Telegram - ใช้ format จาก Debug Bot

if enable_telegram and send_test_message and not test_sent and barstate.islast

test_message = "🧪 ทดสอบ HYBRID SCALPING Bot\n\n" +

"✅ การเชื่อมต่อสำเร็จ!\n" +

"📊 Symbol: " + syminfo.ticker + "\n" +

"💲 ราคาปัจจุบัน: $" + str.tostring(close, "#.####") + "\n" +

"⚡ ระดับ: " + signal_sensitivity + "\n" +

"⏰ เวลา: " + str.tostring(hour, "00") + ":" + str.tostring(minute, "00") + "\n\n" +

"🎯 Bot พร้อมทำงาน!"

alert(test_message, alert.freq_once_per_bar)

test_sent := true

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// 💰 การดำเนินการเทรด - Scalping Logic

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// Variables for Scalping

var float entry_price = 0

var float highest_profit = 0

var float trailing_stop_price = 0

// Entry Long

if buy_signal and can_trade

strategy.entry("LONG", strategy.long)

trades_today := trades_today + 1

entry_price := close

highest_profit := 0

trailing_stop_price := close * (1 - sl_percent / 100)

// Set exits

strategy.exit("SL/TP", "LONG",

stop=close * (1 - sl_percent / 100),

limit=close * (1 + tp_percent / 100))

// Telegram Alert - ใช้ format ง่าย

if enable_telegram

entry_message = "🚀 HYBRID LONG!\n" +

"📊 " + syminfo.ticker + "\n" +

"💰 Entry: $" + str.tostring(close, "#.####") + "\n" +

"🛑 SL: $" + str.tostring(close * (1 - sl_percent / 100), "#.####") + "\n" +

"🎯 TP: $" + str.tostring(close * (1 + tp_percent / 100), "#.####") + "\n" +

"📈 RSI: " + str.tostring(rsi, "#.#") + "\n" +

"⚡ Level: " + signal_sensitivity + "\n" +

"📊 เทรดที่: " + str.tostring(trades_today)

alert(entry_message, alert.freq_once_per_bar)

// Entry Short

if sell_signal and can_trade

strategy.entry("SHORT", strategy.short)

trades_today := trades_today + 1

entry_price := close

highest_profit := 0

trailing_stop_price := close * (1 + sl_percent / 100)

// Set exits

strategy.exit("SL/TP", "SHORT",

stop=close * (1 + sl_percent / 100),

limit=close * (1 - tp_percent / 100))

// Telegram Alert

if enable_telegram

entry_message = "📉 HYBRID SHORT!\n" +

"📊 " + syminfo.ticker + "\n" +

"💰 Entry: $" + str.tostring(close, "#.####") + "\n" +

"🛑 SL: $" + str.tostring(close * (1 + sl_percent / 100), "#.####") + "\n" +

"🎯 TP: $" + str.tostring(close * (1 - tp_percent / 100), "#.####") + "\n" +

"📈 RSI: " + str.tostring(rsi, "#.#") + "\n" +

"⚡ Level: " + signal_sensitivity + "\n" +

"📊 เทรดที่: " + str.tostring(trades_today)

alert(entry_message, alert.freq_once_per_bar)

// Trailing Stop Logic - จาก Scalping Bot

if strategy.position_size > 0 and use_trailing_stop // Long position

current_profit = (close - entry_price) / entry_price * 100

if current_profit > highest_profit

highest_profit := current_profit

trailing_stop_price := close * (1 - trailing_percent / 100)

if close <= trailing_stop_price

strategy.close("LONG", comment="Trailing Stop")

if enable_telegram

exit_message = "🔒 TRAILING STOP LONG!\n" +

"📊 " + syminfo.ticker + "\n" +

"💰 Exit: $" + str.tostring(close, "#.####") + "\n" +

"📈 Profit: +" + str.tostring(current_profit, "#.##") + "%"

alert(exit_message, alert.freq_once_per_bar)

if strategy.position_size < 0 and use_trailing_stop // Short position

current_profit = (entry_price - close) / entry_price * 100

if current_profit > highest_profit

highest_profit := current_profit

trailing_stop_price := close * (1 + trailing_percent / 100)

if close >= trailing_stop_price

strategy.close("SHORT", comment="Trailing Stop")

if enable_telegram

exit_message = "🔒 TRAILING STOP SHORT!\n" +

"📊 " + syminfo.ticker + "\n" +

"💰 Exit: $" + str.tostring(close, "#.####") + "\n" +

"📈 Profit: +" + str.tostring(current_profit, "#.##") + "%"

alert(exit_message, alert.freq_once_per_bar)

// Quick Exit Logic - จาก Scalping Bot

if strategy.position_size > 0 and quick_exit_long

strategy.close("LONG", comment="Quick Exit")

if enable_telegram

current_pnl = (close - entry_price) / entry_price * 100

exit_message = "⚡ QUICK EXIT LONG!\n" +

"📊 " + syminfo.ticker + "\n" +

"💰 Exit: $" + str.tostring(close, "#.####") + "\n" +

"📈 P&L: " + str.tostring(current_pnl, "#.##") + "%"

alert(exit_message, alert.freq_once_per_bar)

if strategy.position_size < 0 and quick_exit_short

strategy.close("SHORT", comment="Quick Exit")

if enable_telegram

current_pnl = (entry_price - close) / entry_price * 100

exit_message = "⚡ QUICK EXIT SHORT!\n" +

"📊 " + syminfo.ticker + "\n" +

"💰 Exit: $" + str.tostring(close, "#.####") + "\n" +

"📈 P&L: " + str.tostring(current_pnl, "#.##") + "%"

alert(exit_message, alert.freq_once_per_bar)

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// 🎨 การแสดงผลบนชาร์ต

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// Plot signals

plotshape(buy_signal and show_signals, "Buy", shape.triangleup, location.belowbar, color.lime, size=size.small)

plotshape(sell_signal and show_signals, "Sell", shape.triangledown, location.abovebar, color.red, size=size.small)

// Plot exit signals

plotshape(quick_exit_long and show_exit_signals, "Quick Exit Long", shape.xcross, location.abovebar, color.orange, size=size.tiny)

plotshape(quick_exit_short and show_exit_signals, "Quick Exit Short", shape.xcross, location.belowbar, color.orange, size=size.tiny)

// Plot EMAs

plot(ema21, "EMA21", color.blue, linewidth=1)

plot(ema50, "EMA50", color.purple, linewidth=1)

// Dashboard - ปรับปรุงให้ปลอดภัย

if show_dashboard and barstate.islast

var table dashboard = table.new(position.top_right, 2, 7, bgcolor=color.white, border_width=1)

table.cell(dashboard, 0, 0, "🔥 HYBRID", text_color=color.white, bgcolor=color.orange, text_size=size.small)

table.cell(dashboard, 1, 0, syminfo.ticker, text_color=color.white, bgcolor=color.orange, text_size=size.small)

table.cell(dashboard, 0, 1, "💰 P&L", text_color=color.black, text_size=size.small)

pnl_value = strategy.netprofit

pnl_color = pnl_value >= 0 ? color.green : color.red

table.cell(dashboard, 1, 1, "$" + str.tostring(pnl_value, "#.##"), text_color=pnl_color, text_size=size.small)

table.cell(dashboard, 0, 2, "⚡ Level", text_color=color.black, text_size=size.small)

table.cell(dashboard, 1, 2, signal_sensitivity, text_color=color.purple, text_size=size.small)

table.cell(dashboard, 0, 3, "📈 RSI", text_color=color.black, text_size=size.small)

rsi_color = rsi < 30 ? color.green : rsi > 70 ? color.red : color.gray

table.cell(dashboard, 1, 3, str.tostring(rsi, "#.#"), text_color=rsi_color, text_size=size.small)

table.cell(dashboard, 0, 4, "📊 เทรด", text_color=color.black, text_size=size.small)

table.cell(dashboard, 1, 4, str.tostring(trades_today) + "/" + str.tostring(daily_trade_limit), text_color=color.navy, text_size=size.small)

table.cell(dashboard, 0, 5, "📍 สถานะ", text_color=color.black, text_size=size.small)

position_text = strategy.position_size > 0 ? "LONG" : strategy.position_size < 0 ? "SHORT" : "ว่าง"

position_color = strategy.position_size > 0 ? color.green : strategy.position_size < 0 ? color.red : color.gray

table.cell(dashboard, 1, 5, position_text, text_color=position_color, text_size=size.small)

table.cell(dashboard, 0, 6, "🎯 Trend", text_color=color.black, text_size=size.small)

trend_text = uptrend ? "UP" : downtrend ? "DOWN" : "SIDE"

trend_color = uptrend ? color.green : downtrend ? color.red : color.gray

table.cell(dashboard, 1, 6, trend_text, text_color=trend_color, text_size=size.small)