波动率自适应海肯阿希ATR追踪止损趋势交易策略

ATR EMA HEIKIN ASHI Trailing Stop TREND FOLLOWING volatility STOP LOSS

概述

波动率自适应海肯阿希ATR追踪止损趋势交易策略是一个专为金融市场趋势识别和风险管理设计的系统化交易方法。该策略基于海肯阿希(Heikin Ashi)蜡烛图技术来过滤市场噪音,结合平均真实波幅(ATR)动态调整的追踪止损系统,通过指数移动平均线(EMA)交叉来生成交易信号。该策略仅执行多头交易,并通过波动率调整的组件来增强信号稳健性和交易管理。该策略特别适合加密货币等高波动性市场,也适用于追求系统化趋势跟踪的交易者。

策略原理

该策略的核心原理基于几个关键技术组件的协同作用:

海肯阿希蜡烛图过滤:策略提供三种不同的海肯阿希计算模式(手动计算、TradingView内置函数和常规蜡烛图),以减轻市场短期噪音并突出潜在趋势方向。手动计算模式提供最透明和可靠的结果,而内置函数则使用已确认的历史柱体来防止重绘。

ATR追踪止损机制:平均真实波幅(ATR)作为市场波动性的动态衡量指标,结合用户定义的参数(关键值和ATR周期)来校准追踪止损的敏感度,使其能够适应不同的市场波动性环境。这一机制旨在提供动态的退出点,在趋势发展过程中保护资金和锁定收益。

EMA交叉信号生成:入场和出场信号由海肯阿希价格与指数移动平均线(EMA)之间的交互派生。这两个组件之间的交叉事件被用来客观识别动量转变,发出潜在的多头入场或出场信号。

严格的止损实施:策略包含可选的止损功能,可配置为入场价格的百分比或固定点数偏差。重要的是,止损执行基于真实市场价格,而非合成的海肯阿希值,确保风险管理基于实际市场流动性和价格水平。

回测协议:策略配置为realistic回测,采用fill_orders_on_standard_ohlc=true来模拟在标准OHLC价格上的订单执行,并包含可配置的日期过滤器来定义特定的历史期间进行性能评估。

数据可视化:脚本提供买入/卖出信号、ATR追踪止损和止损水平的图表叠加,以及显示实时策略参数、当前仓位状态、趋势方向和关键价格水平的信息表格。

策略优势

噪音过滤能力:海肯阿希蜡烛图技术有效过滤短期市场噪音,帮助交易者专注于更重要的市场趋势,减少假信号干扰。

动态风险管理:基于ATR的追踪止损机制能够根据市场波动性自动调整,在波动加剧时提供更宽松的止损,在波动减弱时收紧保护,优化风险回报比。

客观的入场和出场信号:通过EMA交叉生成的信号消除了主观判断,使交易决策更加系统化和可重复,有助于保持情绪纪律。

真实市场价格执行:策略在回测中使用真实市场价格(而非海肯阿希合成价格)执行交易和止损,提供更准确的回测结果,更接近实际交易环境。

视觉反馈和监控:集成的信息表格和视觉指标提供实时策略状态和关键数据点,便于快速评估和监控,增强决策能力。

灵活的参数配置:可调整的关键参数(敏感度值、ATR周期、海肯阿希方法和止损设置)使策略能够适应不同市场环境和交易者的风险偏好。

仅多头策略设计:专注于捕捉上升趋势,避免了潜在的空头挤压风险,特别适合长期看涨的市场,如某些加密货币。

策略风险

趋势反转风险:作为趋势跟踪策略,在市场横盘或快速反转时可能面临较大的回撤,ATR追踪止损可能无法完全防止这类损失。

参数优化陷阱:过度优化参数可能导致曲线拟合,使策略在历史数据上表现出色但在未来市场中表现不佳。建议在多个市场和时间框架上测试,以确保稳健性。

入场时机风险:EMA交叉信号可能出现在趋势已经发展的较晚阶段,导致入场位置不理想。在强势市场中,这可能导致在高位买入。

止损触发风险:在高波动性市场中,即使总体趋势向好,价格也可能短暂触及止损水平,导致不必要的退出。需要根据市场特性谨慎设置止损参数。

单一技术指标依赖:策略主要依赖ATR和EMA指标,不考虑基本面因素或其他技术指标,可能错过重要的市场转折点。

长期横盘市场表现:在长期横盘市场中,该策略可能产生多次错误信号,导致连续小亏损累积。建议在确认市场处于趋势状态时使用。

滑点和执行风险:虽然策略在回测中考虑了滑点,但实际交易中的滑点和执行延迟可能比设定值更大,特别是在流动性较低的市场。

策略优化方向

多时间框架分析整合:考虑整合更高时间框架的趋势确认信号,只在更高时间框架趋势方向一致时才执行交易,可以显著提高胜率和风险回报比。

波动率过滤器:增加基于波动率的过滤器,在异常高波动期间暂停交易或调整仓位大小,可以减少市场极端波动带来的风险。

动态仓位管理:实现基于波动率和市场状况的动态仓位大小调整,而不是固定的百分比配置,可以在不同市场条件下优化资金使用效率。

多指标确认:整合其他互补性技术指标(如相对强弱指数RSI、随机指标或MACD)作为二级确认,可以降低虚假信号率并提高交易质量。

止损策略改进:实现更复杂的止损策略,如跟踪ATR的倍数或基于支撑/阻力水平的止损,而不是简单的百分比或固定点数,可以更好地适应市场结构。

出场策略细化:开发更精细的部分获利和分批出场机制,可以在保持趋势敞口的同时锁定部分利润,优化整体回报曲线。

市场体制识别:添加市场体制识别算法,自动调整策略参数以适应不同的市场状态(趋势、震荡或反转),提高策略的自适应能力。

机器学习集成:探索机器学习技术来优化参数选择或预测最佳入场/出场点,可以进一步提升策略性能并减少主观干预。

总结

波动率自适应海肯阿希ATR追踪止损趋势交易策略是一个设计合理、风险可控的趋势跟踪系统,特别适合波动性较大的市场。通过结合海肯阿希蜡烛图的噪音过滤能力、ATR的动态风险管理和EMA的趋势识别功能,该策略提供了一个客观、系统化的交易框架。

该策略的主要优势在于其自适应性和动态风险管理能力,能够根据市场波动情况自动调整止损水平,保护资金并锁定利润。同时,其严格的止损实施和基于真实市场价格的执行机制确保了回测结果的可靠性和可复制性。

然而,作为一个趋势跟踪策略,在市场横盘或快速反转时可能面临挑战。通过整合多时间框架分析、增加波动率过滤器、优化仓位管理和细化出场策略等改进措施,可以进一步增强策略的稳健性和性能。

对于希望构建系统化交易方法的交易者来说,这一策略提供了一个坚实的基础,可以根据个人风险偏好和市场特性进行自定义和扩展,有潜力在各种市场环境中实现稳定的风险调整回报。

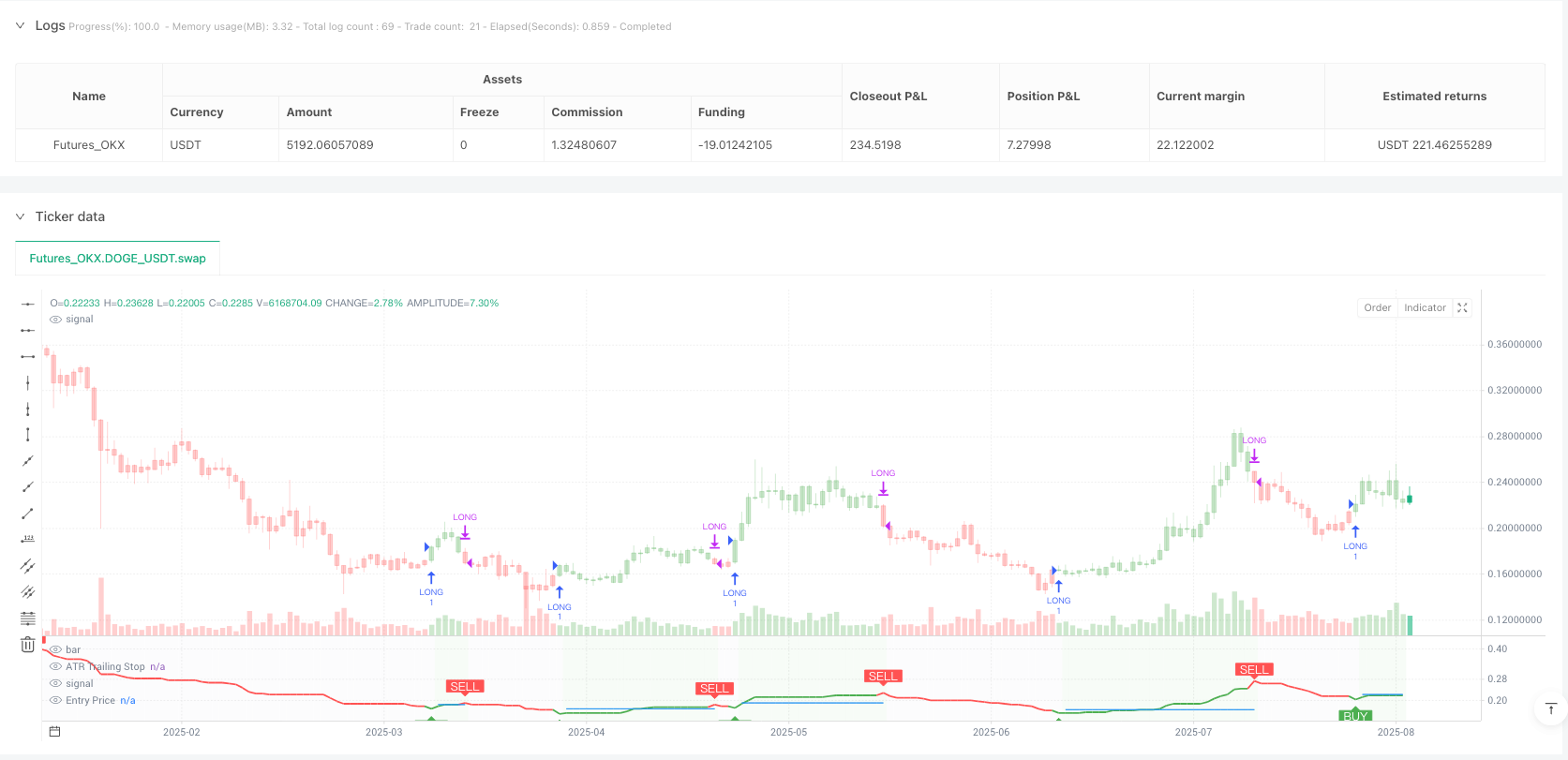

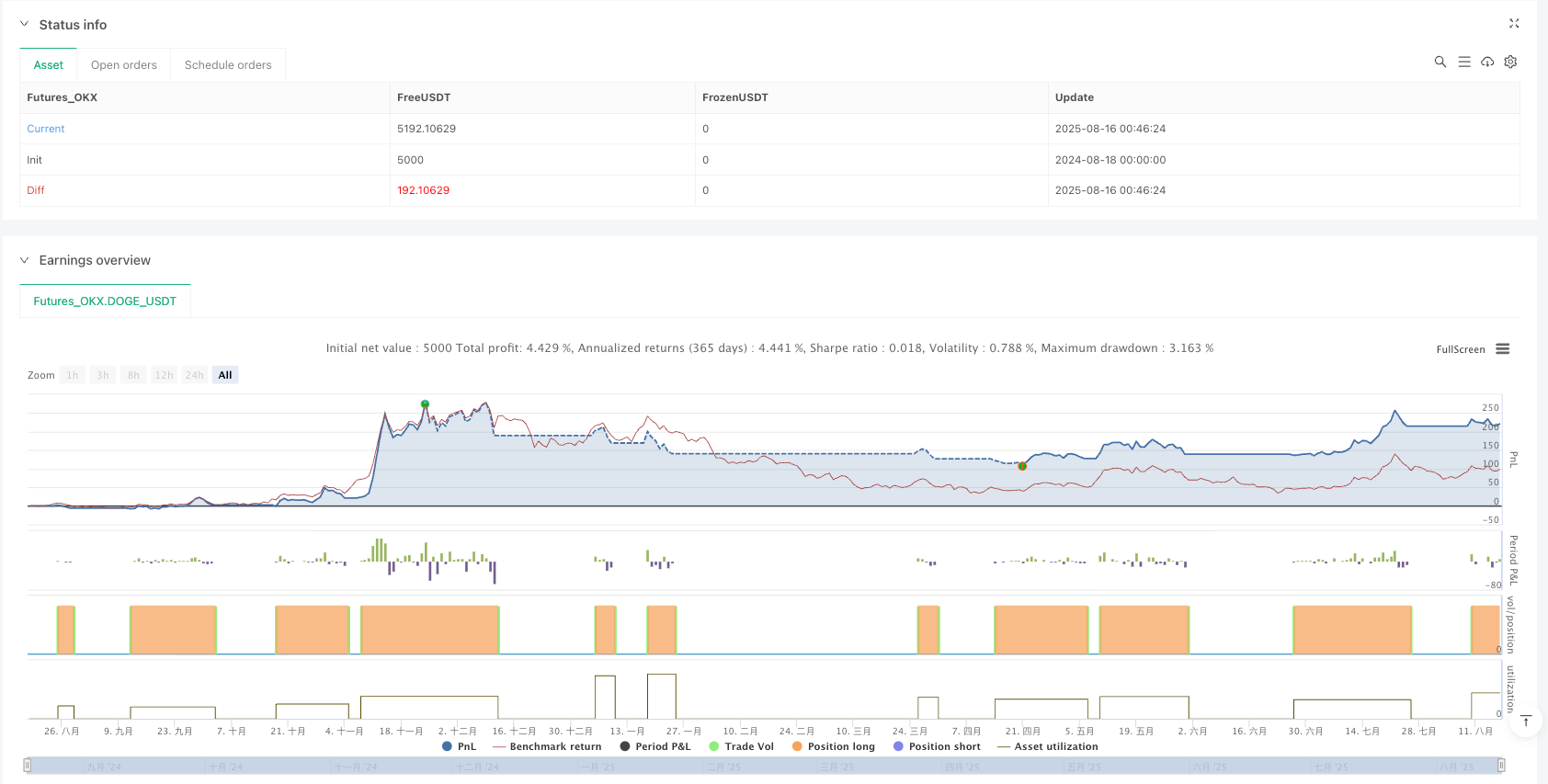

/*backtest

start: 2024-08-18 00:00:00

end: 2025-08-17 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_OKX","currency":"DOGE_USDT","balance":5000}]

*/

//@version=6

strategy(title="Mutanabby_AI | ATR+ | ") // Ensures realistic execution

// 📊 INPUT PARAMETERS

//=============================================================================

a = input.int(1, title="🔧 Key Value (Sensitivity)", minval=1, maxval=10,

tooltip="Lower = More signals, Higher = Fewer signals")

c = input.int(10, title="📈 ATR Period", minval=1, maxval=500,

tooltip="Period for ATR calculation")

// 🕯️ HEIKIN ASHI METHOD SELECTION

//=============================================================================

ha_method = input.string("Manual Calculation", title="🕯️ Heikin Ashi Method",

options=["Manual Calculation", "ticker.heikinashi()", "Regular Candles"],

tooltip="Manual = Most reliable, ticker.heikinashi = Good, Regular = Standard OHLC")

// 🛡️ STOP LOSS SETTINGS

//=============================================================================

use_stop_loss = input.bool(false, title="🛡️ Enable Stop Loss",

tooltip="Enable stop loss at entry price level")

stop_loss_type = input.string("Percentage", title="📊 Stop Loss Type",

options=["Percentage", "Fixed Points"],

tooltip="Choose stop loss calculation method")

stop_loss_percent = input.float(2.0, title="📉 Stop Loss %", minval=0.1, maxval=50.0, step=0.1,

tooltip="Stop loss percentage below entry price")

stop_loss_points = input.float(10.0, title="📉 Stop Loss Points", minval=0.1, step=0.1, tooltip="Stop loss in price points below entry price")

// Date condition

date_condition = true

// 🎨 VISUAL SETTINGS

//=============================================================================

show_signals = input.bool(true, title="🎯 Show Buy/Sell Signals")

show_trailing_stop = input.bool(true, title="📈 Show ATR Trailing Stop")

show_stop_loss = input.bool(true, title="🛡️ Show Stop Loss Line")

show_bar_colors = input.bool(true, title="🎨 Color Bars")

show_position_info = input.bool(true, title="📊 Show Position Info")

// 🧮 HEIKIN ASHI CALCULATIONS

//=============================================================================

// METHOD 1: MANUAL HEIKIN ASHI CALCULATION (MOST RELIABLE)

//=============================================================================

// Manual HA calculation - most transparent and reliable

var float ha_open_manual = na

ha_close_manual = (open + high + low + close) / 4

ha_open_manual := na(ha_open_manual[1]) ? (open + close) / 2 : (ha_open_manual[1] + ha_close_manual[1]) / 2

ha_high_manual = math.max(high, math.max(ha_open_manual, ha_close_manual))

ha_low_manual = math.min(low, math.min(ha_open_manual, ha_close_manual))

// METHOD 2: TICKER.HEIKINASHI() (GOOD ALTERNATIVE)

//=============================================================================

// Get Heikin Ashi data via ticker.heikinashi() - non-repainting

ha_ticker = ticker.heikinashi(syminfo.tickerid)

[ha_open_ticker, ha_high_ticker, ha_low_ticker, ha_close_ticker] = request.security(ha_ticker, timeframe.period, [open[1], high[1], low[1], close[1]], lookahead=barmerge.lookahead_on) // Use confirmed bars to prevent repainting

// METHOD 3: REGULAR CANDLES

//=============================================================================

// Regular OHLC data

ha_open_regular = open

ha_high_regular = high

ha_low_regular = low

ha_close_regular = close

// SELECT METHOD BASED ON USER INPUT

//=============================================================================

src = ha_method == "Manual Calculation" ? ha_close_manual :

ha_method == "ticker.heikinashi()" ? ha_close_ticker : ha_close_regular

source_open = ha_method == "Manual Calculation" ? ha_open_manual :

ha_method == "ticker.heikinashi()" ? ha_open_ticker : ha_open_regular

source_high = ha_method == "Manual Calculation" ? ha_high_manual :

ha_method == "ticker.heikinashi()" ? ha_high_ticker : ha_high_regular

source_low = ha_method == "Manual Calculation" ? ha_low_manual :

ha_method == "ticker.heikinashi()" ? ha_low_ticker : ha_low_regular

// 📊 ATR TRAILING STOP CALCULATION

//=============================================================================

// Calculate True Range using selected method

tr1 = source_high - source_low

tr2 = math.abs(source_high - src[1])

tr3 = math.abs(source_low - src[1])

tr = math.max(tr1, math.max(tr2, tr3))

// ATR calculation

xATR = ta.sma(tr, c)

nLoss = a * xATR

// ATR Trailing Stop logic

var float xATRTrailingStop = na

xATRTrailingStop := if src > nz(xATRTrailingStop[1], 0) and src[1] > nz(xATRTrailingStop[1], 0)

math.max(nz(xATRTrailingStop[1]), src - nLoss)

else if src < nz(xATRTrailingStop[1], 0) and src[1] < nz(xATRTrailingStop[1], 0)

math.min(nz(xATRTrailingStop[1]), src + nLoss)

else if src > nz(xATRTrailingStop[1], 0)

src - nLoss

else

src + nLoss

// Position state tracking

var int pos = na

pos := if src[1] < nz(xATRTrailingStop[1], 0) and src > nz(xATRTrailingStop[1], 0)

1

else if src[1] > nz(xATRTrailingStop[1], 0) and src < nz(xATRTrailingStop[1], 0)

-1

else

nz(pos[1], 0)

// 🎯 SIGNAL GENERATION

//=============================================================================

// EMA for crossover detection

ema_val = ta.ema(src, 1)

// Crossover conditions

above = ta.crossover(ema_val, xATRTrailingStop)

below = ta.crossover(xATRTrailingStop, ema_val)

// Buy and sell signals

buy_signal = src > xATRTrailingStop and above

sell_signal = src < xATRTrailingStop and below

// Trend direction

is_uptrend = src > xATRTrailingStop

is_downtrend = src < xATRTrailingStop

// 🛡️ STOP LOSS CALCULATION

//=============================================================================

var float entry_price = na

var float stop_loss_level = na

// Calculate stop loss level

calculate_stop_loss(entry_price_val) =>

if stop_loss_type == "Percentage"

entry_price_val * (1 - stop_loss_percent / 100)

else

entry_price_val - stop_loss_points

// 📈 LONG ONLY STRATEGY LOGIC

//=============================================================================

var bool in_long_position = false

// Entry condition: Buy signal when not in position

long_entry = buy_signal and date_condition and not in_long_position

// Exit conditions - CRITICAL: Use real prices for stop loss, not HA prices

atr_exit = sell_signal and date_condition and in_long_position

stop_loss_hit = use_stop_loss and in_long_position and low <= stop_loss_level // Uses real low price

// Combined exit condition

long_exit = atr_exit or stop_loss_hit

// Execute trades - Orders execute at REAL market prices

if long_entry

strategy.entry("LONG", strategy.long, comment="🚀 LONG")

in_long_position := true

entry_price := close // REAL entry price, not HA price

stop_loss_level := use_stop_loss ? calculate_stop_loss(entry_price) : na

if long_exit

exit_reason = stop_loss_hit ? "🛡️ STOP LOSS" : "💰 ATR EXIT"

strategy.close("LONG", comment=exit_reason)

in_long_position := false

entry_price := na

stop_loss_level := na

// 🎨 VISUAL ELEMENTS

//=============================================================================

// Trailing stop line color

stop_color = pos == 1 ? color.green : pos == -1 ? color.red : color.blue

// Plot ATR Trailing Stop

plot(show_trailing_stop ? xATRTrailingStop : na,

color=stop_color,

linewidth=2,

title="ATR Trailing Stop")

// Plot Stop Loss Level

plot(show_stop_loss and use_stop_loss and in_long_position ? stop_loss_level : na,

color=color.new(color.red, 0),

linewidth=2,

style=plot.style_linebr,

title="Stop Loss Level")

// Plot buy/sell signals

plotshape(show_signals and buy_signal,

title="Buy Signal",

text="BUY",

style=shape.labelup,

location=location.belowbar,

color=color.new(color.green, 0),

textcolor=color.white,

size=size.small)

plotshape(show_signals and sell_signal,

title="Sell Signal",

text="SELL",

style=shape.labeldown,

location=location.abovebar,

color=color.new(color.red, 0),

textcolor=color.white,

size=size.small)

// Plot stop loss hit signal

plotshape(show_signals and stop_loss_hit,

title="Stop Loss Hit",

text="SL",

style=shape.labeldown,

location=location.abovebar,

color=color.new(color.orange, 0),

textcolor=color.white,

size=size.small)

// Bar coloring

barcolor(show_bar_colors ? (is_uptrend ? color.new(color.green, 70) :

is_downtrend ? color.new(color.red, 70) : na) : na)

// Position status background

bgcolor(show_position_info and strategy.position_size > 0 ? color.new(color.green, 95) : show_position_info and strategy.position_size == 0 ? color.new(color.gray, 98) : na, title="Position Status")

// Entry price line - shows REAL entry price

plot(show_position_info and strategy.position_size > 0 ? strategy.position_avg_price : na,

color=color.new(color.blue, 0),

linewidth=1,

style=plot.style_linebr,

title="Entry Price")

// 📊 INFORMATION TABLE

//=============================================================================

if show_position_info and barstate.islast

var table info_table = table.new(position.top_right, 3, 11,

bgcolor=color.white,

border_width=1,

border_color=color.gray,

frame_width=1,

frame_color=color.black)

// Table headers

table.cell(info_table, 0, 0, "Mutanabby_AI | Manual HA | ATR | SL", text_color=color.white, bgcolor=color.blue, text_size=size.small)

table.cell(info_table, 1, 0, "", text_color=color.white, bgcolor=color.blue)

table.cell(info_table, 2, 0, "", text_color=color.white, bgcolor=color.blue)

// Strategy info

table.cell(info_table, 0, 1, "HA Method:", text_color=color.rgb(10, 10, 10), text_size=size.small)

method_color = ha_method == "Manual Calculation" ? color.green :

ha_method == "ticker.heikinashi()" ? color.blue : color.gray

table.cell(info_table, 1, 1, ha_method, text_color=method_color, text_size=size.small)

table.cell(info_table, 0, 2, "Key Value:", text_color=color.rgb(10, 10, 10), text_size=size.small)

table.cell(info_table, 1, 2, str.tostring(a), text_color=color.blue, text_size=size.small)

table.cell(info_table, 0, 3, "ATR Period:", text_color=color.rgb(2, 2, 2), text_size=size.small)

table.cell(info_table, 1, 3, str.tostring(c), text_color=color.blue, text_size=size.small)

table.cell(info_table, 0, 4, "Stop Loss:", text_color=color.rgb(3, 3, 3), text_size=size.small)

table.cell(info_table, 1, 4, use_stop_loss ? "ON" : "OFF",

text_color=use_stop_loss ? color.green : color.gray, text_size=size.small)

table.cell(info_table, 0, 5, "Position:", text_color=color.rgb(3, 3, 3), text_size=size.small)

table.cell(info_table, 1, 5, strategy.position_size > 0 ? "LONG" : "NONE",

text_color=strategy.position_size > 0 ? color.green : color.gray, text_size=size.small)

table.cell(info_table, 0, 6, "Trend:", text_color=color.rgb(0, 0, 0), text_size=size.small)

table.cell(info_table, 1, 6, is_uptrend ? "UP" : "DOWN",

text_color=is_uptrend ? color.green : color.red, text_size=size.small)

table.cell(info_table, 0, 7, "Current Price:", text_color=color.black, text_size=size.small)

table.cell(info_table, 1, 7, str.tostring(close, "#.##"), text_color=color.black, text_size=size.small)

table.cell(info_table, 0, 8, "Trailing Stop:", text_color=color.black, text_size=size.small)

table.cell(info_table, 1, 8, str.tostring(xATRTrailingStop, "#.##"), text_color=color.blue, text_size=size.small)

// Show stop loss level if enabled and in position

if use_stop_loss and in_long_position

table.cell(info_table, 0, 9, "Stop Loss:", text_color=color.black, text_size=size.small)

table.cell(info_table, 1, 9, str.tostring(stop_loss_level, "#.##"), text_color=color.red, text_size=size.small)

else

table.cell(info_table, 0, 9, "Stop Loss:", text_color=color.black, text_size=size.small)

table.cell(info_table, 1, 9, "N/A", text_color=color.gray, text_size=size.small)

table.cell(info_table, 0, 10, "Last Signal:", text_color=color.black, text_size=size.small)

signal_text = buy_signal ? "BUY" : sell_signal ? "SELL" : stop_loss_hit ? "STOP LOSS" : "NONE"

signal_color = buy_signal ? color.green : sell_signal ? color.red : stop_loss_hit ? color.orange : color.gray

table.cell(info_table, 1, 10, signal_text, text_color=signal_color, text_size=size.small)

// 🚨 ALERTS

//=============================================================================

// Alert conditions

alertcondition(buy_signal, title="🚀 Mutanabby_AI | ATR+ LONG Entry",

message="Mutanabby_AI | ATR+ : BUY signal at {{close}}")

alertcondition(sell_signal, title="💰 Mutanabby_AI | ATR+ LONG Exit",

message="Mutanabby_AI | ATR+ : SELL signal at {{close}}")

alertcondition(stop_loss_hit, title="🛡️ Mutanabby_AI | ATR+ Stop Loss Hit",

message="Mutanabby_AI | ATR+ : STOP LOSS hit at {{close}}")

alertcondition(buy_signal or sell_signal or stop_loss_hit, title="🔔 Mutanabby_AI | ATR+ Any Signal",

message="Mutanabby_AI| ATR+ : {{ticker}} - {{close}} - Signal: {{strategy.position_size > 0 ? 'EXIT' : 'ENTRY'}}")

//=============================================================================

// 📝 STRATEGY NOTES:

//

// 🎯 OPTIMAL IMPLEMENTATION for realistic backtesting:

// 📈 Uses manual HA calculation for transparency and reliability

// 💰 Orders execute at REAL market prices (not synthetic HA prices)

// 🛡️ Stop loss uses real market prices for accurate risk management

// 🔧 Multiple HA methods available for comparison and validation

// ⚡ Added fill_orders_on_standard_ohlc=true for extra protection

//

// 🎯 METHOD COMPARISON:

// 🥇 Manual Calculation: Most reliable, transparent, no external dependencies

// 🥈 ticker.heikinashi(): Good alternative, uses confirmed bars to prevent repainting

// 🥉 Regular Candles: Standard OHLC for comparison purposes

//

// 💡 BEST PRACTICES IMPLEMENTED:

// ✅ Always run on regular candlestick charts (not native HA charts)

// ✅ Use confirmed/historical HA values to prevent repainting

// ✅ Execute all orders at real market prices

// ✅ Stop loss based on real prices, not synthetic HA prices

// ✅ Entry price tracking uses actual fill prices

// ✅ Transparent calculation methods for verification

//

// 🚨 AVOID:

// ❌ Running strategies directly on TradingView's native HA charts

// ❌ Using current bar HA values (causes repainting)

// ❌ Stop loss based on HA prices instead of real prices

//=============================================================================