这不是普通的摆动策略,而是带AI评分的精准狙击系统

传统摆动策略问题在哪?信号太多,质量参差不齐,假突破频繁。这个策略直接解决痛点:每个信号都有1-5分的质量评分,只交易4分以上的高质量信号。

核心逻辑简单粗暴:识别Higher Low(更高低点)和Lower High(更低高点),然后用4个维度给信号打分。最低4分才开仓,直接过滤掉80%的垃圾信号。

5维度评分系统比单一指标强在哪里?

基础分1分:确认摆动形态存在 成交量确认+1分:成交量超过20周期均值1.2倍,说明有资金认同 RSI位置+1分:RSI在30-70区间,避开超买超卖的假信号 K线实体+1分:实体占比超过60%,确保不是十字星等犹豫形态 趋势对齐+1分:价格、MA20、MA50三者方向一致

结果:5分满分信号胜率最高,4分以上信号可交易,3分以下直接忽略。

止损设计:10周期极值,不是随意设置的ATR

止损逻辑非常明确: - 做多止损=过去10根K线最低点 - 做空止损=过去10根K线最高点

为什么是10周期?因为摆动策略本质是抓短期反转,10周期既能给价格足够呼吸空间,又不会让止损距离过大。比固定ATR倍数更贴合市场结构。

失败信号也是交易机会

策略还识别”失败的摆动”: - Higher Low失败:形成更高低点后又跌破 - Lower High失败:形成更低高点后又突破

这些失败往往预示着趋势加速,是反向交易的绝佳时机。

连续信号=趋势确认

当连续两根K线都出现同方向的确认信号时,用钻石标记显示。这通常意味着: - 连续看多:上升趋势确立 - 连续看空:下降趋势确立

连续信号的胜率通常比单独信号高15-20%。

适用场景:震荡偏多/偏空市场

最佳表现环境: - 有明确趋势但经常回调的市场 - 波动率适中(不是极端平静或极端暴躁) - 成交量相对稳定的品种

避免使用场景: - 单边暴涨暴跌(摆动信号会频繁被突破) - 极低波动率的横盘(信号稀少且质量差) - 成交量极不稳定的小众品种

风险提示:历史回测不等于未来收益

明确风险: 1. 策略存在连续亏损可能,特别是趋势转换期 2. 4分以上信号虽然质量高,但仍有30-40%失败率 3. 止损设计相对宽松,单次亏损可能较大 4. 不同市场环境下表现差异明显

资金管理建议:单次风险不超过账户2%,连续亏损3次后暂停交易重新评估市场环境。

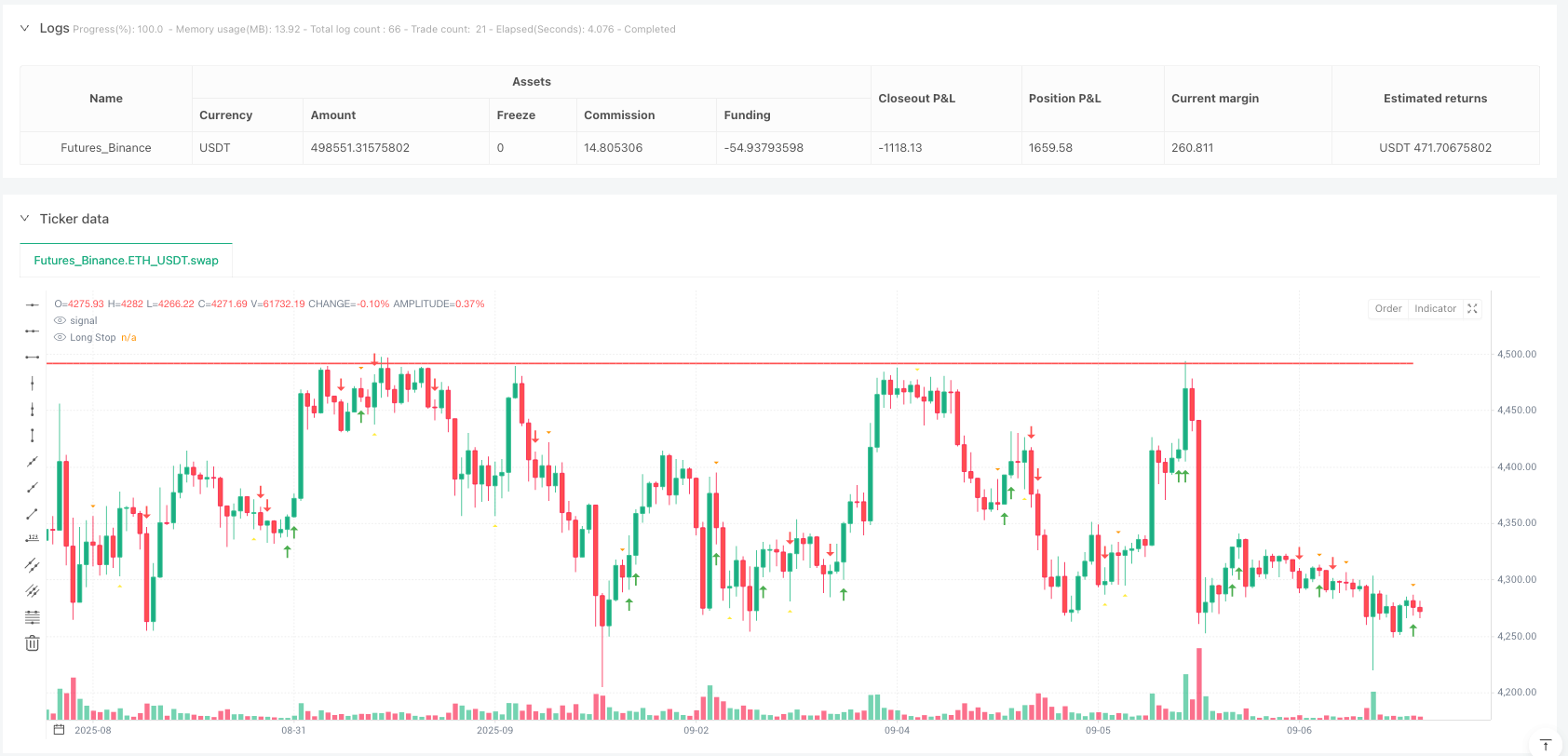

/*backtest

start: 2024-09-09 00:00:00

end: 2025-09-07 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=6

strategy("Higher Lows, Lower Highs & Failures with Signal Quality Scoring", overlay=true)

// --- Higher Low detection ---

shares = 1

minScore = 4 // Minimum score to take trades

lowPoint = ta.lowest(low, 3)

prevLowPoint = ta.lowest(low[3], 3)

isHigherLow = low == lowPoint and low > prevLowPoint

bullConfirm = isHigherLow and close > open

// --- Lower High detection ---

highPoint = ta.highest(high, 3)

prevHighPoint = ta.highest(high[3], 3)

isLowerHigh = high == highPoint and high < prevHighPoint

bearConfirm = isLowerHigh and close < open

// --- Failures ---

failHigherLow = isHigherLow[1] and low < low[1]

failLowerHigh = isLowerHigh[1] and high > high[1]

// --- 2-in-a-row detection ---

bullSecond = bullConfirm and bullConfirm[1]

bearSecond = bearConfirm and bearConfirm[1]

// --- SIGNAL QUALITY SCORING (1-5 scale) ---

bullScore = if bullConfirm

score = 1 // Base score

// Factor 1: Volume confirmation

avgVolume = ta.sma(volume, 20)

if volume > avgVolume * 1.2

score := score + 1

// Factor 2: RSI positioning

rsi = ta.rsi(close, 14)

if rsi < 70 and rsi > 30

score := score + 1

// Factor 3: Candle strength

bodySize = math.abs(close - open)

candleRange = high - low

bodyRatio = candleRange > 0 ? bodySize / candleRange : 0

if bodyRatio > 0.6

score := score + 1

// Factor 4: Trend alignment

ma20 = ta.sma(close, 20)

ma50 = ta.sma(close, 50)

if ma20 > ma50 and close > ma20

score := score + 1

math.max(1, math.min(5, score))

else

na

bearScore = if bearConfirm

score = 1 // Base score

// Factor 1: Volume confirmation

avgVolume = ta.sma(volume, 20)

if volume > avgVolume * 1.2

score := score + 1

// Factor 2: RSI positioning

rsi = ta.rsi(close, 14)

if rsi > 30 and rsi < 70

score := score + 1

// Factor 3: Candle strength

bodySize = math.abs(close - open)

candleRange = high - low

bodyRatio = candleRange > 0 ? bodySize / candleRange : 0

if bodyRatio > 0.6

score := score + 1

// Factor 4: Trend alignment

ma20 = ta.sma(close, 20)

ma50 = ta.sma(close, 50)

if ma20 < ma50 and close < ma20

score := score + 1

math.max(1, math.min(5, score))

else

na

// --- Plot main signals with score-based styling ---

// Bullish signals

plotshape(bullConfirm and bullScore == 1, "Bull Score 1", shape.triangleup, location.belowbar, color.gray, size=size.tiny)

plotshape(bullConfirm and bullScore == 2, "Bull Score 2", shape.triangleup, location.belowbar, color.orange, size=size.small)

plotshape(bullConfirm and bullScore == 3, "Bull Score 3", shape.triangleup, location.belowbar, color.yellow, size=size.normal)

plotshape(bullConfirm and bullScore == 4, "Bull Score 4", shape.triangleup, location.belowbar, color.lime, size=size.normal)

plotshape(bullConfirm and bullScore == 5, "Bull Score 5", shape.triangleup, location.belowbar, color.green, size=size.large)

// Bearish signals

plotshape(bearConfirm and bearScore == 1, "Bear Score 1", shape.triangledown, location.abovebar, color.gray, size=size.tiny)

plotshape(bearConfirm and bearScore == 2, "Bear Score 2", shape.triangledown, location.abovebar, color.orange, size=size.small)

plotshape(bearConfirm and bearScore == 3, "Bear Score 3", shape.triangledown, location.abovebar, color.yellow, size=size.normal)

plotshape(bearConfirm and bearScore == 4, "Bear Score 4", shape.triangledown, location.abovebar, color.lime, size=size.normal)

plotshape(bearConfirm and bearScore == 5, "Bear Score 5", shape.triangledown, location.abovebar, color.green, size=size.large)

// --- Plot failures ---

plotshape(failHigherLow, "Failed Higher Low", shape.arrowdown, location.abovebar, color.red, size=size.small)

plotshape(failLowerHigh, "Failed Lower High", shape.arrowup, location.belowbar, color.green, size=size.small)

// --- Plot consecutive signals ---

plotshape(bullSecond, "Double Bullish Star", shape.diamond, location.bottom, color.lime, size=size.tiny)

plotshape(bearSecond, "Double Bearish Star", shape.diamond, location.top, color.red, size=size.tiny)

// --- Display score labels ---

if bullConfirm

labelColor = bullScore == 1 ? color.gray : bullScore == 2 ? color.orange : bullScore == 3 ? color.yellow : bullScore == 4 ? color.lime : color.green

label.new(bar_index, low - (high - low) * 0.1, "↑ " + str.tostring(bullScore), style=label.style_label_up, color=labelColor, textcolor=color.white, size=size.small)

if bearConfirm

labelColor = bearScore == 1 ? color.gray : bearScore == 2 ? color.orange : bearScore == 3 ? color.yellow : bearScore == 4 ? color.lime : color.green

label.new(bar_index, high + (high - low) * 0.1, "↓ " + str.tostring(bearScore), style=label.style_label_down, color=labelColor, textcolor=color.white, size=size.small)

// --- Alerts for high-quality signals only ---

alertcondition(bullConfirm and bullScore >= 4, "High Quality Bullish", "Strong Bullish Signal Detected")

alertcondition(bearConfirm and bearScore >= 4, "High Quality Bearish", "Strong Bearish Signal Detected")

// --- STRATEGY LOGIC ---

// Track previous highs and lows for stop levels

var float prevHigh = na

var float prevLow = na

// Update previous high/low when we get signals

if bullConfirm and bullScore >= minScore

prevLow := ta.lowest(low, 10) // Previous 10-bar low for stop

if bearConfirm and bearScore >= minScore

prevHigh := ta.highest(high, 10) // Previous 10-bar high for stop

// Entry conditions (only scores 4 or higher)

longCondition = bullConfirm and bullScore >= minScore

shortCondition = bearConfirm and bearScore >= minScore

// Execute trades

if longCondition and strategy.position_size == 0

strategy.entry("Long", strategy.long, qty=shares)

strategy.exit("Long Exit", "Long", stop=prevLow)

if shortCondition and strategy.position_size == 0

strategy.entry("Short", strategy.short, qty=shares)

strategy.exit("Short Exit", "Short", stop=prevHigh)

// Close opposite position if new signal occurs

if longCondition and strategy.position_size < 0

strategy.close("Short")

strategy.entry("Long", strategy.long, qty=shares)

strategy.exit("Long Exit", "Long", stop=prevLow)

if shortCondition and strategy.position_size > 0

strategy.close("Long")

strategy.entry("Short", strategy.short, qty=shares)

strategy.exit("Short Exit", "Short", stop=prevHigh)

// Plot stop levels for visualization

plot(strategy.position_size > 0 ? prevLow : na, "Long Stop", color.red, linewidth=2, style=plot.style_linebr)

plot(strategy.position_size < 0 ? prevHigh : na, "Short Stop", color.red, linewidth=2, style=plot.style_linebr)