概述

该策略基于蜡烛图形态分析市场情绪,通过三个核心振荡器(犹豫振荡器、恐惧振荡器和贪婪振荡器)来量化市场心理。策略综合了动量和趋势指标,同时结合成交量确认,构建了一个完整的交易系统。该策略适用于希望通过市场情绪分析来识别高概率交易机会的交易者。

策略原理

策略的核心是通过分析不同的蜡烛图形态来构建三个情绪振荡器: 1. 犹豫振荡器 - 通过十字星和陀螺形态来衡量市场的不确定性 2. 恐惧振荡器 - 通过流星、上吊线和看跌吞没形态来跟踪空头情绪 3. 贪婪振荡器 - 通过光头阳线、锤子线、看涨吞没和三白兵来检测多头情绪

这三个振荡器的平均值构成了蜡烛情绪指数(CEI)。当CEI突破不同阈值时触发多空交易信号,并通过成交量确认。

策略优势

- 系统化的情绪分析 - 通过量化蜡烛图形态将主观分析转化为客观指标

- 风险管理完善 - 包含最大持仓期限、止盈止损和冷却期等机制

- 灵活的恢复机制 - 当交易出现亏损时,策略会尝试通过突破平衡点来恢复

- 多市场适用性 - 可应用于股票、外汇和加密货币等多个市场

- 信号可靠性高 - 通过成交量确认和多重技术指标验证来提高准确率

策略风险

- 参数敏感性 - 各类阈值的设置需要充分测试和优化

- 市场环境依赖 - 在震荡市场中可能产生错误信号

- 滑点风险 - 在流动性较差的市场可能面临执行风险

- 过度交易风险 - 需要合理设置冷却期来避免频繁交易

- 系统性风险 - 在重大市场事件中可能遭受较大损失

策略优化方向

- 动态阈值 - 根据市场波动率自动调整各类阈值

- 市场状态分类 - 增加趋势和震荡市场的识别机制

- 机器学习优化 - 使用机器学习算法优化参数组合

- 风险管理增强 - 加入资金管理和仓位控制模块

- 信号过滤 - 整合更多技术指标来过滤虚假信号

总结

这是一个将技术分析与量化交易相结合的创新策略。通过系统化的情绪分析和严格的风险管理,该策略能够为交易者提供可靠的交易信号。虽然存在一定的优化空间,但策略的基本框架是稳健的,适合进一步开发和实盘应用。

策略源码

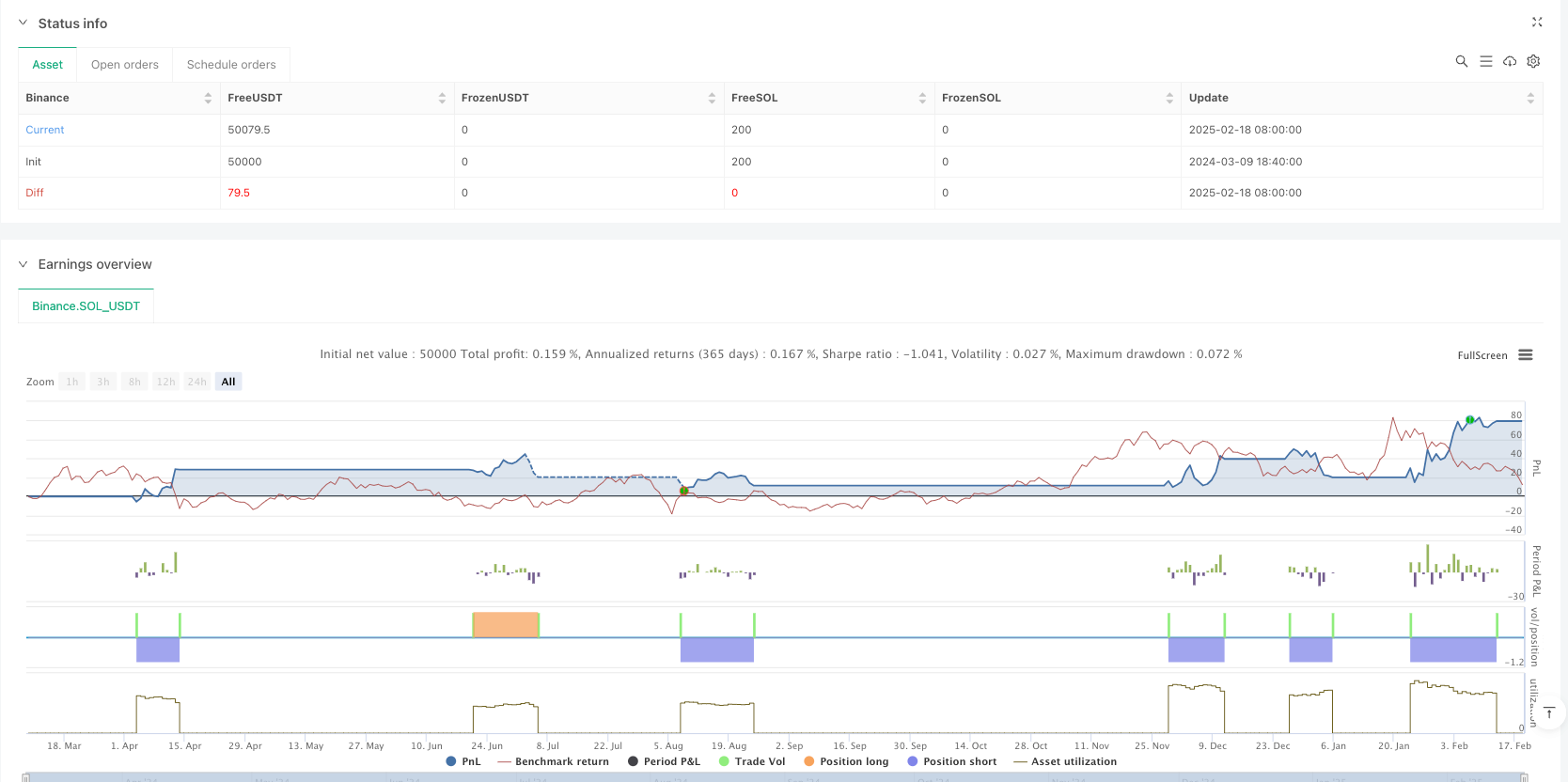

/*backtest

start: 2024-03-09 18:40:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=6

strategy("Candle Emotion Index Strategy", shorttitle="CEI Strategy", overlay=true)

// User Inputs

length = input.int(14, title="Lookback Period", minval=1)

dojiThreshold = input.float(0.1, title="Doji Threshold", minval=0.01, maxval=0.5)

spinningTopThreshold = input.float(0.3, title="Spinning Top Threshold", minval=0.1, maxval=0.5)

shootingStarThreshold = input.float(0.5, title="Shooting Star Threshold", minval=0.1, maxval=1.0)

hangingManThreshold = input.float(0.5, title="Hanging Man Threshold", minval=0.1, maxval=1.0)

engulfingThreshold = input.float(0.5, title="Engulfing Threshold", minval=0.1, maxval=1.0)

marubozuThreshold = input.float(0.9, title="Marubozu Threshold", minval=0.5, maxval=1.0)

hammerThreshold = input.float(0.5, title="Hammer Threshold", minval=0.1, maxval=1.0)

threeWhiteSoldiersThreshold = input.float(0.5, title="Three White Soldiers Threshold", minval=0.1, maxval=1.0)

// Volume Multiplier Input

volumeMultiplier = input.float(1.5, title="Volume Multiplier", minval=1.0)

// Cooldown Period Input

cooldownPeriod = input.int(10, title="Cooldown Period (Candles)", minval=1)

// Maximum Holding Period Inputs

maxHoldingPeriod = input.int(20, title="Maximum Holding Period (Candles)", minval=1)

lossHoldingPeriod = input.int(10, title="Loss Exit Holding Period (Candles)", minval=1)

lossThreshold = input.float(0.02, title="Loss Threshold (as % of Entry Price)", minval=0.01, maxval=1.0)

// --- Indecision Oscillator Functions ---

isDoji(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

rangeSize = high - low

bodySize / rangeSize < threshold

isSpinningTop(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

rangeSize = high - low

bodySize / rangeSize < threshold and bodySize / rangeSize >= dojiThreshold

indecisionOscillator() =>

var float dojiScore = 0.0

var float spinningTopScore = 0.0

for i = 1 to length

if isDoji(open[i], close[i], high[i], low[i], dojiThreshold)

dojiScore := dojiScore + 1.0

if isSpinningTop(open[i], close[i], high[i], low[i], spinningTopThreshold)

spinningTopScore := spinningTopScore + 1.0

dojiScore := dojiScore / length

spinningTopScore := spinningTopScore / length

(dojiScore + spinningTopScore) / 2

// --- Fear Oscillator Functions ---

isShootingStar(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

upperWick = high - math.max(open, close)

lowerWick = math.min(open, close) - low

upperWick / bodySize > threshold and lowerWick < bodySize

isHangingMan(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

upperWick = high - math.max(open, close)

lowerWick = math.min(open, close) - low

lowerWick / bodySize > threshold and upperWick < bodySize

isBearishEngulfing(open, close, openPrev, closePrev, threshold) =>

bodySize = math.abs(close - open)

prevBodySize = math.abs(closePrev - openPrev)

close < openPrev and open > closePrev and bodySize / prevBodySize > threshold

fearOscillator() =>

var float shootingStarScore = 0.0

var float hangingManScore = 0.0

var float engulfingScore = 0.0

for i = 1 to length

if isShootingStar(open[i], close[i], high[i], low[i], shootingStarThreshold)

shootingStarScore := shootingStarScore + 1.0

if isHangingMan(open[i], close[i], high[i], low[i], hangingManThreshold)

hangingManScore := hangingManScore + 1.0

if isBearishEngulfing(open[i], close[i], open[i+1], close[i+1], engulfingThreshold)

engulfingScore := engulfingScore + 1.0

shootingStarScore := shootingStarScore / length

hangingManScore := hangingManScore / length

engulfingScore := engulfingScore / length

(shootingStarScore + hangingManScore + engulfingScore) / 3

// --- Greed Oscillator Functions ---

isMarubozu(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

totalRange = high - low

bodySize / totalRange > threshold

isHammer(open, close, high, low, threshold) =>

bodySize = math.abs(close - open)

lowerWick = math.min(open, close) - low

upperWick = high - math.max(open, close)

lowerWick / bodySize > threshold and upperWick < bodySize

isBullishEngulfing(open, close, openPrev, closePrev, threshold) =>

bodySize = math.abs(close - open)

prevBodySize = math.abs(closePrev - openPrev)

close > openPrev and open < closePrev and bodySize / prevBodySize > threshold

isThreeWhiteSoldiers(open, close, openPrev, closePrev, openPrev2, closePrev2, threshold) =>

close > open and closePrev > openPrev and closePrev2 > openPrev2 and close > closePrev and closePrev > closePrev2

greedOscillator() =>

var float marubozuScore = 0.0

var float hammerScore = 0.0

var float engulfingScore = 0.0

var float soldiersScore = 0.0

for i = 1 to length

if isMarubozu(open[i], close[i], high[i], low[i], marubozuThreshold)

marubozuScore := marubozuScore + 1.0

if isHammer(open[i], close[i], high[i], low[i], hammerThreshold)

hammerScore := hammerScore + 1.0

if isBullishEngulfing(open[i], close[i], open[i+1], close[i+1], engulfingThreshold)

engulfingScore := engulfingScore + 1.0

if isThreeWhiteSoldiers(open[i], close[i], open[i+1], close[i+1], open[i+2], close[i+2], threeWhiteSoldiersThreshold)

soldiersScore := soldiersScore + 1.0

marubozuScore := marubozuScore / length

hammerScore := hammerScore / length

engulfingScore := engulfingScore / length

soldiersScore := soldiersScore / length

(marubozuScore + hammerScore + engulfingScore + soldiersScore) / 4

// --- Final Calculations ---

indecision = indecisionOscillator()

fear = fearOscillator()

greed = greedOscillator()

// Calculate the average of the three oscillators

averageOscillator = (indecision + fear + greed) / 3

// --- Combined Strategy Logic ---

var float entryPriceLong = na

var float entryPriceShort = na

var int holdingPeriodLong = 0

var int holdingPeriodShort = 0

var int cooldownCounter = 0

// Buy Signal Logic for Long and Short

longBuySignal = ta.crossover(averageOscillator, 0.1)

shortBuySignal = ta.crossover(averageOscillator, 0.2)

// Calculate average volume over the lookback period

avgVolume = ta.sma(volume, length)

// Take Profit Conditions

longTakeProfitCondition = close > open and volume > avgVolume * volumeMultiplier

shortTakeProfitCondition = close < open and volume > avgVolume * volumeMultiplier

// Buy Logic for Long Positions

if longBuySignal and strategy.position_size == 0 and cooldownCounter <= 0

entryPriceLong := close

strategy.entry("Long Entry", strategy.long)

cooldownCounter := cooldownPeriod

holdingPeriodLong := 0

// Increment holding period if in a long position

if strategy.position_size > 0

holdingPeriodLong := holdingPeriodLong + 1

// Sell Logic for Long Positions

if longTakeProfitCondition and strategy.position_size > 0 and close > entryPriceLong

strategy.close_all()

cooldownCounter := cooldownPeriod

if holdingPeriodLong >= maxHoldingPeriod and strategy.position_size > 0 and close >= entryPriceLong

strategy.close_all()

cooldownCounter := cooldownPeriod

if holdingPeriodLong >= lossHoldingPeriod and strategy.position_size > 0 and close < entryPriceLong * (1 - lossThreshold)

strategy.close_all()

cooldownCounter := cooldownPeriod

// Short Logic for Short Positions

if shortBuySignal and strategy.position_size == 0 and cooldownCounter <= 0

entryPriceShort := close

strategy.entry("Short Entry", strategy.short)

cooldownCounter := cooldownPeriod

holdingPeriodShort := 0

// Increment holding period if in a short position

if strategy.position_size < 0

holdingPeriodShort := holdingPeriodShort + 1

// Cover Logic for Short Positions

if shortTakeProfitCondition and strategy.position_size < 0 and close < entryPriceShort

strategy.close_all()

cooldownCounter := cooldownPeriod

if holdingPeriodShort >= maxHoldingPeriod and strategy.position_size < 0 and close <= entryPriceShort

strategy.close_all()

cooldownCounter := cooldownPeriod

if holdingPeriodShort >= lossHoldingPeriod and strategy.position_size < 0 and close > entryPriceShort * (1 + lossThreshold)

strategy.close_all()

cooldownCounter := cooldownPeriod

// Decrement the cooldown counter each candle

if cooldownCounter > 0

cooldownCounter := cooldownCounter - 1

相关推荐