币圈量化交易萌新看过来--带你走近币圈量化(八)

创建于: 2021-06-18 18:24:23,

更新于:

2024-12-04 21:16:56

6

6

4176

4176

币圈量化交易萌新看过来–带你走近币圈量化(八)

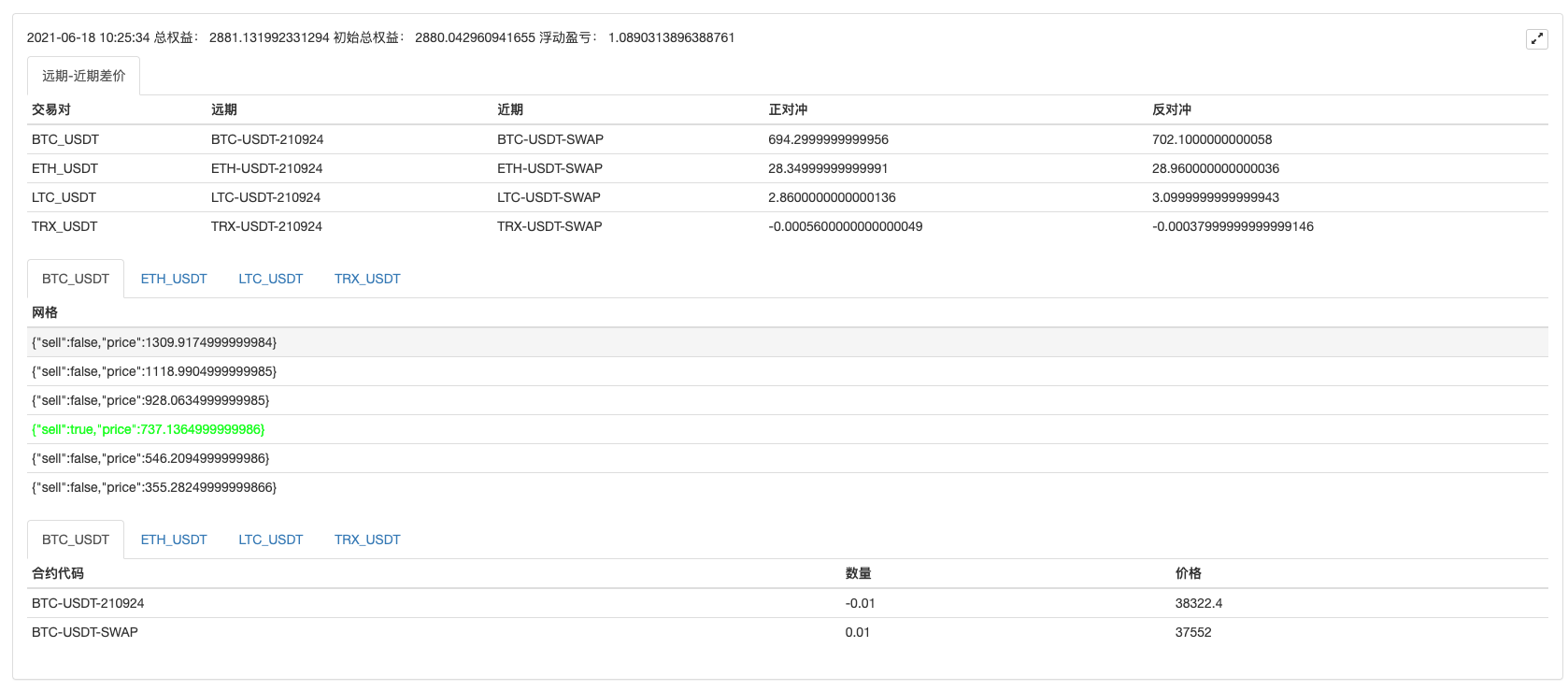

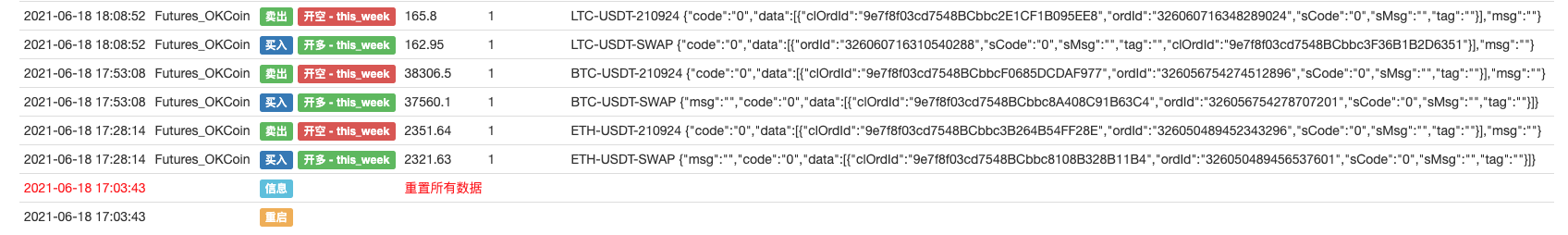

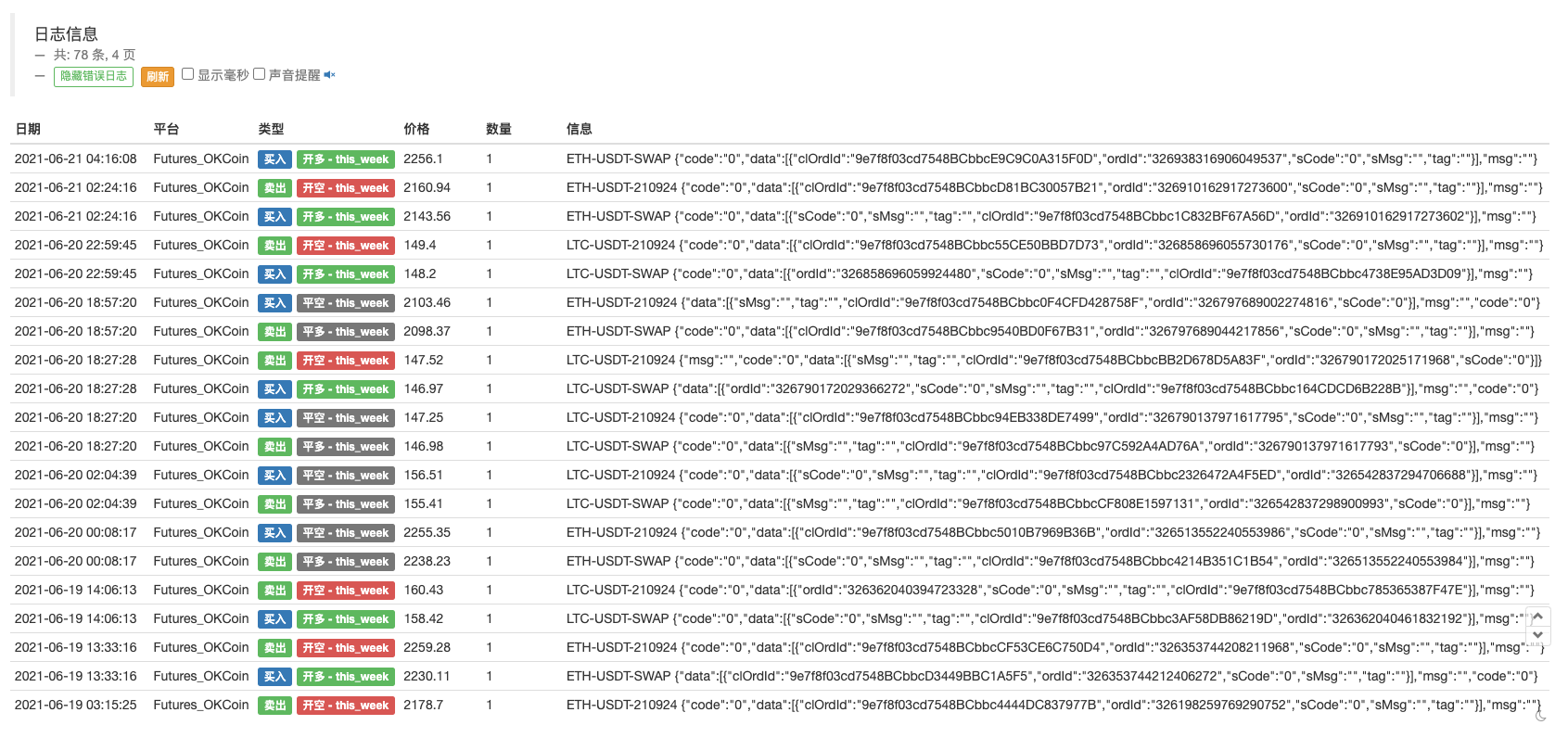

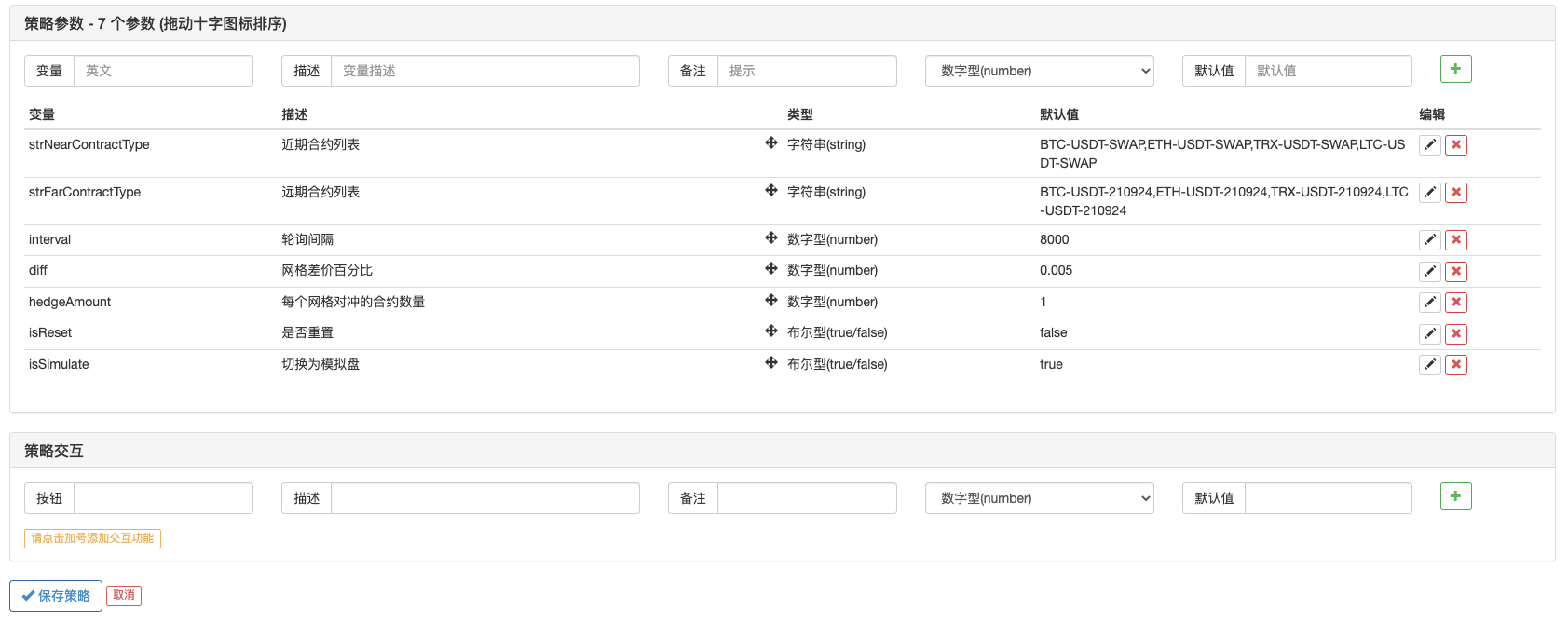

上一篇文章,我们一起设计了一个多品种的合约差价监控策略,本篇文章我们继续完善这个思路。来看一下这个思路是否可行,并且用OKEX V5的模拟盘跑一跑,验证一下策略设计。这些过程也是做数字货币程序化交易、量化交易过程中需要经历的,希望萌新们能积累下宝贵的经验。

先剧透一下,策略跑起来了,有些小激动!

策略整体设计按照最简思路去实现,虽然对于细节处理没有过于苛求,但是还是可以从代码中学习到一些小技巧。策略代码整体不到400行,阅读理解起来不会很枯燥。当然这个只是一个测试DEMO,需要跑一段时间测试看看。所以我要说的是:目前策略仅仅是成功的开仓,还有平仓等等各种情况要实际测试检验,程序设计中BUG不可避免,所以测试,DEBUG(排错)很重要!

回到策略设计来说,在上篇文章的代码基础上,给策略加上了:

- 数据持久化设计(使用_G函数保存数据,在重启后可以恢复数据)

- 给每个监控的合约差价对增加了网格数据结构(用来控制对冲开平仓)

- 实现了一个简单的对冲函数用来对冲开平仓

- 增加了一个总权益获取函数用来计算浮动盈亏

- 增加了一些状态栏数据输出显示。

以上就是增加的功能,为了简化设计,策略只设计了做正对冲(空远期合约,多近期合约)。目前永续合约(近期)为负费率,正好做多永续合约,看能不能在增加点费率收益。

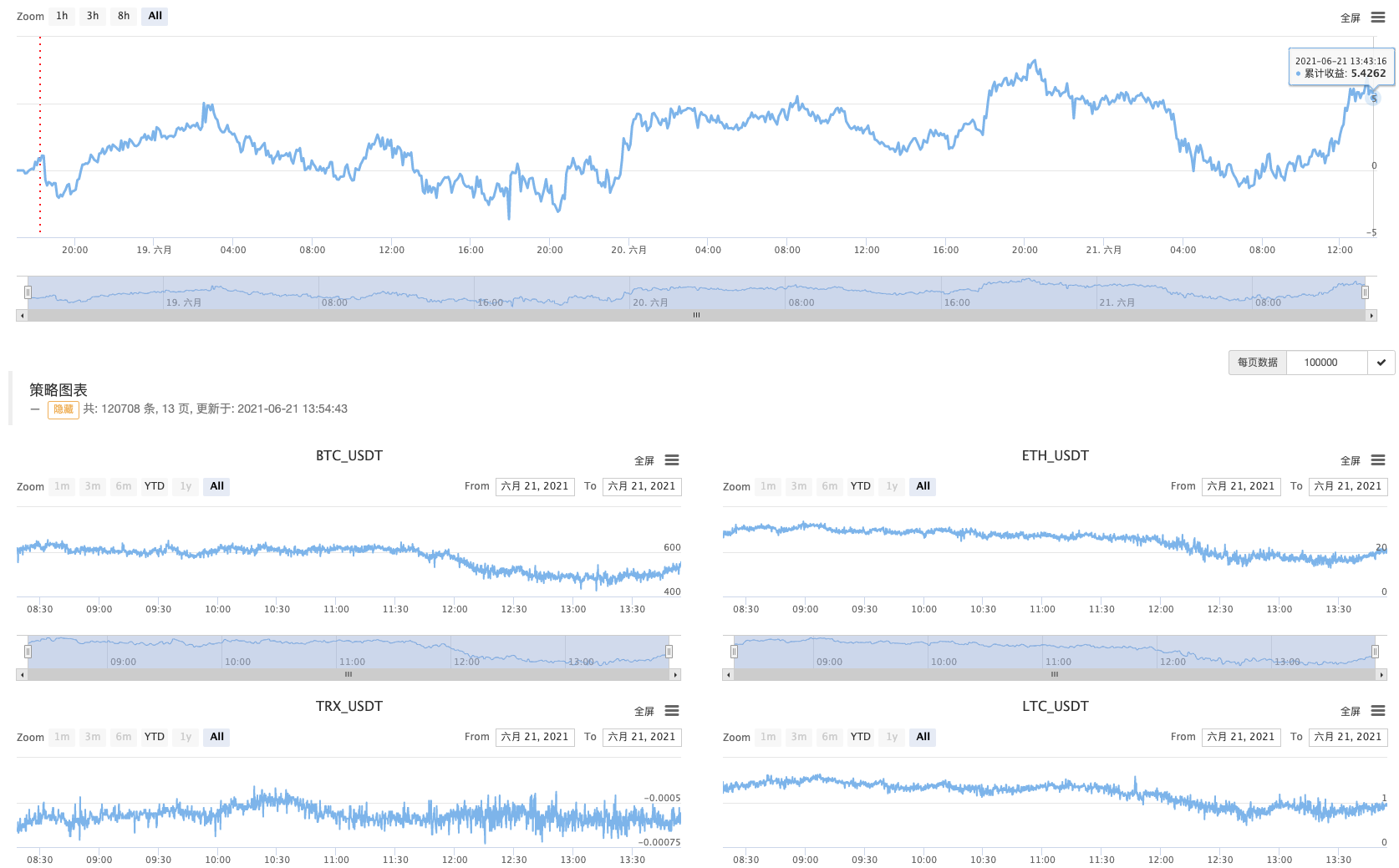

让策略跑一会儿~

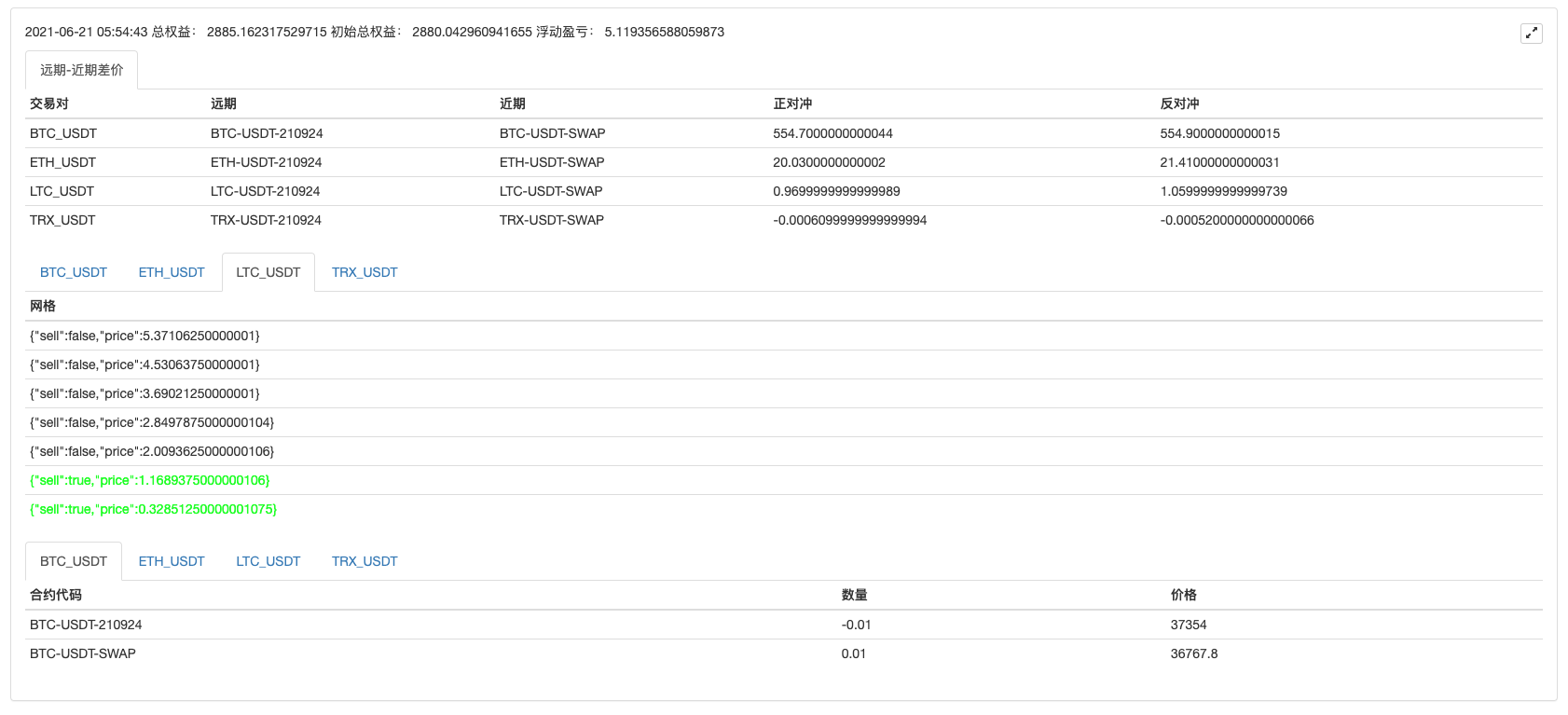

测试了大概3天时间,差价波动其实还是可以的。

可以看到有部分资金费率的收益。

下面分享一下策略源码:

var arrNearContractType = strNearContractType.split(",")

var arrFarContractType = strFarContractType.split(",")

var nets = null

var initTotalEquity = null

var OPEN_PLUS = 1

var COVER_PLUS = 2

function createNet(begin, diff, initAvgPrice, diffUsagePercentage) {

if (diffUsagePercentage) {

diff = diff * initAvgPrice

}

var oneSideNums = 3

var up = []

var down = []

for (var i = 0 ; i < oneSideNums ; i++) {

var upObj = {

sell : false,

price : begin + diff / 2 + i * diff

}

up.push(upObj)

var j = (oneSideNums - 1) - i

var downObj = {

sell : false,

price : begin - diff / 2 - j * diff

}

if (downObj.price <= 0) { // 价格不能小于等于0

continue

}

down.push(downObj)

}

return down.concat(up)

}

function createCfg(symbol) {

var cfg = {

extension: {

layout: 'single',

height: 300,

col: 6

},

title: {

text: symbol

},

xAxis: {

type: 'datetime'

},

series: [{

name: 'plus',

data: []

}]

}

return cfg

}

function formatSymbol(originalSymbol) {

var arr = originalSymbol.split("-")

return [arr[0] + "_" + arr[1], arr[0], arr[1]]

}

function main() {

if (isSimulate) {

exchange.IO("simulate", true) // 切换为模拟环境

Log("仅支持OKEX V5 API,切换为OKEX V5 模拟盘:")

} else {

exchange.IO("simulate", false) // 切换为实盘

Log("仅支持OKEX V5 API,切换为OKEX V5 实盘:")

}

if (exchange.GetName() != "Futures_OKCoin") {

throw "支持OKEX期货"

}

// 初始化

if (isReset) {

_G(null)

LogReset(1)

LogProfitReset()

LogVacuum()

Log("重置所有数据", "#FF0000")

}

// 初始化标记

var isFirst = true

// 收益打印周期

var preProfitPrintTS = 0

// 总权益

var totalEquity = 0

var posTbls = [] // 持仓表格数组

// 声明arrCfg

var arrCfg = []

_.each(arrNearContractType, function(ct) {

arrCfg.push(createCfg(formatSymbol(ct)[0]))

})

var objCharts = Chart(arrCfg)

objCharts.reset()

// 创建对象

var exName = exchange.GetName() + "_V5"

var nearConfigureFunc = $.getConfigureFunc()[exName]

var farConfigureFunc = $.getConfigureFunc()[exName]

var nearEx = $.createBaseEx(exchange, nearConfigureFunc)

var farEx = $.createBaseEx(exchange, farConfigureFunc)

// 预先写入需要订阅的合约

_.each(arrNearContractType, function(ct) {

nearEx.pushSubscribeSymbol(ct)

})

_.each(arrFarContractType, function(ct) {

farEx.pushSubscribeSymbol(ct)

})

while (true) {

var ts = new Date().getTime()

// 获取行情数据

nearEx.goGetTickers()

farEx.goGetTickers()

var nearTickers = nearEx.getTickers()

var farTickers = farEx.getTickers()

if (!farTickers || !nearTickers) {

Sleep(2000)

continue

}

var tbl = {

type : "table",

title : "远期-近期差价",

cols : ["交易对", "远期", "近期", "正对冲", "反对冲"],

rows : []

}

var subscribeFarTickers = []

var subscribeNearTickers = []

_.each(farTickers, function(farTicker) {

_.each(arrFarContractType, function(symbol) {

if (farTicker.originalSymbol == symbol) {

subscribeFarTickers.push(farTicker)

}

})

})

_.each(nearTickers, function(nearTicker) {

_.each(arrNearContractType, function(symbol) {

if (nearTicker.originalSymbol == symbol) {

subscribeNearTickers.push(nearTicker)

}

})

})

var pairs = []

_.each(subscribeFarTickers, function(farTicker) {

_.each(subscribeNearTickers, function(nearTicker) {

if (farTicker.symbol == nearTicker.symbol) {

var pair = {symbol: nearTicker.symbol, nearTicker: nearTicker, farTicker: farTicker, plusDiff: farTicker.bid1 - nearTicker.ask1, minusDiff: farTicker.ask1 - nearTicker.bid1}

pairs.push(pair)

tbl.rows.push([pair.symbol, farTicker.originalSymbol, nearTicker.originalSymbol, pair.plusDiff, pair.minusDiff])

for (var i = 0 ; i < arrCfg.length ; i++) {

if (arrCfg[i].title.text == pair.symbol) {

objCharts.add([i, [ts, pair.plusDiff]])

}

}

}

})

})

// 初始化

if (isFirst) {

isFirst = false

var recoveryNets = _G("nets")

var recoveryInitTotalEquity = _G("initTotalEquity")

if (!recoveryNets) {

// 检查持仓

_.each(subscribeFarTickers, function(farTicker) {

var pos = farEx.getFuPos(farTicker.originalSymbol, ts)

if (pos.length != 0) {

Log(farTicker.originalSymbol, pos)

throw "初始化时有持仓"

}

})

_.each(subscribeNearTickers, function(nearTicker) {

var pos = nearEx.getFuPos(nearTicker.originalSymbol, ts)

if (pos.length != 0) {

Log(nearTicker.originalSymbol, pos)

throw "初始化时有持仓"

}

})

// 构造nets

nets = []

_.each(pairs, function (pair) {

farEx.goGetAcc(pair.farTicker.originalSymbol, ts)

nearEx.goGetAcc(pair.nearTicker.originalSymbol, ts)

var obj = {

"symbol" : pair.symbol,

"farSymbol" : pair.farTicker.originalSymbol,

"nearSymbol" : pair.nearTicker.originalSymbol,

"initPrice" : (pair.nearTicker.ask1 + pair.farTicker.bid1) / 2,

"prePlus" : pair.farTicker.bid1 - pair.nearTicker.ask1,

"net" : createNet((pair.farTicker.bid1 - pair.nearTicker.ask1), diff, (pair.nearTicker.ask1 + pair.farTicker.bid1) / 2, true),

"initFarAcc" : farEx.getAcc(pair.farTicker.originalSymbol, ts),

"initNearAcc" : nearEx.getAcc(pair.nearTicker.originalSymbol, ts),

"farTicker" : pair.farTicker,

"nearTicker" : pair.nearTicker,

"farPos" : null,

"nearPos" : null,

}

nets.push(obj)

})

var currTotalEquity = getTotalEquity()

if (currTotalEquity) {

initTotalEquity = currTotalEquity

} else {

throw "初始化获取总权益失败!"

}

} else {

// 恢复

nets = recoveryNets

initTotalEquity = recoveryInitTotalEquity

}

}

// 检索网格,检查是否触发交易

_.each(nets, function(obj) {

var currPlus = null

_.each(pairs, function(pair) {

if (pair.symbol == obj.symbol) {

currPlus = pair.plusDiff

obj.farTicker = pair.farTicker

obj.nearTicker = pair.nearTicker

}

})

if (!currPlus) {

Log("没有查询到", obj.symbol, "的差价")

return

}

// 检查网格,动态添加

while (currPlus >= obj.net[obj.net.length - 1].price) {

obj.net.push({

sell : false,

price : obj.net[obj.net.length - 1].price + diff * obj.initPrice,

})

}

while (currPlus <= obj.net[0].price) {

var price = obj.net[0].price - diff * obj.initPrice

if (price <= 0) {

break

}

obj.net.unshift({

sell : false,

price : price,

})

}

// 检索网格

for (var i = 0 ; i < obj.net.length - 1 ; i++) {

var p = obj.net[i]

var upP = obj.net[i + 1]

if (obj.prePlus <= p.price && currPlus > p.price && !p.sell) {

if (hedge(nearEx, farEx, obj.nearSymbol, obj.farSymbol, obj.nearTicker, obj.farTicker, hedgeAmount, OPEN_PLUS)) { // 正对冲开仓

p.sell = true

}

} else if (obj.prePlus >= p.price && currPlus < p.price && upP.sell) {

if (hedge(nearEx, farEx, obj.nearSymbol, obj.farSymbol, obj.nearTicker, obj.farTicker, hedgeAmount, COVER_PLUS)) { // 正对冲平仓

upP.sell = false

}

}

}

obj.prePlus = currPlus // 记录本次差价,作为缓存,下次用于判断上穿下穿

// 增加其它表格输出

})

if (ts - preProfitPrintTS > 1000 * 60 * 5) { // 5分钟打印一次

var currTotalEquity = getTotalEquity()

if (currTotalEquity) {

totalEquity = currTotalEquity

LogProfit(totalEquity - initTotalEquity, "&") // 打印动态权益收益

}

// 检查持仓

posTbls = [] // 重置,更新

_.each(nets, function(obj) {

var currFarPos = farEx.getFuPos(obj.farSymbol)

var currNearPos = nearEx.getFuPos(obj.nearSymbol)

if (currFarPos && currNearPos) {

obj.farPos = currFarPos

obj.nearPos = currNearPos

}

var posTbl = {

"type" : "table",

"title" : obj.symbol,

"cols" : ["合约代码", "数量", "价格"],

"rows" : []

}

_.each(obj.farPos, function(pos) {

posTbl.rows.push([pos.symbol, pos.amount, pos.price])

})

_.each(obj.nearPos, function(pos) {

posTbl.rows.push([pos.symbol, pos.amount, pos.price])

})

posTbls.push(posTbl)

})

preProfitPrintTS = ts

}

// 显示网格

var netTbls = []

_.each(nets, function(obj) {

var netTbl = {

"type" : "table",

"title" : obj.symbol,

"cols" : ["网格"],

"rows" : []

}

_.each(obj.net, function(p) {

var color = ""

if (p.sell) {

color = "#00FF00"

}

netTbl.rows.push([JSON.stringify(p) + color])

})

netTbl.rows.reverse()

netTbls.push(netTbl)

})

LogStatus(_D(), "总权益:", totalEquity, "初始总权益:", initTotalEquity, " 浮动盈亏:", totalEquity - initTotalEquity,

"\n`" + JSON.stringify(tbl) + "`" + "\n`" + JSON.stringify(netTbls) + "`" + "\n`" + JSON.stringify(posTbls) + "`")

Sleep(interval)

}

}

function getTotalEquity() {

var totalEquity = null

var ret = exchange.IO("api", "GET", "/api/v5/account/balance", "ccy=USDT")

if (ret) {

try {

totalEquity = parseFloat(ret.data[0].details[0].eq)

} catch(e) {

Log("获取账户总权益失败!")

return null

}

}

return totalEquity

}

function hedge(nearEx, farEx, nearSymbol, farSymbol, nearTicker, farTicker, amount, tradeType) {

var farDirection = null

var nearDirection = null

if (tradeType == OPEN_PLUS) {

farDirection = farEx.OPEN_SHORT

nearDirection = nearEx.OPEN_LONG

} else {

farDirection = farEx.COVER_SHORT

nearDirection = nearEx.COVER_LONG

}

var nearSymbolInfo = nearEx.getSymbolInfo(nearSymbol)

var farSymbolInfo = farEx.getSymbolInfo(farSymbol)

nearAmount = nearEx.calcAmount(nearSymbol, nearDirection, nearTicker.ask1, amount * nearSymbolInfo.multiplier)

farAmount = farEx.calcAmount(farSymbol, farDirection, farTicker.bid1, amount * farSymbolInfo.multiplier)

if (!nearAmount || !farAmount) {

Log(nearSymbol, farSymbol, "下单量计算错误:", nearAmount, farAmount)

return

}

nearEx.goGetTrade(nearSymbol, nearDirection, nearTicker.ask1, nearAmount[0])

farEx.goGetTrade(farSymbol, farDirection, farTicker.bid1, farAmount[0])

var nearIdMsg = nearEx.getTrade()

var farIdMsg = farEx.getTrade()

return [nearIdMsg, farIdMsg]

}

function onexit() {

Log("执行扫尾函数", "#FF0000")

_G("nets", nets)

_G("initTotalEquity", initTotalEquity)

Log("保存数据:", _G("nets"), _G("initTotalEquity"))

}

策略公开地址:https://www.fmz.com/strategy/288559

策略用到了一个我自己写的模板类库,由于写的太菜就不公开了,以上策略源码可以修改一下不使用这个模板。

有兴趣的可以挂个OKEX V5模拟盘测试。 哦!对了,这策略不能回测~

相关推荐

- 发明者量化交易平台APP使用快速入门

- 币本位合约期现差价回归套利分析

- 发明者通用协议合约接入示例

- 数字货币手动期现对冲策略

- 研究平台进阶——Python进行数据分析和策略回测

- My语言策略实时推送仓位变化到手机App与微信

- 数字货币现货对冲策略设计(2)

- 数字货币现货对冲策略设计(1)

- 发明者量化交易平台主界面概览及架构

- 数字货币期货类马丁策略设计

- 币圈量化交易萌新看过来--带你走近币圈量化(七)

- 币圈量化交易萌新看过来--带你走近币圈量化(六)

- 币圈量化交易萌新看过来--带你走近币圈量化(五)

- 币圈量化交易萌新看过来--带你走近币圈量化(四)

- 如何通过策略出租码元数据给出租的策略指定不同的版本数据

- 币圈量化交易萌新看过来--带你走近币圈量化(三)

- 币圈量化交易萌新看过来--带你走近币圈量化(二)

- 币圈量化交易萌新看过来--带你走近币圈量化(一)

- 数字货币合约简易跟单机器人

- 利用SQLite构建发明者量化数据库

全部留言

N95

时隔两年,梦总~这个策略如何设定不同交易对,不同的开仓数量

2023-10-12 15:02:58

发明者量化-小小梦

```

// 声明arrCfg

var arrCfg = []

_.each(arrNearContractType, function(ct) {

arrCfg.push(createCfg(formatSymbol(ct)[0]))

})

```

把hedgeAmount 这个参数也做类似这样的处理,把这个参数设计成一个字符串类似:100,200,330 。 这样100就对应第一个对冲组合,然后具体去使用就行了。

2023-10-12 15:22:19

chao

改到了币安来,但是下单那块不懂ok怎么操作的,下单还没改成功

2021-07-11 23:35:35

发明者量化-小小梦

下单那块可以自己封装一下,例子中用到了一个模板类库,没公开。

2021-07-12 09:21:47

轨迹生物

怎么可以在ok模拟盘上跑。。。我用那个插件好像不行啊。。。

2021-06-18 23:14:48

发明者量化-小小梦

什么插件 ?

2021-06-21 09:05:04