How to read the Big Three financial statements in a way that's interesting and interesting?

Author: The Little Dream, Created: 2016-12-23 12:19:53, Updated:How to read the Big Three financial statements in a way that's interesting and interesting?

-

Impressions

When it comes to financial people, many people immediately think of the idea of being in a bad mood, having a bad day, having a dead-end job. When it comes to financial statements, most people will think that it is more difficult than writing a notebook every day. So for most people, it is very difficult to fall in love with financial statements.

However, the managers of the company do not understand the financial statements? We may recall the news of Alibaba's initial public offering. Look again at what Ma Yun is going to do in the United States, in addition to talking about his China Dream and China Story, he also has to talk to thousands of American investment experts about Alibaba's financial statements and financial condition at the time and future financial statements and financial condition.

Is a real financial statement really that difficult to understand? Many financial experts or professional financial people like to interpret and analyze financial statements in a particularly rigorous professional way, which makes financial analysis boring; while accountants prefer to interpret the statement in a way that is both borrowed and loaned, so that the reader does not know what is going on. This reminds me of the particularly popular catchphrase of the past, such as saying that the cake is really good, I will also eat another piece of chicken, I prefer to say all kinds of emotions:

Oh, the cake you bought today is excellent, the thick cheese with the rich mousse, is the best. I'd like to try a few more, although it will be decent, but it won't hurt.

In this article, I, a not-so-sophisticated professional financier, will share with you the financial statements that are more difficult than a diary, in the usual way, hoping to give you a word to wake up the feeling of dreaming and make you fall in love with the important financial statements.

-

First, what's the first thing you talk about with your financial statements?

The financial statements that we often refer to are mainly three-dimensional balance sheets, profit sheets and cash flow sheets. These three reports are the most commonly used in business management. These three reports have different functions, they provide a high level of generalization and summary of the situation of various aspects of the enterprise, and business managers can conduct comprehensive business management by analyzing and reading the statements.

-

The balance sheet. The balance sheet is mainly used to record the assets and liabilities of the enterprise.

Let me give you a simple example. For example, if you have $2 million in cash now, and you want to buy a 10-square-meter school building at the entrance of the University of Tsinghua, and if it is worth $300,000 per square meter, the total cost of the school building is $3 million. And you don't have enough money, you need to borrow $1 million from a bank. Although you may need to borrow $1 million to pay off your grandchildren, you feel that living in Tsinghua is so much better for your children's education that it's likely to create two generations of elites. In order to be happy, you have to take stock of your assets and liabilities.

You've paid all your savings and bought this house, and now your assets are this 10-square-meter, one-bedroom house that's worth $3 million; your liabilities correspond to your assets, and the liabilities are the $1 million you borrow from the bank; and then there's something called ownership, which is your right to your house, which is worth $2 million of your investment at the time.

In a nutshell, a balance sheet can help you understand your current assets, liabilities, and vested interests.

-

The profit and loss statement. The profit and loss statement is easier to understand than the balance sheet. It records how much money your company or you personally made and how much profit you made over the past period. For ease of understanding, I will give another example of a house.

For example, you buy a house, build a pressure mountain, start a job with an income of 8,000 yuan, after work you also go to the Wangfu well practice shop in the month of 5,000 yuan, in the evening you also go to the village gate part-time to work as a night shift security guard in the month of 2,000 yuan, every day in the morning greedily, a monthly income of 15,000 yuan. Then on the financial statement, your income this month is 15,000 yuan; buy a house, pay back the rent on the 20th of each month, a month still needs 10,000 yuan, and pay for various expenses, diesel salt tea, baby diaper bottles, a large size of a month to feed the province, eat cabbage also cost 4,000 yuan.

In a nutshell, a profit and loss statement is a statement of your income, expenses and profits over a period of time.

-

Cash flow charts have been given special importance by the finance ministers since the year 2000, especially after the fake events in the United States. However, the accountants of our country have long attached great importance to it, and their accounting is mostly cash-based.

This may be because Chinese companies often start with small-scale workshops, where they ask for money, pay for bulk goods, and without cash, businesses cannot operate. This is the simplest common sense, but is now ignored by many large companies. Know that many companies that suddenly fail are due to a sudden breakdown in the flow of capital, not a huge loss of the company.

Let's go back to the example we just discussed: if at the beginning, your boss pays your salary on time every month, the salary of the shopkeeper, when the income of the security guard is all cash, that one month later, your current income is 15000 yuan. We all know that bank payments must be cash transactions, there is no white line, and all the timely withdrawals, so you do not have the opportunity to make white lines, the deferral of repayment will increase the arrears, you can only pay on time.

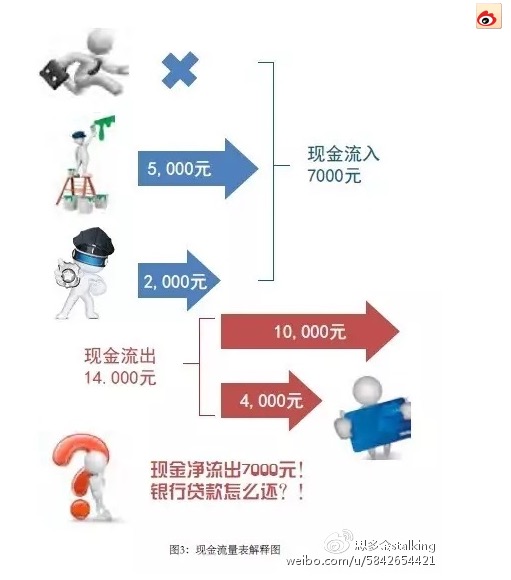

This is of course the most ideal outcome. But not all bosses can pay you on time. If the boss promises to pay you 8,000 yuan per month, but because of the economic downturn, the company's performance is not good, it is temporarily impossible to pay you on time, and you have to delay for a while. This means that the monthly fixed income of 8,000 yuan from formal work cannot be credited, the cash flow is less than 8,000 yuan, only the cash flow from the dressing room and the night shift is 2000 = 7,000 yuan.

The cash flow was 7,000, the cash flow was 14,000, and the net cash flow was 7,000.

If you have only 7000 yuan in your savings this month, it means that you can only earn one month more in the years that you have not spent, and if your boss doesn't pay you next month, you will have to stay on the streets, which is called a break in the chain of funds.

So a cash flow statement is a report of your cash flow and cash outflows over a period of time.

-

Relationship between balance sheet, profit and cash flow statements

The three most basic and most important financial statements are easily interpreted from the above description. What is the relationship between the three?

The balance sheet is the basis of the three reports. Using the human body as a metaphor, as if it were the bones of the human body. The bones are not the bigger the better, the most important thing is strong. Enterprises are also a reason not to pursue the expansion of the size of assets, but should strive to improve the quality of assets. Many enterprises are pursuing the position of the industry's leaders, but ultimately fall on the path of pursuit.

The profit table is like the muscles of the human body. Muscles need to be strong and strong, with impact and explosive power, and even more need to have endurance and endurance. If a person's muscles are soft, how else are the bones strong, then the person is always sick. The profit table is like a person, the worst is fat, looks good, inside is all fat, oily, soft, sub-healthy state.

With strong bones (balance sheet), strong muscles (profit table), the most important thing at this time is the cash flow table with a healthy blood flow. The key to maintaining life is the flow of blood, which is the key to maintaining the body. The most important sign of healthy blood is the constant flow; blood that does not flow is harmful to the human body and even life-threatening.

The cash flow chart is an important report to examine and analyze the blood flow and blood quality of enterprises. By analyzing and interpreting the cash flow chart, the managers and investors of the enterprise can understand how the blood production mechanism of the enterprise works, how the enterprise's extracorporeal blood flow mechanism works, and how the enterprise's blood donation mechanism and cash flow of investment activities work, so as to avoid the real situation of the enterprise.

The three reports are like a three-dimensional map of the enterprise, exploring the situation in all aspects of the enterprise through different perspectives and focuses, ultimately helping the managers of the enterprise to find the opportunity for the development of the enterprise, positioning the problem, seeking solutions and ways of improvement.

-

3 - How to think about digital management

Here, I will try to explore the business model and ideas of the company from the beginning. The initial development of a company always starts with an idea, which is now called strategy, according to Yang Guo. A company with a good strategy is a big step towards success.

Once the strategic objectives are in place, the enterprise starts to gather all the necessary resources, including human resources, money, treasures and equipment, and of course also information. Once these necessary resources are in place, the next step is to make the most of and develop the existing resources for production manufacturing, providing a variety of cooking products or cooking services, thereby obtaining economic benefits.

In a nutshell, the process of business management is the process of fully and efficiently utilizing and developing, producing, manufacturing, and providing products and services from a variety of resources to maximize economic returns.

Efficiency in resource use includes efficiency in the use of capital, efficiency in the use of equipment, efficiency in the use of talent, and efficiency in the use of other assets. Product returns usually refer to the revenue and profit from the sale of products. According to the above formula, if we want to maximize the value of the enterprise, business managers must maximize the efficiency of the use of resources of the enterprise, while maximizing the return of the product.

So how do you analyze and manage the efficiency of resource use and product returns? What is the most effective management approach? Here, we have to mention the financial statements (balance sheet, profit and cash flow statements), which are important tools for digital management of enterprises.

The balance sheet mainly records the source of the various resources that the enterprise raises, as well as the state and efficiency of their use. For example, the operational efficiency of machinery and equipment, which we usually analyze with fixed asset turnover rates; the operational efficiency of funds, which we usually analyze with monetary capital turnover rates and receivables turnover rates; the efficiency of raising and using funds, which we usually analyze with assets and liabilities ("financial leverage"). Through the project analysis of these balance sheets, managers can be helped to understand and master the operational efficiency and state of enterprise resources, thus further improving the efficiency of the enterprise.

Thus, the balance sheet is the report responsible for analyzing the resource efficiency of the enterprise.

Profit charts mainly record product returns and information from product research and development, to procurement, to production, to warehouse logistics, to sales channels, and finally to customers, throughout the value chain. For example, we use market share, sales and sales to analyze product sales, gross profit and net profit margin to analyze product production profits and operating profits. Through research and analysis of a variety of profit programs, profit charts can help managers gain insight into the returns of the products the company operates, which helps managers find ways and methods to further improve product returns.

The profit and loss statement is therefore the report responsible for analyzing the return of a company's products.

Thus, we can say that the balance sheet is responsible for the efficiency of the use of resources (assets and liabilities and the willingness of the owner); the profit table is responsible for the return of products (sales revenues and profits of various products).

The cash flow chart, in my opinion, is more like a comprehensive early warning report for a business, commonly known as a thermometer, which provides early warning tips for different functions and modules of the business by analyzing different cash flows and helping the business find possible or already occurring problems.

Therefore, the cash flow statement is an important addition to the balance sheet and the profit and loss account.

-

This article is translated from the blog of Siddho Kinstalking

- Interested in understanding the simplicity of Bayes

- 2.11 API: Simple example of use of Chart function (graph function)

- Details of the currency pair

- Beware of the Linear Mind Trap

- I've heard that reading like this can make a lot of money.

- The story of the escape and the survival of the gambler and the gambler

- 30 lines of code that takes you into the world of quantitative investing (python version)

- Gambling is a form of high-tech business

- The quantity-price relationship is an important indicator!

- A strong demand for the platform to add do-as-you-go retargeting

- Mathematical thinking in investment finance, how many have you done?

- Why slippage occurs in programmatic transactions

- The core of money management -- the choice of leverage

- Financial knowledge

- Causes and uses of ionization rates

- What are the advantages of leveraged trading?

- Here are 20 questions you didn't know about futures trading tips!

- Robots often report mistakes and disconnect

- How do traders sell off risk?

- Robots are getting information that is often wrong, is there a good solution?

muiaThank you for sharing Little Dream

The Little Dream