Playing JavaScript with the old man - creating a partner who will do the buying and selling (4) teaching him a little simple knowledge (even-line applications)

Author: The Little Dream, Created: 2017-03-08 11:52:02, Updated: 2017-10-11 10:37:23Playing JavaScript with the old man, creating a partner who will buy and sell.

Teach him simple knowledge (similar application)

In the last chapter we practiced a lot of interesting code in the sandbox system, today we need to get our little program out of the sandbox and see the world outside, of course we have to teach it something first!

-

Uniform buying and selling logic

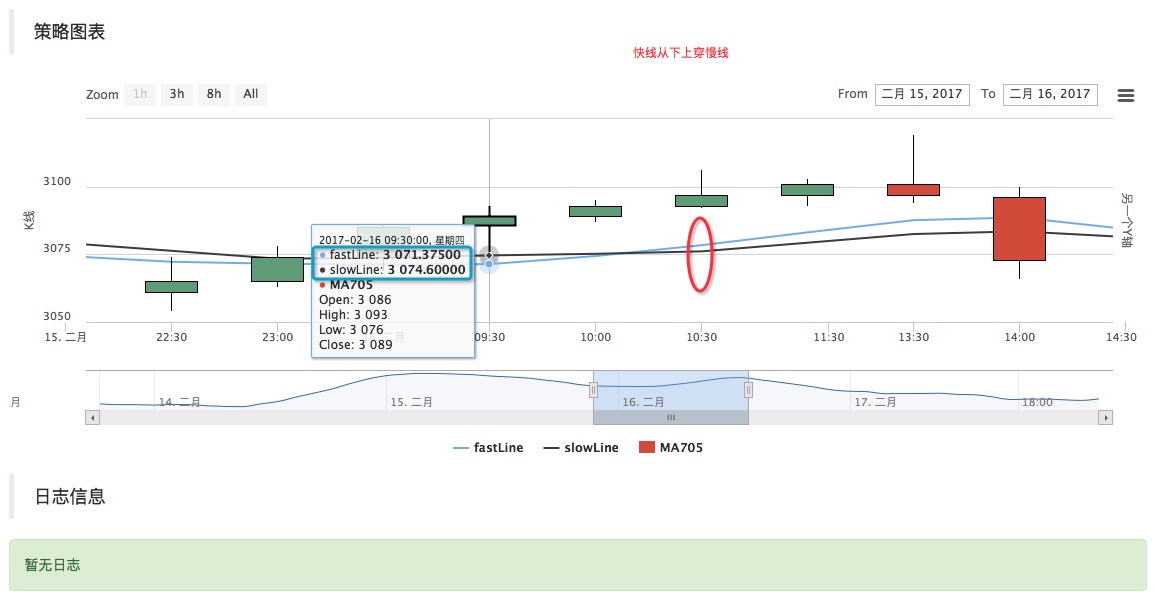

This buying and selling logic is probably the simplest and most basic strategy in the world of programmatic trading, quantitative trading. The principle is simple, and it is used to determine the future direction of the price of a commodity by comparing the average value of historical prices. That is: a standard object such as the MA705 contract (methanol contract) cycle is 10 Bar (K line column) and the cycle is 8 Bar (K line column), the difference in contrast. The following are the 10 cycles (long cycle) for the slow line, 8 cycles (relatively short cycle) for the fast line, some readers may not understand, it does not matter, we let our little friend draw it in the sandbox system (see the graphic code of the previous chapter to draw the picture again is so easy!), For ease of use, the code of the last block of graphic is packaged into a file.

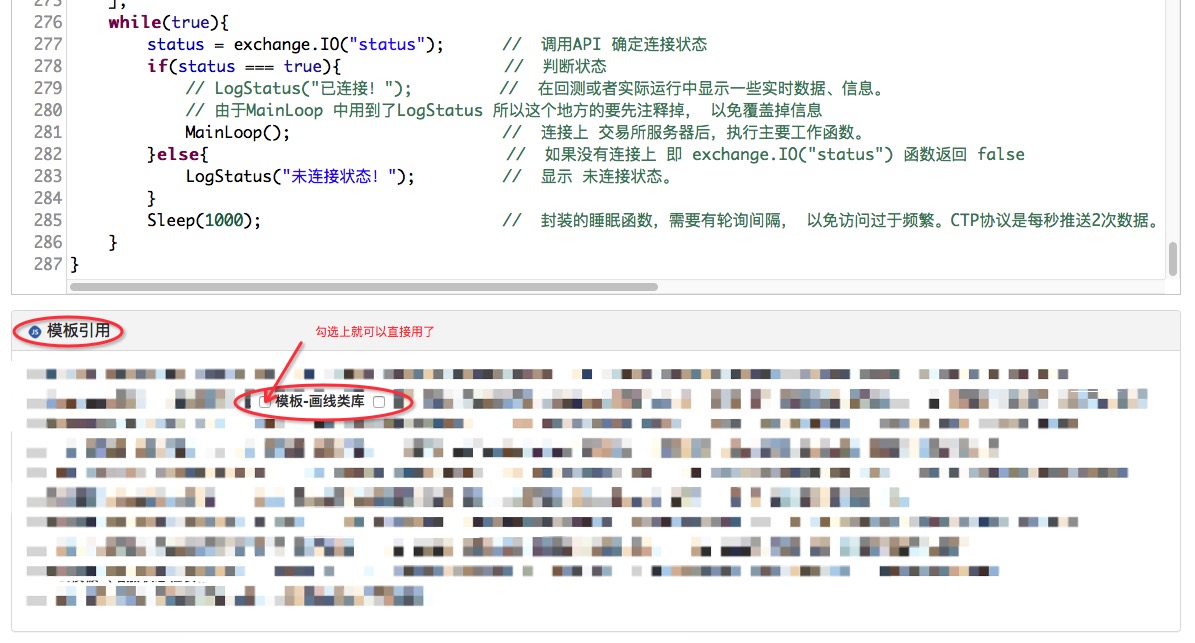

This is the address of the image template:https://www.fmz.com/strategy/27293

If you copy it, it will appear in the template reference bar, use it directly, and remember to tick it.

The code is simple:

var PreRecordTime = 0; var isFirst = true; function MainLoop(){ var info = exchange.SetContractType("MA705"); if(!info){ return; } var records = exchange.GetRecords(); if(!records || records.length < 10){ // 因为长周期 为10 所以要计算10个Bar的均值, 必须要有10个K线才能计算出来。 return; // 不满足的情况,返回,重新来。 } if(isFirst){ PreRecordTime = records[records.length - 1].Time; isFirst = false; } var fastLine = TA.MA(records, 8); // 均线指标,计算出给定 的K线数据 8个 Bar 的均值, 按顺序压入数组(随时间序列,和K线Bar时间同步形成一条线,所以叫快线) 返回这个数组给变量fastLine var slowLine = TA.MA(records, 10); // 同上 区别是10个Bar ,所以叫慢线(周期大,均值变化的慢)。 var current_fastLine = fastLine[fastLine.length - 1]; // 这个数组的 倒数第一个索引 fastLine.length - 1 ,也就是表示的 快线的最后一个值 ,就是当前K线 对应的 快线均值。 var current_slowLine = slowLine[slowLine.length - 1]; // 同上 if(PreRecordTime !== records[records.length - 1].Time){ // K线更新了才确定当前最新的前一根Bar $.PlotLine("fastLine", fastLine[fastLine.length - 2], PreRecordTime); // 引用了模板,可以直接使用这个模块导出函数 画线。(其实就是封装成 模块了) $.PlotLine("slowLine", slowLine[slowLine.length - 2], PreRecordTime); // 同上 画指标线 PreRecordTime = records[records.length - 1].Time; $.PlotLine("fastLine", current_fastLine, records[records.length - 1].Time); $.PlotLine("slowLine", current_slowLine, records[records.length - 1].Time); }else{ $.PlotLine("fastLine", current_fastLine, records[records.length - 1].Time); // 当前的不停在变动。 $.PlotLine("slowLine", current_slowLine, records[records.length - 1].Time); } $.PlotRecords(records, "MA705"); // 画K线 } var cfg = $.GetCfg(); function main() { var status = null; cfg.yAxis = [{ title: {text: 'K线'}, //标题 style: {color: '#4572A7'}, //样式 opposite: false //生成右边Y轴 }, { title:{text: "另一个Y轴"}, opposite: true //生成右边Y轴 ceshi } ]; while(true){ status = exchange.IO("status"); // 调用API 确定连接状态 if(status === true){ // 判断状态 // LogStatus("已连接!"); // 在回测或者实际运行中显示一些实时数据、信息。 // 由于MainLoop 中用到了LogStatus 所以这个地方的要先注释掉, 以免覆盖掉信息 MainLoop(); // 连接上 交易所服务器后,执行主要工作函数。 }else{ // 如果没有连接上 即 exchange.IO("status") 函数返回 false LogStatus("未连接状态!"); // 显示 未连接状态。 } Sleep(1000); // 封装的睡眠函数,需要有轮询间隔, 以免访问过于频繁。CTP协议是每秒推送2次数据。 } }It's not just a question of how to use the sandbox system, it's also a question of how to use it.

You can see that the fast line is going to come up from the bottom of the slow line when it's upside down. How do you describe this in code?

// 判断指标形态 if(fastLine.length > 3 && slowLine.length > 3 && fastLine[fastLine.length - 3] < slowLine[slowLine.length - 3] && fastLine[fastLine.length - 2] > slowLine[slowLine.length - 2]){ $.PlotFlag(records[records.length - 2].Time, '已经交叉', 'X'); // 在图表上打个标记 }

It is also symmetrical that the high-speed line goes from the top down to the slow line. We add a piece of code to the program according to this logic.

-

Teachers learn how to buy and sell.

This is another JavaScript module, but I won't refer to it here, but it's embedded directly into our program. The MA705 contract (methanol) is still used as a trade mark.

// --------交易模块-------------

var Interval = 500;

var SlideTick = 1;

var RiskControl = false;

var __orderCount = 0

var __orderDay = 0

function CanTrade(tradeAmount) {

if (!RiskControl) {

return true

}

if (typeof(tradeAmount) == 'number' && tradeAmount > MaxTradeAmount) {

Log("风控模块限制, 超过最大下单量", MaxTradeAmount, "#ff0000 @");

throw "中断执行"

return false;

}

var nowDay = new Date().getDate();

if (nowDay != __orderDay) {

__orderDay = nowDay;

__orderCount = 0;

}

__orderCount++;

if (__orderCount > MaxTrade) {

Log("风控模块限制, 不可交易, 超过最大下单次数", MaxTrade, "#ff0000 @");

throw "中断执行"

return false;

}

return true;

}

function init() {

if (typeof(SlideTick) === 'undefined') {

SlideTick = 1;

} else {

SlideTick = parseInt(SlideTick);

}

Log("商品交易类库加载成功");

}

function GetPosition(e, contractType, direction, positions) {

var allCost = 0;

var allAmount = 0;

var allProfit = 0;

var allFrozen = 0;

var posMargin = 0;

if (typeof(positions) === 'undefined' || !positions) {

positions = _C(e.GetPosition);

}

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType == contractType &&

(((positions[i].Type == PD_LONG || positions[i].Type == PD_LONG_YD) && direction == PD_LONG) || ((positions[i].Type == PD_SHORT || positions[i].Type == PD_SHORT_YD) && direction == PD_SHORT))

) {

posMargin = positions[i].MarginLevel;

allCost += (positions[i].Price * positions[i].Amount);

allAmount += positions[i].Amount;

allProfit += positions[i].Profit;

allFrozen += positions[i].FrozenAmount;

}

}

if (allAmount === 0) {

return null;

}

return {

MarginLevel: posMargin,

FrozenAmount: allFrozen,

Price: _N(allCost / allAmount),

Amount: allAmount,

Profit: allProfit,

Type: direction,

ContractType: contractType

};

}

function Open(e, contractType, direction, opAmount) {

var initPosition = GetPosition(e, contractType, direction);

var isFirst = true;

var initAmount = initPosition ? initPosition.Amount : 0;

var positionNow = initPosition;

while (true) {

var needOpen = opAmount;

if (isFirst) {

isFirst = false;

} else {

positionNow = GetPosition(e, contractType, direction);

if (positionNow) {

needOpen = opAmount - (positionNow.Amount - initAmount);

}

}

var insDetail = _C(e.SetContractType, contractType);

//Log("初始持仓", initAmount, "当前持仓", positionNow, "需要加仓", needOpen);

if (needOpen < insDetail.MinLimitOrderVolume) {

break;

}

if (!CanTrade(opAmount)) {

break;

}

var depth = _C(e.GetDepth);

var amount = Math.min(insDetail.MaxLimitOrderVolume, needOpen);

e.SetDirection(direction == PD_LONG ? "buy" : "sell");

var orderId;

if (direction == PD_LONG) {

orderId = e.Buy(depth.Asks[0].Price + (insDetail.PriceTick * SlideTick), Math.min(amount, depth.Asks[0].Amount), contractType, 'Ask', depth.Asks[0]);

} else {

orderId = e.Sell(depth.Bids[0].Price - (insDetail.PriceTick * SlideTick), Math.min(amount, depth.Bids[0].Amount), contractType, 'Bid', depth.Bids[0]);

}

// CancelPendingOrders

while (true) {

Sleep(Interval);

var orders = _C(e.GetOrders);

if (orders.length === 0) {

break;

}

for (var j = 0; j < orders.length; j++) {

e.CancelOrder(orders[j].Id);

if (j < (orders.length - 1)) {

Sleep(Interval);

}

}

}

}

var ret = {

price: 0,

amount: 0,

position: positionNow

};

if (!positionNow) {

return ret;

}

if (!initPosition) {

ret.price = positionNow.Price;

ret.amount = positionNow.Amount;

} else {

ret.amount = positionNow.Amount - initPosition.Amount;

ret.price = _N(((positionNow.Price * positionNow.Amount) - (initPosition.Price * initPosition.Amount)) / ret.amount);

}

return ret;

}

function Cover(e, contractType) {

var insDetail = _C(e.SetContractType, contractType);

while (true) {

var n = 0;

var opAmount = 0;

var positions = _C(e.GetPosition);

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType != contractType) {

continue;

}

var amount = Math.min(insDetail.MaxLimitOrderVolume, positions[i].Amount);

var depth;

if (positions[i].Type == PD_LONG || positions[i].Type == PD_LONG_YD) {

depth = _C(e.GetDepth);

opAmount = Math.min(amount, depth.Bids[0].Amount);

if (!CanTrade(opAmount)) {

return;

}

e.SetDirection(positions[i].Type == PD_LONG ? "closebuy_today" : "closebuy");

e.Sell(depth.Bids[0].Price - (insDetail.PriceTick * SlideTick), opAmount, contractType, positions[i].Type == PD_LONG ? "平今" : "平昨", 'Bid', depth.Bids[0]);

n++;

} else if (positions[i].Type == PD_SHORT || positions[i].Type == PD_SHORT_YD) {

depth = _C(e.GetDepth);

opAmount = Math.min(amount, depth.Asks[0].Amount);

if (!CanTrade(opAmount)) {

return;

}

e.SetDirection(positions[i].Type == PD_SHORT ? "closesell_today" : "closesell");

e.Buy(depth.Asks[0].Price + (insDetail.PriceTick * SlideTick), opAmount, contractType, positions[i].Type == PD_SHORT ? "平今" : "平昨", 'Ask', depth.Asks[0]);

n++;

}

}

if (n === 0) {

break;

}

while (true) {

Sleep(Interval);

var orders = _C(e.GetOrders);

if (orders.length === 0) {

break;

}

for (var j = 0; j < orders.length; j++) {

e.CancelOrder(orders[j].Id);

if (j < (orders.length - 1)) {

Sleep(Interval);

}

}

}

}

}

var PositionManager = (function() {

function PositionManager(e) {

if (typeof(e) === 'undefined') {

e = exchange;

}

if (e.GetName() !== 'Futures_CTP') {

throw 'Only support CTP';

}

this.e = e;

this.account = null;

}

// Get Cache

PositionManager.prototype.Account = function() {

if (!this.account) {

this.account = _C(this.e.GetAccount);

}

return this.account;

};

PositionManager.prototype.GetAccount = function(getTable) {

this.account = _C(this.e.GetAccount);

if (typeof(getTable) !== 'undefined' && getTable) {

return AccountToTable(this.e.GetRawJSON())

}

return this.account;

};

PositionManager.prototype.GetPosition = function(contractType, direction, positions) {

return GetPosition(this.e, contractType, direction, positions);

};

PositionManager.prototype.OpenLong = function(contractType, shares) {

if (!this.account) {

this.account = _C(this.e.GetAccount);

}

return Open(this.e, contractType, PD_LONG, shares);

};

PositionManager.prototype.OpenShort = function(contractType, shares) {

if (!this.account) {

this.account = _C(this.e.GetAccount);

}

return Open(this.e, contractType, PD_SHORT, shares);

};

PositionManager.prototype.Cover = function(contractType) {

if (!this.account) {

this.account = _C(this.e.GetAccount);

}

return Cover(this.e, contractType);

};

PositionManager.prototype.CoverAll = function() {

if (!this.account) {

this.account = _C(this.e.GetAccount);

}

while (true) {

var positions = _C(this.e.GetPosition)

if (positions.length == 0) {

break

}

for (var i = 0; i < positions.length; i++) {

// Cover Hedge Position First

if (positions[i].ContractType.indexOf('&') != -1) {

Cover(this.e, positions[i].ContractType)

Sleep(1000)

}

}

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType.indexOf('&') == -1) {

Cover(this.e, positions[i].ContractType)

Sleep(1000)

}

}

}

};

PositionManager.prototype.Profit = function(contractType) {

var accountNow = _C(this.e.GetAccount);

return _N(accountNow.Balance - this.account.Balance);

};

return PositionManager;

})();

$.NewPositionManager = function(e) {

return new PositionManager(e);

};

// Via: http://mt.sohu.com/20160429/n446860150.shtml

$.IsTrading = function(symbol) {

var now = new Date();

var day = now.getDay();

var hour = now.getHours();

var minute = now.getMinutes();

if (day === 0 || (day === 6 && (hour > 2 || hour == 2 && minute > 30))) {

return false;

}

symbol = symbol.replace('SPD ', '').replace('SP ', '');

var p, i, shortName = "";

for (i = 0; i < symbol.length; i++) {

var ch = symbol.charCodeAt(i);

if (ch >= 48 && ch <= 57) {

break;

}

shortName += symbol[i].toUpperCase();

}

var period = [

[9, 0, 10, 15],

[10, 30, 11, 30],

[13, 30, 15, 0]

];

if (shortName === "IH" || shortName === "IF" || shortName === "IC") {

period = [

[9, 30, 11, 30],

[13, 0, 15, 0]

];

} else if (shortName === "TF" || shortName === "T") {

period = [

[9, 15, 11, 30],

[13, 0, 15, 15]

];

}

if (day >= 1 && day <= 5) {

for (i = 0; i < period.length; i++) {

p = period[i];

if ((hour > p[0] || (hour == p[0] && minute >= p[1])) && (hour < p[2] || (hour == p[2] && minute < p[3]))) {

return true;

}

}

}

var nperiod = [

[

['AU', 'AG'],

[21, 0, 02, 30]

],

[

['CU', 'AL', 'ZN', 'PB', 'SN', 'NI'],

[21, 0, 01, 0]

],

[

['RU', 'RB', 'HC', 'BU'],

[21, 0, 23, 0]

],

[

['P', 'J', 'M', 'Y', 'A', 'B', 'JM', 'I'],

[21, 0, 23, 30]

],

[

['SR', 'CF', 'RM', 'MA', 'TA', 'ZC', 'FG', 'IO'],

[21, 0, 23, 30]

],

];

for (i = 0; i < nperiod.length; i++) {

for (var j = 0; j < nperiod[i][0].length; j++) {

if (nperiod[i][0][j] === shortName) {

p = nperiod[i][1];

var condA = hour > p[0] || (hour == p[0] && minute >= p[1]);

var condB = hour < p[2] || (hour == p[2] && minute < p[3]);

// in one day

if (p[2] >= p[0]) {

if ((day >= 1 && day <= 5) && condA && condB) {

return true;

}

} else {

if (((day >= 1 && day <= 5) && condA) || ((day >= 2 && day <= 6) && condB)) {

return true;

}

}

return false;

}

}

}

return false;

};

// --------交易模块完结----------

var PreRecordTime = 0;

var isFirst = true;

var IDLE = 0;

var OPENLONG = 1;

var COVER = 2;

var STATE = IDLE;

var InitAccount = null;

function MainLoop(){

var info = exchange.SetContractType("MA705");

if(!info){

return;

}

var records = exchange.GetRecords();

if(!records || records.length < 10){ // 因为长周期 为10 所以要计算10个Bar的均值, 必须要有10个K线才能计算出来。

return; // 不满足的情况,返回,重新来。

}

if(isFirst){

PreRecordTime = records[records.length - 1].Time;

InitAccount = exchange.GetAccount();

isFirst = false;

}

var fastLine = TA.MA(records, 5); // 均线指标,计算出给定 的K线数据 8个 Bar 的均值, 按顺序压入数组(随时间序列,和K线Bar时间同步形成一条线,所以叫快线) 返回这个数组给变量fastLine

var slowLine = TA.MA(records, 10); // 同上 区别是10个Bar ,所以叫慢线(周期大,均值变化的慢)。

var current_fastLine = fastLine[fastLine.length - 1]; // 这个数组的 倒数第一个索引 fastLine.length - 1 ,也就是表示的 快线的最后一个值 ,就是当前K线 对应的 快线均值。

var current_slowLine = slowLine[slowLine.length - 1]; // 同上

if(PreRecordTime !== records[records.length - 1].Time){ // K线更新了才确定当前最新的前一根Bar

$.PlotLine("fastLine", fastLine[fastLine.length - 2], PreRecordTime); // 引用了模板,可以直接使用这个模块导出函数 画线。(其实就是封装成 模块了)

$.PlotLine("slowLine", slowLine[slowLine.length - 2], PreRecordTime); // 同上 画指标线

PreRecordTime = records[records.length - 1].Time;

$.PlotLine("fastLine", current_fastLine, records[records.length - 1].Time);

$.PlotLine("slowLine", current_slowLine, records[records.length - 1].Time);

}else{

$.PlotLine("fastLine", current_fastLine, records[records.length - 1].Time); // 当前的不停在变动。

$.PlotLine("slowLine", current_slowLine, records[records.length - 1].Time);

}

$.PlotRecords(records, "MA705"); // 画K线

// 判断指标形态

if(STATE === IDLE && fastLine.length > 3 && slowLine.length > 3 && fastLine[fastLine.length - 3] < slowLine[slowLine.length - 3] && fastLine[fastLine.length - 2] > slowLine[slowLine.length - 2]){

P.OpenLong("MA705", 1);

STATE = OPENLONG;

$.PlotFlag(new Date().getTime(), '快线上传慢线', 'OPENLONG');

}

if(STATE === OPENLONG && fastLine[fastLine.length - 3] > slowLine[slowLine.length - 3] && fastLine[fastLine.length - 2] < slowLine[slowLine.length - 2]){

P.Cover("MA705");

STATE = COVER;

$.PlotFlag(new Date().getTime(), '快线下传慢线', 'COVER');

}

if(STATE === COVER){

var nowAccount = exchange.GetAccount();

LogProfit(nowAccount.Balance - InitAccount.Balance, nowAccount);

STATE = IDLE;

}

}

var cfg = $.GetCfg();

var P = null;

function main() {

var status = null;

P = $.NewPositionManager(exchange); // 构造一个 用于控制交易细节的对象。

cfg.yAxis = [{

title: {text: 'K线'}, //标题

style: {color: '#4572A7'}, //样式

opposite: false //生成右边Y轴

},

{

title:{text: "另一个Y轴"},

opposite: true //生成右边Y轴 ceshi

}

];

while(true){

status = exchange.IO("status"); // 调用API 确定连接状态

if(status === true){ // 判断状态

// LogStatus("已连接!"); // 在回测或者实际运行中显示一些实时数据、信息。

// 由于MainLoop 中用到了LogStatus 所以这个地方的要先注释掉, 以免覆盖掉信息

MainLoop(); // 连接上 交易所服务器后,执行主要工作函数。

}else{ // 如果没有连接上 即 exchange.IO("status") 函数返回 false

LogStatus("未连接状态!"); // 显示 未连接状态。

}

Sleep(1000); // 封装的睡眠函数,需要有轮询间隔, 以免访问过于频繁。CTP协议是每秒推送2次数据。

}

}

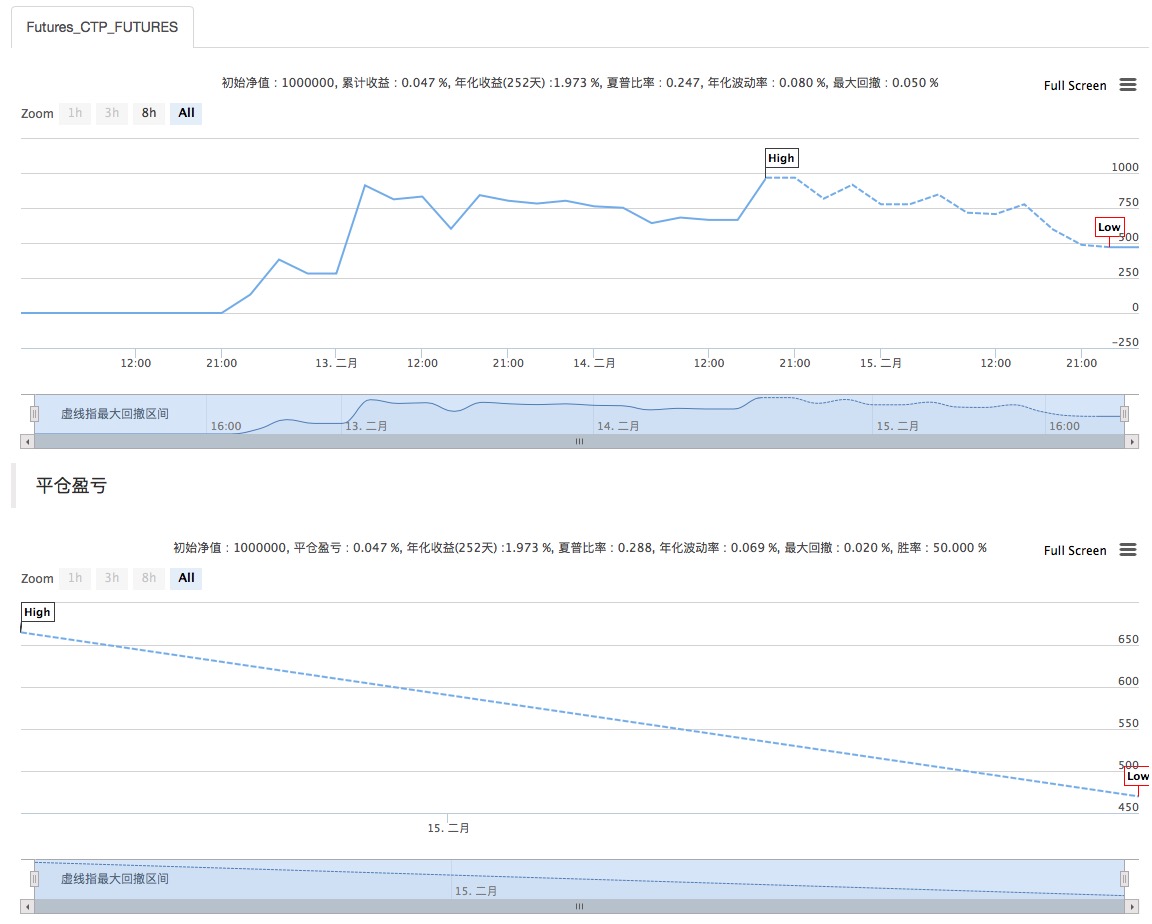

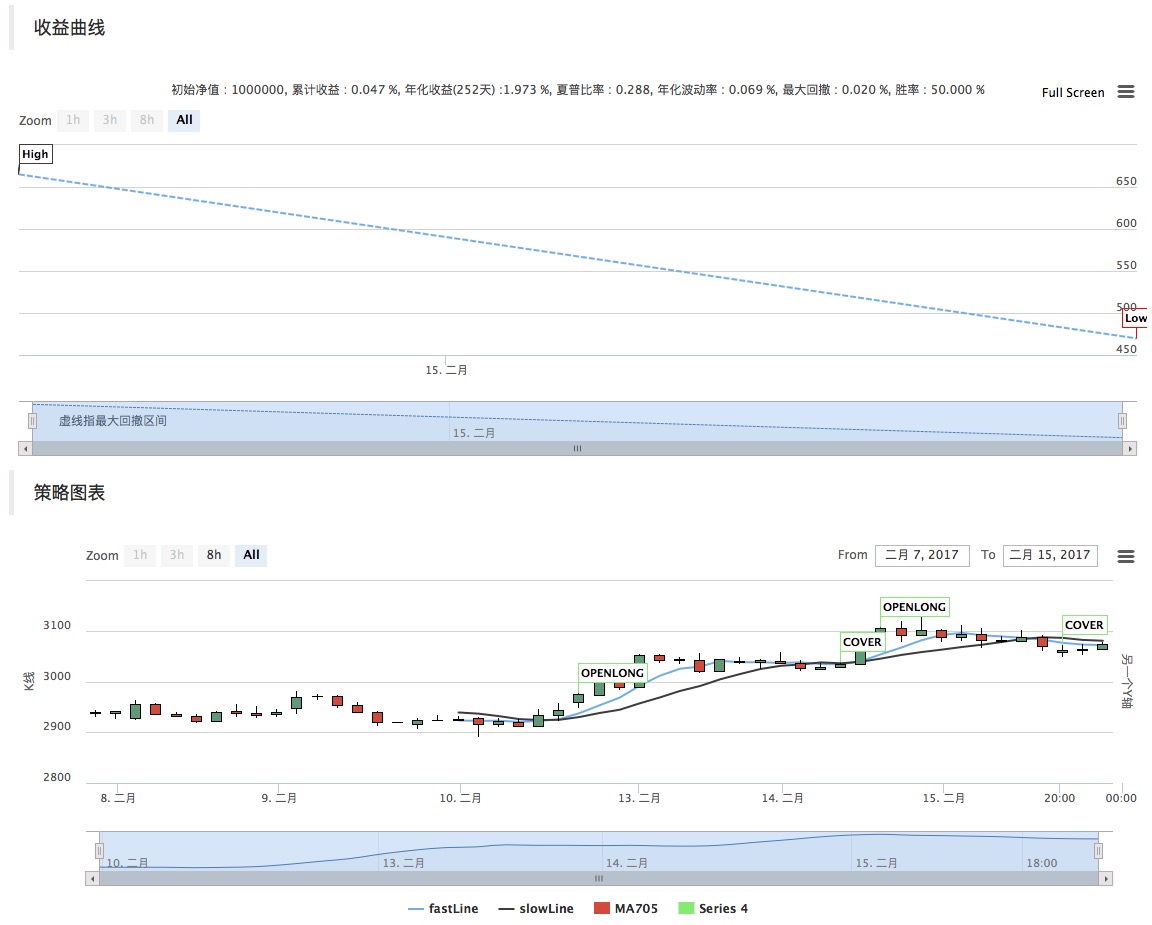

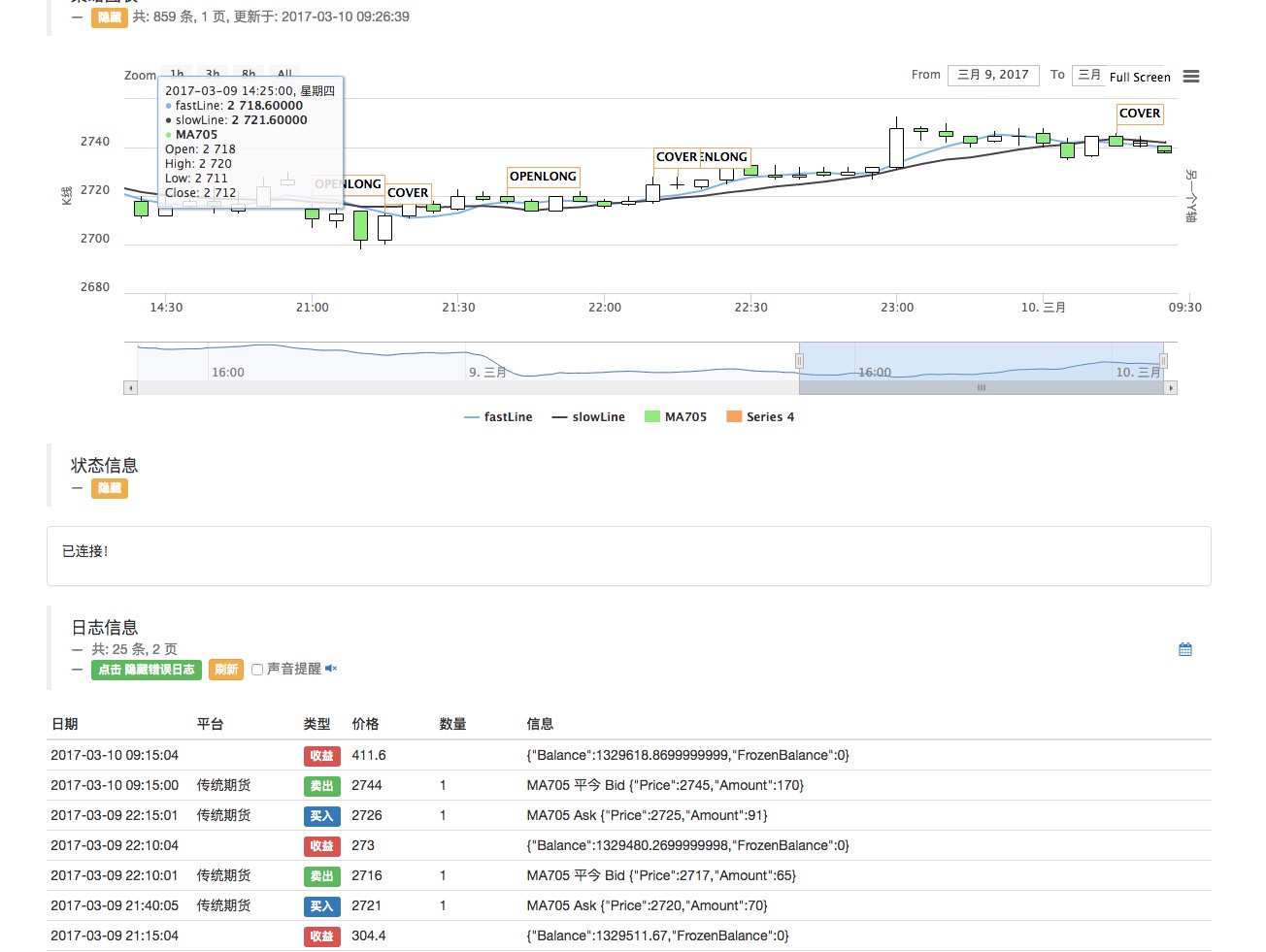

The sandbox was measured as follows:

In the review, the market reversal was very large, it can be seen that the trading logic is very imperfect, the upward trend is positive gains, does not mean there is no problem ((shock market may be shaken = _=)).

-

In the meantime, I'm going to try to get out of my sandbox and see the world outside.

For more details on how to apply for simnow Commodity Futures Simulation Account, see this post:https://www.fmz.com/bbs-topic/325Analog transactions can be programmed directly using the CTP protocol.

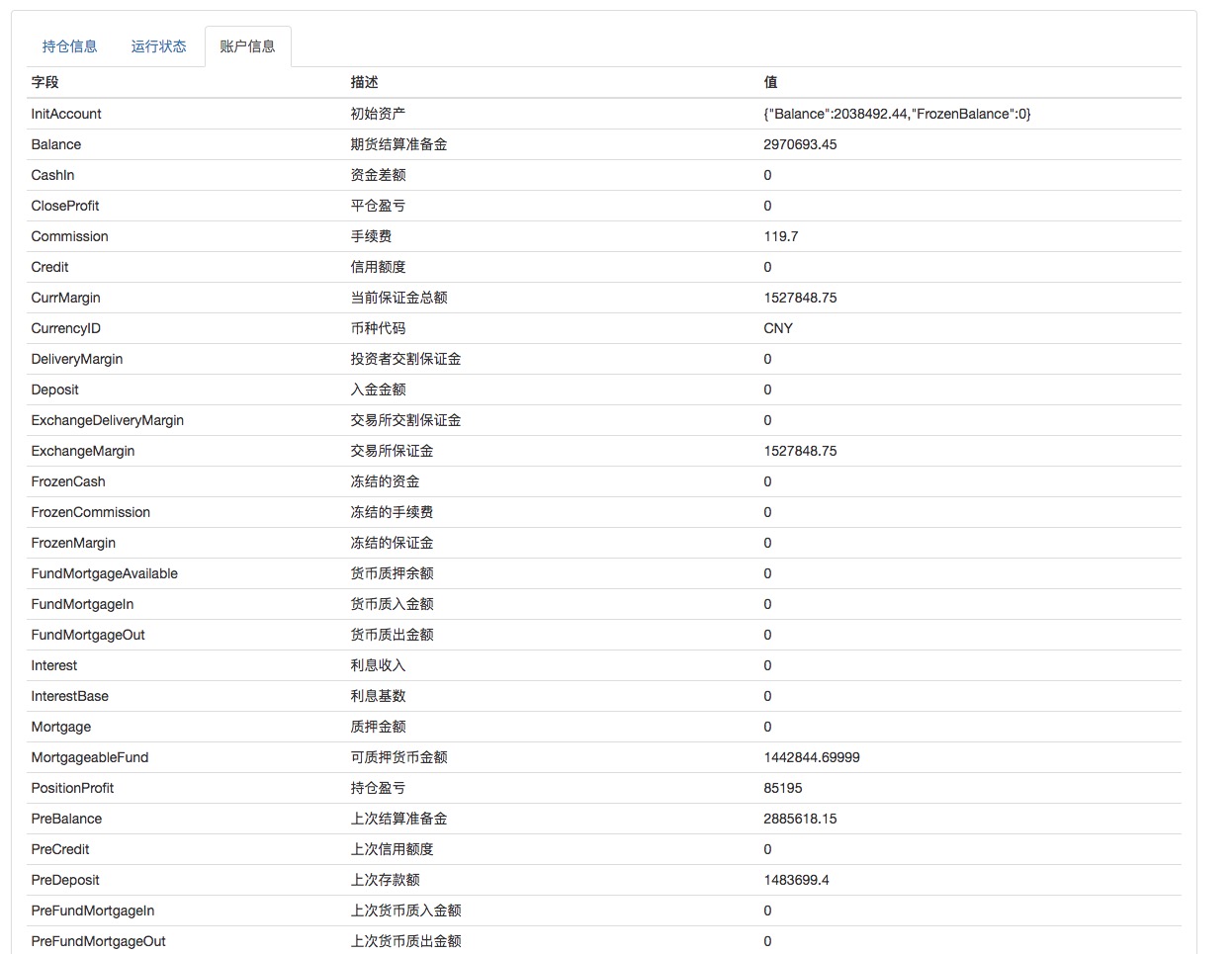

The program runs for a while, the strategy itself is a demonstration, everyone is only for reference, if needed, you can also add position control, stop stop, stop loss, stop warning, etc. (This depends on the native JS programming language, the freedom is high, the writing of the strategy is fun).

I'm going to try this on a fake account. I'm going to try this on a fake account.

Look at my other program running on a simulation disk, this complexity SHOW a bit:

I like to play JS, I study JS, I take it, source code:https://www.fmz.com/strategy/17289

Before I write this, welcome readers to leave me a message! Send me your suggestions and comments, if you feel like it's fun, you can share it with more friends who love the program and love the deal.

https://www.fmz.com/bbs-topic/727

Programmer littleDream originally created

- Ali Cloud Linux host is running the host, the host restarted, how to get back to the original host?

- High volatility means high risk? Value investing defines risk differently than you think.

- I wanted to ask you about the platforms that virtual currency disks can support and the currencies that can be traded.

- Zero and negative markets

- Playing JavaScript with old people - creating a buyer/seller tool (7) Useful tool to know why!

- Playing JavaScript with the old man - creating a buyer/seller partner and developing the tool code used by the robot

- High-frequency trading strategies talk - do the market versus the reverse option

- Becoming a probabilist - a random strolling idiot who reads books

- Positive expectations for probabilities, odds and long-term trades

- Playing JavaScript with the old man - creating a buyer/seller partner (5)

- Playing JavaScript with the old man - creating a buyer/seller partner (3) A lively little guy who likes fresh things around

- I'm going to ask the gods about my doubts about future functions!

- Playing JavaScript with the old man - creating a partner who buys and sells - born in a sandbox

- Playing JavaScript with the old man - creating a partner who will buy and sell 1) The boring life of a front-end middle-aged farmer

- Money and credit in monetary banking

- Futures trading: The pursuit of perfect certainty is a toxin in the trading system!

- Trading strategies of gamblers

- HttpQuery is not used in Python

- What does it mean to be a "dispossessed" hedge fund?

- Details: Shares subject to size restrictions (Shares Trading Rules)