The consistency of the dividend that determines profitability

Author: The Little Dream, Created: 2017-05-02 13:39:34, Updated:The consistency of the dividend that determines profitability

Consistency is the single most important factor in determining whether or not you will make money, and not one of them. Since consistency is a precondition for probability stability, if there is no consistency, the initial conditions change and become statistically meaningless. Many people are unable to achieve consistency, mainly due to two kinds of ignorance: "ignorance of the market and ignorance of themselves".

-

Consistency

Consistency is one of the hardest things for traders to do since they've been involved in a trade, and it's also the key to making money or not. The reason why consistency is hard to do is because you can't fully believe in the role of consistency when you don't have enough verification, and doubting is human nature, and doubting creates an excuse not to execute consistency, which is also the hard part.

What is confusing is that the excuse for non-performance is, on the surface, justified, and is a manifestation of people's ability to shift responsibility. Another reason for the difficulty of shifting responsibility is the example I'm giving, which assumes that you understand the importance of consistency and can stick to more than 90% of the signals.

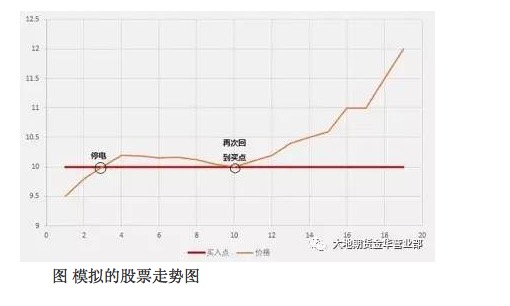

Let's say today there was a power outage and you didn't buy the stock that you should have bought for $10 more, and the stock closed up to $10.20, what would you do next?

The normal thinking is: since the best buy has been missed, the power outage is also an irresistible factor, the consistency is not implemented, although regrettably, it is not my responsibility. If I buy at 10.20, I lose 0.20, and this loss is an out-of-system loss (assuming you can frankly accept an in-system loss), the out-of-system loss will lead to a decrease in the expected rate of return, which should be avoided as much as possible, this way of thinking is typical and reasonable.

And the correct approach is that you should buy at a price of 10.20 because the cost of the power outage is 0.20, the cost you have already paid, it is because of your loss due to the power outage, and this loss, although it is your loss outside the system, is already a real loss, because assuming no power outage, you have now earned 0.20, which should not be an excuse for you not to execute the purchase at the price of 10.20.

Then the market moves further and the price then goes back to 10.00 from 10.20, at which point your mindset changes subtly. Because by convention, a false price breakout goes back to the cost price, the most likely is a false breakout, because a good trade is a trade that makes money at the beginning, and you would think, if I buy at the first break of 10.00, I have an advantage, and if I buy again after the price goes back to 10.00, I have no advantage, because assuming the trade is profitable, it generally does not go back to 10.00; assuming it stops losing, 10.00 is the inevitable way, now this 10.00 does not have the initial 10.00 advantage, simply put, this is an up-and-down differential, so now, I should not buy at the price of 10.00.

And then the stock goes up to $20.00, and you watch it every day.

And, assuming that the transaction will bring you a 30% return on your overall account, and as anyone who has done systematic trading knows, the big profit is followed by a drawdown, and if you don't get the 30% return, then you take the 20% drawdown, at which point your overall trading account and your mindset are in danger of total collapse.

Graph Simulated stock chart

The above example, although fictional, is a very relevant reference and I'm sure many people will not be unfamiliar with it. The irony is that the market gives you two opportunities to buy and you are rejected for seemingly very legitimate reasons.

Note that the temptation for this failure is simply that a loss of 0.20 is unacceptable, the point is that even if you are unacceptable, the loss is actually incurred, you cannot change anything, and merely guiding you by seemingly correct inference violates the principle of consistency and has serious consequences.

When the price returns to 10.00, the second inference seems very reasonable and its logic itself is not a problem, however, you ignore that the second inference is based on the wrong conditions in the first place, because the blackout causes the condition of not chasing the price at 10.20 to be wrong itself, and the conclusion based on an incorrect condition is disastrous. You can see from this example that the so-called inference is actually to avoid loss-making inconsistency in the search for a reason.

You can see that human weakness is perfectly derived in one person and ultimately leads you to failure.

-

Why is the curve that the average person expects is downward curving?

In casinos, the gambler's expectation curve is steadily rising, and they consistently win big money by calculating complex probabilities and by clever cover-ups, using seemingly fair rules; in the marketplace, high rollers also use the laws of probability to consistently win big money by repeatedly executing a set of advantageous systems.

If you believe that the market is perfectly efficient, it is not worth learning all the theories about financial investing, because the best strategy would be to buy and hold the strategy; if you believe that the market is not perfectly efficient, then you should believe that someone in the market can make stable profits. Another proof is that the market is always a majority of losers, a minority of profiteers, and the market is zero-sum (not counting trading fees).

Since the vast majority of what you see is a loss, where does the money go? The money will not decrease, so a small number of people in the market make the money of the majority, this fact can also be deduced, if the market is random, then half of the people should make money and half of the people lose money, right, since this is not the distribution, indicates that the market is not random, let alone completely efficient.

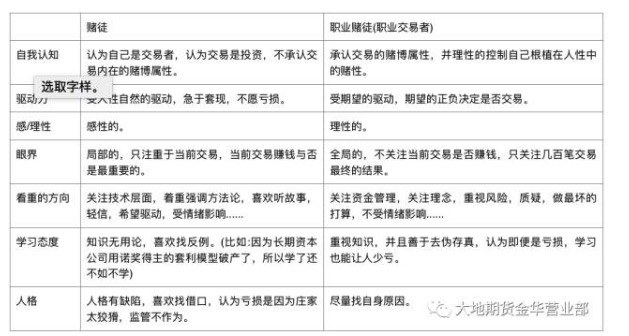

Here, I'm going to define two terms: one is a professional gambler (or professional trader), and the other is a gambler, whose significant difference is the direction of the expected curve.

There is also a category, we call for the time being, the typical state of the hypocritical professional shareholder, the hypocritical professional shareholder: at 9 o'clock in the morning, sitting in front of the computer, according to the graph or experience of trading, a little bit more experienced people, set a stop loss price, more people, after buying it, wait for the arrangement of fate, and after the purchase, they are ready, at a loss, year after year, and start all over again.

The difference between them is as follows:

The most ironic is that gamblers do not recognize the gambling nature of the transaction, but that they do not recognize the gambling nature of the transaction.

In fact, this is also the difference between professional gamblers and gamblers, professional gamblers are able to control human nature and overcome resilience; while gamblers are controlled by humanity and are governed by resilience. I have more admiration for professional gamblers because professional gamblers have broken away from the nature of resilience, they are the elite in the financial markets who can choose from a hundred to be profitable, many of the top hedge fund managers abroad are Texas poker masters, they solve all gambling problems, including transactions, by means of probability.

However, the difficulty of the transaction is greater than that of gambling, mainly due to two things: the uncertainty of the odds and the latency of the timing.

In gambling, the odds are almost certain, as long as you bet $1 each time, you will lose at most $1 but the trade is not. In the case of stocks, many stocks are initially almost unstable and then suddenly fluctuate significantly, in other words, it is the market's size that is not easy to fit into a linear model, this situation is also called the thick tail of the financial market, the more difficult the market, its fluctuations are closer to random, and the greater the change in the volatility rate, and there is also the liquidity risk of extreme situations of jumping over and slumping, these factors lead to the uncertainty of the odds.

The delay in trading timeliness is also a very noteworthy aspect, the results of gambling will be displayed in no more than a few minutes at most, while the trades will not. A long-term trend tracking system can take several years, which is very testing the patience of people, even if you have an expected positive trading system, few people are able to hold on to the system all the time, especially when making money, do not underestimate this, because premature settlement leads to a change in the odds, eventually making the weak advantage disappear.

The above two factors are the main factors that make trading more difficult than gambling in general, and they all work on the human nature. Many technical analysts and people who are struggling to find ways do not understand that many ways can make money, but they do not get past the human link, do not make consistency, the direction of their research may have emerged from a fundamental error.

I am not going to deliberately ignore the trading method, any system is based on the trading method. However, the trading concept is not solved well, and no better way to make a profit, just give you a system: wear more MA20 on MA5, instead of doing nothing, do you think you can make money?

So, solving the problem of consistency is one of the goals of this book, but here I want to give a preliminary conclusion, which is that consistency is extremely difficult to achieve, not difficult, it is extremely difficult, where difficult, I will try to explain later.

Translated from Mainland Futures Binhua

- How to determine the failure of a procedural transaction model

- BitMEX exchange API note BitMEX exchange API terms of use

- Extreme trading in trend trading exposed

- How to use code to fine-tune the filter feedback system to set the filter by default

- High frequency strategy

- The classic mistakes newcomers make when making options

- How Bitcoin's High-Frequency Harvester Strategy 1 was implemented

- Understanding the various stakeholders in the futures market

- The trend is backtracking.

- Three graphs to understand machine learning: basic concepts, five genres and nine common algorithms

- 2.14 How to call an exchange's API

- What do you think of the latest Ethereum and Ethereum platforms?

- null

- Six tips to keep your futures safe overnight

- The gold standard for overnight futures trading (trend trading)

- Playing games

- The Mystery of Leisure

- Sharp is 0.6, should we throw it out?

- How to make money with options strategies, someone finally told us!

- Voting is not a matter of time and strategy.