A simple demonstration of moving averages using the curve.

Author: Goodness, Created: 2019-07-04 14:05:46, Updated: 2023-10-25 19:57:53

Double moving average strategy, by establishing m-day and n-day moving averages, the two moving averages must have a crossing point during the price movement. If m>n, then the n-day moving average is the upward crossing point. The m-day moving average is the buy point, and vice versa. The strategy is based on the intersection of different cyclical moving averages, capturing the strong weak moments of the trade mark, and executing the trade.

We will now use the Commodity Futures Screw Steel Index over the past year as a daily K-line data source. Let's see the strength of the moving average.

如果交易标的是数字货币,以下代码基本不用改动任何地方,只需要把交易标的在发明者量化平台设置成你想要交易的数字货币交易对,然后选好交易所即可。

The single moving average strategy

A single moving average can also be used as a trading strategy. In fact, it is a variant of a double moving average. The current price will be treated as another moving average.

MA5^^MA(C, 5);

CROSS(C, MA5), BK;

CROSSDOWN(C, MA5), SP;

AUTOFILTER;

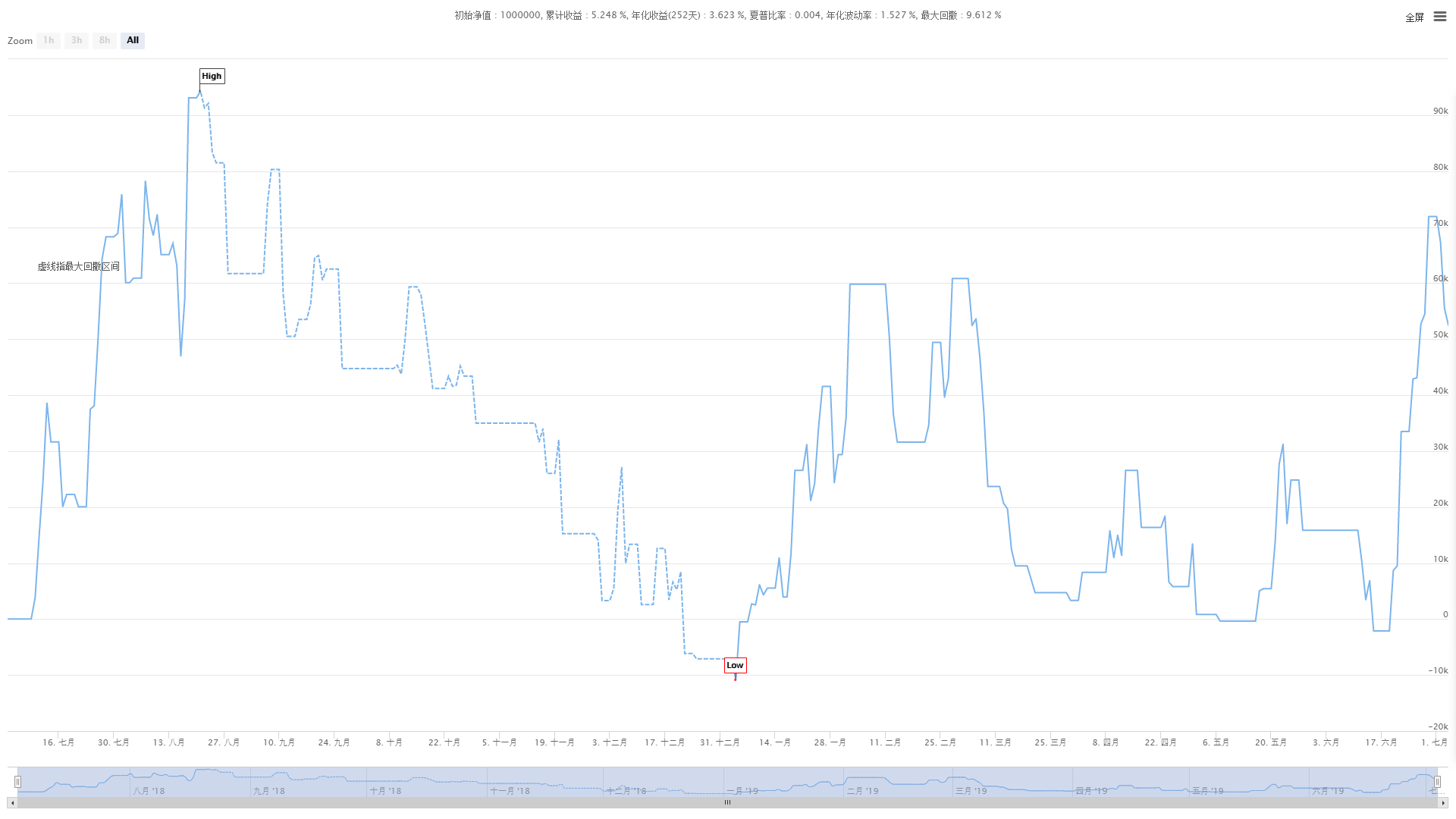

The above is a simple open and close strategy based on a single-root equation. The results of the retest are shown below. Although it looks good, the results are bad when you consider the slippage and commission fees.

The double moving average strategy

MA5:=MA(CLOSE,5);

MA10:=MA(CLOSE,10);

CROSS(MA5,MA10),BK;

CROSSDOWN(MA5,MA10),BP;

CROSS(MA10,MA5),SK;

CROSSDOWN(MA10,MA5),SP;

AUTOFILTER;

This simple strategy, with no optimization, results in the following:

Slight improvement in the double moving average strategy

MA5:=MA(CLOSE,5);

MA10:=MA(CLOSE,10);

CROSS(MA5,MA10)&&MA10>REF(MA10,1)&&REF(MA10,1)>REF(MA10,2)&&MA5>REF(MA5,1)&&REF(MA5,1)>REF(MA5,2),BK;

CROSSDOWN(MA5,MA10),BP;

CROSS(MA10,MA5)&&MA10<REF(MA10,1)&&REF(MA10,1)<REF(MA10,2)&&MA5<REF(MA5,1)&&REF(MA5,1)<REF(MA5,2),SK;

CROSSDOWN(MA10,MA5),SP;

AUTOFILTER;

Confirmation conditions are added here compared to the original strategy. For example, if the strategy wants to do more, ask for MA10 and MA5 to be in an uptrend in the last two periods, filter out some recurring short-term signals and raise the median rate.

The final results of the retest were good.

Moving average deviation strategy

MA1:=EMA(C,33)-EMA(C,60);//计算33周期和60周期指数之间的平均差值为MA1

MA2:=EMA(MA1,9);//计算9周期MA1指数的平均值

MA3:=MA1-MA2;//计算MA1和MA2之间的差异为MA3

MA4:=(MA(MA3,3)*3-MA3)/2;//计算MA3的3周期和MA3的一半的平均值的3倍的差值

MA3>MA4&&C>=REF(C,1),BPK;//当MA3大于MA4且收盘价不低于前一K线的收盘价时,平仓和开仓多头。

MA3<MA4&&C<=REF(C,1),SPK;//当MA3小于MA4且收盘价不大于前一K线的收盘价时,平仓和开仓空头。

AUTOFILTER;

What is the result of long-short-term averages decreasing in moving averages? Strategic research relies on this continuous attempt. MA4 is actually the average of the first two periods of MA3.

When the current value of the MA3 is greater than the average of the previous two periods, do more, which increases the filtering conditions for the current price to be greater than the previous K-line closing price, which increases the median quotation rate.

The effect of eliminating this condition was almost nonexistent. Specific retest results were as follows:

Three strategies for moving averages

Using double moving averages, we naturally think of the results of three moving averages, three moving averages with more filtering conditions.

MA1: MA(C, 10);

MA2: MA(C, 30);

MA3: MA(C, 90);

MA1>MA2&&MA2>MA3, BPK;

MA1<MA2&&MA2<MA3, SPK;

AUTOFILTER;

The following is the source code of the simplest three-line moving average strategies, short, medium and long-term averages, which are used to satisfy the following conditions: short > medium, medium > long term.

By introducing these five strategies, we can see how the straight-line strategy has evolved. A single moving average strategy is easily triggered repeatedly. It is necessary to add filtering conditions. Different conditions produce different strategies, but the nature of the moving average strategy does not change.

Using these strategies as examples, it is estimated that readers can easily motivate themselves to improve their own mobile average strategies.

- Quantifying Fundamental Analysis in the Cryptocurrency Market: Let Data Speak for Itself!

- Quantified research on the basics of coin circles - stop believing in all kinds of crazy professors, data is objective!

- The inventor of the Quantitative Data Exploration Module, an essential tool in the field of quantitative trading.

- Mastering Everything - Introduction to FMZ New Version of Trading Terminal (with TRB Arbitrage Source Code)

- Get all the details about the new FMZ trading terminal (with the TRB suite source code)

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (II)

- How to Exploit Brainless Selling Bots with a High-Frequency Strategy in 80 Lines of Code

- FMZ quantification: common demands on the cryptocurrency market design example analysis (II)

- How to exploit brainless robots for sale with high-frequency strategies of 80 lines of code

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (I)

- FMZ quantification: common demands of the cryptocurrency market design instance analysis (1)