Deribit options Delta is a dynamic hedging strategy

Author: The Little Dream, Created: 2021-03-26 11:18:53, Updated: 2023-09-24 19:38:01

Deribit options Delta is a dynamic hedging strategy

The strategy of this FMZ quantification is:Deribit options Delta is a dynamic hedging strategyThis is known as the dynamic delta hedging (DDH) strategy.

In order to learn options trading, we usually need to master these concepts:

-

Option pricing model, B-S model, option price is determined by the price fluctuation of the item, the leverage fluctuation, the expiry remaining time fluctuation, the implied volatility fluctuation, the risk-free interest rate fluctuation.

-

The risk of options:

- The directional risk of the Delta option. If the Delta is +0.50, the option is treated as a 0.50 spot if the gain or loss on the price falls.

- The acceleration of risk in the direction of the Gamma curve. For example, a bullish option, due to the action of Gamma, starts from the price of the index at the price of the trading position, and the Delta will rise gradually from +0.50 to +1.00 as the price rises.

- Theta leverage time leverage. When you buy an option, if the quoted price does not move, you will pay the fee indicated in the theta amount ("Deribit in USD") every day. When you sell the option, if the price of the option does not move, you will receive the fee indicated in the Theta amount every other day.

- Vega Curve Volatility cap. When you buy an option, the Vega is positive, i.e. it has a high volatility. When the implied volatility increases, you will gain at the Vega cap. Conversely, when you sell the option, the implied volatility decreases, you will gain.

DDH explains its strategy:

-

The DDH Principle explained The risk neutrality of the direction of trade is achieved by aligning the options and futures deltas. Since the options deltas are variable and follow the price changes of the indices, the futures and spot deltas are constant. After holding options contract positions and matching them with a futures hedge delta, the overall delta will again be unbalanced as the price of the underlying changes. A continuous dynamic hedge delta is required for a combination of options and futures positions.

For example: When we buy a bear option, we hold a bear position; this is when we need to hedge the option delta with a blank futures to achieve overall delta neutrality ((0 or close to 0)). We don't take into account the remaining time of the option contract, the volatility rate and other factors. The first scenario: The price of the underlying asset rises, the delta of the option portion increases, the overall delta moves to the positive number, the futures need to be hedged again, and the opening of a portion of the blank position continues to be a blank futures, bringing the overall delta back into balance. (Before rebalancing, the delta of the option is large, the delta of the futures is relatively small, and the marginal gains of the options outweigh the marginal losses of the contract blank, and the entire portfolio gains)

Situation two: Commodity prices fell, the options part of the delta decreased, the overall delta moved negative, and some of the futures holdings of the blank heads of the equation leveled off, bringing the overall delta back into balance. (Before rebalancing again, the delta of the option is small, the delta of the futures is relatively large, and the marginal loss of the options is less than the marginal gain of the contract blank, and the entire portfolio will still have gains)

So ideally, a fall in the price of a commodity will bring a profit, as long as the market is volatile.

However, there are also factors to consider: time value, transaction costs, etc.

So I quote from the explanation of the cow:

Gamma Scalping 的关注点并不是delta,dynamic delta hedging 只是过程中规避underlying价格风险的一种做法而已。 Gamma Scalping 关注的是Alpha,此Alpha不是选股的Alpha,这里的Alpha = Gamma/Theta也就是单位Theta的时间损耗换来多少Gamma, 这个是关注的点。可以构建出上涨和下跌都浮盈的组合,但一定伴随时间损耗,那问题就在于性价比了。 作者:许哲 链接:https://www.zhihu.com/question/51630805/answer/128096385

DDH explains its strategy

- Aggregate market interface packaging, frame design

- Strategic UI design

- Strategic interaction design

- Automatic hedging feature design

This is a video of the incident.

// 构造函数

function createManager(e, subscribeList, msg) {

var self = {}

self.supportList = ["Futures_Binance", "Huobi", "Futures_Deribit"] // 支持的交易所的

// 对象属性

self.e = e

self.msg = msg

self.name = e.GetName()

self.type = self.name.includes("Futures_") ? "Futures" : "Spot"

self.label = e.GetLabel()

self.quoteCurrency = ""

self.subscribeList = subscribeList // subscribeList : [strSymbol1, strSymbol2, ...]

self.tickers = [] // 接口获取的所有行情数据,定义数据格式:{bid1: 123, ask1: 123, symbol: "xxx"}}

self.subscribeTickers = [] // 需要的行情数据,定义数据格式:{bid1: 123, ask1: 123, symbol: "xxx"}}

self.accData = null

self.pos = null

// 初始化函数

self.init = function() {

// 判断是否支持该交易所

if (!_.contains(self.supportList, self.name)) {

throw "not support"

}

}

self.setBase = function(base) {

// 切换基地址,用于切换为模拟盘

self.e.SetBase(base)

Log(self.name, self.label, "切换为模拟盘:", base)

}

// 判断数据精度

self.judgePrecision = function (p) {

var arr = p.toString().split(".")

if (arr.length != 2) {

if (arr.length == 1) {

return 0

}

throw "judgePrecision error, p:" + String(p)

}

return arr[1].length

}

// 更新资产

self.updateAcc = function(callBackFuncGetAcc) {

var ret = callBackFuncGetAcc(self)

if (!ret) {

return false

}

self.accData = ret

return true

}

// 更新持仓

self.updatePos = function(httpMethod, url, params) {

var pos = self.e.IO("api", httpMethod, url, params)

var ret = []

if (!pos) {

return false

} else {

// 整理数据

// {"jsonrpc":"2.0","result":[],"usIn":1616484238870404,"usOut":1616484238870970,"usDiff":566,"testnet":true}

try {

_.each(pos.result, function(ele) {

ret.push(ele)

})

} catch(err) {

Log("错误:", err)

return false

}

self.pos = ret

}

return true

}

// 更新行情数据

self.updateTicker = function(url, callBackFuncGetArr, callBackFuncGetTicker) {

var tickers = []

var subscribeTickers = []

var ret = self.httpQuery(url)

if (!ret) {

return false

}

// Log("测试", ret)// 测试

try {

_.each(callBackFuncGetArr(ret), function(ele) {

var ticker = callBackFuncGetTicker(ele)

tickers.push(ticker)

if (self.subscribeList.length == 0) {

subscribeTickers.push(ticker)

} else {

for (var i = 0 ; i < self.subscribeList.length ; i++) {

if (self.subscribeList[i] == ticker.symbol) {

subscribeTickers.push(ticker)

}

}

}

})

} catch(err) {

Log("错误:", err)

return false

}

self.tickers = tickers

self.subscribeTickers = subscribeTickers

return true

}

self.getTicker = function(symbol) {

var ret = null

_.each(self.subscribeTickers, function(ticker) {

if (ticker.symbol == symbol) {

ret = ticker

}

})

return ret

}

self.httpQuery = function(url) {

var ret = null

try {

var retHttpQuery = HttpQuery(url)

ret = JSON.parse(retHttpQuery)

} catch (err) {

// Log("错误:", err)

ret = null

}

return ret

}

self.returnTickersTbl = function() {

var tickersTbl = {

type : "table",

title : "tickers",

cols : ["symbol", "ask1", "bid1"],

rows : []

}

_.each(self.subscribeTickers, function(ticker) {

tickersTbl.rows.push([ticker.symbol, ticker.ask1, ticker.bid1])

})

return tickersTbl

}

// 返回持仓表格

self.returnPosTbl = function() {

var posTbl = {

type : "table",

title : "pos|" + self.msg,

cols : ["instrument_name", "mark_price", "direction", "size", "delta", "index_price", "average_price", "settlement_price", "average_price_usd", "total_profit_loss"],

rows : []

}

/* 接口返回的持仓数据格式

{

"mark_price":0.1401105,"maintenance_margin":0,"instrument_name":"BTC-25JUN21-28000-P","direction":"buy",

"vega":5.66031,"total_profit_loss":0.01226105,"size":0.1,"realized_profit_loss":0,"delta":-0.01166,"kind":"option",

"initial_margin":0,"index_price":54151.77,"floating_profit_loss_usd":664,"floating_profit_loss":0.000035976,

"average_price_usd":947.22,"average_price":0.0175,"theta":-7.39514,"settlement_price":0.13975074,"open_orders_margin":0,"gamma":0

}

*/

_.each(self.pos, function(ele) {

if(ele.direction != "zero") {

posTbl.rows.push([ele.instrument_name, ele.mark_price, ele.direction, ele.size, ele.delta, ele.index_price, ele.average_price, ele.settlement_price, ele.average_price_usd, ele.total_profit_loss])

}

})

return posTbl

}

self.returnOptionTickersTbls = function() {

var arr = []

var arrDeliveryDate = []

_.each(self.subscribeTickers, function(ticker) {

if (self.name == "Futures_Deribit") {

var arrInstrument_name = ticker.symbol.split("-")

var currency = arrInstrument_name[0]

var deliveryDate = arrInstrument_name[1]

var deliveryPrice = arrInstrument_name[2]

var optionType = arrInstrument_name[3]

if (!_.contains(arrDeliveryDate, deliveryDate)) {

arr.push({

type : "table",

title : arrInstrument_name[1],

cols : ["PUT symbol", "ask1", "bid1", "mark_price", "underlying_price", "CALL symbol", "ask1", "bid1", "mark_price", "underlying_price"],

rows : []

})

arrDeliveryDate.push(arrInstrument_name[1])

}

// 遍历arr

_.each(arr, function(tbl) {

if (tbl.title == deliveryDate) {

if (tbl.rows.length == 0 && optionType == "P") {

tbl.rows.push([ticker.symbol, ticker.ask1, ticker.bid1, ticker.mark_price, ticker.underlying_price, "", "", "", "", ""])

return

} else if (tbl.rows.length == 0 && optionType == "C") {

tbl.rows.push(["", "", "", "", "", ticker.symbol, ticker.ask1, ticker.bid1, ticker.mark_price, ticker.underlying_price])

return

}

for (var i = 0 ; i < tbl.rows.length ; i++) {

if (tbl.rows[i][0] == "" && optionType == "P") {

tbl.rows[i][0] = ticker.symbol

tbl.rows[i][1] = ticker.ask1

tbl.rows[i][2] = ticker.bid1

tbl.rows[i][3] = ticker.mark_price

tbl.rows[i][4] = ticker.underlying_price

return

} else if(tbl.rows[i][5] == "" && optionType == "C") {

tbl.rows[i][5] = ticker.symbol

tbl.rows[i][6] = ticker.ask1

tbl.rows[i][7] = ticker.bid1

tbl.rows[i][8] = ticker.mark_price

tbl.rows[i][9] = ticker.underlying_price

return

}

}

if (optionType == "P") {

tbl.rows.push([ticker.symbol, ticker.ask1, ticker.bid1, ticker.mark_price, ticker.underlying_price, "", "", "", "", ""])

} else if(optionType == "C") {

tbl.rows.push(["", "", "", "", "", ticker.symbol, ticker.ask1, ticker.bid1, ticker.mark_price, ticker.underlying_price])

}

}

})

}

})

return arr

}

// 初始化

self.init()

return self

}

function main() {

// 初始化,清空日志

if(isResetLog) {

LogReset(1)

}

var m1 = createManager(exchanges[0], [], "option")

var m2 = createManager(exchanges[1], ["BTC-PERPETUAL"], "future")

// 切换为模拟盘

var base = "https://www.deribit.com"

if (isTestNet) {

m1.setBase(testNetBase)

m2.setBase(testNetBase)

base = testNetBase

}

while(true) {

// 期权

var ticker1GetSucc = m1.updateTicker(base + "/api/v2/public/get_book_summary_by_currency?currency=BTC&kind=option",

function(data) {return data.result},

function(ele) {return {bid1: ele.bid_price, ask1: ele.ask_price, symbol: ele.instrument_name, underlying_price: ele.underlying_price, mark_price: ele.mark_price}})

// 永续期货

var ticker2GetSucc = m2.updateTicker(base + "/api/v2/public/get_book_summary_by_currency?currency=BTC&kind=future",

function(data) {return data.result},

function(ele) {return {bid1: ele.bid_price, ask1: ele.ask_price, symbol: ele.instrument_name}})

if (!ticker1GetSucc || !ticker2GetSucc) {

Sleep(5000)

continue

}

// 更新持仓

var pos1GetSucc = m1.updatePos("GET", "/api/v2/private/get_positions", "currency=BTC&kind=option")

var pos2GetSucc = m2.updatePos("GET", "/api/v2/private/get_positions", "currency=BTC&kind=future")

if (!pos1GetSucc || !pos2GetSucc) {

Sleep(5000)

continue

}

// 交互

var cmd = GetCommand()

if(cmd) {

// 处理交互

Log("交互命令:", cmd)

var arr = cmd.split(":")

// cmdClearLog

if(arr[0] == "setContractType") {

// parseFloat(arr[1])

m1.e.SetContractType(arr[1])

Log("exchanges[0]交易所对象设置合约:", arr[1])

} else if (arr[0] == "buyOption") {

var actionData = arr[1].split(",")

var price = parseFloat(actionData[0])

var amount = parseFloat(actionData[1])

m1.e.SetDirection("buy")

m1.e.Buy(price, amount)

Log("执行价格:", price, "执行数量:", amount, "执行方向:", arr[0])

} else if (arr[0] == "sellOption") {

var actionData = arr[1].split(",")

var price = parseFloat(actionData[0])

var amount = parseFloat(actionData[1])

m1.e.SetDirection("sell")

m1.e.Sell(price, amount)

Log("执行价格:", price, "执行数量:", amount, "执行方向:", arr[0])

} else if (arr[0] == "setHedgeDeltaStep") {

hedgeDeltaStep = parseFloat(arr[1])

Log("设置参数hedgeDeltaStep:", hedgeDeltaStep)

}

}

// 获取期货合约价格

var perpetualTicker = m2.getTicker("BTC-PERPETUAL")

var hedgeMsg = " PERPETUAL:" + JSON.stringify(perpetualTicker)

// 从账户数据中获取delta总值

var acc1GetSucc = m1.updateAcc(function(self) {

self.e.SetCurrency("BTC_USD")

return self.e.GetAccount()

})

if (!acc1GetSucc) {

Sleep(5000)

continue

}

var sumDelta = m1.accData.Info.result.delta_total

if (Math.abs(sumDelta) > hedgeDeltaStep && perpetualTicker) {

if (sumDelta < 0) {

// delta 大于0 对冲期货做空

var amount = _N(Math.abs(sumDelta) * perpetualTicker.ask1, -1)

if (amount > 10) {

Log("超过对冲阈值,当前总delta:", sumDelta, "买入期货")

m2.e.SetContractType("BTC-PERPETUAL")

m2.e.SetDirection("buy")

m2.e.Buy(-1, amount)

} else {

hedgeMsg += ", 对冲下单量小于10"

}

} else {

// delta 小于0 对冲期货做多

var amount = _N(Math.abs(sumDelta) * perpetualTicker.bid1, -1)

if (amount > 10) {

Log("超过对冲阈值,当前总delta:", sumDelta, "卖出期货")

m2.e.SetContractType("BTC-PERPETUAL")

m2.e.SetDirection("sell")

m2.e.Sell(-1, amount)

} else {

hedgeMsg += ", 对冲下单量小于10"

}

}

}

LogStatus(_D(), "sumDelta:", sumDelta, hedgeMsg,

"\n`" + JSON.stringify([m1.returnPosTbl(), m2.returnPosTbl()]) + "`", "\n`" + JSON.stringify(m2.returnTickersTbl()) + "`", "\n`" + JSON.stringify(m1.returnOptionTickersTbls()) + "`")

Sleep(10000)

}

}

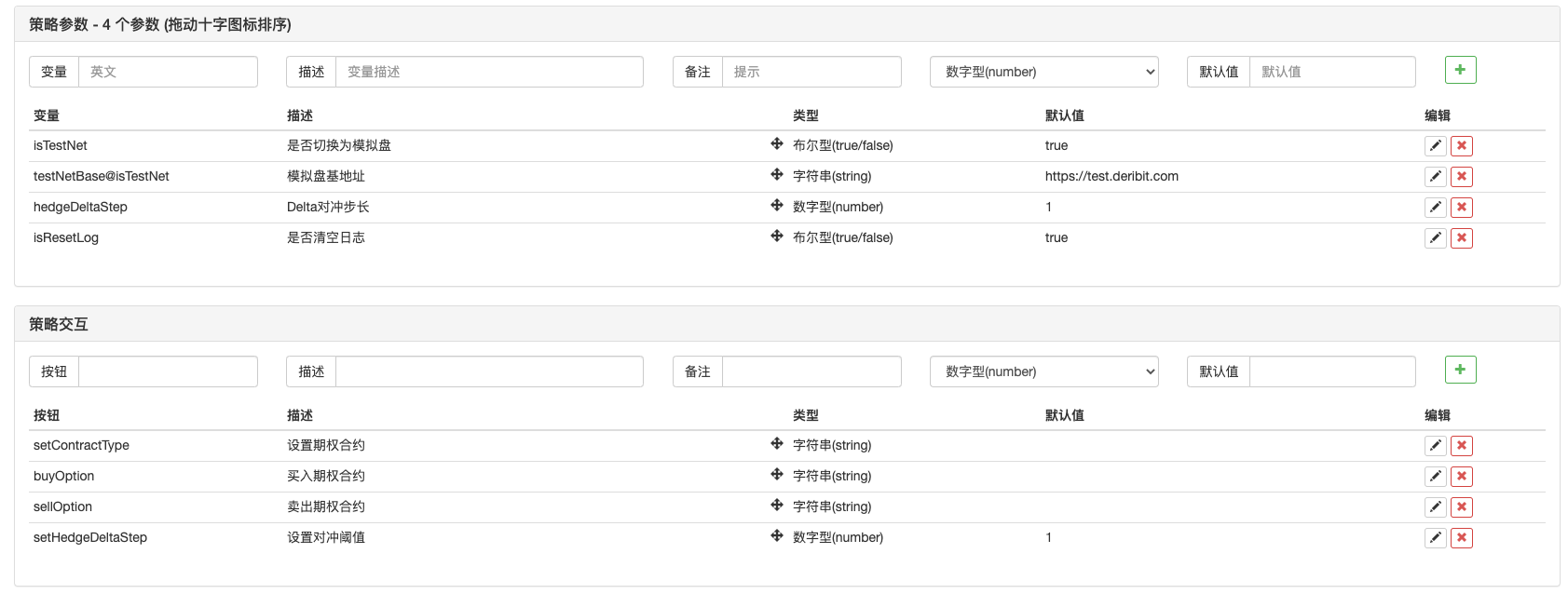

The policy parameters:

The policy address:https://www.fmz.com/strategy/265090

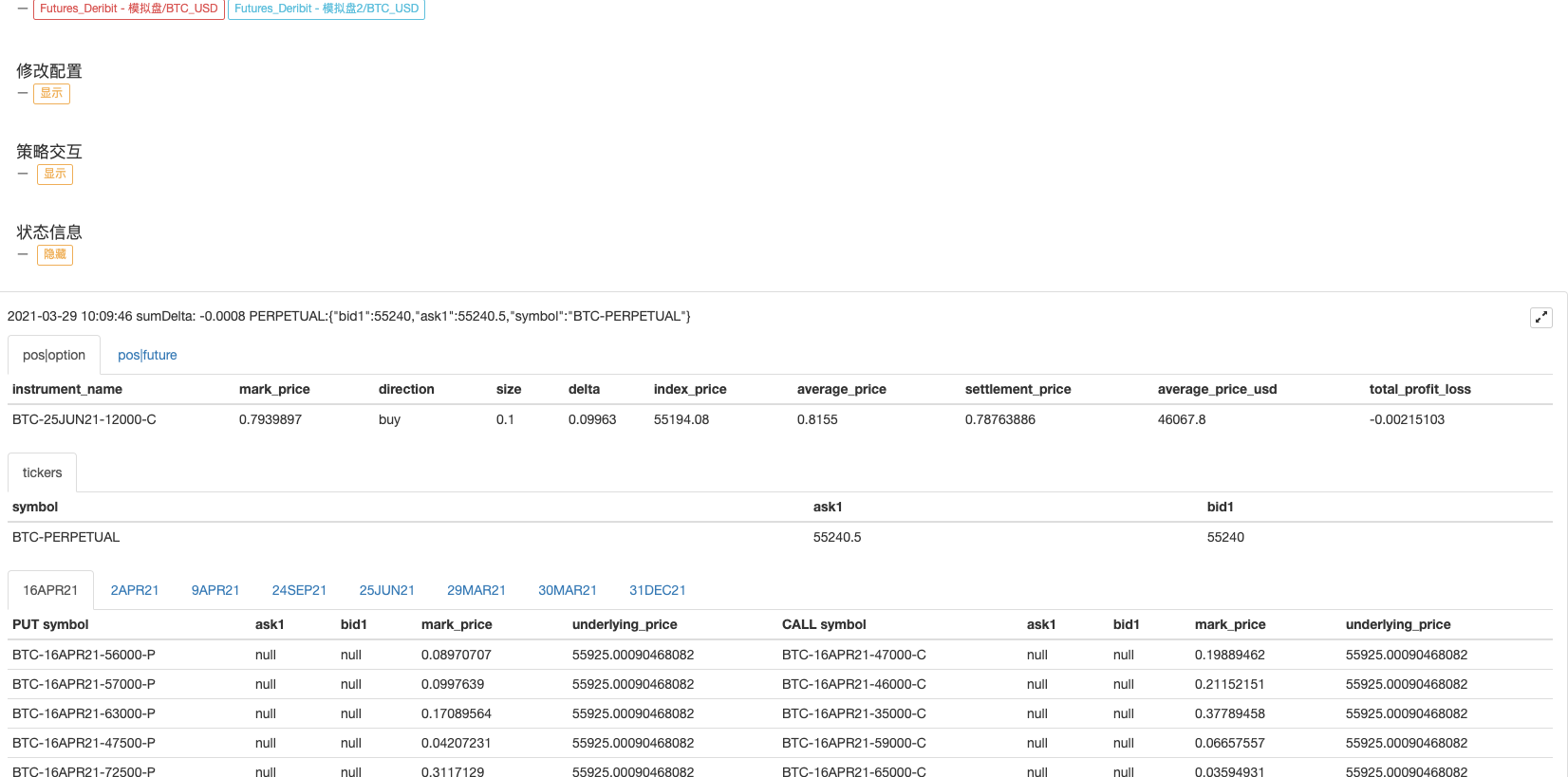

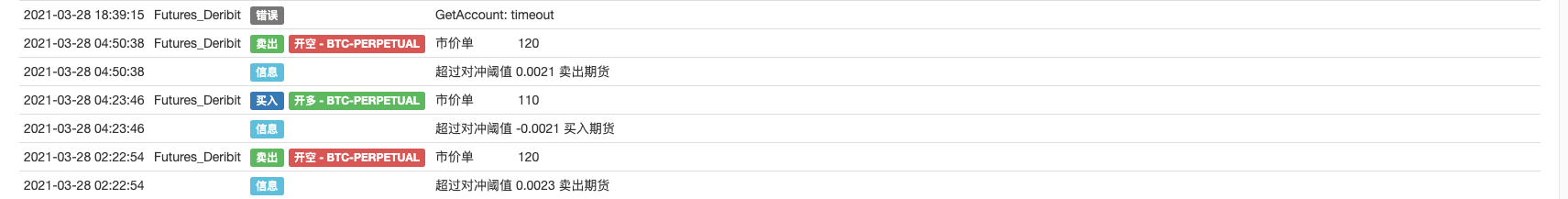

The strategy works:

This strategy is for teaching, learning and use with caution.

- Quantifying Fundamental Analysis in the Cryptocurrency Market: Let Data Speak for Itself!

- Quantified research on the basics of coin circles - stop believing in all kinds of crazy professors, data is objective!

- The inventor of the Quantitative Data Exploration Module, an essential tool in the field of quantitative trading.

- Mastering Everything - Introduction to FMZ New Version of Trading Terminal (with TRB Arbitrage Source Code)

- Get all the details about the new FMZ trading terminal (with the TRB suite source code)

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (II)

- How to Exploit Brainless Selling Bots with a High-Frequency Strategy in 80 Lines of Code

- FMZ quantification: common demands on the cryptocurrency market design example analysis (II)

- How to exploit brainless robots for sale with high-frequency strategies of 80 lines of code

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (I)

- FMZ quantification: common demands of the cryptocurrency market design instance analysis (1)

- Build inventor quantified databases with SQLite

- Build a multi-variety strategy with an aggregated market interface using a digital currency exchange

fantadongCan this be used on a real disk?

The trajectory of lifeDeribit, as if you've heard, is an exchange?

The Little DreamThis can be designed to specifically modify the policy code.

fantadongIs it possible to set a price range, for example, to exceed a certain price to do ddh

The Little DreamHello, the strategy is for teaching, testing and you can modify it on your own.

The Little DreamYes, blockchain asset derivatives exchanges, the most specialized options exchanges in the coin world.