C++ futures high-frequency suite currency policy OKEX Websocket version

Author: The Little Dream, Date: 2019-08-24 13:54:04Tags: C++HedgeWebscoket

C++ futures high-frequency suite currency policy OKEX Websocket version

The Strategic Principles

The strategy is very simple, the OKEX contract cross-term hedge, position control design, is designed as a spread grid hedge. The strategy defines two contracts, contract A, contract B. The contract can be set to different contract codes and hedged. For example, set A as a quarterly contract and B as a weekly contract (you can also set A as a short-term contract and B as a long-term contract, otherwise the opposite is the case). Hedging operations are divided into do empty A contracts (quarterly) and do multiple B contracts (similar to do empty long-term contracts in commodity futures, do multiple short-term contracts, and do the main set) Do multiple A contracts, do blank B contracts (similar to commodity futures short term, how long term, reverse)

-

Design features

-

Code language The strategy is to write code using C++ language, which has a high speed performance advantage.

-

It's driven by: The market is driven by the use of the OKEX websocket interface to accept the market pushed by the exchange, the latest market access is more timely, the market data uses less data volume, real-time tick data, and the market data is more efficient. For tick data, the strategy specifically constructed a K-line generator to synthesize the K-line for the contract difference calculated from the tick data obtained. Opening and closing positions for strategic hedging operations are driven by the data generated by the K-line generator class object.

-

Position control Position control is controlled by using a hedged position ratio similar to a "Boffinach" number line. The greater the spread, the greater the amount of leverage hedging, and the more diversified the position, so as to capture the small and large positions.

-

Holding: Stop the loss and stop the rise In the case of a fixed stop-loss spread, the stop-loss spread. Holding the spread until the leverage position is reached, the stop loss position is stopped, the stop loss position is done.

-

In and out of the market, cycle design Parameters NPeriod The period controlled by NPeriod exercises some dynamic control over the strategy's open positions.

-

Position balancing system, order detection system The strategy has a dedicated system of regular checks and balances. The order detection system.

-

Strategic expansion The strategy code design has a low coupling and can be extended to commodity futures hedging, or further optimized and modified.

-

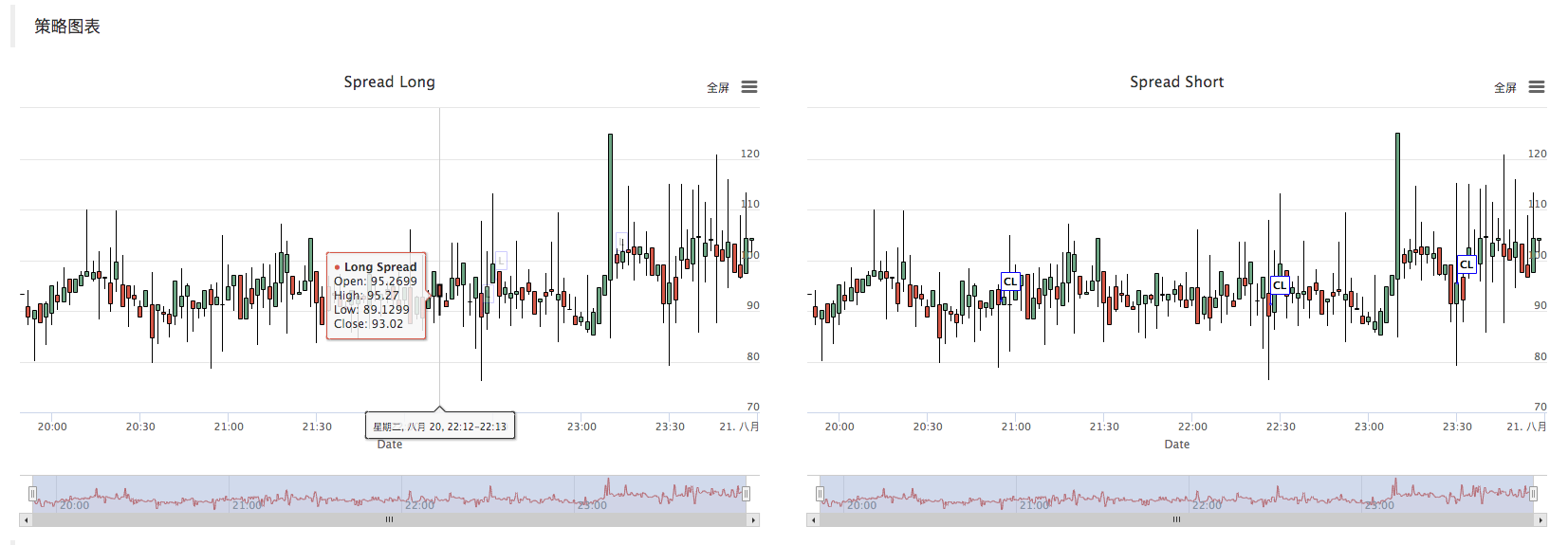

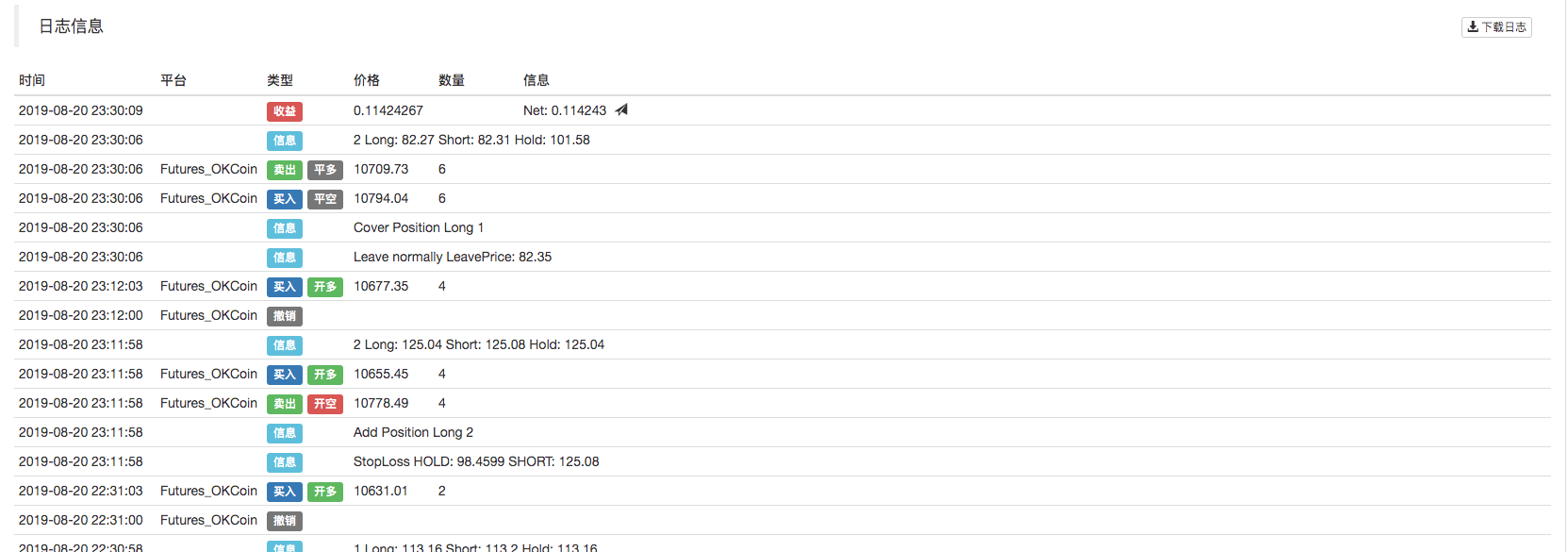

Strategy chart The strategy automatically generates a K-line chart of the spread, marking the relevant transaction information.

-

-

Reassessment

/*backtest

start: 2019-07-22 00:00:00

end: 2019-08-21 00:00:00

period: 1m

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD","stocks":0.1,"fee":[0.02,0.05]}]

args: [["InstrumentB","quarter"],["NPeriod",200],["LeavePeriod",100],["AddMax",3],["StopLoss",20],["StopWin",50],["OpenAmount",2]]

*/

enum State {

STATE_NA,

STATE_IDLE,

STATE_HOLD_LONG,

STATE_HOLD_SHORT,

};

string replace(string s, const string from, const string& to) {

if(!from.empty())

for(size_t pos = 0; (pos = s.find(from, pos)) != std::string::npos; pos += to.size())

s.replace(pos, from.size(), to);

return s;

}

class BarFeeder {

public:

BarFeeder(int period) : _period(period) {

_rs.Valid = true;

}

void feed(double price, Chart *c=nullptr, int chartIdx=0) {

uint64_t epoch = uint64_t(Unix() / _period) * _period * 1000;

bool newBar = false;

if (_rs.size() == 0 || _rs[_rs.size()-1].Time < epoch) {

Record r;

r.Time = epoch;

r.Open = r.High = r.Low = r.Close = price;

_rs.push_back(r);

if (_rs.size() > 2000) {

_rs.erase(_rs.begin());

}

newBar = true;

} else {

Record &r = _rs[_rs.size() - 1];

r.High = max(r.High, price);

r.Low = min(r.Low, price);

r.Close = price;

}

auto bar = _rs[_rs.size()-1];

json point = {bar.Time, bar.Open, bar.High, bar.Low, bar.Close};

if (c != nullptr) {

if (newBar) {

c->add(chartIdx, point);

c->reset(1000);

} else {

c->add(chartIdx, point, -1);

}

}

}

Records & get() {

return _rs;

}

private:

int _period;

Records _rs;

};

class Hedge {

public:

Hedge() {

_isCover = true;

_needCheckOrder = true;

_st = STATE_NA;

for (int i = 0; i < AddMax + 1; i++) {

if (_addArr.size() < 2) {

_addArr.push_back((i+1)*OpenAmount);

}

_addArr.push_back(_addArr[_addArr.size()-1] + _addArr[_addArr.size()-2]);

}

_cfgStr = R"EOF(

[{

"extension": { "layout": "single", "col": 6, "height": "500px"},

"rangeSelector": {"enabled": false},

"tooltip": {"xDateFormat": "%Y-%m-%d %H:%M:%S, %A"},

"plotOptions": {"candlestick": {"color": "#d75442", "upColor": "#6ba583"}},

"chart":{"type":"line"},

"title":{"text":"Spread Long"},

"xAxis":{"title":{"text":"Date"}},

"series":[

{"type":"candlestick", "name":"Long Spread","data":[], "id":"dataseriesA"},

{"type":"flags","data":[], "onSeries": "dataseriesA"}

]

},

{

"extension": { "layout": "single", "col": 6, "height": "500px"},

"rangeSelector": {"enabled": false},

"tooltip": {"xDateFormat": "%Y-%m-%d %H:%M:%S, %A"},

"plotOptions": {"candlestick": {"color": "#d75442", "upColor": "#6ba583"}},

"chart":{"type":"line"},

"title":{"text":"Spread Short"},

"xAxis":{"title":{"text":"Date"}},

"series":[

{"type":"candlestick", "name":"Long Spread","data":[], "id":"dataseriesA"},

{"type":"flags","data":[], "onSeries": "dataseriesA"}

]

}

]

)EOF";

_c.update(_cfgStr);

_c.reset();

};

State getState(string &symbolA, Depth &depthA, string &symbolB, Depth &depthB) {

if (!_needCheckOrder && _st != STATE_NA) {

return _st;

}

//Log("sync orders");

auto orders = exchange.GetOrders();

if (!orders.Valid) {

return STATE_NA;

}

if (orders.size() > 0) {

for (auto &order : orders) {

exchange.CancelOrder(order.Id);

}

return STATE_NA;

}

Sleep(500);

//Log("sync positions");

auto positions = exchange.GetPosition();

if (!positions.Valid) {

return STATE_NA;

}

// cache orders and positions;

_needCheckOrder = false;

if (positions.size() == 0) {

//Log("Position is empty");

return STATE_IDLE;

}

State st[2] = {STATE_IDLE, STATE_IDLE};

double holdAmount[2] = {0, 0};

double holdPrice[2] = {};

for (auto &pos : positions) {

int idx = -1;

if (pos.ContractType == symbolA) {

idx = 0;

} else if (pos.ContractType == symbolB) {

idx = 1;

}

if (idx >= 0) {

holdPrice[idx] = pos.Price;

holdAmount[idx] += pos.Amount;

st[idx] = pos.Type == PD_LONG || pos.Type == PD_LONG_YD ? STATE_HOLD_LONG : STATE_HOLD_SHORT;

}

}

if (holdAmount[0] > holdAmount[1]) {

st[1] = STATE_IDLE;

} else if (holdAmount[0] < holdAmount[1]) {

st[0] = STATE_IDLE;

}

if (st[0] != STATE_IDLE && st[1] != STATE_IDLE) {

// update

_holdPrice = _N(holdPrice[1] - holdPrice[0], 4);

_holdAmount = holdAmount[0];

return st[0];

} else if (st[0] == STATE_IDLE && st[1] == STATE_IDLE) {

return STATE_IDLE;

} else {

double amount = abs(holdAmount[0] - holdAmount[1]);

auto idx_fat = st[0] == STATE_IDLE ? 1 : 0;

if (_isCover) {

exchange.SetContractType(st[0] == STATE_IDLE ? symbolB : symbolA);

if (st[idx_fat] == STATE_HOLD_LONG) {

exchange.SetDirection("closebuy");

exchange.Sell((st[0] == STATE_IDLE ? depthB.Bids[0].Price: depthA.Bids[0].Price)-SlidePrice, amount);

} else {

exchange.SetDirection("closesell");

exchange.Buy((st[0] == STATE_IDLE ? depthB.Asks[0].Price : depthA.Asks[0].Price)+SlidePrice, amount);

}

} else {

exchange.SetContractType(st[0] == STATE_IDLE ? symbolA : symbolB);

if (st[idx_fat] == STATE_HOLD_LONG) {

exchange.SetDirection("sell");

exchange.Sell((st[0] == STATE_IDLE ? depthA.Bids[0].Price : depthB.Bids[0].Price)-SlidePrice, amount);

} else {

exchange.SetDirection("buy");

exchange.Buy((st[0] == STATE_IDLE ? depthA.Asks[0].Price : depthB.Asks[0].Price)+SlidePrice, amount);

}

}

_needCheckOrder = true;

return STATE_NA;

}

Log(positions);

Panic("WTF");

}

bool Loop(string &symbolA, Depth &depthA, string &symbolB, Depth &depthB, string extra="") {

_loopCount++;

auto diffLong = _N(depthB.Bids[0].Price - depthA.Asks[0].Price, 4);

auto diffShort = _N(depthB.Asks[0].Price - depthA.Bids[0].Price, 4);

_feederA.feed(diffLong, &_c, 0);

_feederB.feed(diffShort, &_c, 2);

auto barsA = _feederA.get();

auto barsB = _feederB.get();

if (barsA.size() < max(LeavePeriod, NPeriod) + 2) {

LogStatus(_D(), "Calc His", barsA.size());

return true;

}

bool expired = false;

auto seconds = Unix();

if (seconds - _lastCache > 600) {

_needCheckOrder = true;

expired = true;

}

State st = getState(symbolA, depthA, symbolB, depthB);

if (st == STATE_NA) {

return true;

}

if (st == STATE_IDLE) {

_holdPrice = 0;

}

// cache st

_st = st;

if (expired) {

_lastCache = seconds;

}

if (Unix() - seconds > 5) {

Log("skip this tick");

return true;

}

LogStatus(_D(), "State: ", _state_desc[st], "Hold:", _holdPrice, "Long:", diffLong, "Short:", diffShort, "Loop:", _loopCount, extra);

if (st == STATE_IDLE && _isCover) {

auto account = exchange.GetAccount();

if (account.Valid) {

double profit = _N(exchange.GetName() == "Futures_OKCoin" ? account.Stocks + account.FrozenStocks : account.Balance + account.FrozenBalance, 8);

LogProfit(profit, _hedgeCount > 0 ? format("Net: %f @", profit) : "");

}

_isCover = false;

return true;

}

auto ratio = abs(diffLong - diffShort);

bool condOpenLong = (st == STATE_IDLE || st == STATE_HOLD_LONG) && (diffLong - _countOpen * max(1.0, _holdPrice * 0.1)) > TA.Highest(barsA.High(), NPeriod) && _countOpen < AddMax;

bool condOpenShort = (st == STATE_IDLE || st == STATE_HOLD_SHORT) && (diffShort + _countOpen * max(1.0, _holdPrice * 0.1)) < TA.Lowest(barsB.Low(), NPeriod) && _countOpen < AddMax;

bool condCoverLong = false;

bool condCoverShort = false;

bool isLeave = false;

bool isStopLoss = false;

bool isStopWin = false;

if (st == STATE_HOLD_LONG) {

auto leavePrice = (diffShort + _countCover + ratio);

isLeave = leavePrice < TA.Lowest(barsB.Low(), LeavePeriod);

if (!isLeave) {

isStopLoss = diffShort - _holdPrice >= StopLoss;

if (!isStopLoss) {

isStopWin = _holdPrice - diffShort >= StopWin;

if (isStopWin) {

Log("Stop Win", "HOLD:", _holdPrice, "SHORT:", diffShort);

}

} else {

Log("StopLoss", "HOLD:", _holdPrice, "SHORT:", diffShort);

}

} else {

Log("Leave normally", "LeavePrice:", leavePrice);

}

condCoverLong = isLeave || isStopLoss || isStopWin;

} else if (st == STATE_HOLD_SHORT) {

auto leavePrice = (diffLong - _countCover - ratio);

isLeave = leavePrice > TA.Highest(barsA.High(), NPeriod);

if (!isLeave) {

isStopLoss = _holdPrice - diffLong >= StopLoss;

if (!isStopLoss) {

isStopWin = diffLong - _holdPrice >= StopWin;

if (isStopWin) {

Log("Stop Win", "HOLD:", _holdPrice, "LONG:", diffLong);

}

} else {

Log("StopLoss", "HOLD:", _holdPrice, "LONG:", diffLong);

}

} else {

Log("Leave normally", "LeavePrice:", leavePrice);

}

condCoverShort = isLeave || isStopLoss || isStopWin;

}

string action, color;

double opPrice;

int chartIdx = 0;

if (condOpenLong) {

// Must Increase

if (_countOpen > 0 && diffLong <= _holdPrice) {

return STATE_IDLE;

}

_isCover = false;

_countOpen++;

_countCover = 0;

_holdPrice = diffLong;

auto amount = _addArr[_countOpen];

if (_countOpen > 0) {

Log("Add Position Long", _countOpen);

}

exchange.SetContractType(symbolB);

exchange.SetDirection("sell");

exchange.Sell(depthB.Bids[0].Price-SlidePrice, amount);

exchange.SetContractType(symbolA);

exchange.SetDirection("buy");

exchange.Buy(depthA.Asks[0].Price+SlidePrice, amount);

action = "L";

color = "blue";

opPrice = diffLong;

chartIdx = 1;

} else if (condOpenShort) {

// Must Decrease

if (_countOpen > 0 && diffShort >= _holdPrice) {

return STATE_IDLE;

}

_isCover = false;

_countOpen++;

_countCover = 0;

_holdPrice = diffShort;

auto amount = _addArr[_countOpen];

if (_countOpen > 0) {

Log("Add Position Short", _countOpen);

}

exchange.SetContractType(symbolA);

exchange.SetDirection("sell");

exchange.Sell(depthA.Bids[0].Price-SlidePrice, amount);

exchange.SetContractType(symbolB);

exchange.SetDirection("buy");

exchange.Buy(depthB.Asks[0].Price+SlidePrice, amount);

action = "S";

color = "red";

opPrice = diffShort;

chartIdx = 3;

} else if (condCoverLong) {

_isCover = true;

_countOpen = 0;

_countCover++;

_hedgeCount++;

if (_countCover > 0) {

Log("Cover Position Long", _countCover);

}

exchange.SetContractType(symbolB);

exchange.SetDirection("closesell");

exchange.Buy(depthB.Asks[0].Price+SlidePrice, _holdAmount);

exchange.SetContractType(symbolA);

exchange.SetDirection("closebuy");

exchange.Sell(depthA.Bids[0].Price-SlidePrice, _holdAmount);

action = "CL";

color = "blue";

opPrice = diffShort;

chartIdx = 3;

} else if (condCoverShort) {

_hedgeCount++;

_isCover = true;

_countOpen = 0;

_countCover++;

if (_countCover > 0) {

Log("Cover Position Short", _countCover);

}

exchange.SetContractType(symbolA);

exchange.SetDirection("closesell");

exchange.Buy(depthA.Asks[0].Price+SlidePrice, _holdAmount);

exchange.SetContractType(symbolB);

exchange.SetDirection("closebuy");

exchange.Sell(depthB.Bids[0].Price-SlidePrice, _holdAmount);

action = "CS";

color = "blue";

opPrice = diffLong;

chartIdx = 1;

} else {

return true;

}

_needCheckOrder = true;

_c.add(chartIdx, {{"x", UnixNano()/1000000}, {"title", action}, {"text", format("diff: %f", opPrice)}, {"color", color}});

Log(st, "Long:", diffLong, "Short:", diffShort, "Hold:", _holdPrice);

return true;

}

private:

vector<double> _addArr;

string _state_desc[4] = {"NA", "IDLE", "LONG", "SHORT"};

int _countOpen = 0;

int _countCover = 0;

int _lastCache = 0;

int _hedgeCount = 0;

int _loopCount = 0;

double _holdPrice = 0;

BarFeeder _feederA = BarFeeder(DPeriod);

BarFeeder _feederB = BarFeeder(DPeriod);

State _st = STATE_NA;

string _cfgStr;

double _holdAmount = 0;

bool _isCover = false;

bool _needCheckOrder = true;

Chart _c = Chart("{}");

};

inline unsigned char toHex(unsigned char x) {

return x > 9 ? x + 55 : x + 48;

}

std::string urlencode(const std::string& str) {

std::string strTemp = "";

size_t length = str.length();

for (size_t i = 0; i < length; i++)

{

if (isalnum((unsigned char)str[i]) ||

(str[i] == '-') ||

(str[i] == '_') ||

(str[i] == '.') ||

(str[i] == '~'))

strTemp += str[i];

else if (str[i] == ' ')

strTemp += "+";

else

{

strTemp += '%';

strTemp += toHex((unsigned char)str[i] >> 4);

strTemp += toHex((unsigned char)str[i] % 16);

}

}

return strTemp;

}

uint64_t _Time(string &s) {

tm t_init;

t_init.tm_year = 70;

t_init.tm_mon = 0;

t_init.tm_mday = 1;

t_init.tm_hour = 0;

t_init.tm_min = 0;

t_init.tm_sec = 0;

tm t;

int year, month, day, hour, minute, second, ms;

sscanf(s.c_str(), "%d-%d-%dT%d:%d:%d.%dZ", &year, &month, &day, &hour, &minute, &second, &ms);

t.tm_year = year - 1900;

t.tm_mon = month - 1;

t.tm_mday = day;

t.tm_hour = hour;

t.tm_min = minute;

t.tm_sec = second;

t.tm_isdst = 0;

return uint64_t(mktime(&t))*1000+ms-uint64_t(mktime(&t_init))*1000;

}

void main() {

// exchange.IO("base", "https://www.okex.me"); // 测试

if (IsSetProxy) {

exchange.SetProxy(Proxy);

}

LogReset();

LogProfitReset();

SetErrorFilter("ready|timeout|500");

Log("Init OK");

string symbolA = InstrumentA;

string symbolB = InstrumentB;

Hedge h;

if (IsVirtual()) {

while (true) {

exchange.SetContractType(symbolA);

auto depthA = exchange.GetDepth();

if (depthA.Valid) {

exchange.SetContractType(symbolB);

auto depthB = exchange.GetDepth();

if (depthB.Valid) {

h.Loop(symbolA, depthA, symbolB, depthB);

}

}

}

return;

}

if (exchange.GetName() != "Futures_OKCoin") {

Panic("only support Futures_OKCoin");

}

string realSymbolA = exchange.SetContractType(symbolA)["instrument"];

string realSymbolB = exchange.SetContractType(symbolB)["instrument"];

string qs = urlencode(json({{"op", "subscribe"}, {"args", {"futures/depth5:" + realSymbolA, "futures/depth5:" + realSymbolB}}}).dump());

Log("try connect to websocket");

// wss://real.OKEx.com:8443/ws/v3

auto ws = Dial("wss://real.okex.com:8443/ws/v3|compress=gzip_raw&mode=recv&reconnect=true&payload="+qs);

// auto ws = Dial("wss://real.okex.me:8443/ws/v3|compress=gzip_raw&mode=recv&reconnect=true&payload="+qs);

Log("connect to websocket success");

Depth depthA, depthB;

auto fillDepth = [](json &data, Depth &d) {

d.Valid = true;

d.Asks.clear();

d.Asks.push_back({atof(string(data["asks"][0][0]).c_str()), atof(string(data["asks"][0][1]).c_str())});

d.Bids.clear();

d.Bids.push_back({atof(string(data["bids"][0][0]).c_str()), atof(string(data["bids"][0][1]).c_str())});

};

string timeA;

string timeB;

while (true) {

auto buf = ws.read();

// Log("buf:", buf); // 测试

json obj;

try {

obj = json::parse(buf);

} catch (json::parse_error& e) {

Log(buf);

Log(e.what());

continue;

}

if (obj["data"].size() == 0) {

continue;

}

auto data = obj["data"][0];

string ins = data["instrument_id"];

if (ins == realSymbolA) {

fillDepth(data, depthA);

timeA = data["timestamp"];

} else if (ins == realSymbolB) {

fillDepth(data, depthB);

timeB = data["timestamp"];

}

if (depthA.Valid && depthB.Valid) {

auto diffA = uint64_t(UnixNano()/1000000)-_Time(timeA);

auto diffB = uint64_t(UnixNano()/1000000)-_Time(timeB);

if (diffA > MaxDelay || diffB > MaxDelay) {

continue;

}

h.Loop(symbolA, depthA, symbolB, depthB, format("market delay (ms): %d, %d", diffA, diffB));

}

}

}

- websocket version of OKEX cross-term hedging strategy (learning)

- C++ API call examples

- C++ version of multi-graph testing

- OKEx's cross-currency hedging strategy

- Bitcoin Cash Staircase to hedge differences

- Newcomer testing cross-platform

- Two platforms hedging-JS

- Hedging strategies for different currencies (Teaching)

- Hedge_BTC/ETH Demo

- Testing the speed of the websocket versus rest

- FMEX simple sorting mining robot

- V1.0_OKex contract for the bulls and bears

- OKex futures test for beginners

- Single-commodity retail strategy V2.0_ annualised by 130%

- The city of Ox Bear is judging V1.0_

- Unitary currency dynamic equilibrium V1.0_ zone owner

- The classic linear equation V1.0_ zone is simplified.

- SeamlessConnWS

- Monitoring the spot price of digital currency futures

- HUSD/USD stablecoin leverage

- The Coin Pointing Card

- Time format tool

- Multi-threaded batch tasks

- Nails pushed

- Precision of coins

- OKEx's cross-currency hedging strategy

- The strategy of the shark is to reverse the trend of trading.

- RSI statistical strategies for leverage

- OKEX is hedged

- Example of equilinear strategy 02

What is it?So, if you ask me, the actual treadmill is a picture, but the treadmill jumps out. Exchange_GetOrders: 429: {"error_message:"Too Many Requests","code":30014,"error_code":"30014","message:"Too Many Requests"} This is a list of all the different ways Exchange_GetOrders is credited in the database. Exchange_GetOrders: 400: {"error_message:"Coin type wrong","code":30031,"error_code":"30031","message:"Coin type wrong"} What is the reason?

AIlin/upload/asset/bb5df259b6a8148b1f65.png Dream Big, I ran from yesterday at noon until the evening without order, I ran again from the evening until now without order is it possible to go straight to the real world? 0.0

Lee is smiling.Re-testing the hard disk is reporting json parsing errors.

elvis1213/upload/asset/14bc485151de321c0a6a1.jpg I ran it for a while and then it suddenly started to crash again.

elvis1213I'm trying to find out if I'm getting this error right now, and I'm getting a few dozen pages of logs /upload/asset/14bfcf6f9da5f49807e68.jpg.

elvis1213I have been reporting this error /upload/asset/14b9d3530ce1a60bde3ca.jpg, but the exchange chose OKEX futures.

Light clouds/upload/asset/5a8be467dae6c9a52b7d.jpg This is a list of characters who are or have been a part of the main cast of the television series The Walking Dead. Dream big, run ahead well, then come out this, what to do?

wyzcbDoes this strategy support EOS futures?

The Air Force will never be a slave.[json.exception.type_error.305] cannot use operator[] with a string argument with boolean, How to solve this problem?

hardmyexchange.SetContractType ((symbolA) returns an error and returns a type of boolean.

The Little DreamThe first error is Coin type wrong, checking if the transaction pair is wrong and where the currency is set up wrong. The second error is due to the first error, which leads to frequent retrying, exceeding the frequency limit of access to the exchange interface.

The Little DreamThe code, you debug, see what the data is after the ws interface read. Find the problem, I'm testing fine.

AIlinIs it a server problem? But this server is in the trading terminal and can trade OKEX normally.

The Little DreamThis explains the network problem. No connection to the exchange. No data push.

AIlinThere is no K line, only a strategy chart /upload/asset/ba842a27a3766766bf54.png

The Little DreamWhen the robot is running, does the chart appear on the page? The chart K line appears is normal, it does not trigger the transaction, if the chart does not appear, it indicates the market problem, check it out.

The Little DreamIf the policy has been adjusted, you can copy the policy again, run it, test it.

Lee is smiling.I see the Okeyx interface hasn't changed.

The Little DreamThis policy does not support retesting, as it is based on the WS interface of the exchange, and you can set it in the policy code to see if the OKEX WS interface port has changed in real time.

The Little DreamThis complete message is supposed to be caused by a data anomaly returned by the exchange's wss interface when parsing JSON.

elvis1213The IP problem has been solved.

The Little DreamThe OKEX WS interface address seems to have changed, to go to the OKEX documentation and see what the address is now, you can fill it in, the Dial function in the policy will fill the address.

elvis1213Thank you

The Little DreamThis strategy is mainly used for learning, practical use, and suggests understanding the code, understanding the principles, and optimizing the transformation according to your trading habits.

elvis1213Thank goodness, the deployment has been successful!

The Little DreamIt is recommended to use a private host server. Public server is for practice and testing only.

elvis1213The exchange is OKEX futures Is it related to the server, I chose the public server /upload/asset/14b2c038dcb23dfa93b8b.jpg

The Little DreamWhen you configure an exchange object, select the option to be in stock. When you reconfigure the test, select: /upload/asset/178df7ad9e03924f4dda.png This is a list of all the different ways Upload/asset/178df7ad9e03924f4dda.png is credited in the database.

Light cloudsGood, thank you Dream Big, I'm trying to bind the IP.

The Little DreamThis is not an error report, this is a WS interface data anomaly, an anomalous message printed by the policy.

Inventors quantifiedUpdating the host can solve this.

The Little DreamThis is not a report of a mistake, it's a printed message after the exception is caught, a blue log. If you don't want to, you can delete this line of output from the code. Or maybe the host is older and JSON handles the problem. You can update the host.

The Little DreamError message View the screenshot below, or copy and paste the message.