Versión de JavaScript de la estrategia SuperTrend

El autor:La bondad, Creado: 2020-04-29 12:09:15, Actualizado: 2023-11-06 20:03:58

Versión de JavaScript de la estrategia SuperTrend

Hay muchas versiones del indicador de SuperTrend en el televisor. Encontré un algoritmo relativamente fácil de entender y lo trasplanté. Comparado con el indicador de SuperTrend cargado en el gráfico de TV del sistema de prueba de retroceso de la plataforma de comercio FMZ, encontré una ligera diferencia y no entendí la razón de las causas, estoy esperando la orientación de nuestros lectores. Primero mostraré mi comprensión como sigue.

Indicador de SuperTendencia Algoritmo de versión JavaScript

// VIA: https://github.com/freqtrade/freqtrade-strategies/issues/30

function SuperTrend(r, period, multiplier) {

// atr

var atr = talib.ATR(r, period)

// baseUp , baseDown

var baseUp = []

var baseDown = []

for (var i = 0; i < r.length; i++) {

if (isNaN(atr[i])) {

baseUp.push(NaN)

baseDown.push(NaN)

continue

}

baseUp.push((r[i].High + r[i].Low) / 2 + multiplier * atr[i])

baseDown.push((r[i].High + r[i].Low) / 2 - multiplier * atr[i])

}

// fiUp , fiDown

var fiUp = []

var fiDown = []

var prevFiUp = 0

var prevFiDown = 0

for (var i = 0; i < r.length; i++) {

if (isNaN(baseUp[i])) {

fiUp.push(NaN)

} else {

fiUp.push(baseUp[i] < prevFiUp || r[i - 1].Close > prevFiUp ? baseUp[i] : prevFiUp)

prevFiUp = fiUp[i]

}

if (isNaN(baseDown[i])) {

fiDown.push(NaN)

} else {

fiDown.push(baseDown[i] > prevFiDown || r[i - 1].Close < prevFiDown ? baseDown[i] : prevFiDown)

prevFiDown = fiDown[i]

}

}

var st = []

var prevSt = NaN

for (var i = 0; i < r.length; i++) {

if (i < period) {

st.push(NaN)

continue

}

var nowSt = 0

if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close <= fiUp[i]) {

nowSt = fiUp[i]

} else if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close > fiUp[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close >= fiDown[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close < fiDown[i]) {

nowSt = fiUp[i]

}

st.push(nowSt)

prevSt = st[i]

}

var up = []

var down = []

for (var i = 0; i < r.length; i++) {

if (isNaN(st[i])) {

up.push(st[i])

down.push(st[i])

}

if (r[i].Close < st[i]) {

down.push(st[i])

up.push(NaN)

} else {

down.push(NaN)

up.push(st[i])

}

}

return [up, down]

}

// The main function for testing indicators is not a trading strategy

function main() {

while (1) {

var r = _C(exchange.GetRecords)

var st = SuperTrend(r, 10, 3)

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

Sleep(2000)

}

}

Comparación del código de prueba con el backtest:

Una estrategia sencilla utilizando el indicador SuperTrend

La parte de la lógica de negociación es relativamente simple, es decir, cuando la tendencia corta se convierte en una tendencia larga, se abren posiciones largas. Abre una posición corta cuando la tendencia larga se convierta en una tendencia corta.

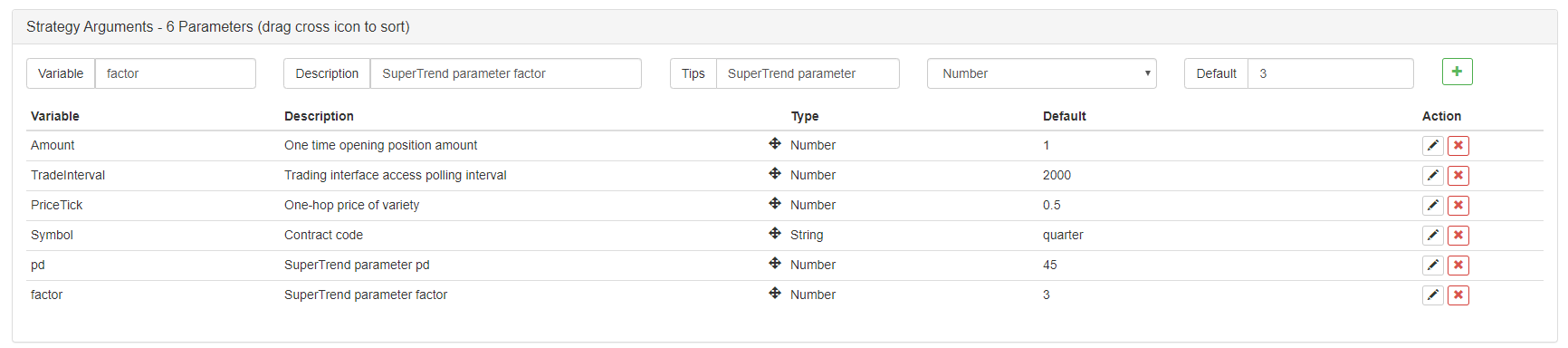

Parámetros de la estrategia:

Estrategia de negociación de SuperTrend

/*backtest

start: 2019-08-01 00:00:00

end: 2020-03-11 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

*/

// Global variables

var OpenAmount = 0 // The number of open positions after opening

var KeepAmount = 0 // Reserved position

var IDLE = 0

var LONG = 1

var SHORT = 2

var COVERLONG = 3

var COVERSHORT = 4

var COVERLONG_PART = 5

var COVERSHORT_PART = 6

var OPENLONG = 7

var OPENSHORT = 8

var State = IDLE

// Trading logic part

function GetPosition(posType) {

var positions = _C(exchange.GetPosition)

/*

if(positions.length > 1){

throw "positions error:" + JSON.stringify(positions)

}

*/

var count = 0

for(var j = 0; j < positions.length; j++){

if(positions[j].ContractType == Symbol){

count++

}

}

if(count > 1){

throw "positions error:" + JSON.stringify(positions)

}

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType == Symbol && positions[i].Type === posType) {

return [positions[i].Price, positions[i].Amount];

}

}

Sleep(TradeInterval);

return [0, 0]

}

function CancelPendingOrders() {

while (true) {

var orders = _C(exchange.GetOrders)

for (var i = 0; i < orders.length; i++) {

exchange.CancelOrder(orders[i].Id);

Sleep(TradeInterval);

}

if (orders.length === 0) {

break;

}

}

}

function Trade(Type, Price, Amount, CurrPos, OnePriceTick){ // Processing transactions

if(Type == OPENLONG || Type == OPENSHORT){ // Handling open positions

exchange.SetDirection(Type == OPENLONG ? "buy" : "sell")

var pfnOpen = Type == OPENLONG ? exchange.Buy : exchange.Sell

var idOpen = pfnOpen(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idOpen) {

exchange.CancelOrder(idOpen)

} else {

CancelPendingOrders()

}

} else if(Type == COVERLONG || Type == COVERSHORT){ // Deal with closing positions

exchange.SetDirection(Type == COVERLONG ? "closebuy" : "closesell")

var pfnCover = Type == COVERLONG ? exchange.Sell : exchange.Buy

var idCover = pfnCover(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idCover){

exchange.CancelOrder(idCover)

} else {

CancelPendingOrders()

}

} else {

throw "Type error:" + Type

}

}

function SuperTrend(r, period, multiplier) {

// atr

var atr = talib.ATR(r, period)

// baseUp , baseDown

var baseUp = []

var baseDown = []

for (var i = 0; i < r.length; i++) {

if (isNaN(atr[i])) {

baseUp.push(NaN)

baseDown.push(NaN)

continue

}

baseUp.push((r[i].High + r[i].Low) / 2 + multiplier * atr[i])

baseDown.push((r[i].High + r[i].Low) / 2 - multiplier * atr[i])

}

// fiUp , fiDown

var fiUp = []

var fiDown = []

var prevFiUp = 0

var prevFiDown = 0

for (var i = 0; i < r.length; i++) {

if (isNaN(baseUp[i])) {

fiUp.push(NaN)

} else {

fiUp.push(baseUp[i] < prevFiUp || r[i - 1].Close > prevFiUp ? baseUp[i] : prevFiUp)

prevFiUp = fiUp[i]

}

if (isNaN(baseDown[i])) {

fiDown.push(NaN)

} else {

fiDown.push(baseDown[i] > prevFiDown || r[i - 1].Close < prevFiDown ? baseDown[i] : prevFiDown)

prevFiDown = fiDown[i]

}

}

var st = []

var prevSt = NaN

for (var i = 0; i < r.length; i++) {

if (i < period) {

st.push(NaN)

continue

}

var nowSt = 0

if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close <= fiUp[i]) {

nowSt = fiUp[i]

} else if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close > fiUp[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close >= fiDown[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close < fiDown[i]) {

nowSt = fiUp[i]

}

st.push(nowSt)

prevSt = st[i]

}

var up = []

var down = []

for (var i = 0; i < r.length; i++) {

if (isNaN(st[i])) {

up.push(st[i])

down.push(st[i])

}

if (r[i].Close < st[i]) {

down.push(st[i])

up.push(NaN)

} else {

down.push(NaN)

up.push(st[i])

}

}

return [up, down]

}

var preTime = 0

function main() {

exchange.SetContractType(Symbol)

while (1) {

var r = _C(exchange.GetRecords)

var currBar = r[r.length - 1]

if (r.length < pd) {

Sleep(5000)

continue

}

var st = SuperTrend(r, pd, factor)

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

if(!isNaN(st[0][st[0].length - 2]) && isNaN(st[0][st[0].length - 3])){

if (State == SHORT) {

State = COVERSHORT

} else if(State == IDLE) {

State = OPENLONG

}

}

if(!isNaN(st[1][st[1].length - 2]) && isNaN(st[1][st[1].length - 3])){

if (State == LONG) {

State = COVERLONG

} else if (State == IDLE) {

State = OPENSHORT

}

}

// 执行信号

var pos = null

var price = null

if(State == OPENLONG){ // Open long positions

pos = GetPosition(PD_LONG) // Check positions

// Determine whether the status is satisfied, if it is satisfied, modify the status

if(pos[1] >= Amount){ // Open positions exceed or equal to the open positions set by the parameters

Sleep(1000)

$.PlotFlag(currBar.Time, "Open long positions", 'OL') // mark

OpenAmount = pos[1] // Record the number of open positions

State = LONG // Mark as long

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2 // Calculate the price

Trade(OPENLONG, price, Amount - pos[1], pos, PriceTick) // Placing Order function (Type, Price, Amount, CurrPos, PriceTick)

}

if(State == OPENSHORT){ // Open short position

pos = GetPosition(PD_SHORT) // Check positions

if(pos[1] >= Amount){

Sleep(1000)

$.PlotFlag(currBar.Time, "Open short position", 'OS')

OpenAmount = pos[1]

State = SHORT

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(OPENSHORT, price, Amount - pos[1], pos, PriceTick)

}

if(State == COVERLONG){ // Handling long positions

pos = GetPosition(PD_LONG) // Get position information

if(pos[1] == 0){ // Determine if the position is 0

$.PlotFlag(currBar.Time, "Close long position", '----CL') // mark

State = IDLE

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(COVERLONG, price, pos[1], pos, PriceTick)

}

if(State == COVERSHORT){ // Deal with long positions

pos = GetPosition(PD_SHORT)

if(pos[1] == 0){

$.PlotFlag(currBar.Time, "Close short position", '----CS')

State = IDLE

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2

Trade(COVERSHORT, price, pos[1], pos, PriceTick)

}

if(State == COVERLONG_PART) { // Partially close long positions

pos = GetPosition(PD_LONG) // Get positions

if(pos[1] <= KeepAmount){ // The position is less than or equal to the holding amount, this time the closing action is completed

$.PlotFlag(currBar.Time, "Close long positions, keep:" + KeepAmount, '----CL') // mark

State = pos[1] == 0 ? IDLE : LONG // update status

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(COVERLONG, price, pos[1] - KeepAmount, pos, PriceTick)

}

if(State == COVERSHORT_PART){

pos = GetPosition(PD_SHORT)

if(pos[1] <= KeepAmount){

$.PlotFlag(currBar.Time, "Close short positions, keep:" + KeepAmount, '----CS')

State = pos[1] == 0 ? IDLE : SHORT

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2

Trade(COVERSHORT, price, pos[1] - KeepAmount, pos, PriceTick)

}

LogStatus(_D())

Sleep(1000)

}

}

Dirección estratégica:https://www.fmz.com/strategy/201837

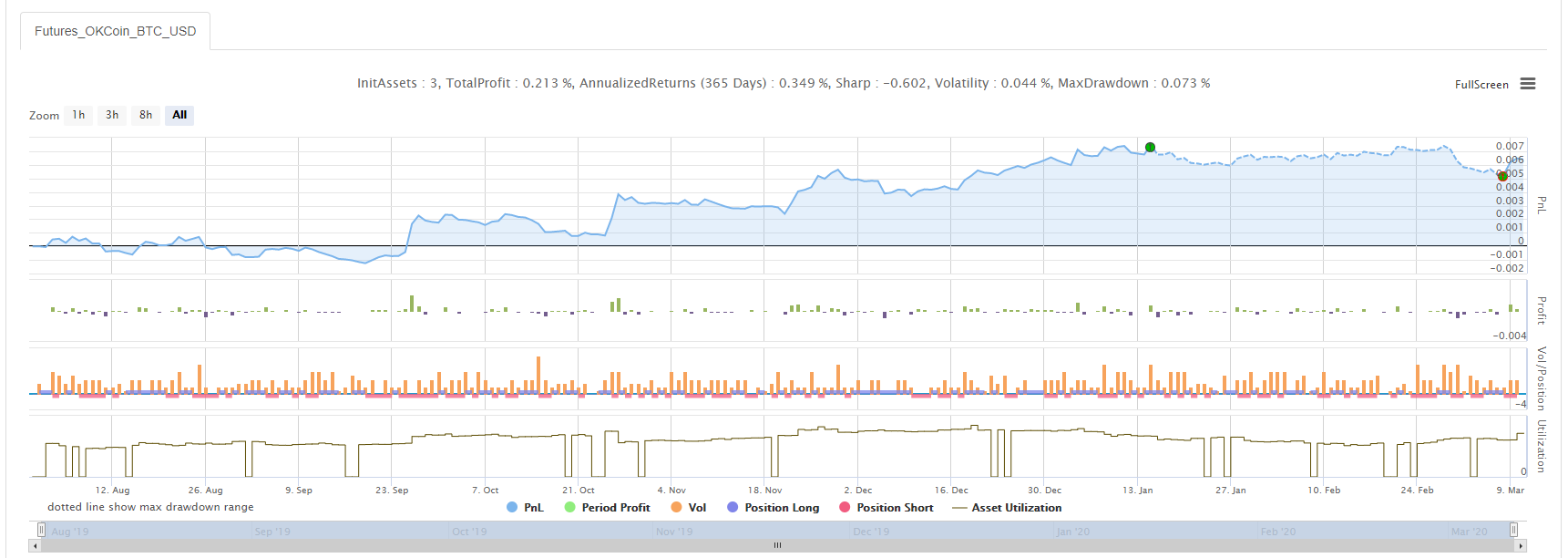

Desempeño de las pruebas de retroceso

Configuración de parámetros, período de la línea K, referencia: homilía SuperTrend V.1

El período de la línea K se establece en 15 minutos, y el parámetro SuperTrend se establece en 45, 3. Pruebe el contrato trimestral de futuros de OKEX para el año más reciente y establezca un contrato para operar a la vez. Debido al ajuste para operar solo un contrato a la vez, la tasa de utilización de los fondos es muy baja y no necesita preocuparse por el valor Sharpe.

- Cuantificar el análisis fundamental en el mercado de criptomonedas: ¡Deja que los datos hablen por sí mismos!

- La investigación cuantitativa básica del círculo monetario - ¡No confíes más en los profesores de idiomas, los datos hablan objetivamente!

- Una herramienta esencial en el campo de la transacción cuantitativa - inventor de módulos de exploración de datos cuantitativos

- Dominarlo todo - Introducción a FMZ Nueva versión de la terminal de negociación (con el código fuente de TRB Arbitrage)

- Conozca todo acerca de la nueva versión del terminal de operaciones de FMZ (con código de código de TRB)

- FMZ Quant: Análisis de ejemplos de diseño de requisitos comunes en el mercado de criptomonedas (II)

- Cómo explotar robots de venta sin cerebro con una estrategia de alta frecuencia en 80 líneas de código

- Cuantificación FMZ: Desarrollo de casos de diseño de necesidades comunes en el mercado de criptomonedas (II)

- Cómo utilizar una estrategia de alta frecuencia de 80 líneas de código para explotar y vender robots sin cerebro

- FMZ Quant: Análisis de ejemplos de diseño de requisitos comunes en el mercado de criptomonedas (I)

- Cuantificación FMZ: Desarrollo de casos de diseño de necesidades comunes en el mercado de criptomonedas (1)