-

善

|

Créé le:2019-03-29 11:19:52

“Always understand when to quit” – 6 exit strategiesNo matter how much time, effort, and money you put into an investment, if you don’t have a predetermined exit strategy, everything can be gone. For this reason, investment guru never invests without k

善

|

Créé le:2019-03-29 11:19:52

“Always understand when to quit” – 6 exit strategiesNo matter how much time, effort, and money you put into an investment, if you don’t have a predetermined exit strategy, everything can be gone. For this reason, investment guru never invests without k0

1587

-

善

|

Créé le:2019-03-28 14:43:59

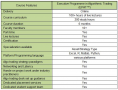

What are the Different Types of Quant Funds?Institutional asset managers specialize in a particular asset class, style, sector, or geography, based on their expertise or domain knowledge. This is reflected in the investment products they offer

善

|

Créé le:2019-03-28 14:43:59

What are the Different Types of Quant Funds?Institutional asset managers specialize in a particular asset class, style, sector, or geography, based on their expertise or domain knowledge. This is reflected in the investment products they offer0

1446

-

善

|

Créé le:2019-03-28 10:51:06

Backtesting An Intraday Mean Reversion Pairs Strategy Between SPY And IWMIn this article we are going to consider our first intraday trading strategy. It will be using a classic trading idea, that of “trading pairs”. In this instance we are going to be making use of two Ex

善

|

Créé le:2019-03-28 10:51:06

Backtesting An Intraday Mean Reversion Pairs Strategy Between SPY And IWMIn this article we are going to consider our first intraday trading strategy. It will be using a classic trading idea, that of “trading pairs”. In this instance we are going to be making use of two Ex

0

2497

-

善

|

Créé le:2019-03-27 15:11:40

Backtesting a Moving Average Crossover in Python with pandasIn this article we will make use of the machinery we introduced to carry out research on an actual strategy, namely the Moving Average Crossover on AAPL. Moving Average Crossover Strategy The Movi

善

|

Créé le:2019-03-27 15:11:40

Backtesting a Moving Average Crossover in Python with pandasIn this article we will make use of the machinery we introduced to carry out research on an actual strategy, namely the Moving Average Crossover on AAPL. Moving Average Crossover Strategy The Movi

0

2444

-

善

|

Créé le:2019-03-27 11:08:57

How to Identify Algorithmic Trading StrategiesIn this article I want to introduce you to the methods by which I myself identify profitable algorithmic trading strategies. Our goal today is to understand in detail how to find, evaluate and select

善

|

Créé le:2019-03-27 11:08:57

How to Identify Algorithmic Trading StrategiesIn this article I want to introduce you to the methods by which I myself identify profitable algorithmic trading strategies. Our goal today is to understand in detail how to find, evaluate and select0

1869

-

善

|

Créé le:2019-03-26 16:38:59

Event-Driven Backtesting with Python - Part VIIIIt’s been a while since we’ve considered the event-driven backtester, which we began discussing in this article. In Part VI I described how to code a stand-in ExecutionHandler model that worked for a

善

|

Créé le:2019-03-26 16:38:59

Event-Driven Backtesting with Python - Part VIIIIt’s been a while since we’ve considered the event-driven backtester, which we began discussing in this article. In Part VI I described how to code a stand-in ExecutionHandler model that worked for a0

1677

-

善

|

Créé le:2019-03-26 10:52:49

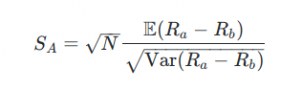

Event-Driven Backtesting with Python - Part VIIIn the last article on the Event-Driven Backtester series we considered a basic ExecutionHandler hierarchy. In this article we are going to discuss how to assess the performance of a strategy post-bac

善

|

Créé le:2019-03-26 10:52:49

Event-Driven Backtesting with Python - Part VIIIn the last article on the Event-Driven Backtester series we considered a basic ExecutionHandler hierarchy. In this article we are going to discuss how to assess the performance of a strategy post-bac

0

1900

-

善

|

Créé le:2019-03-26 09:13:08

Event-Driven Backtesting with Python - Part VIThis article continues the discussion of event-driven backtesters in Python. In the previous article we considered a portfolio class hierarchy that handled current positions, generated trading orders

善

|

Créé le:2019-03-26 09:13:08

Event-Driven Backtesting with Python - Part VIThis article continues the discussion of event-driven backtesters in Python. In the previous article we considered a portfolio class hierarchy that handled current positions, generated trading orders0

2423

-

善

|

Créé le:2019-03-25 15:54:16

Event-Driven Backtesting with Python - Part VIn the previous article on event-driven backtesting we considered how to construct a Strategy class hierarchy. Strategies, as defined here, are used to generate signals, which are used by a portfolio

善

|

Créé le:2019-03-25 15:54:16

Event-Driven Backtesting with Python - Part VIn the previous article on event-driven backtesting we considered how to construct a Strategy class hierarchy. Strategies, as defined here, are used to generate signals, which are used by a portfolio0

2097

-

善

|

Créé le:2019-03-25 14:24:46

Event-Driven Backtesting with Python - Part IVThe discussion of the event-driven backtesting implementation has previously considered the event-loop, the event class hierarchy and the data handling component. In this article a Strategy class hier

善

|

Créé le:2019-03-25 14:24:46

Event-Driven Backtesting with Python - Part IVThe discussion of the event-driven backtesting implementation has previously considered the event-loop, the event class hierarchy and the data handling component. In this article a Strategy class hier0

1648

-

善

|

Créé le:2019-03-23 11:22:28

Event-Driven Backtesting with Python - Part IIIIn the previous two articles of the series we discussed what an event-driven backtesting system is and the class hierarchy for the Event object. In this article we are going to consider how market dat

善

|

Créé le:2019-03-23 11:22:28

Event-Driven Backtesting with Python - Part IIIIn the previous two articles of the series we discussed what an event-driven backtesting system is and the class hierarchy for the Event object. In this article we are going to consider how market dat0

2286

-

善

|

Créé le:2019-03-23 09:13:33

Event-Driven Backtesting with Python - Part IIIn the last article we described the concept of an event-driven backtester. The remainder of this series of articles will concentrate on each of the separate class hierarchies that make up the overall

善

|

Créé le:2019-03-23 09:13:33

Event-Driven Backtesting with Python - Part IIIn the last article we described the concept of an event-driven backtester. The remainder of this series of articles will concentrate on each of the separate class hierarchies that make up the overall0

2331

-

善

|

Créé le:2019-03-22 11:53:50

Event-Driven Backtesting with Python - Part IWe’ve spent the last couple of months on QuantStart backtesting various trading strategies utilising Python and pandas. The vectorised nature of pandas ensures that certain operations on large dataset

善

|

Créé le:2019-03-22 11:53:50

Event-Driven Backtesting with Python - Part IWe’ve spent the last couple of months on QuantStart backtesting various trading strategies utilising Python and pandas. The vectorised nature of pandas ensures that certain operations on large dataset0

3652

-

善

|

Créé le:2019-03-21 14:09:21

Successful Backtesting of Algorithmic Trading Strategies - Part IIIn the first article on successful backtesting we discussed statistical and behavioural biases that affect our backtest performance. We also discussed software packages for backtesting, including Exce

善

|

Créé le:2019-03-21 14:09:21

Successful Backtesting of Algorithmic Trading Strategies - Part IIIn the first article on successful backtesting we discussed statistical and behavioural biases that affect our backtest performance. We also discussed software packages for backtesting, including Exce0

1818

-

善

|

Créé le:2019-03-20 17:00:16

Successful Backtesting of Algorithmic Trading Strategies - Part IThis article continues the series on quantitative trading, which started with the Beginner’s Guide and Strategy Identification. Both of these longer, more involved articles have been very popular so I

善

|

Créé le:2019-03-20 17:00:16

Successful Backtesting of Algorithmic Trading Strategies - Part IThis article continues the series on quantitative trading, which started with the Beginner’s Guide and Strategy Identification. Both of these longer, more involved articles have been very popular so I0

1767

-

善

|

Créé le:2019-03-20 11:45:00

Value at Risk (VaR) for Algorithmic Trading Risk ManagementValue at Risk (VaR) for Algorithmic Trading Risk Management Estimating the risk of loss to an algorithmic trading strategy, or portfolio of strategies, is of extreme importance for long-term capital

善

|

Créé le:2019-03-20 11:45:00

Value at Risk (VaR) for Algorithmic Trading Risk ManagementValue at Risk (VaR) for Algorithmic Trading Risk Management Estimating the risk of loss to an algorithmic trading strategy, or portfolio of strategies, is of extreme importance for long-term capital0

1621

-

2019-03-19 14:08:48

善

|

Créé le:2019-03-19 14:03:46

Should You Build Your Own Backtester?About This Post The post is suitable for those who are beginning quantitative trading as well as those who have had some experience with the area. The post discusses the common pitfalls of backtest

善

|

Créé le:2019-03-19 14:03:46

Should You Build Your Own Backtester?About This Post The post is suitable for those who are beginning quantitative trading as well as those who have had some experience with the area. The post discusses the common pitfalls of backtest0

1724

-

善

|

Créé le:2019-03-19 09:27:44

Money Management via the Kelly CriterionMoney Management via the Kelly Criterion Risk and money management are absolutely critical topics in quantitative trading. We have yet to explore these concepts in any reasonable amount of detail bey

善

|

Créé le:2019-03-19 09:27:44

Money Management via the Kelly CriterionMoney Management via the Kelly Criterion Risk and money management are absolutely critical topics in quantitative trading. We have yet to explore these concepts in any reasonable amount of detail bey

0

1527

-

善

|

Créé le:2019-03-18 13:24:11

Sharpe Ratio for Algorithmic Trading Performance MeasurementWhen carrying out an algorithmic trading strategy it is tempting to consider the annualised return as the most useful performance metric. However, there are many flaws with using this measure in isola

善

|

Créé le:2019-03-18 13:24:11

Sharpe Ratio for Algorithmic Trading Performance MeasurementWhen carrying out an algorithmic trading strategy it is tempting to consider the annualised return as the most useful performance metric. However, there are many flaws with using this measure in isola

0

1551

-

善

|

Créé le:2019-03-18 10:48:28

Continuous Futures Contracts for Backtesting PurposesBrief Overview of Futures Contracts Futures are a form of contract drawn up between two parties for the purchase or sale of a quantity of an underlying asset at a specified date in the future. This

善

|

Créé le:2019-03-18 10:48:28

Continuous Futures Contracts for Backtesting PurposesBrief Overview of Futures Contracts Futures are a form of contract drawn up between two parties for the purchase or sale of a quantity of an underlying asset at a specified date in the future. This0

1473

-

善

|

Créé le:2019-03-16 11:58:20

Research Backtesting Environments in Python with pandasBacktesting is the research process of applying a trading strategy idea to historical data in order to ascertain past performance. In particular, a backtester makes no guarantee about the future perfo

善

|

Créé le:2019-03-16 11:58:20

Research Backtesting Environments in Python with pandasBacktesting is the research process of applying a trading strategy idea to historical data in order to ascertain past performance. In particular, a backtester makes no guarantee about the future perfo0

1875

-

2019-03-16 10:29:54

善

|

Créé le:2019-03-16 10:29:22

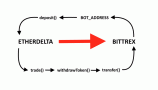

How to make your own trading botForeword I’m certainly not a great programmer, but writing this project taught me a lot (and kept me occupied). Most of my code were done on FMZ.COM, and if I were to refactor the python code I wou

善

|

Créé le:2019-03-16 10:29:22

How to make your own trading botForeword I’m certainly not a great programmer, but writing this project taught me a lot (and kept me occupied). Most of my code were done on FMZ.COM, and if I were to refactor the python code I wou

0

1842

-

善

|

Créé le:2019-03-15 11:04:50

Top 5 Essential Beginner Books for Algorithmic TradingAlgorithmic trading is usually perceived as a complex area for beginners to get to grips with. It covers a wide range of disciplines, with certain aspects requiring a significant degree of mathematica

善

|

Créé le:2019-03-15 11:04:50

Top 5 Essential Beginner Books for Algorithmic TradingAlgorithmic trading is usually perceived as a complex area for beginners to get to grips with. It covers a wide range of disciplines, with certain aspects requiring a significant degree of mathematica0

1761

-

善

|

Créé le:2019-03-15 10:50:36

Can Algorithmic Traders Still Succeed at the Retail Level?It is common, as a beginning algorithmic trader practising at retail level, to question whether it is still possible to compete with the large institutional quant funds. In this article I would like t

善

|

Créé le:2019-03-15 10:50:36

Can Algorithmic Traders Still Succeed at the Retail Level?It is common, as a beginning algorithmic trader practising at retail level, to question whether it is still possible to compete with the large institutional quant funds. In this article I would like t0

1401

-

善

|

Créé le:2019-03-13 15:44:49

Steps to Becoming a Quant TraderLucrative salaries, hefty bonuses and creativity on the job have resulted in quantitative trading becoming an attractive career option. Quantitative traders, or quants for short, use mathematical mode

善

|

Créé le:2019-03-13 15:44:49

Steps to Becoming a Quant TraderLucrative salaries, hefty bonuses and creativity on the job have resulted in quantitative trading becoming an attractive career option. Quantitative traders, or quants for short, use mathematical mode0

1460

-

2019-03-09 15:54:56

善

|

Créé le:2019-03-09 15:52:50

Everything You Need To Know About Automated TradingWouldn’t it be great to have a robot trade on your behalf and earn guaranteed profits? It’s a dream of many to find the perfect computerised trading system for automated trading that guarantees profit

善

|

Créé le:2019-03-09 15:52:50

Everything You Need To Know About Automated TradingWouldn’t it be great to have a robot trade on your behalf and earn guaranteed profits? It’s a dream of many to find the perfect computerised trading system for automated trading that guarantees profit0

1758

-

善

|

Créé le:2019-03-09 10:52:03

Automated Trading Systems: The Pros and ConsTraders and investors can turn precise entry, exit and money management rules into automated trading systems that allow computers to execute and monitor the trades. One of the biggest attractions of s

善

|

Créé le:2019-03-09 10:52:03

Automated Trading Systems: The Pros and ConsTraders and investors can turn precise entry, exit and money management rules into automated trading systems that allow computers to execute and monitor the trades. One of the biggest attractions of s

0

1431

-

善

|

Créé le:2019-03-08 10:17:10

Learn Algorithmic Trading: A Step By Step GuideWith the boom in technological advancements in trading and financial market applications, algorithmic trading and high-frequency trading is being welcomed and accepted by exchanges all over the world.

善

|

Créé le:2019-03-08 10:17:10

Learn Algorithmic Trading: A Step By Step GuideWith the boom in technological advancements in trading and financial market applications, algorithmic trading and high-frequency trading is being welcomed and accepted by exchanges all over the world.

0

2485

-

善

|

Créé le:2019-03-07 10:12:47

Intro To Algo TradingIntro To Algo Trading I discussed the different types of trading which includes algorithmic, discretionary, and hybrid trading. Let’s say you are intrigued by algorithmic trading. What is it exactl

善

|

Créé le:2019-03-07 10:12:47

Intro To Algo TradingIntro To Algo Trading I discussed the different types of trading which includes algorithmic, discretionary, and hybrid trading. Let’s say you are intrigued by algorithmic trading. What is it exactl

0

1529

-

2019-03-06 17:14:45

善

|

Créé le:2019-03-06 14:14:10

Basics of Algorithmic Trading: Concepts and ExamplesBasics of Algorithmic Trading: Concepts and Examples Algorithmic trading (also called automated trading, black-box trading, or algo-trading) uses a computer program that follows a defined set of in

善

|

Créé le:2019-03-06 14:14:10

Basics of Algorithmic Trading: Concepts and ExamplesBasics of Algorithmic Trading: Concepts and Examples Algorithmic trading (also called automated trading, black-box trading, or algo-trading) uses a computer program that follows a defined set of in0

1603