Python版 アイスバーグ委員会戦略

作者: リン・ハーン優しさ作成日:2020年7月21日 10:21:10 更新日:2023年10月26日 20:08:29

この記事では,移植のための2つの古典的な戦略を紹介しています. アイスバーグ・コミッション (買/売). この戦略は,FMZプラットフォームのAiceberg・コミッション JavaScript バージョンから移植されています. 戦略のアドレスはhttps://www.fmz.com/square/s:Iceberg/1

アイスバーグ・コミッション・トレーディング・ストラテジーの JavaScript バージョンを引用します

アイスバーグ・コミッション (Iceberg commission) とは,投資家が大きな取引を行うとき,市場への過剰な影響を避けるため,大きなオーダー・コミッションは,現在の最新の1買/売1価格とトレーダーが設定した価格に基づいて,自動的に複数のコミッションに分けられるという事実を指す.この戦略は自動的に小さなオーダーをコミッションする.最後のコミッションが完全に取引されたとき,または最新の価格が現在のコミッション価格から大幅に逸脱すると,コミッション操作は自動的に再開されます.

多くの取引先の取引ページには,豊富な機能を持つアイスバーグの委任ツールが付属していますが,いくつかの機能をカスタマイズしたり,自分のニーズに応じていくつかの機能を修正したい場合は,より柔軟なツールが必要です. FMZプラットフォームは,この問題を解決するために設計されています. 私たちの戦略スクエアにはPythonの取引戦略が多くありません. Python言語を使用して取引ツールや戦略を書きたい一部のトレーダーは,例を参照する必要があります. したがって,クラシックなアイスバーグの委任戦略はPython版に移植されました.

パイソンのためのアイスバーグ委員会 - 購入

import random # Import random number library

def CancelPendingOrders(): # The function of CancelPendingOrders is to cancel all pending orders of the current transaction.

while True: # Loop detection, call GetOrders function to detect the current pending order, if orders is an empty array, that is, len(orders) is equal to 0, indicating that all orders have been cancelled, you can exit the function and call return to exit.

orders = _C(exchange.GetOrders)

if len(orders) == 0 :

return

for j in range(len(orders)): # Traverse the current array of pending orders, and call CancelOrder to cancel the orders one by one.

exchange.CancelOrder(orders[j]["Id"])

if j < len(orders) - 1: # Except for the last order, execute Sleep every time and let the program wait for a while to avoid canceling orders too frequently.

Sleep(Interval)

LastBuyPrice = 0 # Set a global variable to record the the latest buying price.

InitAccount = None # Set a global variable to record the initial account asset information.

def dispatch(): # Main functions of iceberg commission logic

global InitAccount, LastBuyPrice # Reference global variables

account = None # Declare a variable to record the account information obtained in real time for comparison calculation.

ticker = _C(exchange.GetTicker) # Declare a variable to record the latest market quotes.

LogStatus(_D(), "ticker:", ticker) # Output time and latest quotation in the status bar

if LastBuyPrice > 0: # When LastBuyPrice is greater than 0, that is, when the commission has started, the code in the if condition is executed.

if len(_C(exchange.GetOrders)) > 0: # Call the exchange.GetOrders function to get all current pending orders, determine that there are pending orders, and execute the code in the if condition.

if ticker["Last"] > LastBuyPrice and ((ticker["Last"] - LastBuyPrice) / LastBuyPrice) > (2 * (EntrustDepth / 100)): # Detect the degree of deviation, if the condition is triggered, execute the code in the if, and cancel the order.

Log("Too much deviation, the latest transaction price:", ticker["Last"], "Commission price", LastBuyPrice)

CancelPendingOrders()

else :

return True

else : # If there is no pending order, it proves that the order is completely filled.

account = _C(exchange.GetAccount) # Get current account asset information.

Log("The buying order is completed, the cumulative cost:", _N(InitAccount["Balance"] - account["Balance"]), "Average buying price:", _N((InitAccount["Balance"] - account["Balance"]) / (account["Stocks"] - InitAccount["Stocks"]))) # Print transaction information.

LastBuyPrice = 0 # Reset LastBuyPrice to 0

BuyPrice = _N(ticker["Buy"] * (1 - EntrustDepth / 100)) # Calculate the price of pending orders based on current market conditions and parameters.

if BuyPrice > MaxBuyPrice: # Determine whether the maximum price set by the parameter is exceeded

return True

if not account: # If account is null, execute the code in the if statement to retrieve the current asset information and copy it to account

account = _C(exchange.GetAccount)

if (InitAccount["Balance"] - account["Balance"]) >= TotalBuyNet: # Determine whether the total amount of money spent on buying exceeds the parameter setting.

return False

RandomAvgBuyOnce = (AvgBuyOnce * ((100.0 - FloatPoint) / 100.0)) + (((FloatPoint * 2) / 100.0) * AvgBuyOnce * random.random()) # random number 0~1

UsedMoney = min(account["Balance"], RandomAvgBuyOnce, TotalBuyNet - (InitAccount["Balance"] - account["Balance"]))

BuyAmount = _N(UsedMoney / BuyPrice) # Calculate the buying quantity

if BuyAmount < MinStock: # Determine whether the buying quantity is less than the minimum buying quantity limit on the parameter.

return False

LastBuyPrice = BuyPrice # Record the price of this order and assign it to LastBuyPrice

exchange.Buy(BuyPrice, BuyAmount, "spend:¥", _N(UsedMoney), "Last transaction price", ticker["Last"]) # Place orders

return True

def main():

global LoopInterval, InitAccount # Refer to LoopInterval, InitAccount global variables

CancelPendingOrders() # Cancel all pending orders when starting to run

InitAccount = _C(exchange.GetAccount) # Account assets at the beginning of the initial record

Log(InitAccount) # Print initial account information

if InitAccount["Balance"] < TotalBuyNet: # If the initial assets are insufficient, an error will be thrown and the program will stop

raise Exception("Insufficient account balance")

LoopInterval = max(LoopInterval, 1) # Set LoopInterval to at least 1

while dispatch(): # The main loop, the iceberg commission logic function dispatch is called continuously, and the loop stops when the dispatch function returns false.

Sleep(LoopInterval * 1000) # Pause each cycle to control the polling frequency.

Log("委托全部完成", _C(exchange.GetAccount)) # When the loop execution jumps out, the current account asset information is printed.

アイスバーグ委員会 Python - 販売

戦略の論理は 購入の論理と同じで わずかな違いがあるだけです

import random

def CancelPendingOrders():

while True:

orders = _C(exchange.GetOrders)

if len(orders) == 0:

return

for j in range(len(orders)):

exchange.CancelOrder(orders[j]["Id"])

if j < len(orders) - 1:

Sleep(Interval)

LastSellPrice = 0

InitAccount = None

def dispatch():

global LastSellPrice, InitAccount

account = None

ticker = _C(exchange.GetTicker)

LogStatus(_D(), "ticker:", ticker)

if LastSellPrice > 0:

if len(_C(exchange.GetOrders)) > 0:

if ticker["Last"] < LastSellPrice and ((LastSellPrice - ticker["Last"]) / ticker["Last"]) > (2 * (EntrustDepth / 100)):

Log("Too much deviation, the latest transaction price:", ticker["Last"], "Commission price", LastSellPrice)

CancelPendingOrders()

else :

return True

else :

account = _C(exchange.GetAccount)

Log("The buy order is completed, and the accumulated selling:", _N(InitAccount["Stocks"] - account["Stocks"]), "Average selling price:", _N((account["Balance"] - InitAccount["Balance"]) / (InitAccount["Stocks"] - account["Stocks"])))

LastSellPrice = 0

SellPrice = _N(ticker["Sell"] * (1 + EntrustDepth / 100))

if SellPrice < MinSellPrice:

return True

if not account:

account = _C(exchange.GetAccount)

if (InitAccount["Stocks"] - account["Stocks"]) >= TotalSellStocks:

return False

RandomAvgSellOnce = (AvgSellOnce * ((100.0 - FloatPoint) / 100.0)) + (((FloatPoint * 2) / 100.0) * AvgSellOnce * random.random())

SellAmount = min(TotalSellStocks - (InitAccount["Stocks"] - account["Stocks"]), RandomAvgSellOnce)

if SellAmount < MinStock:

return False

LastSellPrice = SellPrice

exchange.Sell(SellPrice, SellAmount, "Last transaction price", ticker["Last"])

return True

def main():

global InitAccount, LoopInterval

CancelPendingOrders()

InitAccount = _C(exchange.GetAccount)

Log(InitAccount)

if InitAccount["Stocks"] < TotalSellStocks:

raise Exception("Insufficient account currency")

LoopInterval = max(LoopInterval, 1)

while dispatch():

Sleep(LoopInterval)

Log("All commissioned", _C(exchange.GetAccount))

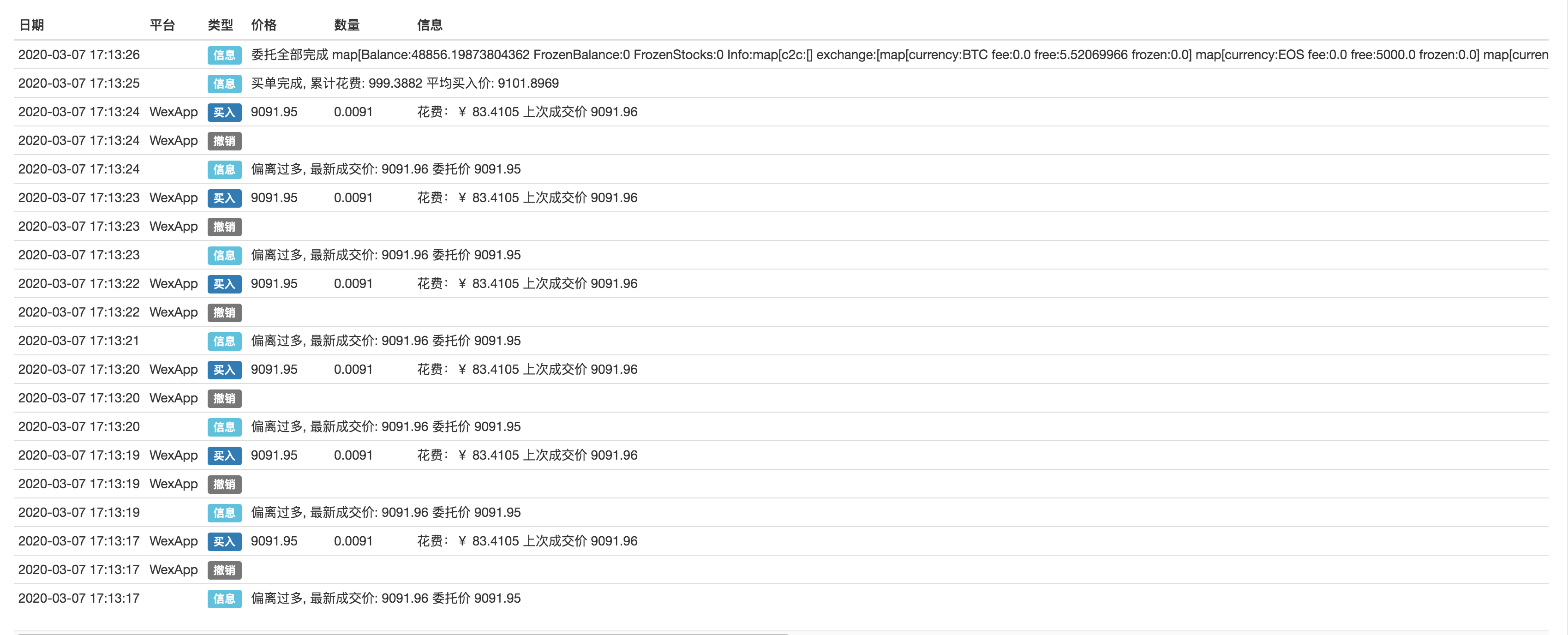

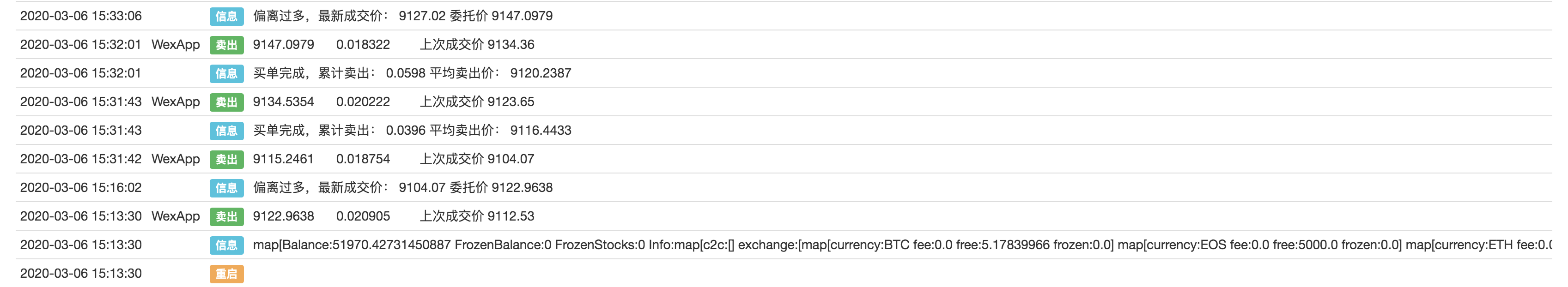

戦略作戦

交換テストをシミュレートするためにWexAppを使用します:

購入する

販売:

戦略論理は複雑ではありません. 戦略が実行されると,戦略パラメータと現在の市場価格に基づいて動的に注文を置き,キャンセルします. 取引金額/コイン番号がパラメータ設定番号に達または接近すると,戦略は停止します. 戦略コードは非常にシンプルで,初心者にとって適しています. 興味のある読者はそれを修正し,彼らの取引スタイルに合った戦略を設計することができます.

- 暗号通貨市場の基本分析を定量化する: データが自分で話せ!

- 通貨圏の基礎的な定量化研究 - 数字を客観的に話すために,あらゆる

教師を信頼しなくていい! - 量化取引の必須ツール - 発明者による量化データ探索モジュール

- すべてをマスターする - FMZの新バージョンの取引ターミナルへの紹介 (TRB仲裁ソースコード)

- FMZの新バージョンの取引端末のご紹介 (TRBの利息ソースコード追加)

- FMZ Quant: 仮想通貨市場における共通要件設計例の分析 (II)

- 80行のコードで高周波戦略で 脳のない販売ボットを利用する方法

- FMZ定量化:仮想通貨市場の常用需要設計事例解析 (II)

- 80行コードの高周波戦略で脳のないロボットを搾取して売る方法

- FMZ Quant: 仮想通貨市場における共通要件設計例の分析 (I)

- FMZ定量化:仮想通貨市場の常用需要設計事例解析 (1)