Versi Python strategi suruhanjaya aisberg

Penulis:Kebaikan, Dicipta: 2020-07-21 10:21:10, Dikemas kini: 2023-10-26 20:08:29

Artikel ini membawa dua strategi klasik untuk pemindahan: Suruhanjaya Iceberg (beli / jual). Strategi ini dipindahkan dari versi JavaScript Suruhanjaya Iceberg platform FMZ. Alamat strategi adalahhttps://www.fmz.com/square/s:Iceberg/1

Mengutip versi JavaScript Iceberg perkenalan strategi perdagangan komisen:

Komisen Iceberg merujuk kepada fakta bahawa apabila pelabur menjalankan urus niaga bernilai besar, untuk mengelakkan kesan yang berlebihan pada pasaran, komisen pesanan besar secara automatik dibahagikan kepada beberapa komisen, berdasarkan harga beli / jual 1 terkini dan harga yang ditetapkan oleh peniaga.

Banyak halaman perdagangan bursa dilengkapi dengan alat pengisian aisberg, yang mempunyai fungsi yang kaya, tetapi jika anda ingin menyesuaikan beberapa fungsi atau mengubah suai beberapa fungsi mengikut keperluan anda sendiri, anda memerlukan alat yang lebih fleksibel. Platform FMZ direka untuk menyelesaikan masalah ini dengan betul. Square strategi kami tidak mempunyai terlalu banyak strategi perdagangan Python. Sesetengah peniaga yang ingin menggunakan bahasa Python untuk menulis alat dan strategi perdagangan perlu merujuk kepada contoh. Oleh itu, strategi pengisian aisberg klasik dipindahkan ke versi Python.

Suruhanjaya Iceberg untuk Python - Pembelian

import random # Import random number library

def CancelPendingOrders(): # The function of CancelPendingOrders is to cancel all pending orders of the current transaction.

while True: # Loop detection, call GetOrders function to detect the current pending order, if orders is an empty array, that is, len(orders) is equal to 0, indicating that all orders have been cancelled, you can exit the function and call return to exit.

orders = _C(exchange.GetOrders)

if len(orders) == 0 :

return

for j in range(len(orders)): # Traverse the current array of pending orders, and call CancelOrder to cancel the orders one by one.

exchange.CancelOrder(orders[j]["Id"])

if j < len(orders) - 1: # Except for the last order, execute Sleep every time and let the program wait for a while to avoid canceling orders too frequently.

Sleep(Interval)

LastBuyPrice = 0 # Set a global variable to record the the latest buying price.

InitAccount = None # Set a global variable to record the initial account asset information.

def dispatch(): # Main functions of iceberg commission logic

global InitAccount, LastBuyPrice # Reference global variables

account = None # Declare a variable to record the account information obtained in real time for comparison calculation.

ticker = _C(exchange.GetTicker) # Declare a variable to record the latest market quotes.

LogStatus(_D(), "ticker:", ticker) # Output time and latest quotation in the status bar

if LastBuyPrice > 0: # When LastBuyPrice is greater than 0, that is, when the commission has started, the code in the if condition is executed.

if len(_C(exchange.GetOrders)) > 0: # Call the exchange.GetOrders function to get all current pending orders, determine that there are pending orders, and execute the code in the if condition.

if ticker["Last"] > LastBuyPrice and ((ticker["Last"] - LastBuyPrice) / LastBuyPrice) > (2 * (EntrustDepth / 100)): # Detect the degree of deviation, if the condition is triggered, execute the code in the if, and cancel the order.

Log("Too much deviation, the latest transaction price:", ticker["Last"], "Commission price", LastBuyPrice)

CancelPendingOrders()

else :

return True

else : # If there is no pending order, it proves that the order is completely filled.

account = _C(exchange.GetAccount) # Get current account asset information.

Log("The buying order is completed, the cumulative cost:", _N(InitAccount["Balance"] - account["Balance"]), "Average buying price:", _N((InitAccount["Balance"] - account["Balance"]) / (account["Stocks"] - InitAccount["Stocks"]))) # Print transaction information.

LastBuyPrice = 0 # Reset LastBuyPrice to 0

BuyPrice = _N(ticker["Buy"] * (1 - EntrustDepth / 100)) # Calculate the price of pending orders based on current market conditions and parameters.

if BuyPrice > MaxBuyPrice: # Determine whether the maximum price set by the parameter is exceeded

return True

if not account: # If account is null, execute the code in the if statement to retrieve the current asset information and copy it to account

account = _C(exchange.GetAccount)

if (InitAccount["Balance"] - account["Balance"]) >= TotalBuyNet: # Determine whether the total amount of money spent on buying exceeds the parameter setting.

return False

RandomAvgBuyOnce = (AvgBuyOnce * ((100.0 - FloatPoint) / 100.0)) + (((FloatPoint * 2) / 100.0) * AvgBuyOnce * random.random()) # random number 0~1

UsedMoney = min(account["Balance"], RandomAvgBuyOnce, TotalBuyNet - (InitAccount["Balance"] - account["Balance"]))

BuyAmount = _N(UsedMoney / BuyPrice) # Calculate the buying quantity

if BuyAmount < MinStock: # Determine whether the buying quantity is less than the minimum buying quantity limit on the parameter.

return False

LastBuyPrice = BuyPrice # Record the price of this order and assign it to LastBuyPrice

exchange.Buy(BuyPrice, BuyAmount, "spend:¥", _N(UsedMoney), "Last transaction price", ticker["Last"]) # Place orders

return True

def main():

global LoopInterval, InitAccount # Refer to LoopInterval, InitAccount global variables

CancelPendingOrders() # Cancel all pending orders when starting to run

InitAccount = _C(exchange.GetAccount) # Account assets at the beginning of the initial record

Log(InitAccount) # Print initial account information

if InitAccount["Balance"] < TotalBuyNet: # If the initial assets are insufficient, an error will be thrown and the program will stop

raise Exception("Insufficient account balance")

LoopInterval = max(LoopInterval, 1) # Set LoopInterval to at least 1

while dispatch(): # The main loop, the iceberg commission logic function dispatch is called continuously, and the loop stops when the dispatch function returns false.

Sleep(LoopInterval * 1000) # Pause each cycle to control the polling frequency.

Log("委托全部完成", _C(exchange.GetAccount)) # When the loop execution jumps out, the current account asset information is printed.

Suruhanjaya Iceberg untuk Python - Jualan

Logik strategi adalah sama dengan pembelian, hanya dengan sedikit perbezaan.

import random

def CancelPendingOrders():

while True:

orders = _C(exchange.GetOrders)

if len(orders) == 0:

return

for j in range(len(orders)):

exchange.CancelOrder(orders[j]["Id"])

if j < len(orders) - 1:

Sleep(Interval)

LastSellPrice = 0

InitAccount = None

def dispatch():

global LastSellPrice, InitAccount

account = None

ticker = _C(exchange.GetTicker)

LogStatus(_D(), "ticker:", ticker)

if LastSellPrice > 0:

if len(_C(exchange.GetOrders)) > 0:

if ticker["Last"] < LastSellPrice and ((LastSellPrice - ticker["Last"]) / ticker["Last"]) > (2 * (EntrustDepth / 100)):

Log("Too much deviation, the latest transaction price:", ticker["Last"], "Commission price", LastSellPrice)

CancelPendingOrders()

else :

return True

else :

account = _C(exchange.GetAccount)

Log("The buy order is completed, and the accumulated selling:", _N(InitAccount["Stocks"] - account["Stocks"]), "Average selling price:", _N((account["Balance"] - InitAccount["Balance"]) / (InitAccount["Stocks"] - account["Stocks"])))

LastSellPrice = 0

SellPrice = _N(ticker["Sell"] * (1 + EntrustDepth / 100))

if SellPrice < MinSellPrice:

return True

if not account:

account = _C(exchange.GetAccount)

if (InitAccount["Stocks"] - account["Stocks"]) >= TotalSellStocks:

return False

RandomAvgSellOnce = (AvgSellOnce * ((100.0 - FloatPoint) / 100.0)) + (((FloatPoint * 2) / 100.0) * AvgSellOnce * random.random())

SellAmount = min(TotalSellStocks - (InitAccount["Stocks"] - account["Stocks"]), RandomAvgSellOnce)

if SellAmount < MinStock:

return False

LastSellPrice = SellPrice

exchange.Sell(SellPrice, SellAmount, "Last transaction price", ticker["Last"])

return True

def main():

global InitAccount, LoopInterval

CancelPendingOrders()

InitAccount = _C(exchange.GetAccount)

Log(InitAccount)

if InitAccount["Stocks"] < TotalSellStocks:

raise Exception("Insufficient account currency")

LoopInterval = max(LoopInterval, 1)

while dispatch():

Sleep(LoopInterval)

Log("All commissioned", _C(exchange.GetAccount))

Operasi Strategi

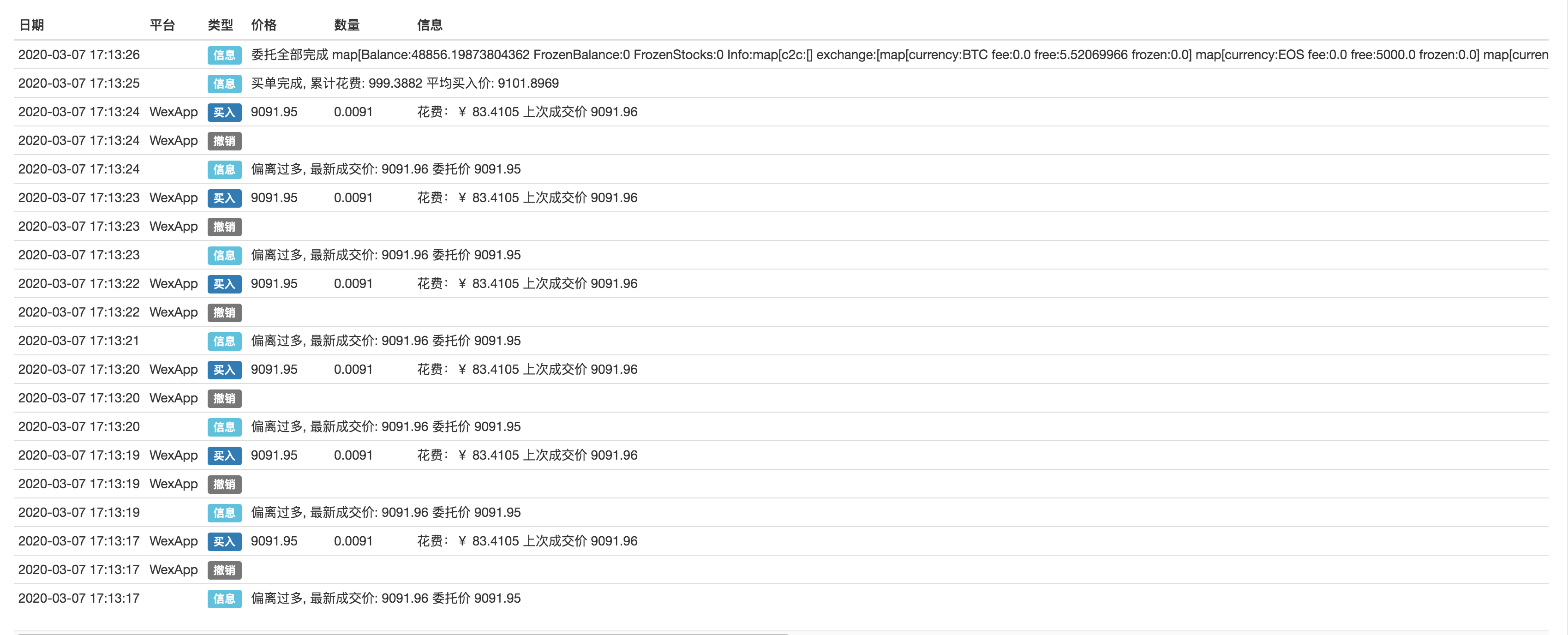

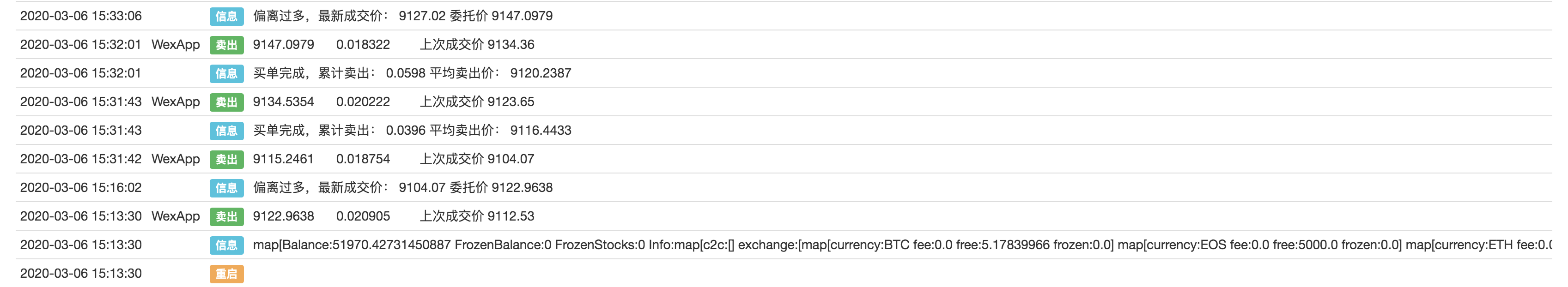

Gunakan WexApp untuk mensimulasikan ujian pertukaran:

Membeli:

Menjual:

Logik strategi tidak rumit. Apabila strategi dilaksanakan, ia akan secara dinamik meletakkan dan membatalkan pesanan berdasarkan parameter strategi dan harga pasaran semasa. Apabila jumlah transaksi / nombor syiling mencapai atau mendekati nombor tetapan parameter, strategi berhenti. Kod strategi sangat mudah dan sesuai untuk pemula. Pembaca yang berminat boleh mengubahnya dan merancang strategi yang sesuai dengan gaya perdagangan mereka.

- Mengukur Analisis Dasar di Pasaran Cryptocurrency: Biarkan Data Bercakap Sendiri!

- Perbincangan mengenai kajian kuantitatif asas dalam lingkaran mata wang - jangan mempercayai guru-guru sihir yang bodoh, data adalah objektif!

- Alat penting dalam bidang transaksi kuantitatif - Pencipta modul pencarian data kuantitatif

- Menguasai Semuanya - Pengenalan kepada FMZ Versi Baru Terminal Dagangan (dengan Kod Sumber Arbitraj TRB)

- Menguasai segala-galanya FMZ versi baru terminal perdagangan pengenalan (tambahan kod sumber TRB suite)

- FMZ Quant: Analisis Contoh Reka Bentuk Keperluan Umum di Pasaran Cryptocurrency (II)

- Bagaimana untuk mengeksploitasi bot jualan tanpa otak dengan strategi frekuensi tinggi dalam 80 baris kod

- FMZ Kuantitatif: Penyelesaian contoh reka bentuk permintaan biasa di pasaran mata wang kripto (II)

- Bagaimana untuk mengeksploitasi robot tanpa otak yang dijual dengan strategi frekuensi tinggi 80 baris kod

- FMZ Quant: Analisis Contoh Reka Bentuk Keperluan Umum di Pasaran Cryptocurrency (I)

- FMZ Kuantitatif: Penyelesaian contoh reka bentuk permintaan biasa di pasaran mata wang kripto