Versão Python Commodity Futures Moving Average Estratégia

Autora:Bem-estar, Criado: 2020-05-28 13:17:45, Atualizado: 2023-11-02 19:57:32

É completamente transplantado do

Como a estratégia mais simples, a estratégia da média móvel é muito fácil de aprender, porque a estratégia da média móvel não tem algoritmos avançados e lógica complexa. As ideias são claras e fáceis, permitindo que os iniciantes se concentrem mais no estudo do design da estratégia, e até removam a parte relacionada à codificação, deixando uma estrutura de estratégia multi-variedade que pode ser facilmente expandida em ATR, MACD, BOLL e outras estratégias de indicadores.

Artigos relacionados à versão JavaScript:https://www.fmz.com/bbs-topic/5235.

Código fonte da estratégia

'''backtest

start: 2019-07-01 09:00:00

end: 2020-03-25 15:00:00

period: 1d

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

'''

import json

import re

import time

_bot = ext.NewPositionManager()

class Manager:

'Strategy logic control'

ACT_IDLE = 0

ACT_LONG = 1

ACT_SHORT = 2

ACT_COVER = 3

ERR_SUCCESS = 0

ERR_SET_SYMBOL = 1

ERR_GET_ORDERS = 2

ERR_GET_POS = 3

ERR_TRADE = 4

ERR_GET_DEPTH = 5

ERR_NOT_TRADING = 6

errMsg = ["Success", "Failed to switch contract", "Failed to get order info", "Failed to get position info", "Placing Order failed", "Failed to get order depth info", "Not in trading hours"]

def __init__(self, needRestore, symbol, keepBalance, fastPeriod, slowPeriod):

# Get symbolDetail

symbolDetail = _C(exchange.SetContractType, symbol)

if symbolDetail["VolumeMultiple"] == 0 or symbolDetail["MaxLimitOrderVolume"] == 0 or symbolDetail["MinLimitOrderVolume"] == 0 or symbolDetail["LongMarginRatio"] == 0 or symbolDetail["ShortMarginRatio"] == 0:

Log(symbolDetail)

raise Exception("Abnormal contract information")

else :

Log("contract", symbolDetail["InstrumentName"], "1 lot", symbolDetail["VolumeMultiple"], "lot, Maximum placing order quantity", symbolDetail["MaxLimitOrderVolume"], "Margin rate: ", _N(symbolDetail["LongMarginRatio"]), _N(symbolDetail["ShortMarginRatio"]), "Delivery date", symbolDetail["StartDelivDate"])

# Initialization

self.symbol = symbol

self.keepBalance = keepBalance

self.fastPeriod = fastPeriod

self.slowPeriod = slowPeriod

self.marketPosition = None

self.holdPrice = None

self.holdAmount = None

self.holdProfit = None

self.task = {

"action" : Manager.ACT_IDLE,

"amount" : 0,

"dealAmount" : 0,

"avgPrice" : 0,

"preCost" : 0,

"preAmount" : 0,

"init" : False,

"retry" : 0,

"desc" : "idle",

"onFinish" : None

}

self.lastPrice = 0

self.symbolDetail = symbolDetail

# Position status information

self.status = {

"symbol" : symbol,

"recordsLen" : 0,

"vm" : [],

"open" : 0,

"cover" : 0,

"st" : 0,

"marketPosition" : 0,

"lastPrice" : 0,

"holdPrice" : 0,

"holdAmount" : 0,

"holdProfit" : 0,

"symbolDetail" : symbolDetail,

"lastErr" : "",

"lastErrTime" : "",

"isTrading" : False

}

# Other processing work during object construction

vm = None

if RMode == 0:

vm = _G(self.symbol)

else:

vm = json.loads(VMStatus)[self.symbol]

if vm:

Log("Ready to resume progress, current contract status is", vm)

self.reset(vm[0])

else:

if needRestore:

Log("could not find" + self.symbol + "progress recovery information")

self.reset()

def setLastError(self, err=None):

if err is None:

self.status["lastErr"] = ""

self.status["lastErrTime"] = ""

return

t = _D()

self.status["lastErr"] = err

self.status["lastErrTime"] = t

def reset(self, marketPosition=None):

if marketPosition is not None:

self.marketPosition = marketPosition

pos = _bot.GetPosition(self.symbol, PD_LONG if marketPosition > 0 else PD_SHORT)

if pos is not None:

self.holdPrice = pos["Price"]

self.holdAmount = pos["Amount"]

Log(self.symbol, "Position", pos)

else :

raise Exception("Restore" + self.symbol + "position status is wrong, no position information found")

Log("Restore", self.symbol, "average holding position price:", self.holdPrice, "Number of positions:", self.holdAmount)

self.status["vm"] = [self.marketPosition]

else :

self.marketPosition = 0

self.holdPrice = 0

self.holdAmount = 0

self.holdProfit = 0

self.holdProfit = 0

self.lastErr = ""

self.lastErrTime = ""

def Status(self):

self.status["marketPosition"] = self.marketPosition

self.status["holdPrice"] = self.holdPrice

self.status["holdAmount"] = self.holdAmount

self.status["lastPrice"] = self.lastPrice

if self.lastPrice > 0 and self.holdAmount > 0 and self.marketPosition != 0:

self.status["holdProfit"] = _N((self.lastPrice - self.holdPrice) * self.holdAmount * self.symbolDetail["VolumeMultiple"], 4) * (1 if self.marketPosition > 0 else -1)

else :

self.status["holdProfit"] = 0

return self.status

def setTask(self, action, amount = None, onFinish = None):

self.task["init"] = False

self.task["retry"] = 0

self.task["action"] = action

self.task["preAmount"] = 0

self.task["preCost"] = 0

self.task["amount"] = 0 if amount is None else amount

self.task["onFinish"] = onFinish

if action == Manager.ACT_IDLE:

self.task["desc"] = "idle"

self.task["onFinish"] = None

else:

if action != Manager.ACT_COVER:

self.task["desc"] = ("Adding long position" if action == Manager.ACT_LONG else "Adding short position") + "(" + str(amount) + ")"

else :

self.task["desc"] = "Closing Position"

Log("Task received", self.symbol, self.task["desc"])

self.Poll(True)

def processTask(self):

insDetail = exchange.SetContractType(self.symbol)

if not insDetail:

return Manager.ERR_SET_SYMBOL

SlideTick = 1

ret = False

if self.task["action"] == Manager.ACT_COVER:

hasPosition = False

while True:

if not ext.IsTrading(self.symbol):

return Manager.ERR_NOT_TRADING

hasPosition = False

positions = exchange.GetPosition()

if positions is None:

return Manager.ERR_GET_POS

depth = exchange.GetDepth()

if depth is None:

return Manager.ERR_GET_DEPTH

orderId = None

for i in range(len(positions)):

if positions[i]["ContractType"] != self.symbol:

continue

amount = min(insDetail["MaxLimitOrderVolume"], positions[i]["Amount"])

if positions[i]["Type"] == PD_LONG or positions[i]["Type"] == PD_LONG_YD:

exchange.SetDirection("closebuy_today" if positions[i].Type == PD_LONG else "closebuy")

orderId = exchange.Sell(_N(depth["Bids"][0]["Price"] - (insDetail["PriceTick"] * SlideTick), 2), min(amount, depth["Bids"][0]["Amount"]), self.symbol, "Close today's position" if positions[i]["Type"] == PD_LONG else "Close yesterday's position", "Bid", depth["Bids"][0])

hasPosition = True

elif positions[i]["Type"] == PD_SHORT or positions[i]["Type"] == PD_SHORT_YD:

exchange.SetDirection("closesell_today" if positions[i]["Type"] == PD_SHORT else "closesell")

orderId = exchange.Buy(_N(depth["Asks"][0]["Price"] + (insDetail["PriceTick"] * SlideTick), 2), min(amount, depth["Asks"][0]["Amount"]), self.symbol, "Close today's position" if positions[i]["Type"] == PD_SHORT else "Close yesterday's position", "Ask", depth["Asks"][0])

hasPosition = True

if hasPosition:

if not orderId:

return Manager.ERR_TRADE

Sleep(1000)

while True:

orders = exchange.GetOrders()

if orders is None:

return Manager.ERR_GET_ORDERS

if len(orders) == 0:

break

for i in range(len(orders)):

exchange.CancelOrder(orders[i]["Id"])

Sleep(500)

if not hasPosition:

break

ret = True

elif self.task["action"] == Manager.ACT_LONG or self.task["action"] == Manager.ACT_SHORT:

while True:

if not ext.IsTrading(self.symbol):

return Manager.ERR_NOT_TRADING

Sleep(1000)

while True:

orders = exchange.GetOrders()

if orders is None:

return Manager.ERR_GET_ORDERS

if len(orders) == 0:

break

for i in range(len(orders)):

exchange.CancelOrder(orders[i]["Id"])

Sleep(500)

positions = exchange.GetPosition()

if positions is None:

return Manager.ERR_GET_POS

pos = None

for i in range(len(positions)):

if positions[i]["ContractType"] == self.symbol and (((positions[i]["Type"] == PD_LONG or positions[i]["Type"] == PD_LONG_YD) and self.task["action"] == Manager.ACT_LONG) or ((positions[i]["Type"] == PD_SHORT) or positions[i]["Type"] == PD_SHORT_YD) and self.task["action"] == Manager.ACT_SHORT):

if not pos:

pos = positions[i]

pos["Cost"] = positions[i]["Price"] * positions[i]["Amount"]

else :

pos["Amount"] += positions[i]["Amount"]

pos["Profit"] += positions[i]["Profit"]

pos["Cost"] += positions[i]["Price"] * positions[i]["Amount"]

# records pre position

if not self.task["init"]:

self.task["init"] = True

if pos:

self.task["preAmount"] = pos["Amount"]

self.task["preCost"] = pos["Cost"]

else:

self.task["preAmount"] = 0

self.task["preCost"] = 0

remain = self.task["amount"]

if pos:

self.task["dealAmount"] = pos["Amount"] - self.task["preAmount"]

remain = int(self.task["amount"] - self.task["dealAmount"])

if remain <= 0 or self.task["retry"] >= MaxTaskRetry:

ret = {

"price" : (pos["Cost"] - self.task["preCost"]) / (pos["Amount"] - self.task["preAmount"]),

"amount" : (pos["Amount"] - self.task["preAmount"]),

"position" : pos

}

break

elif self.task["retry"] >= MaxTaskRetry:

ret = None

break

depth = exchange.GetDepth()

if depth is None:

return Manager.ERR_GET_DEPTH

orderId = None

if self.task["action"] == Manager.ACT_LONG:

exchange.SetDirection("buy")

orderId = exchange.Buy(_N(depth["Asks"][0]["Price"] + (insDetail["PriceTick"] * SlideTick), 2), min(remain, depth["Asks"][0]["Amount"]), self.symbol, "Ask", depth["Asks"][0])

else:

exchange.SetDirection("sell")

orderId = exchange.Sell(_N(depth["Bids"][0]["Price"] - (insDetail["PriceTick"] * SlideTick), 2), min(remain, depth["Bids"][0]["Amount"]), self.symbol, "Bid", depth["Bids"][0])

if orderId is None:

self.task["retry"] += 1

return Manager.ERR_TRADE

if self.task["onFinish"]:

self.task["onFinish"](ret)

self.setTask(Manager.ACT_IDLE)

return Manager.ERR_SUCCESS

def Poll(self, subroutine = False):

# Judge the trading hours

self.status["isTrading"] = ext.IsTrading(self.symbol)

if not self.status["isTrading"]:

return

# Perform order trading tasks

if self.task["action"] != Manager.ACT_IDLE:

retCode = self.processTask()

if self.task["action"] != Manager.ACT_IDLE:

self.setLastError("The task was not successfully processed:" + Manager.errMsg[retCode] + ", " + self.task["desc"] + ", Retry:" + str(self.task["retry"]))

else :

self.setLastError()

return

if subroutine:

return

suffix = "@" if WXPush else ""

# switch symbol

_C(exchange.SetContractType, self.symbol)

# Get K-line data

records = exchange.GetRecords()

if records is None:

self.setLastError("Failed to get K line")

return

self.status["recordsLen"] = len(records)

if len(records) < self.fastPeriod + 2 or len(records) < self.slowPeriod + 2:

self.setLastError("The length of the K line is less than the moving average period:" + str(self.fastPeriod) + "or" + str(self.slowPeriod))

return

opCode = 0 # 0 : IDLE , 1 : LONG , 2 : SHORT , 3 : CoverALL

lastPrice = records[-1]["Close"]

self.lastPrice = lastPrice

fastMA = TA.EMA(records, self.fastPeriod)

slowMA = TA.EMA(records, self.slowPeriod)

# Strategy logic

if self.marketPosition == 0:

if fastMA[-3] < slowMA[-3] and fastMA[-2] > slowMA[-2]:

opCode = 1

elif fastMA[-3] > slowMA[-3] and fastMA[-2] < slowMA[-2]:

opCode = 2

else:

if self.marketPosition < 0 and fastMA[-3] < slowMA[-3] and fastMA[-2] > slowMA[-2]:

opCode = 3

elif self.marketPosition > 0 and fastMA[-3] > slowMA[-3] and fastMA[-2] < slowMA[-2]:

opCode = 3

# If no condition is triggered, the opcode is 0 and return

if opCode == 0:

return

# Preforming closing position action

if opCode == 3:

def coverCallBack(ret):

self.reset()

_G(self.symbol, None)

self.setTask(Manager.ACT_COVER, 0, coverCallBack)

return

account = _bot.GetAccount()

canOpen = int((account["Balance"] - self.keepBalance) / (self.symbolDetail["LongMarginRatio"] if opCode == 1 else self.symbolDetail["ShortMarginRatio"]) / (lastPrice * 1.2) / self.symbolDetail["VolumeMultiple"])

unit = min(1, canOpen)

# Set up trading tasks

def setTaskCallBack(ret):

if not ret:

self.setLastError("Placing Order failed")

return

self.holdPrice = ret["position"]["Price"]

self.holdAmount = ret["position"]["Amount"]

self.marketPosition += 1 if opCode == 1 else -1

self.status["vm"] = [self.marketPosition]

_G(self.symbol, self.status["vm"])

self.setTask(Manager.ACT_LONG if opCode == 1 else Manager.ACT_SHORT, unit, setTaskCallBack)

def onexit():

Log("Exited strategy...")

def main():

if exchange.GetName().find("CTP") == -1:

raise Exception("Only support commodity futures CTP")

SetErrorFilter("login|ready|flow control|connection failed|initial|Timeout")

mode = exchange.IO("mode", 0)

if mode is None:

raise Exception("Failed to switch modes, please update to the latest docker!")

while not exchange.IO("status"):

Sleep(3000)

LogStatus("Waiting for connection with the trading server," + _D())

positions = _C(exchange.GetPosition)

if len(positions) > 0:

Log("Detecting the current holding position, the system will start to try to resume the progress...")

Log("Position information:", positions)

initAccount = _bot.GetAccount()

initMargin = json.loads(exchange.GetRawJSON())["CurrMargin"]

keepBalance = _N((initAccount["Balance"] + initMargin) * (KeepRatio / 100), 3)

Log("Asset information", initAccount, "Retain funds:", keepBalance)

tts = []

symbolFilter = {}

arr = Instruments.split(",")

arrFastPeriod = FastPeriodArr.split(",")

arrSlowPeriod = SlowPeriodArr.split(",")

if len(arr) != len(arrFastPeriod) or len(arr) != len(arrSlowPeriod):

raise Exception("The moving average period parameter does not match the number of added contracts, please check the parameters!")

for i in range(len(arr)):

symbol = re.sub(r'/\s+$/g', "", re.sub(r'/^\s+/g', "", arr[i]))

if symbol in symbolFilter.keys():

raise Exception(symbol + "Already exists, please check the parameters!")

symbolFilter[symbol] = True

hasPosition = False

for j in range(len(positions)):

if positions[j]["ContractType"] == symbol:

hasPosition = True

break

fastPeriod = int(arrFastPeriod[i])

slowPeriod = int(arrSlowPeriod[i])

obj = Manager(hasPosition, symbol, keepBalance, fastPeriod, slowPeriod)

tts.append(obj)

preTotalHold = -1

lastStatus = ""

while True:

if GetCommand() == "Pause/Resume":

Log("Suspending trading ...")

while GetCommand() != "Pause/Resume":

Sleep(1000)

Log("Continue trading...")

while not exchange.IO("status"):

Sleep(3000)

LogStatus("Waiting for connection with the trading server," + _D() + "\n" + lastStatus)

tblStatus = {

"type" : "table",

"title" : "Position information",

"cols" : ["Contract Name", "Direction of Position", "Average Position Price", "Number of Positions", "Position profits and Losses", "Number of Positions Added", "Current Price"],

"rows" : []

}

tblMarket = {

"type" : "table",

"title" : "Operating status",

"cols" : ["Contract name", "Contract multiplier", "Margin rate", "Trading time", "Bar length", "Exception description", "Time of occurrence"],

"rows" : []

}

totalHold = 0

vmStatus = {}

ts = time.time()

holdSymbol = 0

for i in range(len(tts)):

tts[i].Poll()

d = tts[i].Status()

if d["holdAmount"] > 0:

vmStatus[d["symbol"]] = d["vm"]

holdSymbol += 1

tblStatus["rows"].append([d["symbolDetail"]["InstrumentName"], "--" if d["holdAmount"] == 0 else ("long" if d["marketPosition"] > 0 else "short"), d["holdPrice"], d["holdAmount"], d["holdProfit"], abs(d["marketPosition"]), d["lastPrice"]])

tblMarket["rows"].append([d["symbolDetail"]["InstrumentName"], d["symbolDetail"]["VolumeMultiple"], str(_N(d["symbolDetail"]["LongMarginRatio"], 4)) + "/" + str(_N(d["symbolDetail"]["ShortMarginRatio"], 4)), "is #0000ff" if d["isTrading"] else "not #ff0000", d["recordsLen"], d["lastErr"], d["lastErrTime"]])

totalHold += abs(d["holdAmount"])

now = time.time()

elapsed = now - ts

tblAssets = _bot.GetAccount(True)

nowAccount = _bot.Account()

if len(tblAssets["rows"]) > 10:

tblAssets["rows"][0] = ["InitAccount", "Initial asset", initAccount]

else:

tblAssets["rows"].insert(0, ["NowAccount", "Currently available", nowAccount])

tblAssets["rows"].insert(0, ["InitAccount", "Initial asset", initAccount])

lastStatus = "`" + json.dumps([tblStatus, tblMarket, tblAssets]) + "`\nPolling time:" + str(elapsed) + " Seconds, current time:" + _D() + ", Number of varieties held:" + str(holdSymbol)

if totalHold > 0:

lastStatus += "\nManually restore the string:" + json.dumps(vmStatus)

LogStatus(lastStatus)

if preTotalHold > 0 and totalHold == 0:

LogProfit(nowAccount.Balance - initAccount.Balance - initMargin)

preTotalHold = totalHold

Sleep(LoopInterval * 1000)

Endereço estratégico:https://www.fmz.com/strategy/208512

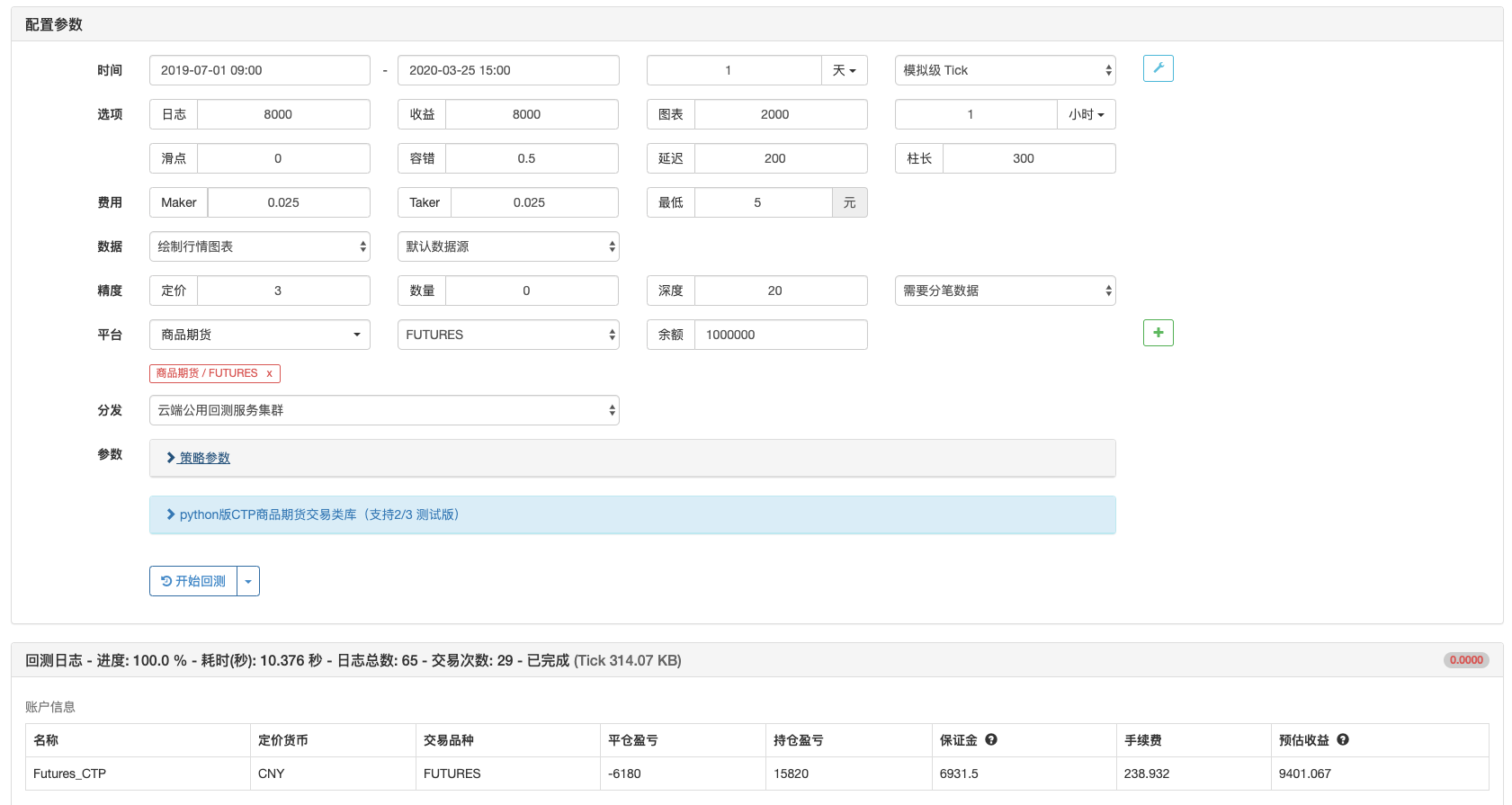

Comparação de ensaio posterior

Comparamos a versão JavaScript e a versão Python da estratégia com backtest.

- Backtest da versão Python

Usamos um servidor público para backtest, e podemos ver que o backtest da versão Python é um pouco mais rápido.

- Backtest da versão JavaScript

Pode-se ver que os resultados dos backtests são exatamente os mesmos.

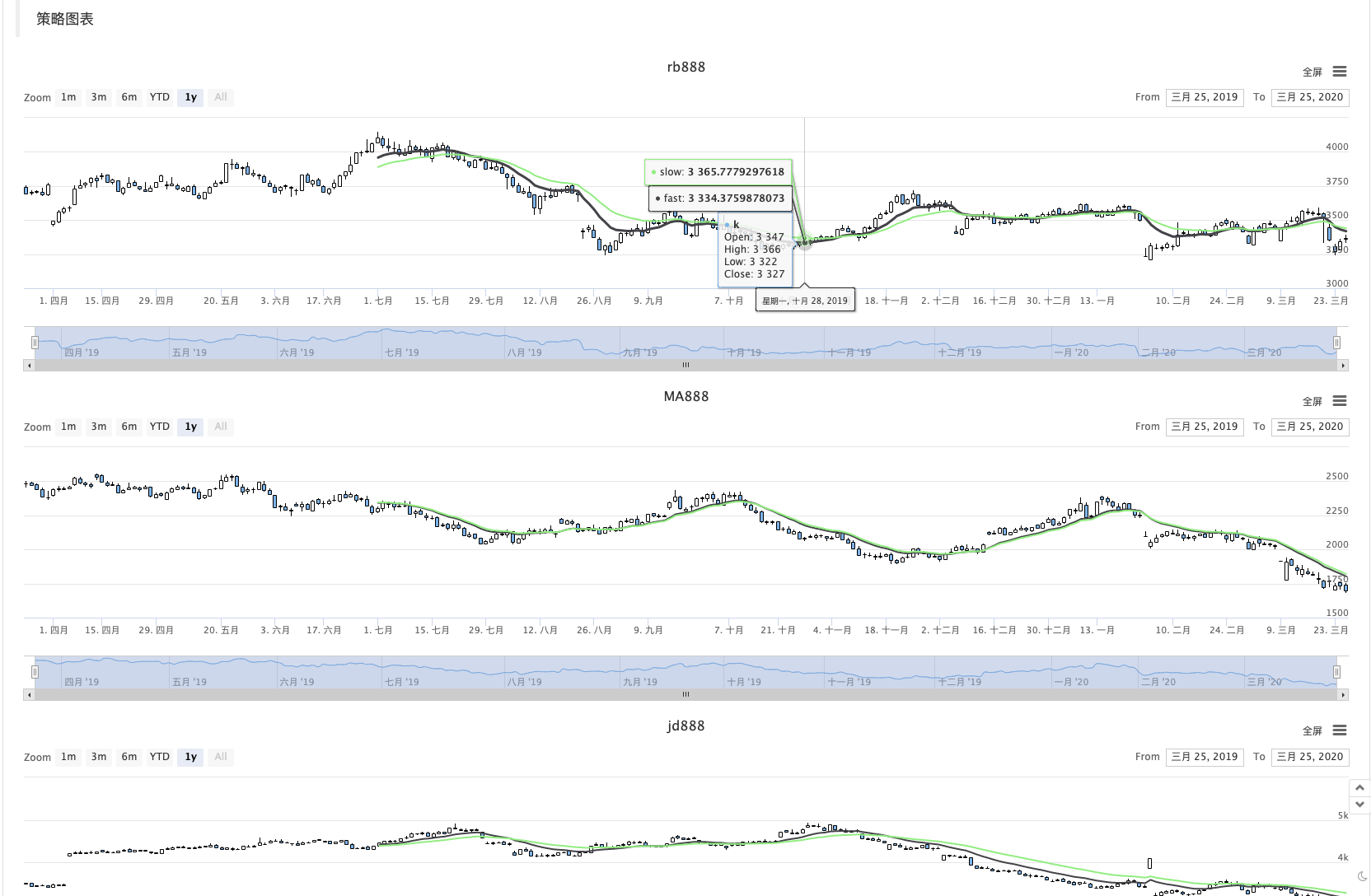

Expandir

Vamos fazer uma demonstração de extensão e estender a função gráfico para a estratégia, como mostrado na figura:

Principalmente aumentar a parte de codificação:

- Adicionar um membro à classe Manager:

objChart - Adicionar um método à classe Manager:

PlotRecords

Algumas outras modificações são feitas em torno desses dois pontos. Você pode comparar as diferenças entre as duas versões e aprender as ideias de funções estendidas.

- Quantificar a análise fundamental no mercado de criptomoedas: deixe os dados falarem por si mesmos!

- A pesquisa quantitativa básica do círculo monetário - deixe de acreditar em todos os professores de matemática loucos, os dados são objetivos!

- Uma ferramenta indispensável no campo da transação quantitativa - inventor do módulo de exploração de dados quantitativos

- Dominar tudo - Introdução ao FMZ Nova versão do Terminal de Negociação (com TRB Arbitrage Source Code)

- Conheça tudo sobre a nova versão do terminal de negociação da FMZ

- FMZ Quant: Análise de Exemplos de Design de Requisitos Comuns no Mercado de Criptomoedas (II)

- Como explorar robôs de venda sem cérebro com uma estratégia de alta frequência em 80 linhas de código

- Quantificação FMZ: Análise de casos de design de necessidades comuns do mercado de criptomoedas (II)

- Como usar estratégias de 80 linhas de código de alta frequência para explorar robôs sem cérebro para venda

- FMZ Quant: Análise de Exemplos de Design de Requisitos Comuns no Mercado de Criptomoedas (I)

- Quantificação FMZ: Análise de casos de design de necessidades comuns do mercado de criptomoedas (I)