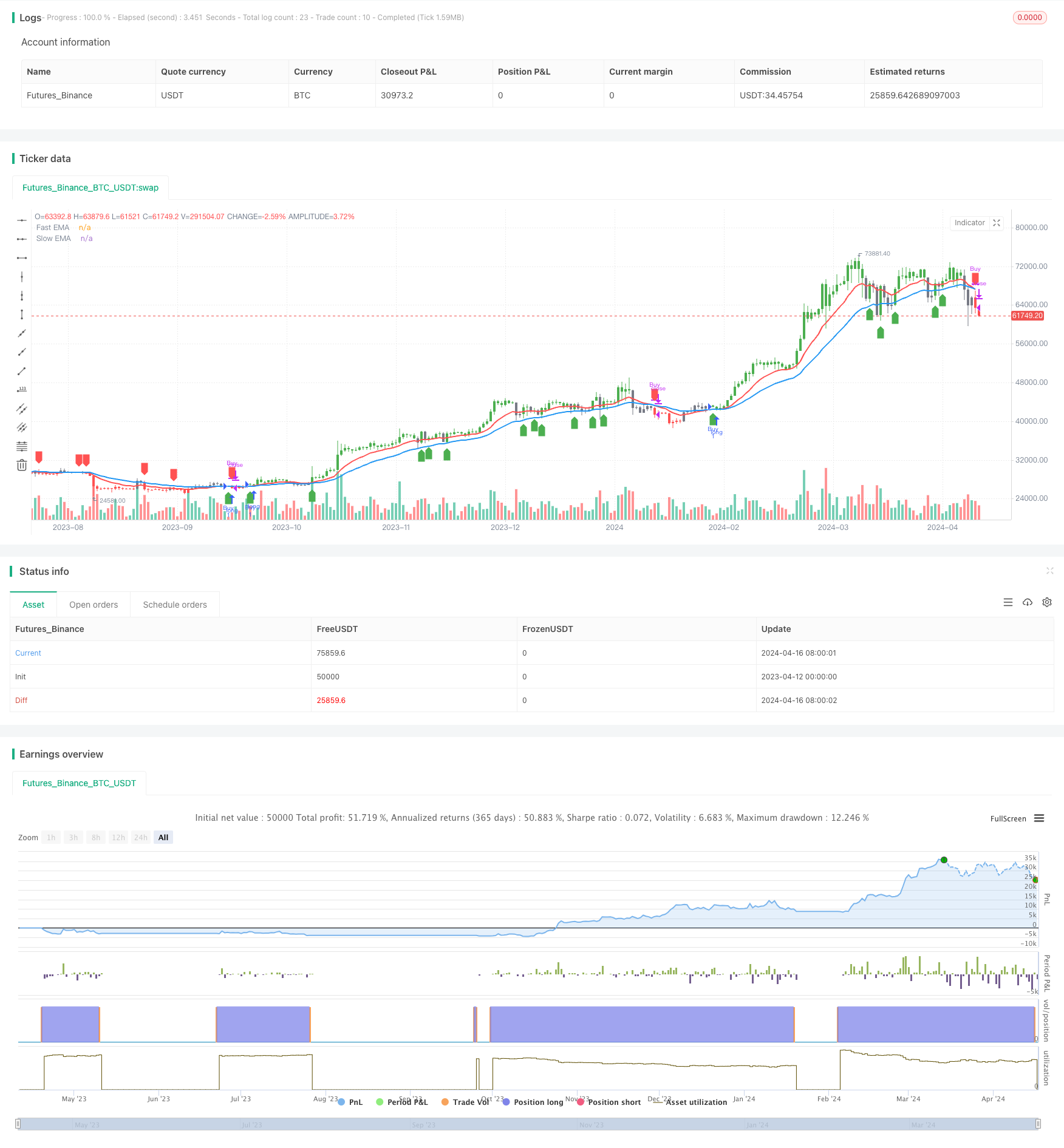

概述

该策略使用两条不同周期的指数移动平均线(EMA)进行交叉,当快速EMA从下往上穿越慢速EMA时产生买入信号,当快速EMA从上往下穿越慢速EMA时产生卖出信号。该策略可以应用于各种金融工具和时间周期,例如黄金在2小时周期上最有效,比特币在日线图上最有效等。

策略原理

- 计算快速EMA(默认周期为12)和慢速EMA(默认周期为26)。

- 定义多头区域(快速EMA在慢速EMA上方且价格在快速EMA上方)和空头区域(快速EMA在慢速EMA下方且价格在快速EMA下方)。

- 当从空头区域转换为多头区域时买入,当从多头区域转换为空头区域时卖出。

- 在图表上用绿色和红色标记多头区域和空头区域,用箭头标记买卖信号。

策略优势

- 简单易懂,适合初学者学习。

- 适用性广,可以用于各种金融工具和时间周期。

- 趋势跟踪能力强,能够捕捉到中长期趋势。

- 参数可调,增加了灵活性。

策略风险

- 在震荡市容易产生错误信号,导致亏损。

- 趋势转折时反应较慢,会造成一定滑点。

- 参数选择不当会影响策略效果。

策略优化方向

- 加入趋势过滤,比如只在ADX大于某个值时交易,减少震荡市的亏损。

- 优化进出场时机,比如使用ATR决定止损止盈,减少单笔亏损。

- 对参数进行优化,找到最佳参数组合,提高稳定性和盈利能力。

- 结合其他指标辅助判断,如MACD、RSI等,提高信号准确率。

总结

MACD交叉策略是一个基于趋势跟踪的简单策略,优点是简单实用、适用范围广,缺点是难以把握趋势转折、参数选择有难度。通过趋势过滤、优化进出场点、参数优选和组合其他指标可以改进该策略的表现,值得进一步研究和测试。

策略源码

/*backtest

start: 2023-04-12 00:00:00

end: 2024-04-17 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Advance EMA Crossover Strategy', overlay=true, precision=6)

//****************************************************************************//

// CDC Action Zone is based on a simple EMA crossover

// between [default] EMA12 and EMA26

// The zones are defined by the relative position of

// price in relation to the two EMA lines

// Different zones can be use to activate / deactivate

// other trading strategies

// The strategy can also be used on its own with

// acceptable results, buy on the first green candle

// and sell on the first red candle

//****************************************************************************//

// Define User Input Variables

xsrc = input(title='Source Data', defval=close)

xprd1 = input(title='Fast EMA period', defval=12)

xprd2 = input(title='Slow EMA period', defval=26)

xsmooth = input(title='Smoothing period (1 = no smoothing)', defval=1)

fillSW = input(title='Paint Bar Colors', defval=true)

fastSW = input(title='Show fast moving average line', defval=true)

slowSW = input(title='Show slow moving average line', defval=true)

plotSigsw = input(title='Plot Buy/Sell Signals?', defval=true)

//****************************************************************************//

//Calculate Indicators

xPrice = ta.ema(xsrc, xsmooth)

FastMA = ta.ema(xPrice, xprd1)

SlowMA = ta.ema(xPrice, xprd2)

//****************************************************************************//

// Define Color Zones and Conditions

BullZone = FastMA > SlowMA and xPrice > FastMA // Bullish Zone

BearZone = FastMA < SlowMA and xPrice < FastMA // Bearish Zone

//****************************************************************************//

// Strategy Entry and Exit Conditions

if (BullZone and not BullZone[1])

strategy.entry("Buy", strategy.long) // Buy on the transition into BullZone

if (BearZone and not BearZone[1])

strategy.close("Buy") // Sell on the transition into BearZone

//****************************************************************************//

// Display color on chart

plotcolor = BullZone ? color.green : BearZone ? color.red : color.gray

barcolor(color=fillSW ? plotcolor : na)

//****************************************************************************//

// Plot Fast and Slow Moving Averages

plot(fastSW ? FastMA : na, color=color.red, title="Fast EMA", linewidth=2)

plot(slowSW ? SlowMA : na, color=color.blue, title="Slow EMA", linewidth=2)

//****************************************************************************//

// Plot Buy and Sell Signals

plotshape(series=plotSigsw and BullZone and not BullZone[1], location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal")

plotshape(series=plotSigsw and BearZone and not BearZone[1], location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal")

//****************************************************************************//

相关推荐