概述

该策略是一种基于移动平均线交叉和动态ATR止盈止损的量化交易策略。该策略使用两条不同周期的简单移动平均线(SMA)来生成交易信号,同时采用平均真实波动幅度(ATR)来动态设置止盈和止损位,以更好地控制风险。此外,该策略还根据不同的交易时段来过滤交易信号,以提高策略的稳健性。

策略原理

该策略的核心原理是利用移动平均线的交叉来捕捉价格趋势的变化。当快速移动平均线从下向上穿越慢速移动平均线时,生成买入信号;当快速移动平均线从上向下穿越慢速移动平均线时,生成卖出信号。同时,该策略使用ATR来动态设置止盈和止损位,止盈位设置为入场价格加上3倍的ATR,止损位设置为入场价格减去1.5倍的ATR。此外,该策略只在欧洲交易时段生成交易信号,以避免在流动性较差的时段交易。

策略优势

- 简单易懂:该策略使用简单移动平均线和ATR等常用技术指标,策略逻辑清晰,易于理解和实现。

- 动态风险控制:通过动态设置止盈和止损位,该策略可以根据市场波动情况自适应地控制风险。

- 时间过滤:通过限定交易时段,该策略可以避免在流动性较差的时段交易,提高策略稳健性。

策略风险

- 参数优化风险:该策略的表现依赖于移动平均线的周期选择和ATR的计算周期,不同的参数设置可能导致策略表现差异较大,存在参数优化的风险。

- 趋势识别风险:移动平均线交叉策略在震荡市场中可能会出现较多的错误信号,导致策略表现不佳。

- 止损风险:虽然该策略设置了动态止损位,但在市场出现剧烈波动时,仍可能出现较大的损失。

策略优化方向

- 信号过滤:可以考虑引入其他技术指标或市场情绪指标,对交易信号进行二次过滤,以提高信号质量。

- 动态参数优化:可以通过机器学习或自适应算法,动态调整策略参数,以适应不同的市场状态。

- 风险管理优化:可以引入更高级的风险管理技术,如波动率调整、动态资金分配等,以进一步控制策略风险。

总结

该策略是一种简单易懂的趋势追踪策略,通过移动平均线交叉来捕捉价格趋势,同时使用ATR来控制风险。尽管该策略存在一定的风险,但通过参数优化、信号过滤、风险管理等方面的优化,可以进一步提高策略的稳健性和盈利能力。对于初学者来说,该策略是一个很好的学习和实践案例。

策略源码

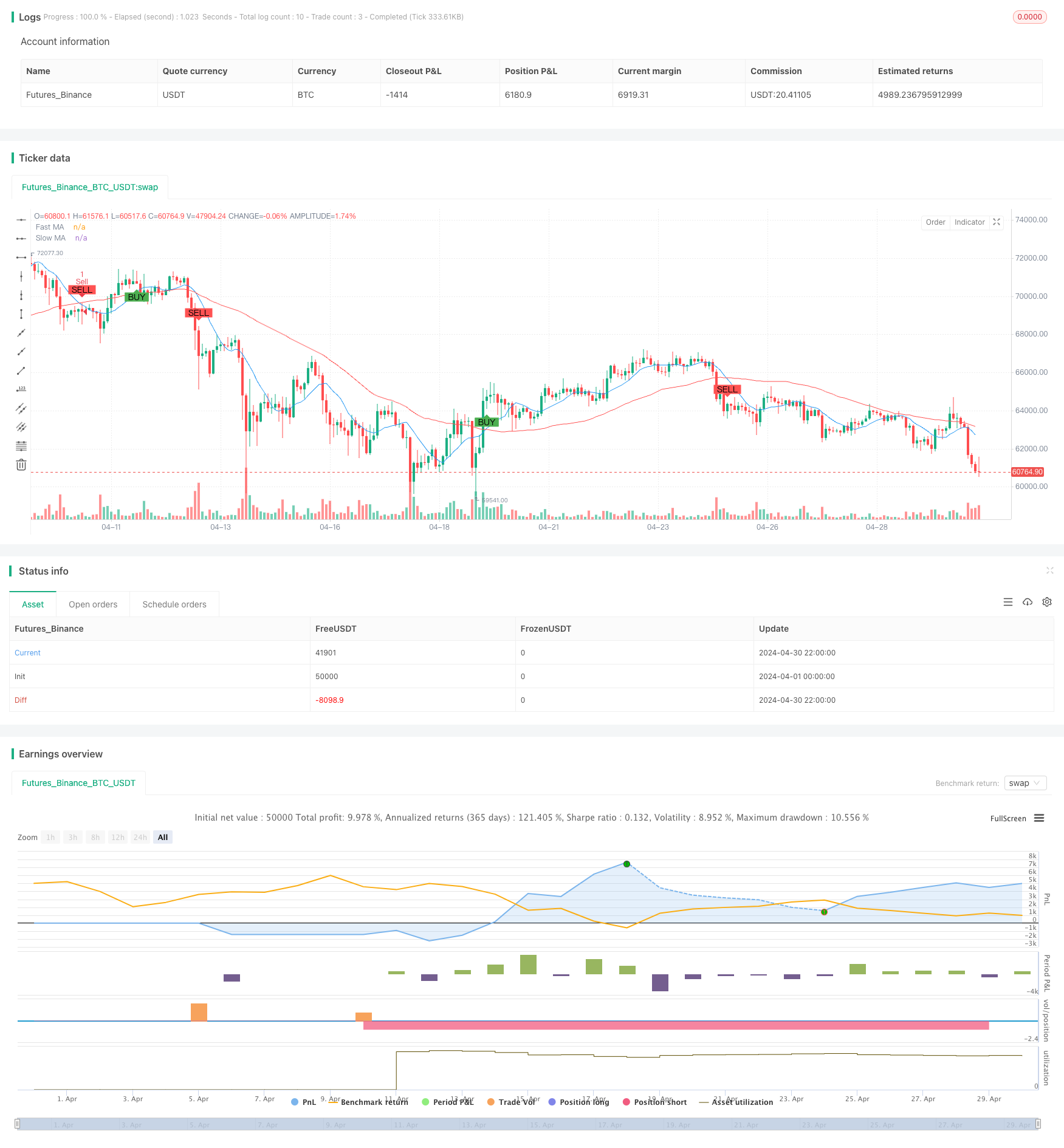

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Enhanced Moving Average Crossover Strategy", overlay=true)

// Input parameters

fastLength = input(10, title="Fast MA Length")

slowLength = input(50, title="Slow MA Length")

atrLength = input(14, title="ATR Length")

riskPerTrade = input(1, title="Risk Per Trade (%)") / 100

// Time-based conditions

isLondonSession = hour >= 8 and hour <= 15

isAsianSession = hour >= 0 and hour <= 7

isEuropeanSession = hour >= 7 and hour <= 14

// Moving Averages

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

// Average True Range (ATR) for dynamic stop loss and take profit

atr = ta.atr(atrLength)

// Buy and Sell Conditions

buySignal = ta.crossover(fastMA, slowMA)

sellSignal = ta.crossunder(fastMA, slowMA)

// Dynamic stop loss and take profit

stopLoss = close - atr * 1.5

takeProfit = close + atr * 3

// Strategy Logic

if (buySignal and isEuropeanSession)

strategy.entry("Buy", strategy.long)

strategy.exit("Take Profit/Stop Loss", "Buy", limit=takeProfit, stop=stopLoss)

if (sellSignal and isEuropeanSession)

strategy.entry("Sell", strategy.short)

strategy.exit("Take Profit/Stop Loss", "Sell", limit=takeProfit, stop=stopLoss)

// Plotting

plot(fastMA, color=color.blue, title="Fast MA")

plot(slowMA, color=color.red, title="Slow MA")

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

相关推荐