概述

这是一个基于ATR动态调整的趋势跟踪策略,结合了移动平均线和ATR指标来确定入场和出场点。该策略的核心特点是通过ATR动态调整移动平均线的上下轨道,在价格突破上轨时入场做多,并设置基于ATR倍数的止损和止盈点。同时,策略还包含了创新的重入场机制,当价格回调至入场点时允许重新建仓。

策略原理

策略运作基于以下几个关键要素: 1. 使用ATR调整后的移动平均线作为趋势判断依据,形成动态的上下轨道 2. 当价格突破上轨时产生做多信号,入场价格为当前收盘价 3. 止损位设置为入场价下方2倍ATR距离 4. 止盈位设置为入场价上方(5+自定义倍数)×ATR距离 5. 在止损或止盈触发后,如果价格回调至原入场价位,策略将自动重新入场 6. 使用最大30根K线的显示限制来优化图表展示

策略优势

- 动态适应性强:通过ATR调整的移动平均线能够自适应市场波动率变化

- 风险管理科学:止损和止盈点基于ATR动态设置,符合市场波动特征

- 重入场机制创新:允许在价格回调至有利位置时重新入场,提高盈利机会

- 可视化效果优秀:策略提供清晰的入场、止损、止盈线条显示,便于交易监控

- 参数灵活可调:通过输入参数可以调整趋势判断周期和止盈倍数

策略风险

- 趋势反转风险:在震荡市场中可能频繁触发止损

- 重入场风险:价格回调至入场点重新建仓可能面临连续止损

- 滑点风险:在波动剧烈时期,实际成交价格可能与信号价格存在偏差

- 参数敏感性:不同市场条件下最优参数可能变化较大

- 计算负载:需要实时计算多个技术指标,可能增加系统负载

策略优化方向

- 引入市场环境过滤:可添加波动率过滤器,在高波动期间调整策略参数或暂停交易

- 优化重入场逻辑:可考虑在重入场时采用更严格的条件限制,如趋势确认指标

- 完善止盈机制:可实现移动止损功能,在趋势延续时保护更多利润

- 增加时间过滤:可添加交易时间段限制,避开低流动性期间

- 优化计算效率:可通过减少不必要的计算和绘图来提升策略运行效率

总结

这是一个设计合理、逻辑清晰的趋势跟踪策略,通过ATR动态调整提供了良好的市场适应性。策略的重入场机制是一个创新点,能够在良好的市场条件下提供额外的盈利机会。虽然存在一些需要注意的风险点,但通过建议的优化方向可以进一步提升策略的稳定性和盈利能力。对于寻求系统化交易方法的投资者来说,这是一个值得考虑的基础策略框架。

策略源码

/*backtest

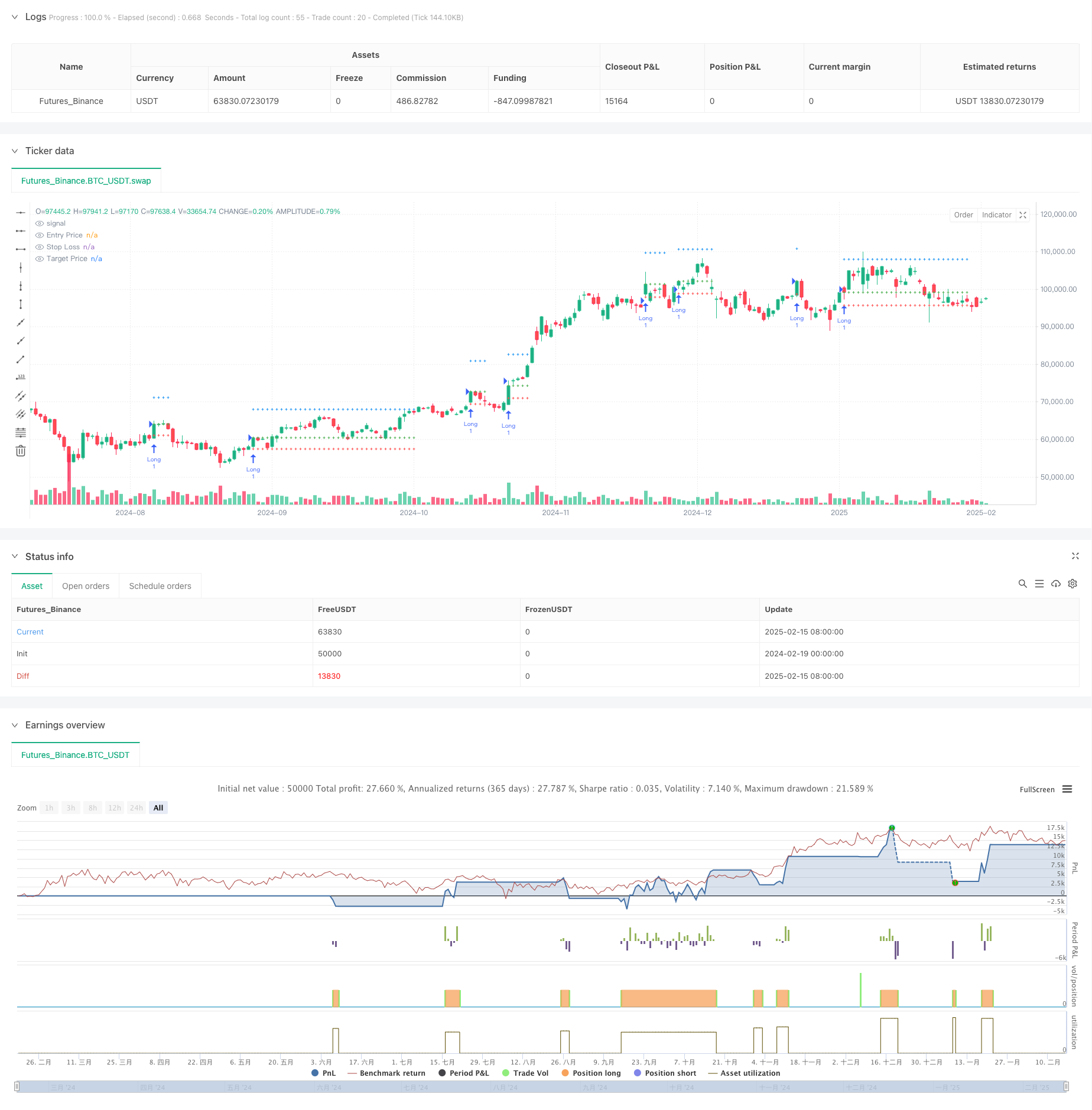

start: 2024-02-19 00:00:00

end: 2025-02-16 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("KON SET By Sai", overlay=true, max_lines_count=40)

// INPUTS

length = input.int(10, "Trend Length")

target_multiplier = input.int(0, "Set Targets") // Target adjustment

max_bars = 30 // Number of bars to display the lines after signal

// VARIABLES

var bool inTrade = false

var float entryPrice = na

var float stopLoss = na

var float targetPrice = na

var int barCount = na // Counter to track how many bars have passed since signal

// ATR for stop-loss and target calculation

atr_value = ta.sma(ta.atr(200), 200) * 0.8

// Moving averages for trend detection

sma_high = ta.sma(high, length) + atr_value

sma_low = ta.sma(low, length) - atr_value

// Signal conditions for trend changes

signal_up = ta.crossover(close, sma_high)

signal_down = ta.crossunder(close, sma_low)

// Entry conditions

if not inTrade and signal_up

entryPrice := close

stopLoss := close - atr_value * 2

targetPrice := close + atr_value * (5 + target_multiplier)

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", stop=stopLoss, limit=targetPrice)

inTrade := true

barCount := 0 // Reset bar count when signal occurs

// Exit conditions

if inTrade and (close <= stopLoss or close >= targetPrice)

inTrade := false

entryPrice := na

stopLoss := na

targetPrice := na

barCount := na // Reset bar count on exit

// Re-entry logic

if not inTrade and close == entryPrice

entryPrice := close

stopLoss := close - atr_value * 2

targetPrice := close + atr_value * (5 + target_multiplier)

strategy.entry("Re-Long", strategy.long)

strategy.exit("Re-Exit Long", "Re-Long", stop=stopLoss, limit=targetPrice)

inTrade := true

barCount := 0 // Reset bar count when re-entry happens

// Count bars since the signal appeared (max 30 bars)

if inTrade and barCount < max_bars

barCount := barCount + 1

// Plotting lines for entry, stop-loss, and targets (Only during active trade and within max_bars)

entry_line = plot(inTrade and barCount <= max_bars ? entryPrice : na, title="Entry Price", color=color.new(color.green, 0), linewidth=1, style=plot.style_cross)

sl_line = plot(inTrade and barCount <= max_bars ? stopLoss : na, title="Stop Loss", color=color.new(color.red, 0), linewidth=1, style=plot.style_cross)

target_line = plot(inTrade and barCount <= max_bars ? targetPrice : na, title="Target Price", color=color.new(color.blue, 0), linewidth=1, style=plot.style_cross)

// Background color between entry and target/stop-loss (Only when inTrade and within max_bars)

fill(entry_line, target_line, color=color.new(color.green, 90), title="Target Zone")

fill(entry_line, sl_line, color=color.new(color.red, 90), title="Stop-Loss Zone")

// Label updates (reduce overlap and clutter)

if bar_index % 50 == 0 and inTrade and barCount <= max_bars // Adjust label frequency for performance

label.new(bar_index + 1, entryPrice, text="Entry: " + str.tostring(entryPrice, "#.##"), style=label.style_label_left, color=color.green, textcolor=color.white, size=size.small)

label.new(bar_index + 1, stopLoss, text="Stop Loss: " + str.tostring(stopLoss, "#.##"), style=label.style_label_left, color=color.red, textcolor=color.white, size=size.small)

label.new(bar_index + 1, targetPrice, text="Target: " + str.tostring(targetPrice, "#.##"), style=label.style_label_left, color=color.blue, textcolor=color.white, size=size.small)

相关推荐