概述

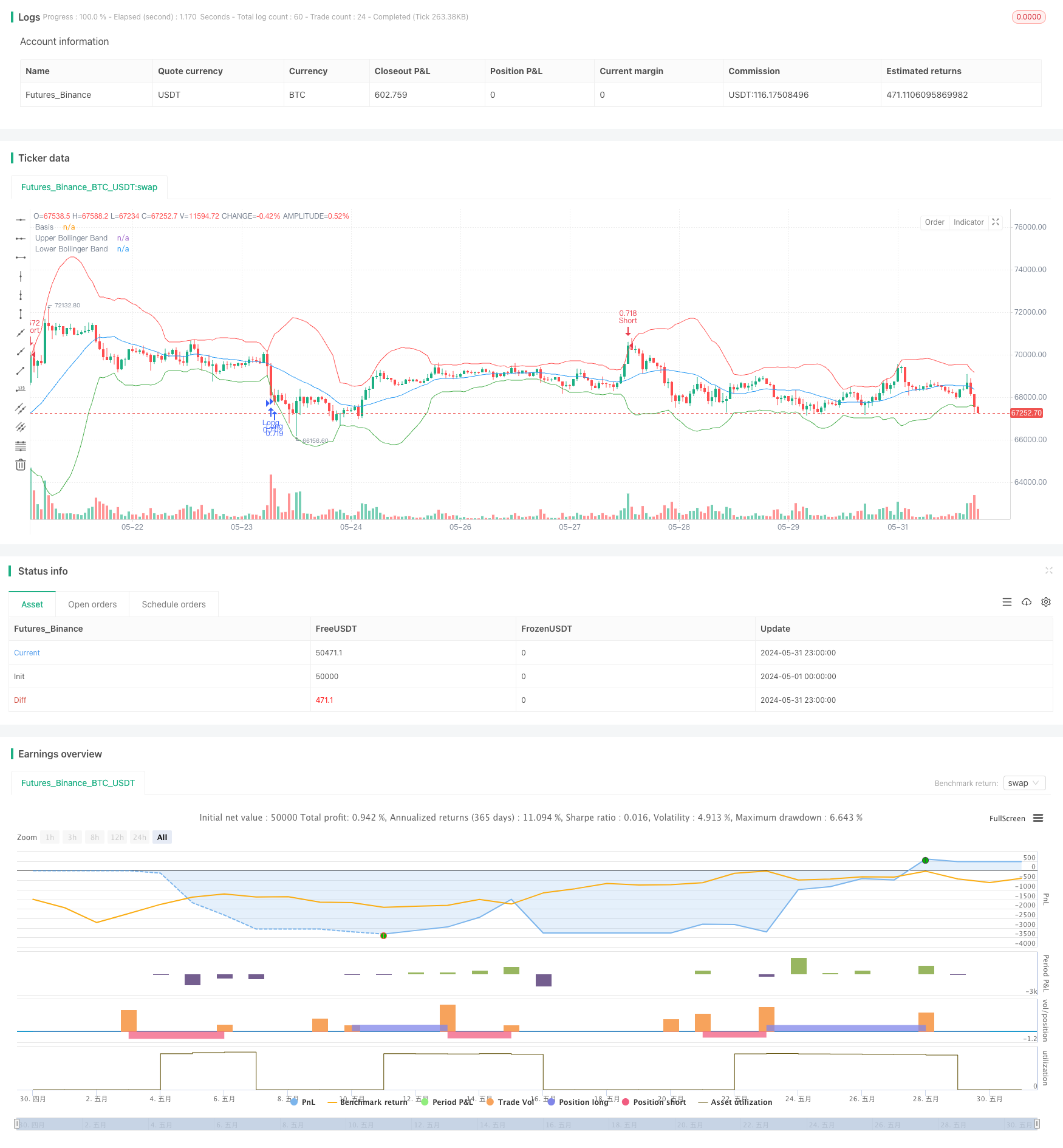

该策略结合了波林格带、相对强弱指数(RSI)和随机RSI三种技术指标,通过分析价格的波动率和动量,寻找市场的超买和超卖状态,以确定最佳的买入和卖出时机。策略使用20倍杠杆模拟期权交易,设置了0.60%的止盈位和0.25%的止损位,并限制每天只进行一次交易,以控制风险。

策略原理

该策略的核心是利用波林格带、RSI和随机RSI三种指标来评估市场状态。波林格带由中轨(20周期简单移动平均线)、上轨(中轨上方3个标准差)和下轨(中轨下方3个标准差)组成,用于衡量价格的波动率。RSI是一个动量振荡器,用于识别超买和超卖条件,本策略使用14周期RSI。随机RSI将随机振荡器公式应用于RSI值,也使用14周期长度。

当RSI低于34,随机RSI低于20,且收盘价在下轨附近或低于下轨时,触发买入信号。当RSI高于66,随机RSI高于80,且收盘价在上轨附近或高于上轨时,触发卖出信号。策略使用20倍杠杆模拟期权交易,止盈位设置为0.60%,止损位设置为0.25%。此外,该策略每天只进行一次交易,以控制风险。

策略优势

- 结合多个技术指标:该策略综合考虑了价格波动率(波林格带)和动量(RSI和随机RSI)两个方面,提供了更全面的市场分析。

- 风险控制:策略设置了明确的止盈和止损位,并限制每天只进行一次交易,有效控制了风险敞口。

- 适应性强:通过调整参数,如波林格带的标准差倍数、RSI和随机RSI的阈值等,该策略可以适应不同的市场条件。

策略风险

- 市场风险:策略的表现依赖于市场条件,在趋势不明朗或波动率极高的情况下,策略可能会表现不佳。

- 参数敏感性:策略的效果取决于所选参数的质量,参数设置不当可能导致策略表现欠佳。

- 杠杆风险:策略使用了20倍杠杆,虽然可以放大收益,但也会放大损失。在极端市场条件下,高杠杆可能导致重大损失。

策略优化方向

- 动态调整参数:根据市场状况的变化,动态调整波林格带的标准差倍数、RSI和随机RSI的阈值等参数,以适应不同的市场环境。

- 加入其他指标:考虑加入其他技术指标,如MACD、ADX等,以提高策略的可靠性和稳定性。

- 优化止盈止损:通过回测和优化,找到最佳的止盈止损比例,以在控制风险的同时最大化收益。

- 改进资金管理:探索更高级的资金管理技巧,如凯利准则,以优化策略的长期表现。

总结

该策略通过结合波林格带、RSI和随机RSI三种技术指标,利用价格波动率和动量信息,寻找最佳的买入和卖出时机。策略设置了明确的止盈止损位,并控制每天的交易次数,以管理风险。尽管该策略有其优势,但仍面临市场风险、参数敏感性和杠杆风险等挑战。通过动态调整参数、纳入其他指标、优化止盈止损和改进资金管理等方法,可以进一步优化该策略的表现。

策略源码

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands + RSI + Stochastic RSI Strategy with OTM Options", overlay=true)

// Define leverage factor (e.g., 20x leverage for OTM options)

leverage = 1

// Bollinger Bands

length = 20

deviation = 3

basis = ta.sma(close, length)

dev = ta.stdev(close, length)

upper = basis + deviation * dev

lower = basis - deviation * dev

// RSI

rsi_length = 14

rsi = ta.rsi(close, rsi_length)

// Stochastic RSI

stoch_length = 14

stoch_k = ta.stoch(close, close, close, stoch_length)

// Entry condition with Bollinger Bands

longCondition = rsi < 34 and stoch_k < 20 and close <= lower

shortCondition = rsi > 66 and stoch_k > 80 and close >= upper

// Plot Bollinger Bands

plot(basis, color=color.blue, title="Basis")

plot(upper, color=color.red, title="Upper Bollinger Band")

plot(lower, color=color.green, title="Lower Bollinger Band")

// Track if a trade has been made today

var int lastTradeDay = na

// Options Simulation: Take-Profit and Stop-Loss Conditions

profitPercent = 0.01 // 1% take profit

lossPercent = 0.002 // 0.2% stop loss

// Entry Signals

if (dayofmonth(timenow) != dayofmonth(lastTradeDay))

if (longCondition)

longTakeProfitPrice = close * (1 + profitPercent)

longStopLossPrice = close * (1 - lossPercent)

strategy.entry("Long", strategy.long, qty=leverage * strategy.equity / close)

strategy.exit("Take Profit Long", from_entry="Long", limit=longTakeProfitPrice, stop=longStopLossPrice)

lastTradeDay := dayofmonth(timenow)

if (shortCondition)

shortTakeProfitPrice = close * (1 - profitPercent)

shortStopLossPrice = close * (1 + lossPercent)

strategy.entry("Short", strategy.short, qty=leverage * strategy.equity / close)

strategy.exit("Take Profit Short", from_entry="Short", limit=shortTakeProfitPrice, stop=shortStopLossPrice)

lastTradeDay := dayofmonth(timenow)

相关推荐