概述

本策略是一个基于商品通道指标(CCI)的动量交易系统,通过监测价格偏离均值的程度来捕捉市场超卖区域的交易机会。策略采用12个周期作为回溯期,在CCI指标跌破-90阈值时进场做多,当收盘价突破前期高点时平仓出场,并配备了可选的止损和获利了结机制。

策略原理

策略核心是利用CCI指标来衡量价格与其均值之间的偏离程度。CCI的计算过程包括:首先计算典型价格(最高价、最低价和收盘价的算术平均值),然后计算典型价格的简单移动平均线(SMA),最后通过típical price减去SMA并除以平均偏差再乘以0.015得到最终的CCI值。当CCI值低于-90时,表明市场可能处于超卖状态,此时入场做多;当价格突破前期高点时,表明上涨趋势确立,此时平仓获利。策略还提供了止损和获利了结的参数设置选项,可根据交易者的风险偏好进行灵活调整。

策略优势

- 信号明确:使用固定的CCI阈值作为入场信号,避免主观判断带来的犹豫不决

- 风险可控:通过可选的止损和获利了结机制,实现了对风险的精确控制

- 参数灵活:交易者可以根据不同市场环境调整CCI的回溯期和入场阈值

- 执行简单:策略逻辑清晰,容易理解和执行,适合各类交易者使用

- 成本效率:采用事件驱动型交易,降低了过度交易带来的成本损失

策略风险

- 假突破风险:CCI跌破阈值后可能出现假突破,导致不必要的交易

- 滑点影响:在市场波动较大时,可能面临较大的滑点损失

- 趋势依赖:策略在横盘市场中可能产生频繁的假信号

- 参数敏感:CCI周期和阈值的选择对策略表现有较大影响

- 延迟风险:作为滞后指标,CCI可能错过最佳入场时机

策略优化方向

- 信号过滤:可以引入额外的技术指标如RSI或MACD来过滤假信号

- 动态阈值:将固定的CCI阈值改为基于波动率的动态阈值

- 分时优化:根据不同时间段的市场特征调整策略参数

- 资金管理:增加动态的仓位管理机制,提高资金使用效率

- 多周期分析:结合更长周期的趋势判断来优化入场时机

总结

该策略通过CCI指标捕捉市场超卖机会,配合止损和获利了结机制,实现了一个完整的交易系统。策略逻辑清晰,易于执行,具有良好的风险控制能力。通过引入信号过滤、动态阈值等优化手段,策略的稳定性和盈利能力还有提升空间。建议交易者在实盘使用前进行充分的回测,并根据具体市场特征调整参数设置。

策略源码

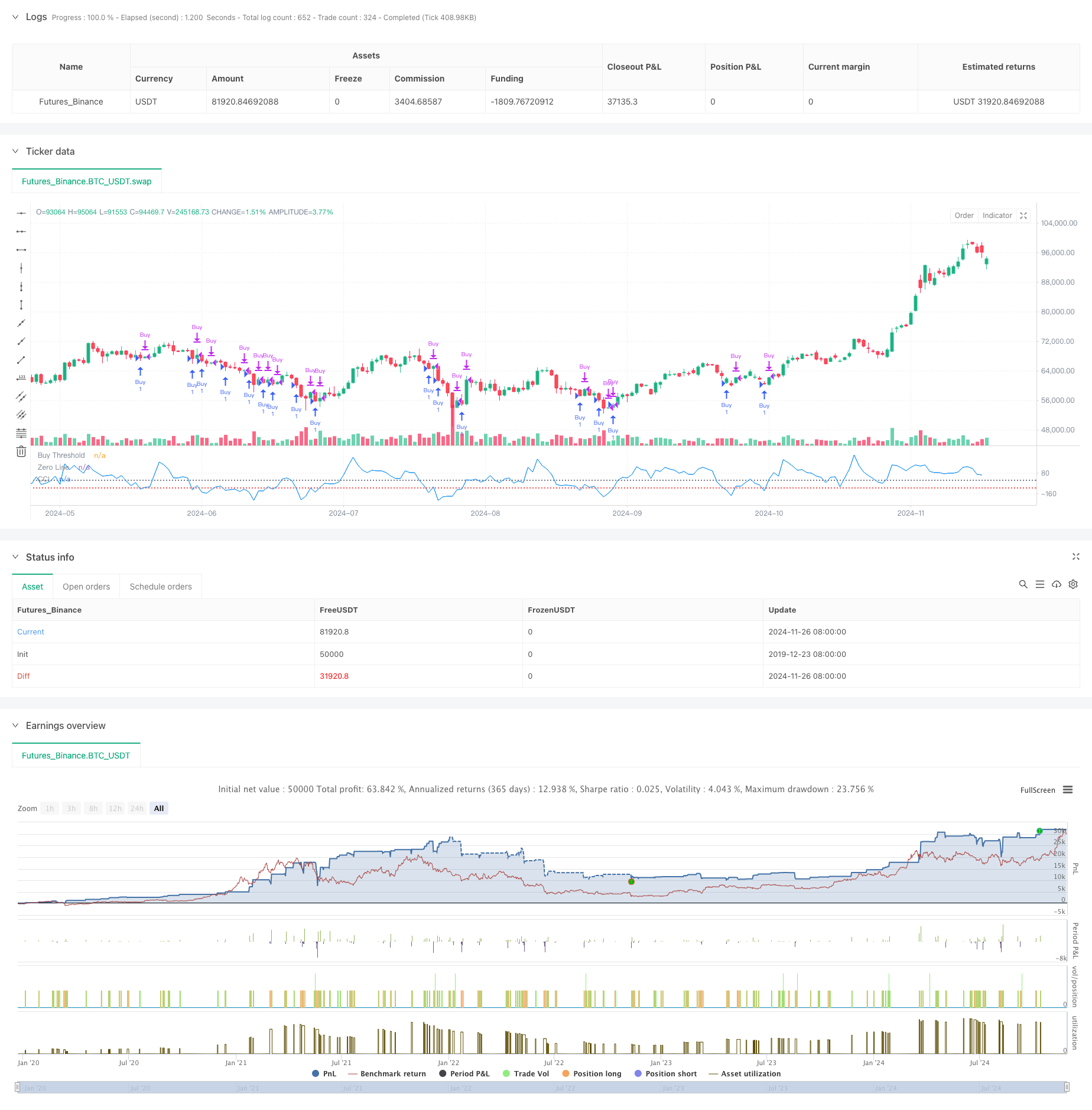

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("CCI Threshold Strategy", overlay=false, initial_capital=50000, pyramiding=0, commission_type=strategy.commission.cash_per_contract, commission_value=0.05, slippage=1)

// --- Input Parameters ---

// Lookback period for CCI calculation

lookbackPeriod = input.int(12, minval=1, title="CCI Lookback Period")

// Buy threshold for CCI; typically represents an oversold condition

buyThreshold = input.int(-90, title="CCI Buy Threshold")

// Stop loss and take profit settings

stopLoss = input.float(100.0, minval=0.0, title="Stop Loss in Points")

takeProfit = input.float(150.0, minval=0.0, title="Take Profit in Points")

// Checkboxes to enable/disable SL and TP

useStopLoss = input.bool(false, title="Enable Stop Loss")

useTakeProfit = input.bool(false, title="Enable Take Profit")

// --- Calculate CCI ---

// CCI (Commodity Channel Index) is used as a momentum indicator to identify oversold and overbought conditions

cci = ta.cci(close, length=lookbackPeriod)

// --- Define Buy and Sell Conditions ---

// Buy condition: CCI drops below -90, indicating potential oversold levels

longCondition = cci < buyThreshold

// Sell condition: Close price crosses above the previous day's high, signaling potential exit

sellCondition = close > ta.highest(close[1], 1)

// --- Strategy Execution ---

// Buy entry based on the long condition

if (longCondition)

strategy.entry("Buy", strategy.long)

// Close the long position based on the sell condition

if (sellCondition)

strategy.close("Buy")

// Optional: Add stop loss and take profit for risk management

if (longCondition)

strategy.exit("Sell", from_entry="Buy", loss=useStopLoss ? stopLoss : na, profit=useTakeProfit ? takeProfit : na)

// --- Plotting for Visualization ---

// Plot CCI with threshold levels for better visualization

plot(cci, title="CCI", color=color.blue)

hline(buyThreshold, "Buy Threshold", color=color.red, linestyle=hline.style_dotted)

hline(0, "Zero Line", color=color.gray, linestyle=hline.style_dotted)

相关推荐