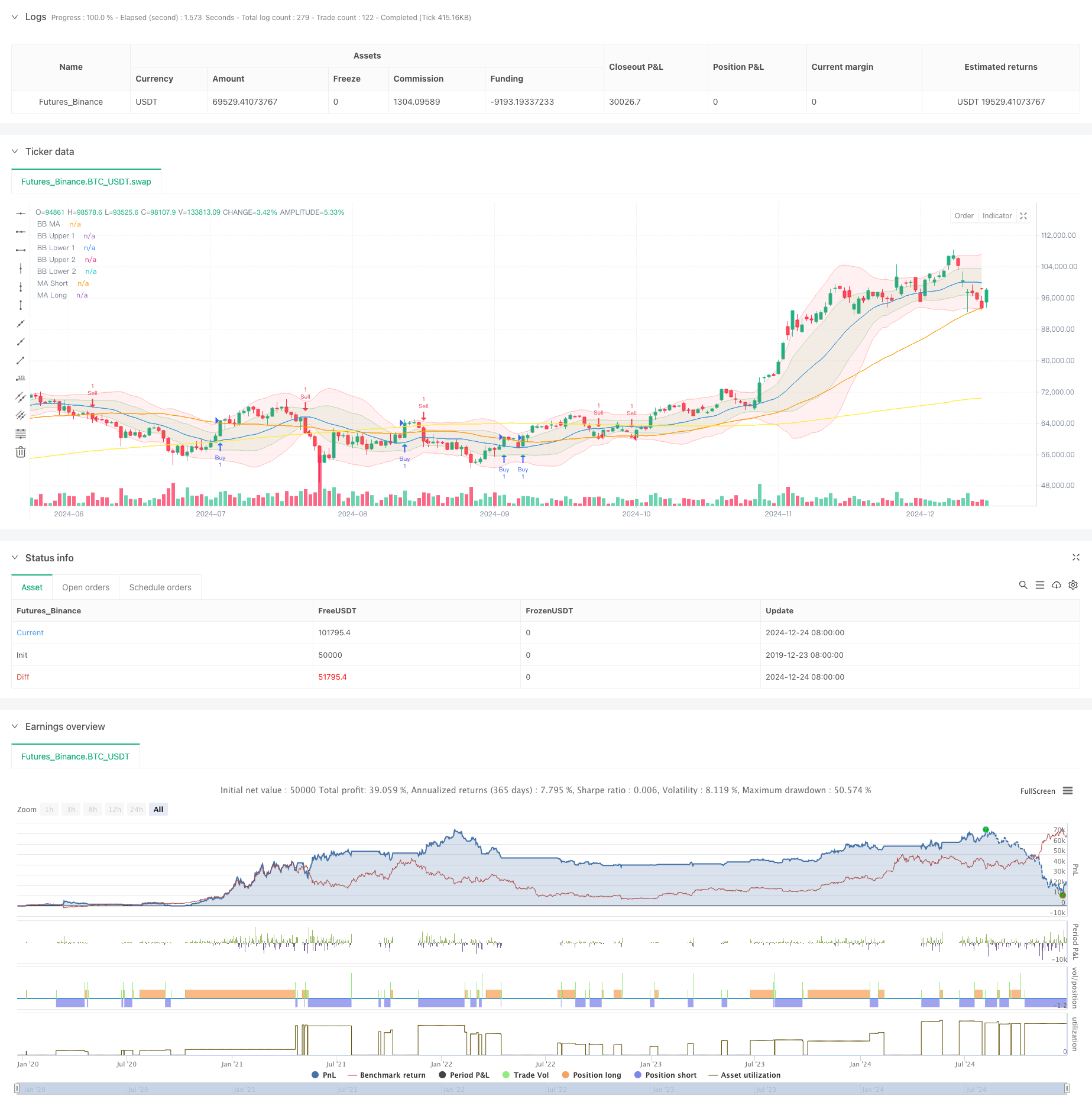

概述

该策略是一个结合了波林带(Bollinger Bands)、伍迪商品通道指数(Woodies CCI)、移动平均线(MA)和交易量平衡指标(OBV)的多重指标交易系统。策略通过波林带提供市场波动区间,使用CCI指标过滤交易信号,再结合均线系统和交易量确认,从而在市场趋势明确时进行交易。同时使用ATR动态设置止盈止损位置,有效控制风险。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 使用两条标准差的波林带(1倍和2倍)构建价格波动通道,提供市场波动范围参考 2. 采用6周期和14周期的CCI指标作为信号过滤器,要求两个周期的CCI同向确认 3. 结合50周期和200周期的移动平均线判断市场趋势,在均线交叉时产生初始交易信号 4. 通过OBV指标的10周期平滑确认成交量趋势 5. 使用14周期ATR动态设置止盈止损,多头止盈为2倍ATR,止损为1倍ATR,空头相反

策略优势

- 多重指标交叉验证,大大降低虚假信号概率

- 波林带和CCI结合提供了准确的市场波动判断

- 长短期均线系统有效把握大趋势

- OBV确认交易量支撑,提高信号可靠性

- 动态止盈止损设置,适应不同市场环境

- 交易信号清晰,执行标准,易于量化实现

策略风险

- 多重指标可能导致信号滞后,错过最佳入场时机

- 在震荡市场中可能频繁触发止损

- 参数优化存在过度拟合风险

- 剧烈波动时期止损可能不够及时 应对措施:

- 根据不同市场周期动态调整指标参数

- 实时监控回撤控制仓位

- 定期检验参数有效性

- 设置最大损失限制

策略优化方向

- 引入市场波动率指标,在高波动期调整仓位

- 增加趋势强度过滤,避免震荡市交易

- 优化CCI周期选择,提高信号灵敏度

- 完善止盈止损机制,如考虑分批止盈

- 加入交易量异常预警机制

总结

这是一个基于技术指标组合的完整交易系统,通过多重信号确认提高交易准确性。策略设计合理,风险控制得当,具有良好的实战应用价值。建议在实盘中采用保守仓位进行测试,并根据市场情况持续优化参数。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy(shorttitle="BB Debug + Woodies CCI Filter", title="Debug Buy/Sell Signals with Woodies CCI Filter", overlay=true)

// Input Parameters

length = input.int(20, minval=1, title="BB MA Length")

src = input.source(close, title="BB Source")

mult1 = input.float(1.0, minval=0.001, maxval=50, title="BB Multiplier 1 (Std Dev 1)")

mult2 = input.float(2.0, minval=0.001, maxval=50, title="BB Multiplier 2 (Std Dev 2)")

ma_length = input.int(50, minval=1, title="MA Length")

ma_long_length = input.int(200, minval=1, title="Long MA Length")

obv_smoothing = input.int(10, minval=1, title="OBV Smoothing Length")

atr_length = input.int(14, minval=1, title="ATR Length") // ATR Length for TP/SL

// Bollinger Bands

basis = ta.sma(src, length)

dev1 = mult1 * ta.stdev(src, length)

dev2 = mult2 * ta.stdev(src, length)

upper_1 = basis + dev1

lower_1 = basis - dev1

upper_2 = basis + dev2

lower_2 = basis - dev2

plot(basis, color=color.blue, title="BB MA")

p1 = plot(upper_1, color=color.new(color.green, 80), title="BB Upper 1")

p2 = plot(lower_1, color=color.new(color.green, 80), title="BB Lower 1")

p3 = plot(upper_2, color=color.new(color.red, 80), title="BB Upper 2")

p4 = plot(lower_2, color=color.new(color.red, 80), title="BB Lower 2")

fill(p1, p2, color=color.new(color.green, 90))

fill(p3, p4, color=color.new(color.red, 90))

// Moving Averages

ma_short = ta.sma(close, ma_length)

ma_long = ta.sma(close, ma_long_length)

plot(ma_short, color=color.orange, title="MA Short")

plot(ma_long, color=color.yellow, title="MA Long")

// OBV and Smoothing

obv = ta.cum(ta.change(close) > 0 ? volume : ta.change(close) < 0 ? -volume : 0)

obv_smooth = ta.sma(obv, obv_smoothing)

// Debugging: Buy/Sell Signals

debugBuy = ta.crossover(close, ma_short)

debugSell = ta.crossunder(close, ma_short)

// Woodies CCI

cciTurboLength = 6

cci14Length = 14

cciTurbo = ta.cci(src, cciTurboLength)

cci14 = ta.cci(src, cci14Length)

// Filter: Only allow trades when CCI confirms the signal

cciBuyFilter = cciTurbo > 0 and cci14 > 0

cciSellFilter = cciTurbo < 0 and cci14 < 0

finalBuySignal = debugBuy and cciBuyFilter

finalSellSignal = debugSell and cciSellFilter

// Plot Debug Buy/Sell Signals

plotshape(finalBuySignal, title="Filtered Buy", location=location.belowbar, color=color.lime, style=shape.triangleup, size=size.normal)

plotshape(finalSellSignal, title="Filtered Sell", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.normal)

// Change candle color based on filtered signals

barcolor(finalBuySignal ? color.lime : finalSellSignal ? color.red : na)

// ATR for Stop Loss and Take Profit

atr = ta.atr(atr_length)

tp_long = close + 2 * atr // Take Profit for Long = 2x ATR

sl_long = close - 1 * atr // Stop Loss for Long = 1x ATR

tp_short = close - 2 * atr // Take Profit for Short = 2x ATR

sl_short = close + 1 * atr // Stop Loss for Short = 1x ATR

// Strategy Execution

if (finalBuySignal)

strategy.entry("Buy", strategy.long)

strategy.exit("Take Profit/Stop Loss", "Buy", limit=tp_long, stop=sl_long)

if (finalSellSignal)

strategy.entry("Sell", strategy.short)

strategy.exit("Take Profit/Stop Loss", "Sell", limit=tp_short, stop=sl_short)

// Check for BTC/USDT pair

isBTCUSDT = syminfo.ticker == "BTCUSDT"

// Add alerts only for BTC/USDT

alertcondition(isBTCUSDT and finalBuySignal, title="BTCUSDT Buy Signal", message="Buy signal detected for BTCUSDT!")

alertcondition(isBTCUSDT and finalSellSignal, title="BTCUSDT Sell Signal", message="Sell signal detected for BTCUSDT!")

相关推荐