概述

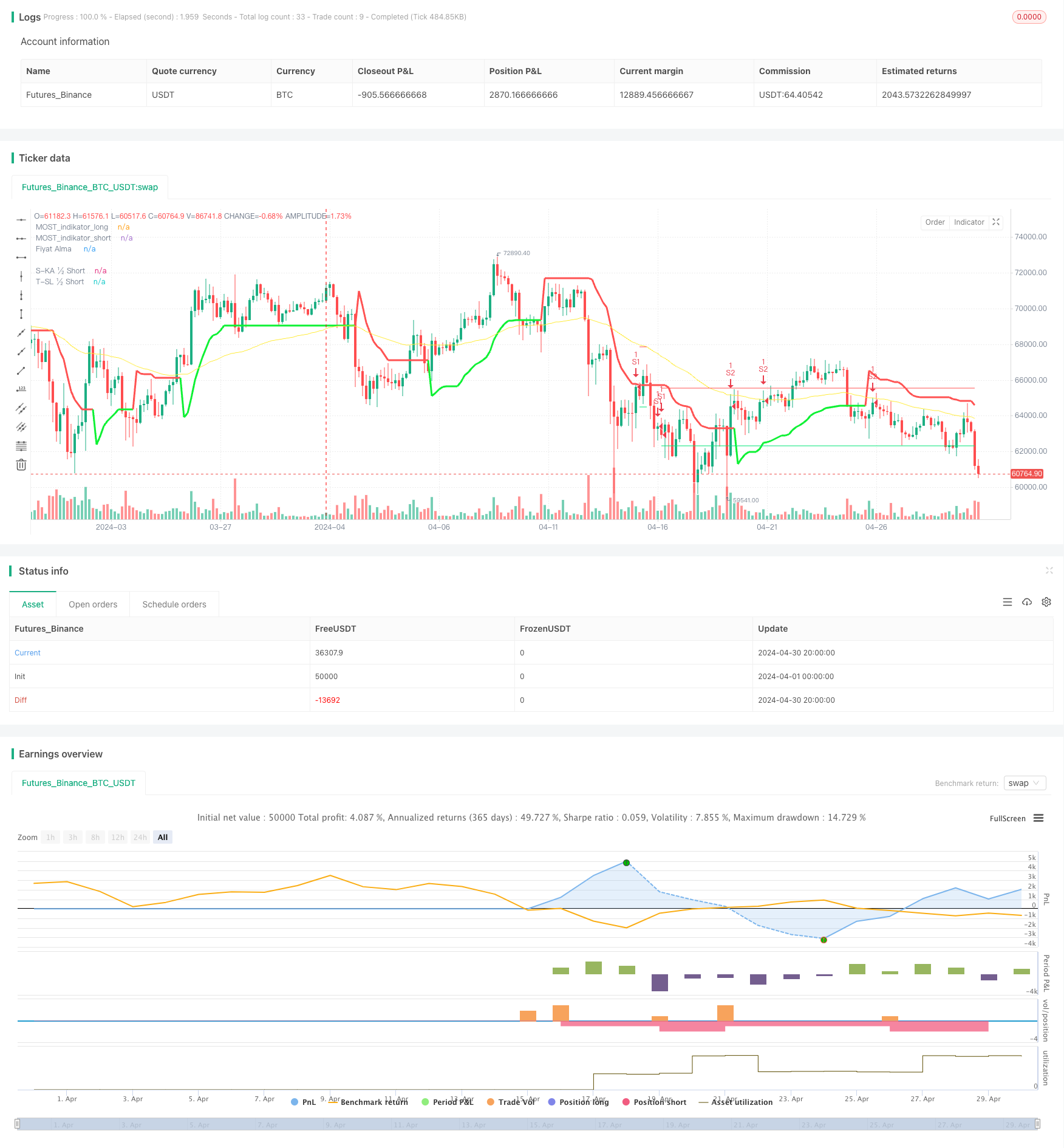

该策略是一个基于MOST指标的双仓位自适应量化交易策略。策略通过计算MOST指标的长短周期线,结合价格、交易量等因素,自适应调整开仓方向、仓位大小和止盈止损点位,以期获得稳健的收益。该策略同时考虑了趋势和震荡两种市场状态,通过动态调整参数,适应不同的市场环境。

策略原理

- 计算MOST指标的长短周期线,通过比较当前价格与MOST指标的位置关系,判断多空方向。

- 根据趋势方向和趋势强度,自适应调整开仓仓位大小。若趋势较强,则适当加大仓位;若趋势较弱,则适当减小仓位。

- 设置多个止盈和止损点位,并根据市场波动情况,动态调整止盈止损点位,以控制风险。

- 引入交易时间窗口和过滤器,避免在市场波动较大或趋势不明确时交易,提高策略稳健性。

- 综合考虑多个指标,如RSI、CCI等,对开仓条件进行过滤,提高开仓准确性。

策略优势

- 自适应调整仓位:根据趋势强度和市场波动情况,动态调整开仓仓位大小,在趋势较强时获取更多利润,在趋势较弱时控制风险。

- 动态止盈止损:根据市场波动情况,动态调整止盈止损点位,既能及时锁定利润,又能有效控制回撤。

- 多指标过滤:综合考虑多个指标,如RSI、CCI等,对开仓条件进行过滤,提高开仓准确性,降低误判风险。

- 适应性强:通过设置交易时间窗口和过滤器,避免在市场波动较大或趋势不明确时交易,提高策略适应性。

- 参数优化:该策略有多个参数可以优化,如MOST指标周期、止盈止损点位、仓位大小等,可以根据不同市场环境和资产特点,进行参数优化,提高策略收益。

策略风险

- 参数优化风险:该策略有多个参数需要优化,不同的参数设置可能导致策略表现差异较大,存在参数优化风险。

- 过拟合风险:若参数优化过于复杂,可能导致策略过拟合,在样本外数据上表现不佳。

- 黑天鹅事件风险:该策略基于历史数据进行优化,可能无法应对极端行情,如黑天鹅事件等。

- 市场风险:该策略在趋势不明确或市场波动较大时,可能出现较大回撤。

策略优化方向

- 引入机器学习算法,如支持向量机、随机森林等,对开仓条件和仓位大小进行优化,提高策略收益和稳健性。

- 引入市场情绪指标,如恐慌指数等,对市场情绪进行量化,在市场情绪极端时,及时调整仓位,控制风险。

- 引入多因子模型,如基本面因子、技术面因子等,对资产进行量化评分,选择优质资产,提高策略收益。

- 引入资金管理模块,根据账户盈亏情况,动态调整仓位大小,控制回撤,提高策略稳健性。

- 进行参数自适应优化,根据市场环境变化,自适应调整策略参数,提高策略适应性。

总结

该策略是一个基于MOST指标的双仓位自适应量化交易策略,通过动态调整仓位大小、止盈止损点位,适应不同的市场环境,获取稳健收益。同时,该策略引入了多个过滤条件,提高开仓准确性,控制回撤风险。未来可以引入机器学习算法、市场情绪指标、多因子模型等,对策略进行优化,提高策略收益和稳健性。总之,该策略是一个具有一定优势和可优化空间的量化交易策略。

策略源码

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//@strategy_alert_message {{strategy.order.alert_message}}

//bu yukardaki otomatik olarak alarma ekleniyormus, diger turlu her seferinde bunu yapistirman gerekiyordu..

//19.05.2024

///////////////////////////////////////////////////////

// code combiner and developer @ Mustafa Özbakır mozbakir

// thank all other code owners

strategy('mge-auto okx', pyramiding=3,close_entries_rule ="FIFO" , use_bar_magnifier = false ,process_orders_on_close=false,calc_on_order_fills = false,calc_on_every_tick= false,format=format.price, overlay=true, default_qty_type=strategy.percent_of_equity , default_qty_value=100, initial_capital=50, currency=currency.USD, commission_value=0.05, commission_type=strategy.commission.percent)

//Fiyat Tick hesabi

RoundToTick( _price) => math.round(_price/syminfo.mintick)*syminfo.mintick

open_fiyat = RoundToTick(open)

close_fiyat = RoundToTick(close)

high_fiyat = RoundToTick(high)

low_fiyat = RoundToTick(low)

hlc3_fiyat = RoundToTick(hlc3)

var float percenval_most_indikator_long = 0.

var float percenval_most_indikator_short = 0.

var float ikinci_giris_long = 0.

var float ikinci_giris_short = 0.

percenval_most_indikator_long := input.float(defval=3.4, minval=0, step=0.1, title='most percent long') / 100 //değeri 0,034 1000 üzerinden

percenval_most_indikator_short := input.float(defval=3.4, minval=0, step=0.1, title='most percent short') / 100

slen_long = input.int(defval=20, title='Long Fiyat MA Period', minval=2)

slen_short = input.int(defval=20, title='Short Fiyat MA Period', minval=2)

sabit_tp_yl = percenval_most_indikator_long / 2 //input.float(defval = 1.9 , title = "_long Sabit Kar-aL Long (%)" , step=0.1, minval=0.1) / 100

sabit_tp_ys = percenval_most_indikator_short / 2 //input.float(defval = 1.9 , title = "_short Sabit Kar-aL Short (%)" , step=0.1, minval=0.1) / 100

ikinci_giris_long := 0.009//(percenval_most_indikator_long) - 0.009 //input.float(defval=0.8, minval=0, step=0.1, title='2.Long Fiyat % Kac Düştüğünde',tooltip = 'İlk pozisyon girişi botun %50 bütçesi ile açılır. İlk açılış fiyatı % kaç düşerse geri kalan %50bütçe ile 2. giriş yapılsın?') / 100

ikinci_giris_short := 0.009//(percenval_most_indikator_short) - 0.009//input.float(defval=0.8, minval=0, step=0.1, title='2.Short Fiyat % Kac Yükseldiğinde',tooltip = 'İlk pozisyon girişi botun %50 bütçesi ile açılır. İlk açılış fiyatı % kaç yükselirse geri kalan %50bütçe ile 2. giriş yapılsın?') / 100

//risk_trail_stop = input.float(defval=1.8, minval=0, step=0.1, title='Trail StopLoss % Kar Çarpanı')

//takipli_sloss_yl = sabit_tp_yl * risk_trail_stop

//takipli_sloss_ys = sabit_tp_ys * risk_trail_stop

//takipli_sloss_yl = input.float(defval = 3.8 , title = "_long Takipli Stop-loss Long (%)" , step=0.1, minval=0.1) / 100

//takipli_sloss_ys = input.float(defval = 3.8 , title = "_short Takipli Stop-loss Short (%)" , step=0.1, minval=0.1) / 100

sabit_loss_yl = percenval_most_indikator_long//input.float(defval = 1.9 , title = "_long zarar (%)" , step=0.1, minval=0.1) / 100

sabit_loss_ys = percenval_most_indikator_short//input.float(defval = 1.9 , title = "_short zarar (%)" , step=0.1, minval=0.1) / 100

vwap_gosterge_filtre_long_most = input.bool(true,'Vwap MOST Long filtre => Aktif / Değil', inline="rc2")

vwap_gosterge_secimi_long_most = input.bool(true,'Vwap MOST Long => rsi / cci', inline="rc2")

vwap_gosterge_filtre_short_most = input.bool(true,'Vwap MOST Short filtre => Aktif / Değil', inline="rc3")

vwap_gosterge_secimi_short_most = input.bool(true,'Vwap MOST Short => rsi / cci', inline="rc3")

stop_loss_secimi_long = input.bool(true,'Long Zarar => Sabit / Takipli', inline="rc3")

stop_loss_secimi_short = input.bool(true,'Short Zarar => Sabit / Takipli', inline="rc3")

//slen = 20//input.int(defval=20, title='MA Period', minval=1)

//////////////////////___trade_gunleri_long__//////////////////////////////////////////////

InSession_long (sessionTimes_long , sessionTimeZone_long =syminfo.timezone) =>

not na(time(timeframe.period, sessionTimes_long , sessionTimeZone_long ))

// Create the session and string inputs

sessionInput = "0000-2359"//input.session("0000-2345", title="Session Times")//, group="Trading Session")

// Create the session string

//weekdays_long = "Long Günleri"

sadece_yer_icin_long = input.bool(defval=false, title="L_Gün :", inline="dL1")

on_mon_long = input.bool(defval=true, title="Psi", inline="dL1")

on_tue_long = input.bool(defval=true, title="S", inline="dL1")

on_wed_long = input.bool(defval=true, title="Ç", inline="dL1")

on_thu_long = input.bool(defval=true, title="P", inline="dL1")

on_fri_long = input.bool(defval=true, title="C", inline="dL1")

on_sat_long = input.bool(defval=true, title="Csi", inline="dL1")

on_sun_long = input.bool(defval=true, title="P", inline="dL1")

session_weekdays_long = ':'

if on_sun_long

session_weekdays_long := session_weekdays_long + "1"

if on_mon_long

session_weekdays_long := session_weekdays_long + "2"

if on_tue_long

session_weekdays_long := session_weekdays_long + "3"

if on_wed_long

session_weekdays_long := session_weekdays_long + "4"

if on_thu_long

session_weekdays_long := session_weekdays_long + "5"

if on_fri_long

session_weekdays_long := session_weekdays_long + "6"

if on_sat_long

session_weekdays_long := session_weekdays_long + "7"

tradingSession_long = sessionInput + session_weekdays_long//":" + daysInput_long

// Highlight background of bars inside the specified session

bgcolor(InSession_long (tradingSession_long ) ? na : color.new(color.teal, 80))

trade_yap_zaman_long = InSession_long(tradingSession_long ) ? true : false

//////////////////////___trade_gunleri_long__bitti___/////////////////////////////////////////////////

/////////////////___trade_gunleri_short__//////////////////////////////////////////////////////

InSession_short (sessionTimes_short , sessionTimeZone_short =syminfo.timezone) =>

not na(time(timeframe.period, sessionTimes_short , sessionTimeZone_short ))

//weekdays_short = "Short Günleri"

sadece_yer_icin_short = input.bool(defval=false, title="S_Gün :", inline="ds1")

on_mon_short = input.bool(defval=true, title="Psi", inline="ds1")

on_tue_short = input.bool(defval=true, title="S", inline="ds1")

on_wed_short = input.bool(defval=true, title="Ç", inline="ds1")

on_thu_short = input.bool(defval=true, title="P", inline="ds1")

on_fri_short = input.bool(defval=true, title="C", inline="ds1")

on_sat_short = input.bool(defval=true, title="Csi", inline="ds1")

on_sun_short = input.bool(defval=true, title="P", inline="ds1")

session_weekdays_short = ':'

if on_sun_short

session_weekdays_short := session_weekdays_short + "1"

if on_mon_short

session_weekdays_short := session_weekdays_short + "2"

if on_tue_short

session_weekdays_short := session_weekdays_short + "3"

if on_wed_short

session_weekdays_short := session_weekdays_short + "4"

if on_thu_short

session_weekdays_short := session_weekdays_short + "5"

if on_fri_short

session_weekdays_short := session_weekdays_short + "6"

if on_sat_short

session_weekdays_short := session_weekdays_short + "7"

tradingSession_short = sessionInput + session_weekdays_short//":" + daysInput_short

// Highlight background of bars inside the specified session

bgcolor(InSession_short (tradingSession_short ) ? na :color.new(color.purple, 80) )

trade_yap_zaman_short = InSession_short(tradingSession_short ) ? true : false

/////////////////___trade_gunleri_short__bitti//////////////////////////////////////////////////////

//////////////////////////////////////////////////////////////

Amount_1a = input.float(51, "1. Giris %Bütce", minval = 0.01, inline = "31")//, group = ALERTGRP_CRED) //pozisyon_1_yuzde

Amount_2a = input.float(49, "2. Giris %Bütce", minval = 0.01, inline = "31")//, group = ALERTGRP_CRED) //pozisyon_2_yuzde

okx_bot_butcesi = input.int(50,'Okx Bot Bütcesi $', inline = "bb1")

okx_bot_kaldirac = input.int(2,'Okx Bot Kaldirac x', inline = "bb1")

/////////////////////////////////////

OpenDirection = input.string(defval="BIRLIKTE", title="ISLEM SECIMI", options=["BIRLIKTE", "LONG", "SHORT"])

///////////////////////////////////////////////////////////////////////

Zlema_Func(src, length) =>

zxLag = length / 2 == math.round(length / 2) ? length / 2 : (length - 1) / 2

zxEMAData = src + src - src[zxLag]

ZLEMA = ta.ema(zxEMAData, length)

ZLEMA

fiyat_zlema = Zlema_Func(close_fiyat,20)

fiyat_alma =ta.alma(close_fiyat,96,8,0.6185)//ta.roc(fiyat_alma2,20) //math.sum(ta.roc(fiyat_alma2,1),1) == -3 and math.sum(ta.roc(fiyat_alma3,1),1) == -2

plot(fiyat_alma,'Fiyat Alma ',color.yellow)

//////////////////////////////////////////

cro_anatrend= ta.crossover(fiyat_zlema,fiyat_alma)//ta.crossover(anatrend_fiyat, mtf_fiyat_alma)

cru_anatrend= ta.crossunder(fiyat_zlema,fiyat_alma)//ta.crossunder(anatrend_fiyat, mtf_fiyat_alma)

direction_anatrend = 0

direction_anatrend := cro_anatrend ? 1 : cru_anatrend ? -1 : direction_anatrend[1]

//////////////////////////////////////////

vwap_cci_Length = 20//input.int(20, minval=1)

vwap_sma_Length = 9//input.int(9, minval=1)

vwap_cci = ta.cci(ta.vwap(close_fiyat[1]),vwap_cci_Length)

vwap_rsi = ta.rsi(ta.vwap(close_fiyat[1]),vwap_cci_Length)

vwap_sma_gosterge_cci = ta.sma(vwap_cci,vwap_sma_Length) // Most momentum icin

vwap_sma_gosterge_rsi = ta.sma(vwap_rsi,vwap_sma_Length) // Most momentum icin

vwap_gosterge_cci = vwap_sma_gosterge_cci

vwap_gosterge_rsi = vwap_sma_gosterge_rsi

vwap_gosterge_long_most = vwap_gosterge_secimi_long_most ? vwap_gosterge_rsi : vwap_gosterge_cci

vwap_gosterge_short_most = vwap_gosterge_secimi_short_most ? vwap_gosterge_rsi : vwap_gosterge_cci

vwap_long_most = vwap_gosterge_secimi_long_most ? (vwap_gosterge_long_most > 70) : (vwap_gosterge_long_most > 50)

vwap_short_most = vwap_gosterge_secimi_short_most ? (vwap_gosterge_short_most < 30) and not(vwap_gosterge_short_most < 10) : (vwap_gosterge_short_most < -50)

///////////////////////////////////

//calculation of the most trend price

/////////////////////////////////////

averprice_long = Zlema_Func(close_fiyat, slen_long)//averprice//input(close)

averprice_short = Zlema_Func(close_fiyat, slen_short)

//plot(plot_goster_fiyat ? averprice : na ,title = 'fiyat')

////////////////////////////////////

exMov_indikator_long = averprice_long

fark_indikator_long = exMov_indikator_long * percenval_most_indikator_long //* 0.01

longStop_indikator_long = exMov_indikator_long - fark_indikator_long

longStopPrev_indikator_long = nz(longStop_indikator_long[1], longStop_indikator_long)

longStop_indikator_long := exMov_indikator_long > longStopPrev_indikator_long ? math.max(longStop_indikator_long, longStopPrev_indikator_long) : longStop_indikator_long

shortStop_indikator_long = exMov_indikator_long + fark_indikator_long

shortStopPrev_indikator_long = nz(shortStop_indikator_long[1], shortStop_indikator_long)

shortStop_indikator_long := exMov_indikator_long < shortStopPrev_indikator_long ? math.min(shortStop_indikator_long, shortStopPrev_indikator_long) : shortStop_indikator_long

dir_indikator_long = 1

dir_indikator_long := nz(dir_indikator_long[1], dir_indikator_long)

dir_indikator_long := dir_indikator_long == -1 and exMov_indikator_long > shortStopPrev_indikator_long ? 1 : dir_indikator_long == 1 and exMov_indikator_long < longStopPrev_indikator_long ? -1 : dir_indikator_long

MOST_indikator_long = dir_indikator_long == 1 ? longStop_indikator_long : shortStop_indikator_long

cro_indikator_long = ta.crossover(exMov_indikator_long, MOST_indikator_long)

cru_indikator_long = ta.crossunder(exMov_indikator_long, MOST_indikator_long)

direction_indikator_long = 0

direction_indikator_long := cro_indikator_long ? 1 : cru_indikator_long ? -1 : direction_indikator_long[1]

colorM_indikator_long = direction_indikator_long == 1 ? color.rgb(14, 241, 52) : direction_indikator_long == -1 ? color.red : color.rgb(59, 248, 255)

plot( MOST_indikator_long, color = colorM_indikator_long, linewidth=3, title='MOST_indikator_long')

//plot(exMov_indikator_long, color=colorM_indikator_long, linewidth=2, title='exMov_indikator_long')

////////////////////////////

exMov_indikator_short = averprice_short

fark_indikator_short = exMov_indikator_short * percenval_most_indikator_short //* 0.01

longStop_indikator_short = exMov_indikator_short - fark_indikator_short

longStopPrev_indikator_short = nz(longStop_indikator_short[1], longStop_indikator_short)

longStop_indikator_short := exMov_indikator_short > longStopPrev_indikator_short ? math.max(longStop_indikator_short, longStopPrev_indikator_short) : longStop_indikator_short

shortStop_indikator_short = exMov_indikator_short + fark_indikator_short

shortStopPrev_indikator_short = nz(shortStop_indikator_short[1], shortStop_indikator_short)

shortStop_indikator_short := exMov_indikator_short < shortStopPrev_indikator_short ? math.min(shortStop_indikator_short, shortStopPrev_indikator_short) : shortStop_indikator_short

dir_indikator_short = 1

dir_indikator_short := nz(dir_indikator_short[1], dir_indikator_short)

dir_indikator_short := dir_indikator_short == -1 and exMov_indikator_short > shortStopPrev_indikator_short ? 1 : dir_indikator_short == 1 and exMov_indikator_short < longStopPrev_indikator_short ? -1 : dir_indikator_short

MOST_indikator_short = dir_indikator_short == 1 ? longStop_indikator_short : shortStop_indikator_short

cro_indikator_short= ta.crossover(exMov_indikator_short, MOST_indikator_short)

cru_indikator_short= ta.crossunder(exMov_indikator_short, MOST_indikator_short)

direction_indikator_short = 0

direction_indikator_short := cro_indikator_short ? 1 : cru_indikator_short ? -1 : direction_indikator_short[1]

colorM_indikator_short = direction_indikator_short == 1 ? color.rgb(14, 241, 52) : direction_indikator_short == -1 ? color.red : color.rgb(59, 248, 255)

plot( MOST_indikator_short, color=colorM_indikator_short, linewidth=3, title='MOST_indikator_short')

//plot(exMov_indikator_short, color=colorM_indikator_short, linewidth=2, title='exMov_indikator_short')

/////////////////////////////////

trend_yonu_oto = input.bool(true,'Ana Trend Indikator Pozisyon Sekli (Yonu Devam Eden - Tersi Tekli) => Auto / Manuel', inline="rb")

indikator_long_sekli = input.bool(true,'Indikator Long Manuel => Devam Eden / Tekli', inline="rc")

indikator_short_sekli = input.bool(true,'Indikator Short Manuel => Devam Eden / Tekli', inline="rc")

longCondition_most_indikator = (indikator_long_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == 1) ? direction_indikator_long == 1 and not(low <= MOST_indikator_long): cro_indikator_long and not(low <= MOST_indikator_long)//ta.crossover(averprice, trendprice) //and (averprice[1] < trendprice[1]) //and ( close[1] < averprice[1])

shortCondition_most_indikator = (indikator_short_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == -1) ? direction_indikator_short == -1 and not(high >= MOST_indikator_short): cru_indikator_short and not(high >= MOST_indikator_short)//ta.crossunder(averprice , trendprice_short) //and (averprice[1] > trendprice_short[1]) //and ( close[1] > averprice[1])

//////////////////////////////

////////////////////////////

//longCondition_most_indikator = cro_indikator_long//(indikator_long_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == 1) ? direction_indikator_long == 1 : cro_indikator_long//ta.crossover(averprice, trendprice) //and (averprice[1] < trendprice[1]) //and ( close[1] < averprice[1])

//shortCondition_most_indikator = cru_indikator_short// or (direction_indikator_short == -1 and ta.crossunder(open,MOST_indikator_short))//(indikator_short_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == -1) ? direction_indikator_short == -1 : cru_indikator_short//ta.crossunder(averprice , trendprice_short) //and (averprice[1] > trendprice_short[1]) //and ( close[1] > averprice[1])

//////////////////////////////

//////////////////////////////

tahmin_uzunlugu_1 = 20//input.int(5,title =' 1=' , minval=1,inline='tu')

tahmin_uzunlugu_2 = 40//input.int(8,title =' 2=' , minval=1,inline='tu')

tahmin_uzunlugu_3 = 96//input.int(20,title =' 3=' , minval=1,inline='tu')

//tahmin_kaynak_secimi = ' close '// input.string(' close ',title="TOlası Tepe/Dip Fiyat Kaynak", options=[' close ', ' Zlema '])

tahmin_kaynak_fiyat = close_fiyat// tahmin_kaynak_secimi == ' close ' ? close : Zlema_Func(close,8)

fonk_tepe_dip_tahmin(string gozuksunmu,float tahmin_kaynak_fiyat,string tepe_dip,int tahmin_uzunluk,int gosterge_yeri) =>

sitil_shape = tepe_dip == "tepe" ? shape.triangledown : tepe_dip == "dip" ? shape.triangleup : na

sitil_label = tepe_dip == "tepe" ? label.style_triangledown : tepe_dip == "dip" ? label.style_triangleup : na

//philo = input.string("Lows", "Highs or Lows?", options=["Highs", "Lows"])

linecolor = color.gray//input.color(color.new(color.gray,0), "Label/Line Color")

ptransp = 33//input.int(33, "Radar Transparency", minval=0, maxval=100)

ltransp = 100//input.int(100, "Line Transparency", minval=0, maxval=100)

n = bar_index

// Input/2 (Default 5) Length Pivot Cycle

hcol = tepe_dip == "tepe" ?color.purple : color.green//input.color(color.purple, "Half Cycle Color", inline="hc")

cych = tahmin_uzunluk//input.int(5, "Length", inline="hc")

labh = true//input.bool(true, "Label?", inline="hc")

labhf = true//input.bool(true, "Forecast?", inline="hc")

plh = tepe_dip == "tepe" ? ta.pivothigh(tahmin_kaynak_fiyat,cych, cych) : ta.pivotlow(tahmin_kaynak_fiyat,cych, cych) // Define a PL or PH based on L/H Switch in settings

plhy = tepe_dip == "tepe" ? gosterge_yeri : -(math.abs(gosterge_yeri)) // Position the pivot on the Y axis of the oscillator

plhi = ta.barssince(plh) // Bars since pivot occured?

plhp = plhi>cych // Bars since pivot occured greater than cycle length?

lowhin = tepe_dip == "tepe" ? ta.highest(tahmin_kaynak_fiyat, cych*2) : ta.lowest(tahmin_kaynak_fiyat, cych*2) // Highest/Lowest for the cycle

lowh = ta.barssince(plh)>cych ? lowhin : na // If the barssince pivot are greater than cycle length, show the uncomnfirmed "pivot tracker"

//plot(plhy, "Half Cycle Radar Line", color=plhp?hcol:color.new(linecolor,ltransp), offset=(cych*-1), display=display.none) // Cycle detection lines v1

//plotshape(plh ? plhy : na, "Half Cycle Confirmed", style=sitil_shape, location=location.absolute, color=hcol, size = size.tiny, offset=(cych*-1)) // Past Pivots

//plotshape(lowh ? plhy : na, "Half Cycle Radar", style=shape.circle, location=location.absolute, color=color.new(hcol, ptransp), size = size.tiny, offset=(cych*-1), show_last=1, display=display.none) // AKA the "Tracker/Radar" v1

// LuxAlgo pivot average calculation used for the forecast

barssince_ph = 0

ph_x2 = ta.valuewhen(plh, n - cych, 1) // x values for pivot

if plh

barssince_ph := (n - cych) - ph_x2 // if there is a pivot, then BarsSincePivot = (BarIndex - Cycle Length) - x values for pivot

avg_barssince_ph = ta.cum(barssince_ph) / ta.cum(math.sign(barssince_ph)) // AvgBarsSincePivot = Sum of the BarsSincePivot divided by (Sum of the number of signs of BarsSincePivot, AKA the number of BarsSincePivots)

// Draw a diamond forecast label and forecast range line

tooltiph = "🔄 Pivot Cycle: " + str.tostring(cych) + " bars" +

"\n⏱ Last Pivot: " + str.tostring(plhi + cych) + " bars ago" +

"\n🧮 Average Pivot: " + str.tostring(math.round(avg_barssince_ph)) + " bars" +

"\n🔮 Next Pivot: " + str.tostring(math.round(avg_barssince_ph)-(plhi + cych)) + " bars" +

"\n📏 Range: +/- " + str.tostring(math.round(avg_barssince_ph/2)) + " bars"

var label fh = na

var line lh = na

if labhf and gozuksunmu == "gozuksun"

fh := label.new(n + math.min((math.round(avg_barssince_ph) - (plhi+cych)), 500), y=plhy, size=size.tiny, style=sitil_label, color=color.new(hcol,ptransp),tooltip =tooltiph)

label.delete(fh[1])

lh := line.new(x1=n + math.min(math.round((avg_barssince_ph - (plhi+cych))-(avg_barssince_ph/2)), 500), x2=n + math.min(math.round((avg_barssince_ph - (plhi+cych))+(avg_barssince_ph/2)), 500), y1=plhy, y2=plhy, color=color.new(hcol,ptransp))

line.delete(lh[1])

var label ch = na // Create a label

if labh and gozuksunmu == "gozuksun"// Define the label

ch := label.new(bar_index, y=plhy, text=str.tostring(cych), size=size.small, style=label.style_label_left, color=color.new(color.white,100), textcolor=color.new(plhp?hcol:linecolor,0), tooltip=tooltiph)

label.delete(ch[1])

int sonraki_pivot = math.round(avg_barssince_ph)-(plhi + cych)

[sonraki_pivot]

[tepe_1_uzaklik] = fonk_tepe_dip_tahmin('',tahmin_kaynak_fiyat,'tepe',tahmin_uzunlugu_1,50)

[tepe_2_uzaklik] = fonk_tepe_dip_tahmin('',tahmin_kaynak_fiyat,'tepe',tahmin_uzunlugu_2,100)

[tepe_3_uzaklik] = fonk_tepe_dip_tahmin('',tahmin_kaynak_fiyat,'tepe',tahmin_uzunlugu_3,150)

[dip_1_uzaklik] = fonk_tepe_dip_tahmin('',tahmin_kaynak_fiyat,'dip',tahmin_uzunlugu_1,50)

[dip_2_uzaklik] = fonk_tepe_dip_tahmin('',tahmin_kaynak_fiyat,'dip',tahmin_uzunlugu_2,100)

[dip_3_uzaklik] = fonk_tepe_dip_tahmin('',tahmin_kaynak_fiyat,'dip',tahmin_uzunlugu_3,150)

gelecek_tepe_adet = 0

gelecek_tepe_adet := tepe_1_uzaklik > 0 ? gelecek_tepe_adet + 1 : gelecek_tepe_adet

gelecek_tepe_adet := tepe_2_uzaklik > 0 ? gelecek_tepe_adet + 1 : gelecek_tepe_adet

gelecek_tepe_adet := tepe_3_uzaklik > 0 ? gelecek_tepe_adet + 1 : gelecek_tepe_adet

gelecek_tepe_uzaklik_toplami = 0

gelecek_tepe_uzaklik_toplami := tepe_1_uzaklik > 0 ? gelecek_tepe_uzaklik_toplami + tepe_1_uzaklik : gelecek_tepe_uzaklik_toplami

gelecek_tepe_uzaklik_toplami := tepe_2_uzaklik > 0 ? gelecek_tepe_uzaklik_toplami + tepe_2_uzaklik : gelecek_tepe_uzaklik_toplami

gelecek_tepe_uzaklik_toplami := tepe_3_uzaklik > 0 ? gelecek_tepe_uzaklik_toplami + tepe_3_uzaklik : gelecek_tepe_uzaklik_toplami

//tepe_xo_text_sayac = str.tostring(gelecek_tepe_adet)//"1. kosul sayısı : " + str.tostring(kss7) + "\n\2. Kosul Sayisi : " + str.tostring(kss14) + "\n\3. Kosul sayisi : " + str.tostring(kss21) + "\n\En yuksek Dongu sayısına sahip kosul -kontrol amacli- : " +str.tostring(istedigim_rsi) + "\n\En yuksek Dongu sayısına sahip kosul degeri -kontrol amacli- : " +str.tostring(istedigim_rsi_deger)

//tepe_l_sayac = label.new(x = bar_index-10, y = high, style = label.style_label_left, text = tepe_xo_text_sayac,color=color.green,textcolor = color.white)

//label.delete(tepe_l_sayac[1])

//tepe_u_xo_text_sayac = str.tostring(gelecek_tepe_uzaklik_toplami)//"1. kosul sayısı : " + str.tostring(kss7) + "\n\2. Kosul Sayisi : " + str.tostring(kss14) + "\n\3. Kosul sayisi : " + str.tostring(kss21) + "\n\En yuksek Dongu sayısına sahip kosul -kontrol amacli- : " +str.tostring(istedigim_rsi) + "\n\En yuksek Dongu sayısına sahip kosul degeri -kontrol amacli- : " +str.tostring(istedigim_rsi_deger)

//tepe_u_l_sayac = label.new(x = bar_index, y = low, style = label.style_label_left, text = tepe_u_xo_text_sayac,color=color.red,textcolor = color.white)

//label.delete(tepe_u_l_sayac[1])

gelecek_dip_adet = 0

gelecek_dip_adet := dip_1_uzaklik > 0 ? gelecek_dip_adet + 1 : gelecek_dip_adet

gelecek_dip_adet := dip_2_uzaklik > 0 ? gelecek_dip_adet + 1 : gelecek_dip_adet

gelecek_dip_adet := dip_3_uzaklik > 0 ? gelecek_dip_adet + 1 : gelecek_dip_adet

gelecek_dip_uzaklik_toplami = 0

gelecek_dip_uzaklik_toplami := dip_1_uzaklik > 0 ? gelecek_dip_uzaklik_toplami + dip_1_uzaklik : gelecek_dip_uzaklik_toplami

gelecek_dip_uzaklik_toplami := dip_2_uzaklik > 0 ? gelecek_dip_uzaklik_toplami + dip_2_uzaklik : gelecek_dip_uzaklik_toplami

gelecek_dip_uzaklik_toplami := dip_3_uzaklik > 0 ? gelecek_dip_uzaklik_toplami + dip_3_uzaklik : gelecek_dip_uzaklik_toplami

//dip_xo_text_sayac = str.tostring(gelecek_dip_adet)//"1. kosul sayısı : " + str.tostring(kss7) + "\n\2. Kosul Sayisi : " + str.tostring(kss14) + "\n\3. Kosul sayisi : " + str.tostring(kss21) + "\n\En yuksek Dongu sayısına sahip kosul -kontrol amacli- : " +str.tostring(istedigim_rsi) + "\n\En yuksek Dongu sayısına sahip kosul degeri -kontrol amacli- : " +str.tostring(istedigim_rsi_deger)

//dip_l_sayac = label.new(x = bar_index-5, y = high, style = label.style_label_left, text = dip_xo_text_sayac,color=color.aqua,textcolor = color.white)

//label.delete(dip_l_sayac[1])

//dip_u_xo_text_sayac = str.tostring(gelecek_dip_uzaklik_toplami)//"1. kosul sayısı : " + str.tostring(kss7) + "\n\2. Kosul Sayisi : " + str.tostring(kss14) + "\n\3. Kosul sayisi : " + str.tostring(kss21) + "\n\En yuksek Dongu sayısına sahip kosul -kontrol amacli- : " +str.tostring(istedigim_rsi) + "\n\En yuksek Dongu sayısına sahip kosul degeri -kontrol amacli- : " +str.tostring(istedigim_rsi_deger)

//dip_u_l_sayac = label.new(x = bar_index+5, y = low, style = label.style_label_left, text = dip_u_xo_text_sayac,color=color.gray,textcolor = color.white)

//label.delete(dip_u_l_sayac[1])

olasi_long_ihtimali = ((gelecek_tepe_adet > 0) and (gelecek_tepe_uzaklik_toplami > 0)) and ((gelecek_tepe_adet > gelecek_dip_adet) and (gelecek_tepe_uzaklik_toplami > gelecek_dip_uzaklik_toplami)) ? true : false

olasi_short_ihtimali = ((gelecek_dip_adet > 0) and (gelecek_dip_uzaklik_toplami > 0)) and ((gelecek_tepe_adet < gelecek_dip_adet) and (gelecek_tepe_uzaklik_toplami < gelecek_dip_uzaklik_toplami)) ? true : false

gelecek_long_tahmini_aktif = input.bool(false,'gelecek long tahmini aktif')

gelecek_short_tahmini_aktif = input.bool(false,'gelecek short tahmini aktif')

////////////////////////////////////////

//pozisyon seçimi

//OpenDirection = input.string(defval="BIRLIKTE", title="ISLEM SECIMI", options=["BIRLIKTE", "LONG", "SHORT"])

open_all = OpenDirection == "BIRLIKTE"

open_all_longs = OpenDirection != "SHORT"

open_all_shorts = OpenDirection != "LONG"

longaktif = bool(na)

shortaktif = bool(na)

longaktif := open_all ? true : open_all_longs ? true : open_all_shorts ? false : na

shortaktif := open_all ? true : open_all_longs ? false : open_all_shorts ? true : na

//Long-Short entry conditions....

/////////////////////////////////////////////////////////////////

////////////____backtest__zaman__baslangic__//////////////////

group_backtest = "Backtest Tarih Aralığı"

stday = input.int(defval=4, title='start Day', minval=1, maxval=31,group = group_backtest)

stmon = input.int(defval=1, title='start Month', minval=1, maxval=12,group = group_backtest)

styear = input.int(defval=2024, title='start Year', minval=2000,group = group_backtest)

fnday = input.int(defval=1, title='Finish Day', minval=1, maxval=31,group = group_backtest)

fnmon = input.int(defval=1, title='finish Month', minval=1, maxval=12,group = group_backtest)

fnyear = input.int(defval=2030, title='finish Year', minval=2000,group = group_backtest)

starttime = timestamp(styear, stmon, stday, 00, 00)

finishtime = timestamp(fnyear, fnmon, fnday, 23, 59)

backtest() =>

time >= starttime and time <= finishtime ? true : false

////////////____backtest__zaman__bitti__///////////////////

indikator_long = longCondition_most_indikator

if vwap_gosterge_filtre_long_most

indikator_long := (vwap_long_most) and indikator_long

if gelecek_long_tahmini_aktif

indikator_long := (olasi_long_ihtimali == true) and indikator_long

indikator_short = shortCondition_most_indikator

if vwap_gosterge_filtre_short_most

indikator_short := (vwap_short_most) and indikator_short

if gelecek_short_tahmini_aktif

indikator_short := (olasi_short_ihtimali == true) and indikator_short

long_giris_baslangic = indikator_long and longaktif == true and (trade_yap_zaman_long ==true) and not(strategy.position_size > 0) //(strategy.position_size == 0) //and

short_giris_baslangic = indikator_short and shortaktif == true and (trade_yap_zaman_short ==true) and not(strategy.position_size < 0) //and //(strategy.position_size == 0)

long_pozisyon_giris = long_giris_baslangic[1]

short_pozisyon_giris = short_giris_baslangic[1]

var float long_pozisyon_giris_fiyati = 0.

var float short_pozisyon_giris_fiyati = 0.

long_pozisyon_giris_fiyati := ta.valuewhen(long_pozisyon_giris and not(str.contains(strategy.opentrades.entry_id(0), "L1") or str.contains(strategy.opentrades.entry_id(0), "L2") or str.contains(strategy.opentrades.entry_id(0), "L3") or str.contains(strategy.opentrades.entry_id(0), "S1") or str.contains(strategy.opentrades.entry_id(0), "S2") or str.contains(strategy.opentrades.entry_id(0), "S3")),close_fiyat,0)

short_pozisyon_giris_fiyati := ta.valuewhen(short_pozisyon_giris and not(str.contains(strategy.opentrades.entry_id(0), "L1") or str.contains(strategy.opentrades.entry_id(0), "L2") or str.contains(strategy.opentrades.entry_id(0), "L3") or str.contains(strategy.opentrades.entry_id(0), "S1") or str.contains(strategy.opentrades.entry_id(0), "S2") or str.contains(strategy.opentrades.entry_id(0), "S3")),close_fiyat,0)

var float sabit_tp_long_fiyat = 0.

var float sabit_tp_short_fiyat = 0.

sabit_tp_long_fiyat := long_pozisyon_giris_fiyati * (1 + sabit_tp_yl)

sabit_tp_short_fiyat := short_pozisyon_giris_fiyati * (1 - sabit_tp_ys)

var float sabit_loss_long_fiyat = 0.

var float sabit_loss_short_fiyat = 0.

sabit_loss_long_fiyat := long_pozisyon_giris_fiyati * (1 - sabit_loss_yl)

sabit_loss_short_fiyat := short_pozisyon_giris_fiyati * (1 + sabit_loss_ys)

////////////////////////////////////////

//Takip stop kodu (TRAILING STOP CODE)

traillongStopPrice = 0., trailshortStopPrice = 0.

traillongStopPrice := if (strategy.position_size > 0)

long_stopValue = low_fiyat * (1 - sabit_loss_yl )

math.max(long_stopValue , traillongStopPrice[1])

else

0

trailshortStopPrice := if (strategy.position_size < 0)

short_stopValue = high_fiyat * (1 + sabit_loss_ys)

math.min(short_stopValue, trailshortStopPrice[1])

else

999999

//Takip stop kodu BITTI (TRAILING STOP CODE)

stop_loss_long_fiyat = stop_loss_secimi_long ? sabit_loss_long_fiyat : traillongStopPrice

stop_loss_short_fiyat = stop_loss_secimi_short ? sabit_loss_short_fiyat : trailshortStopPrice

var float Long_2_giris_fiyati = 0.

Long_2_giris_fiyati := stop_loss_long_fiyat * (1 + ikinci_giris_long)//strategy.position_size > 0 and (str.contains(strategy.opentrades.entry_id(0), "L1")) ? strategy.opentrades.entry_price(strategy.opentrades - 1) * (1 - ikinci_giris_long) : na//sonra bir değişken olarak bakabiliriz.

//var float Long_3_giris_fiyati = 0.

//Long_3_giris_fiyati := most_long_oldugunda_fiyat * (1 - 0.015)

var float Short_2_giris_fiyati = 0.

Short_2_giris_fiyati := stop_loss_short_fiyat * (1 - ikinci_giris_short)//strategy.position_size < 0 and (str.contains(strategy.opentrades.entry_id(0), "S1")) ? strategy.opentrades.entry_price(strategy.opentrades - 1) * (1 + ikinci_giris_short) : na // * (1 + ikinci_girisler)

//var float Short_3_giris_fiyati = 0.

//Short_3_giris_fiyati := most_short_oldugunda_fiyat * (1 + 0.015)

/////___qty__miktari_____/////

//Amount_1 = input.float(51, "Amount İlk Pozisyon", minval = 0.01, inline = "31")//, group = ALERTGRP_CRED) //pozisyon_1_yuzde

//Amount_2 = input.float(49, "Amount 2. Giris", minval = 0.01, inline = "31")//, group = ALERTGRP_CRED) //pozisyon_2_yuzde

//RoundToTick( _price) => math.round(_price/syminfo.mintick)*syminfo.mintick

Amount_1_long = (indikator_long_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == 1) ? Amount_1a / 2 : Amount_1a

Amount_1_short = (indikator_short_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == -1) ? Amount_1a / 2 : Amount_1a

kontrakt_buyuklugu_long_1 = (indikator_long_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == 1) ? (((okx_bot_butcesi*(Amount_1a/100)) * okx_bot_kaldirac) / RoundToTick(long_pozisyon_giris_fiyati)) / 2 : ((okx_bot_butcesi*(Amount_1a/100)) * okx_bot_kaldirac) / RoundToTick(long_pozisyon_giris_fiyati)

//math.round(((okx_bot_butcesi*(Amount_1/100)) * okx_bot_kaldirac) / long_pozisyon_giris_fiyati)

kontrakt_buyuklugu_short_1 = (indikator_short_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == -1) ? (((okx_bot_butcesi*(Amount_1a/100)) * okx_bot_kaldirac) / RoundToTick(short_pozisyon_giris_fiyati)) / 2 : ((okx_bot_butcesi*(Amount_1a/100)) * okx_bot_kaldirac) / RoundToTick(short_pozisyon_giris_fiyati)

//math.round(((okx_bot_butcesi*(Amount_1/100)) * okx_bot_kaldirac) / short_pozisyon_giris_fiyati)

Amount_2_long = (indikator_long_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == 1) ? Amount_2a : Amount_2a / 2

Amount_2_short = (indikator_short_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == -1) ? Amount_2a : Amount_2a / 2

kontrakt_buyuklugu_long_2 = (indikator_long_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == 1) ? (((okx_bot_butcesi*(Amount_2a/100)) * okx_bot_kaldirac) / RoundToTick(long_pozisyon_giris_fiyati)) : (((okx_bot_butcesi*(Amount_2a/100)) * okx_bot_kaldirac) / RoundToTick(long_pozisyon_giris_fiyati)) / 2

//math.round(((okx_bot_butcesi*(Amount_2/100)) * okx_bot_kaldirac) / long_pozisyon_giris_fiyati)

kontrakt_buyuklugu_short_2 = (indikator_short_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == -1) ? (((okx_bot_butcesi*(Amount_2a/100)) * okx_bot_kaldirac) / RoundToTick(short_pozisyon_giris_fiyati)) : (((okx_bot_butcesi*(Amount_2a/100)) * okx_bot_kaldirac) / RoundToTick(short_pozisyon_giris_fiyati)) / 2

//math.round(((okx_bot_butcesi*(Amount_2/100)) * okx_bot_kaldirac) / short_pozisyon_giris_fiyati)

////////////_____okx_borsa_ayar__///////////////////

var ALERTGRP_CRED = "OKX Perpetual-Futures Ayar"

signalToken = "C3sPzbAmZnMpCDnePJziYTF1QNh/Q/VCHcdHIkPc4LU/0HrMGIv1In3dk3O9yLrbDMjqMHkZClQxSZqIUJpdgg=="//input("", "Signal Token", inline = "11", group = ALERTGRP_CRED)

OrderType = "market"//input.string("market", "Order Type", options = ["market", "limit"], inline = "21", group = ALERTGRP_CRED)

OrderPriceOffset = 0//input.float(0, "Order Price Offset", minval = 0, maxval = 100, step = 0.01, inline = "21", group = ALERTGRP_CRED)

InvestmentType = "percentage_investment"//input.string("margin", "Investment Type", options = ["margin", "contract", "percentage_balance", "percentage_investment"], inline = "31", group = ALERTGRP_CRED)

//Amount_1 = input.float(51, "Amount İlk Pozisyon", minval = 0.01, inline = "31", group = ALERTGRP_CRED) //pozisyon_1_yuzde

//Amount_2 = input.float(49, "Amount 2. Giris", minval = 0.01, inline = "31", group = ALERTGRP_CRED) //pozisyon_2_yuzde

getOrderAlertMsgEntry(action, instrument, signalToken, orderType, orderPriceOffset, investmentType, amount) =>

str = '{'

str := str + '"action": "' + action + '", '

str := str + '"instrument": "' + instrument + '", '

str := str + '"signalToken": "' + signalToken + '", '

//str := str + '"timestamp": "' + str.format_time(timenow, "yyyy-MM-dd'T'HH:mm:ssZ", "UTC+0") + '", '

str := str + '"timestamp": "' + '{{timenow}}' + '", '

str := str + '"orderType": "' + orderType + '", '

str := str + '"orderPriceOffset": "' + str.tostring(orderPriceOffset) + '", '

str := str + '"investmentType": "' + investmentType + '", '

str := str + '"amount": "' + str.tostring(amount) + '"'

str := str + '}'

str

getOrderAlertMsgExit(action, instrument, signalToken) =>

str = '{'

str := str + '"action": "' + action + '", '

str := str + '"instrument": "' + instrument + '", '

str := str + '"signalToken": "' + signalToken + '", '

str := str + '"timestamp": "' + '{{timenow}}' + '", '

str := str + '}'

str

buyAlertMsgExit = getOrderAlertMsgExit(action = 'EXIT_LONG', instrument = syminfo.ticker, signalToken = signalToken)

buyAlertMsgEntry_1 = getOrderAlertMsgEntry(action = 'ENTER_LONG', instrument = syminfo.ticker, signalToken = signalToken, orderType = OrderType, orderPriceOffset = OrderPriceOffset, investmentType = InvestmentType, amount = Amount_1_long)

buyAlertMsgEntry_2 = getOrderAlertMsgEntry(action = 'ENTER_LONG', instrument = syminfo.ticker, signalToken = signalToken, orderType = OrderType, orderPriceOffset = OrderPriceOffset, investmentType = InvestmentType, amount = Amount_2_long)

sellAlertMsgExit = getOrderAlertMsgExit(action = 'EXIT_SHORT', instrument = syminfo.ticker, signalToken = signalToken)

sellAlertMsgEntry_1 = getOrderAlertMsgEntry(action = 'ENTER_SHORT', instrument = syminfo.ticker, signalToken = signalToken, orderType = OrderType, orderPriceOffset = OrderPriceOffset, investmentType = InvestmentType, amount = Amount_1_short)

sellAlertMsgEntry_2 = getOrderAlertMsgEntry(action = 'ENTER_SHORT', instrument = syminfo.ticker, signalToken = signalToken, orderType = OrderType, orderPriceOffset = OrderPriceOffset, investmentType = InvestmentType, amount = Amount_2_short)

////////////_____okx_borsa_ayar_bitti_____///////////////////

if backtest()

////________________________pozisyon__________girislersi______________________///////

if long_giris_baslangic and str.contains(strategy.opentrades.entry_id(0), "S1") or str.contains(strategy.opentrades.entry_id(0), "S2") //and (zarar_sonrasi_yeni_gun == true)

strategy.close('S1',comment = "L-B S-Ex_O",immediately = true,alert_message = sellAlertMsgExit)

strategy.close('S2',comment = "L-B S-Ex_O",immediately = true)//alarm mesaji tek yeter mi? canlı test

if (long_pozisyon_giris)

strategy.entry('L1', strategy.long,comment='Gir Long_1',alert_message =buyAlertMsgEntry_1,qty=kontrakt_buyuklugu_long_1)//,comment = '{"symbol":"{{ticker}}","side":"{{strategy.order.action}}","qty":"{{strategy.order.contracts}}","price":"{{close}}","signalId":"f4e95251-7896-4f","uid":"6e6d9668de5c60acecd733524ff66c5edac3c1fe65933ef0abf358b369a2f666"}')

if short_giris_baslangic and str.contains(strategy.opentrades.entry_id(0), "L1") or str.contains(strategy.opentrades.entry_id(0), "L2") //and (zarar_sonrasi_yeni_gun == true)

strategy.close('L1',comment = "S-B L-Ex_O",immediately = true,alert_message = buyAlertMsgExit)

strategy.close('L2',comment = "S-B L-Ex_O",immediately = true)//alarm mesaji tek yeter mi? canlı test

if (short_pozisyon_giris) //and (zarar_sonrasi_yeni_gun == true)

strategy.entry('S1', strategy.short,comment='Gir Short_1',alert_message =sellAlertMsgEntry_1,qty=kontrakt_buyuklugu_short_1)//qty=kontrakt_buyuklugu_short)//,comment = '{"symbol":"{{ticker}}","side":"{{strategy.order.action}}","qty":"{{strategy.order.contracts}}","price":"{{close}}","signalId":"f4e95251-7896-4f","uid":"6e6d9668de5c60acecd733524ff66c5edac3c1fe65933ef0abf358b369a2f666"}')

////________________________pozisyon____cikislari______________________//////////

if (strategy.position_size > 0) and str.contains(strategy.opentrades.entry_id(0), "L1") and ta.crossunder(low_fiyat, Long_2_giris_fiyati) //and not(ta.crossunder(low, Long_3_giris_fiyati)) and not( ta.crossunder(low, Long_4_giris_fiyati))

strategy.entry('L2', strategy.long,comment='Gir Long_2',alert_message =buyAlertMsgEntry_2,qty=kontrakt_buyuklugu_long_2)

if (strategy.position_size > 0) and (short_giris_baslangic)

strategy.close('L1',comment = "S-B L-Ex_O",immediately = true,alert_message = buyAlertMsgExit)

strategy.close('L2',comment = "S-B L-Ex_O",immediately = true)

if (strategy.position_size > 0) and not(short_giris_baslangic)//and (low <= traillongStopPrice) or (high >= sabit_tp_long_fiyat) or (pozisyon_short)

strategy.exit('xL1', from_entry = 'L1',comment='EXIT Long_1-Li/St',alert_message = buyAlertMsgExit, limit = sabit_tp_long_fiyat, stop = stop_loss_long_fiyat)//,qty=21)

strategy.exit('xL2', from_entry = 'L2',comment='EXIT Long_2-Li/St',alert_message = buyAlertMsgExit, limit = sabit_tp_long_fiyat, stop = stop_loss_long_fiyat)//,qty=22)

//strategy.exit('xL3', from_entry = 'L3',comment='EXIT Long_3-Li/St',alert_message = buyAlertMsgExit, limit = sabit_tp_long_fiyat, stop = traillongStopPrice)//,qty=22)

if (strategy.position_size < 0) and str.contains(strategy.opentrades.entry_id(0), "S1") and ta.crossover(high_fiyat, Short_2_giris_fiyati) //and not(ta.crossunder(low, Long_3_giris_fiyati)) and not( ta.crossunder(low, Long_4_giris_fiyati))

strategy.entry('S2', strategy.short,comment='Gir Short_2',alert_message =sellAlertMsgEntry_2,qty=kontrakt_buyuklugu_short_2)

if (strategy.position_size < 0) and (long_giris_baslangic)

strategy.close('S1',comment = "L-B S-Ex_O",immediately = true,alert_message = sellAlertMsgExit)

strategy.close('S2',comment = "L-B S-Ex_O",immediately = true)

if (strategy.position_size < 0) and not(long_giris_baslangic)//and (low <= traillongStopPrice) or (high >= sabit_tp_long_fiyat) or (pozisyon_short)

strategy.exit('xS1', from_entry = 'S1',comment='EXIT Short_1-Li/St',alert_message = sellAlertMsgExit, limit = sabit_tp_short_fiyat, stop = stop_loss_short_fiyat)//,qty=21)

strategy.exit('xS2', from_entry = 'S2',comment='EXIT Short_2-Li/St',alert_message = sellAlertMsgExit, limit = sabit_tp_short_fiyat, stop = stop_loss_short_fiyat)//,qty=22)

//strategy.exit('xS3', from_entry = 'S3',comment='EXIT Short_3-Li/St',alert_message = sellAlertMsgExit, limit = sabit_tp_short_fiyat, stop = trailshortStopPrice)//,qty=22)

sabit_tp_long_plot = plot((strategy.position_size > 0) ? sabit_tp_long_fiyat : na, color=color.lime, style=plot.style_linebr, title="S-KA ½ Long")

takipli_stop_long_plot = plot( (strategy.position_size > 0) ? stop_loss_long_fiyat : na, color=color.red, style=plot.style_linebr, title="T-SL ½ Long")

sabit_tp_short_plot = plot((strategy.position_size < 0) ? sabit_tp_short_fiyat : na, color=color.lime, style=plot.style_linebr, title="S-KA ½ Short")

takipli_stop_short_plot = plot( (strategy.position_size < 0) ? stop_loss_short_fiyat : na, color=color.red, style=plot.style_linebr, title="T-SL ½ Short")

//

相关推荐