概述

该策略基于市场极端下跌时的统计特性进行交易。通过对回撤的统计分析,利用标准差衡量市场波动的极端程度,在市场出现超出正常范围的下跌时进行买入。策略的核心思想是捕捉市场恐慌情绪导致的超跌机会,通过数学统计方法识别市场非理性行为带来的投资机会。

策略原理

策略采用滚动时间窗口计算价格的最大回撤和回撤的统计特征。首先计算过去50个周期内的最高价,然后计算当前收盘价相对最高价的回撤百分比。接着计算回撤的均值和标准差,设置-1倍标准差作为触发阈值。当市场回撤超过均值减去设定倍数的标准差时,表明市场可能出现超跌,此时进入多头头寸。持仓35个周期后自动平仓。策略还绘制了回撤曲线以及一倍、两倍和三倍标准差水平线,用于直观判断市场的超跌程度。

策略优势

- 策略基于统计学原理,具有扎实的理论基础。通过标准差衡量市场波动的极端程度,方法客观科学。

- 策略能够有效捕捉市场恐慌时期的投资机会。在市场出现非理性下跌时入场,符合价值投资的理念。

- 采用固定周期平仓的方式,避免了追踪止损可能错过反弹的问题。

- 策略参数可调整性强,可以根据不同市场环境和交易品种特点灵活设置。

- 回撤和标准差指标计算简单,策略逻辑清晰,易于理解和执行。

策略风险

- 市场可能出现持续下跌,导致策略频繁入场但均亏损。建议设置最大持仓数量限制。

- 固定周期平仓可能错过更大的上涨空间。可以考虑增加趋势跟踪的平仓方式。

- 回撤统计特征可能随市场环境变化而改变。建议定期更新参数设置。

- 策略未考虑成交量等其他市场信息。建议结合多个指标进行交叉验证。

- 在剧烈波动的市场环境下,标准差可能失真。建议设置风险控制措施。

策略优化方向

- 引入成交量指标,确认市场恐慌程度。

- 增加趋势指标,避免在下跌趋势中频繁入场。

- 优化平仓机制,根据市场表现动态调整持仓时间。

- 增加止损设置,控制单次交易风险。

- 考虑使用自适应参数,提高策略对市场变化的适应性。

总结

该策略通过统计学方法捕捉市场超跌机会,具有良好的理论基础和实用价值。策略逻辑简单清晰,参数可调整性强,适合作为基础策略进行扩展和优化。通过增加其他技术指标和风险控制措施,可以进一步提升策略的稳定性和盈利能力。在实盘交易中,建议结合市场环境和交易品种特点,谨慎设置参数,做好风险控制。

策略源码

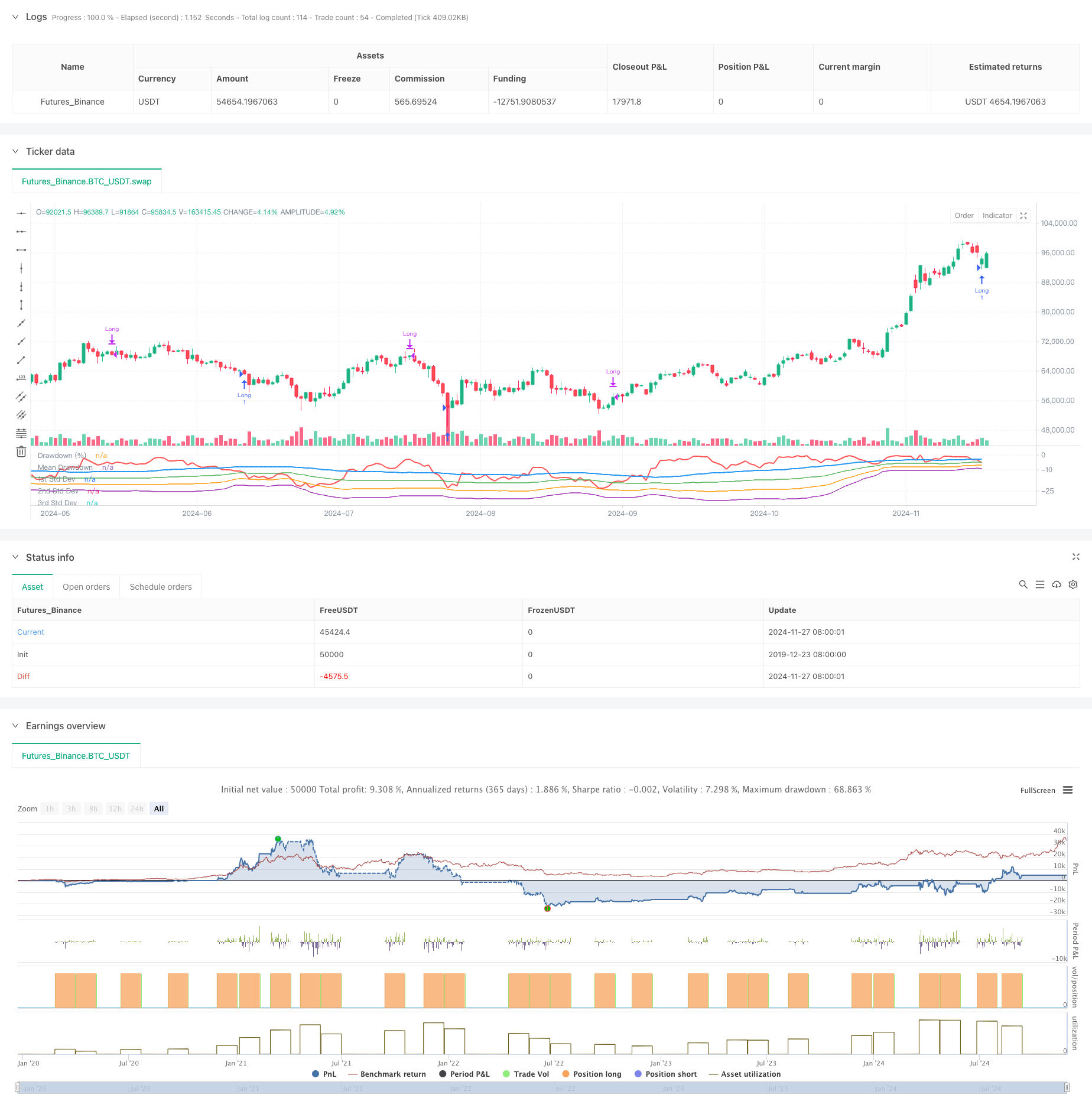

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-28 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Buy When There's Blood in the Streets Strategy", overlay=false, shorttitle="BloodInTheStreets")

//This strategy identifies opportunities to buy during extreme market drawdowns based on standard deviation thresholds.

//It calculates the maximum drawdown over a user-defined lookback period, identifies extreme deviations from the mean,

//and triggers long entries when specific conditions are met. The position is exited after a defined number of bars.

// User Inputs

lookbackPeriod = input.int(50, title="Lookback Period", minval=1, tooltip="Period to calculate the highest high for drawdown")

stdDevLength = input.int(50, title="Standard Deviation Length", minval=1, tooltip="Length of the period to calculate standard deviation")

stdDevThreshold = input.float(-1.0, title="Standard Deviation Threshold", tooltip="Trigger level for long entry based on deviations")

exitBars = input.int(35, title="Exit After (Bars)", minval=1, tooltip="Number of bars after which to exit the trade")

// Drawdown Calculation

peakHigh = ta.highest(high, lookbackPeriod)

drawdown = ((close - peakHigh) / peakHigh) * 100

// Standard Deviation Calculation

drawdownStdDev = ta.stdev(drawdown, stdDevLength)

meanDrawdown = ta.sma(drawdown, stdDevLength)

// Define Standard Deviation Levels

stdDev1 = meanDrawdown - drawdownStdDev

stdDev2 = meanDrawdown - 2 * drawdownStdDev

stdDev3 = meanDrawdown - 3 * drawdownStdDev

// Plot Drawdown and Levels

plot(drawdown, color=color.red, linewidth=2, title="Drawdown (%)")

plot(meanDrawdown, color=color.blue, linewidth=2, title="Mean Drawdown")

plot(stdDev1, color=color.green, linewidth=1, title="1st Std Dev")

plot(stdDev2, color=color.orange, linewidth=1, title="2nd Std Dev")

plot(stdDev3, color=color.purple, linewidth=1, title="3rd Std Dev")

// Entry Condition

var float entryBar = na

goLong = drawdown <= meanDrawdown + stdDevThreshold * drawdownStdDev

if (goLong and strategy.position_size == 0)

strategy.entry("Long", strategy.long)

entryBar := bar_index

// Exit Condition

if (strategy.position_size > 0 and not na(entryBar) and bar_index - entryBar >= exitBars)

strategy.close("Long")

相关推荐