概述

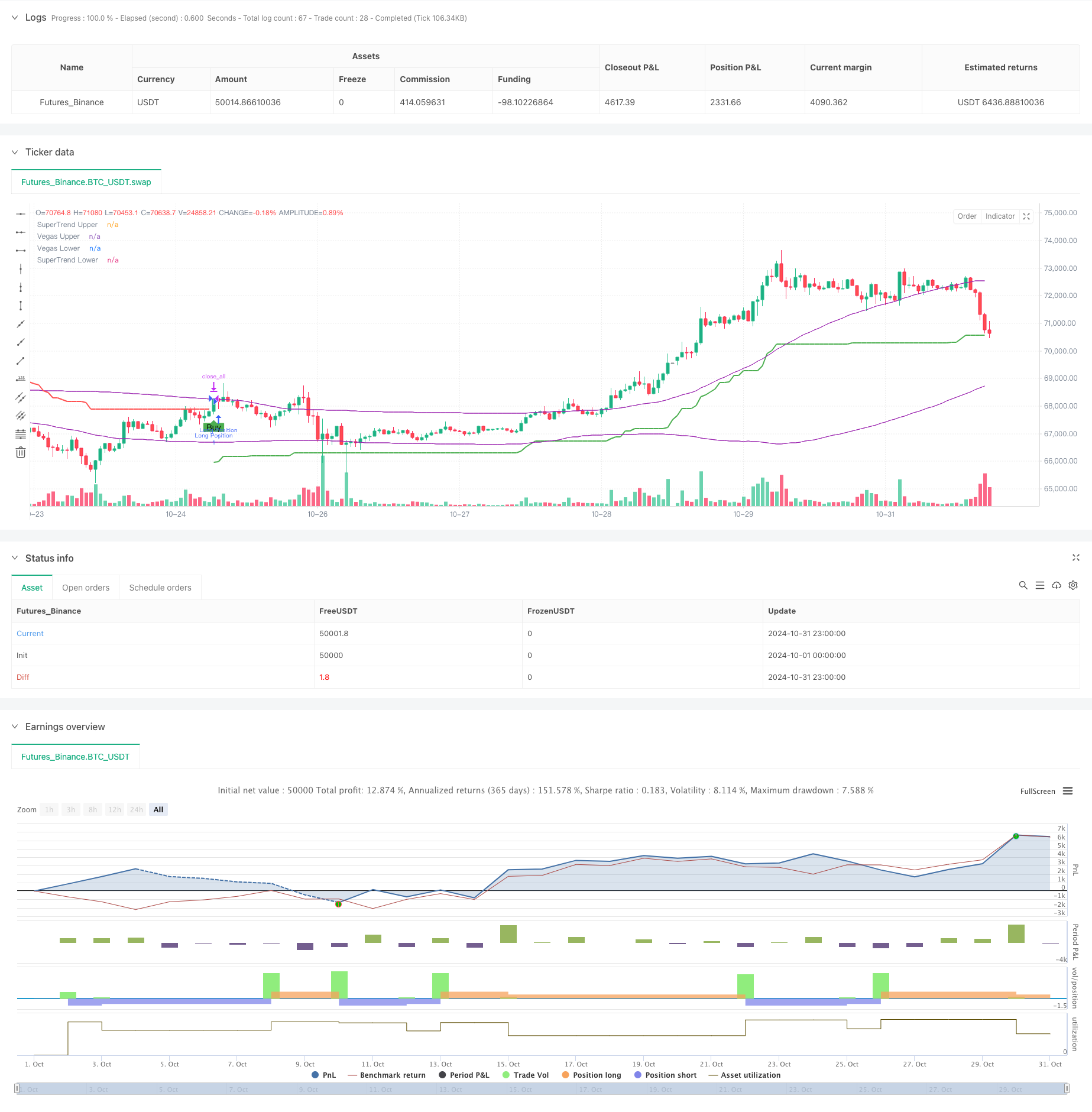

多步波动率自适应动态超趋势策略是一个结合了Vegas通道和SuperTrend指标的创新性交易系统。该策略的独特之处在于其动态适应市场波动性的能力,以及采用多步止盈机制来优化风险收益比。策略通过将Vegas通道的波动性分析与SuperTrend的趋势跟踪功能相结合,在市场条件变化时自动调整其参数,从而提供更准确的交易信号。

策略原理

策略运作基于三个核心组件:Vegas通道计算、趋势检测和多步止盈机制。Vegas通道使用简单移动平均线(SMA)和标准差(STD)来定义价格波动范围,SuperTrend指标根据调整后的ATR值确定趋势方向。当市场趋势发生改变时,系统会生成交易信号。多步止盈机制允许在不同价格水平分批退出,这种方法既能锁定利润,又能让部分仓位继续获得潜在收益。策略的独特之处在于其波动率调整因子,该因子根据Vegas通道的宽度动态调整SuperTrend乘数。

策略优势

- 动态适应性: 通过波动率调整因子,策略能够自动适应不同市场条件。

- 风险管理: 多步止盈机制提供了系统化的获利了结方案。

- 可定制性: 提供多个参数设置选项,满足不同交易风格。

- 全面的市场覆盖: 支持多空双向交易。

- 视觉反馈: 提供清晰的图形界面,便于分析和决策。

策略风险

- 参数敏感性: 不同参数组合可能导致策略表现差异较大。

- 滞后性: 基于移动平均的指标存在一定滞后。

- 假突破风险: 在横盘市场可能产生错误信号。

- 止盈设置的权衡: 过早止盈可能错过大趋势,过晚止盈可能失去已有利润。

策略优化方向

- 引入市场环境过滤器,在不同市场条件下调整策略参数。

- 增加成交量分析,提高信号可靠性。

- 开发自适应止盈机制,根据市场波动动态调整止盈水平。

- 整合其他技术指标,提供信号确认。

- 实现动态仓位管理,根据市场风险调整交易规模。

总结

多步波动率自适应动态超趋势策略代表了一种先进的量化交易方法,通过结合多个技术指标和创新的止盈机制,为交易者提供了一个全面的交易系统。其动态适应性和风险管理功能使其特别适合在不同市场环境下运作,而且具有良好的可扩展性和优化空间。通过持续改进和优化,该策略有望在未来提供更稳定的交易表现。

策略源码

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Multi-Step Vegas SuperTrend - strategy [presentTrading]", shorttitle="Multi-Step Vegas SuperTrend - strategy [presentTrading]", overlay=true, precision=3, commission_value=0.1, commission_type=strategy.commission.percent, slippage=1, currency=currency.USD)

// Input settings allow the user to customize the strategy's parameters.

tradeDirectionChoice = input.string(title="Trade Direction", defval="Both", options=["Long", "Short", "Both"]) // Option to select the trading direction

atrPeriod = input(10, "ATR Period for SuperTrend") // Length of the ATR for volatility measurement

vegasWindow = input(100, "Vegas Window Length") // Length of the moving average for the Vegas Channel

superTrendMultiplier = input(5, "SuperTrend Multiplier Base") // Base multiplier for the SuperTrend calculation

volatilityAdjustment = input.float(5, "Volatility Adjustment Factor") // Factor to adjust the SuperTrend sensitivity to the Vegas Channel width

// User inputs for take profit settings

useTakeProfit = input.bool(true, title="Use Take Profit", group="Take Profit Settings")

takeProfitPercent1 = input.float(3.0, title="Take Profit % Step 1", group="Take Profit Settings")

takeProfitPercent2 = input.float(6.0, title="Take Profit % Step 2", group="Take Profit Settings")

takeProfitPercent3 = input.float(12.0, title="Take Profit % Step 3", group="Take Profit Settings")

takeProfitPercent4 = input.float(21.0, title="Take Profit % Step 4", group="Take Profit Settings")

takeProfitAmount1 = input.float(25, title="Take Profit Amount % Step 1", group="Take Profit Settings")

takeProfitAmount2 = input.float(20, title="Take Profit Amount % Step 2", group="Take Profit Settings")

takeProfitAmount3 = input.float(10, title="Take Profit Amount % Step 3", group="Take Profit Settings")

takeProfitAmount4 = input.float(15, title="Take Profit Amount % Step 4", group="Take Profit Settings")

numberOfSteps = input.int(4, title="Number of Take Profit Steps", minval=1, maxval=4, group="Take Profit Settings")

// Calculate the Vegas Channel using a simple moving average and standard deviation.

vegasMovingAverage = ta.sma(close, vegasWindow)

vegasChannelStdDev = ta.stdev(close, vegasWindow)

vegasChannelUpper = vegasMovingAverage + vegasChannelStdDev

vegasChannelLower = vegasMovingAverage - vegasChannelStdDev

// Adjust the SuperTrend multiplier based on the width of the Vegas Channel.

channelVolatilityWidth = vegasChannelUpper - vegasChannelLower

adjustedMultiplier = superTrendMultiplier + volatilityAdjustment * (channelVolatilityWidth / vegasMovingAverage)

// Calculate the SuperTrend indicator values.

averageTrueRange = ta.atr(atrPeriod)

superTrendUpper = hlc3 - (adjustedMultiplier * averageTrueRange)

superTrendLower = hlc3 + (adjustedMultiplier * averageTrueRange)

var float superTrendPrevUpper = na

var float superTrendPrevLower = na

var int marketTrend = 1

// Update SuperTrend values and determine the current trend direction.

superTrendPrevUpper := nz(superTrendPrevUpper[1], superTrendUpper)

superTrendPrevLower := nz(superTrendPrevLower[1], superTrendLower)

marketTrend := close > superTrendPrevLower ? 1 : close < superTrendPrevUpper ? -1 : nz(marketTrend[1], 1)

superTrendUpper := marketTrend == 1 ? math.max(superTrendUpper, superTrendPrevUpper) : superTrendUpper

superTrendLower := marketTrend == -1 ? math.min(superTrendLower, superTrendPrevLower) : superTrendLower

superTrendPrevUpper := superTrendUpper

superTrendPrevLower := superTrendLower

// Enhanced Visualization

// Plot the SuperTrend and Vegas Channel for visual analysis.

plot(marketTrend == 1 ? superTrendUpper : na, "SuperTrend Upper", color=color.green, linewidth=2)

plot(marketTrend == -1 ? superTrendLower : na, "SuperTrend Lower", color=color.red, linewidth=2)

plot(vegasChannelUpper, "Vegas Upper", color=color.purple, linewidth=1)

plot(vegasChannelLower, "Vegas Lower", color=color.purple, linewidth=1)

// Apply a color to the price bars based on the current market trend.

barcolor(marketTrend == 1 ? color.green : marketTrend == -1 ? color.red : na)

// Detect trend direction changes and plot entry/exit signals.

trendShiftToBullish = marketTrend == 1 and marketTrend[1] == -1

trendShiftToBearish = marketTrend == -1 and marketTrend[1] == 1

plotshape(series=trendShiftToBullish, title="Enter Long", location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

plotshape(series=trendShiftToBearish, title="Enter Short", location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")

// Define conditions for entering long or short positions, and execute trades based on these conditions.

enterLongCondition = marketTrend == 1

enterShortCondition = marketTrend == -1

// Check trade direction choice before executing trade entries.

if enterLongCondition and (tradeDirectionChoice == "Long" or tradeDirectionChoice == "Both")

strategy.entry("Long Position", strategy.long)

if enterShortCondition and (tradeDirectionChoice == "Short" or tradeDirectionChoice == "Both")

strategy.entry("Short Position", strategy.short)

// Close all positions when the market trend changes.

if marketTrend != marketTrend[1]

strategy.close_all()

// Multi-Stage Take Profit Logic

if (strategy.position_size > 0)

entryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

if numberOfSteps >= 1

strategy.exit("Take Profit 1", from_entry="Long Position", qty_percent=takeProfitAmount1, limit=entryPrice * (1 + takeProfitPercent1 / 100))

if numberOfSteps >= 2

strategy.exit("Take Profit 2", from_entry="Long Position", qty_percent=takeProfitAmount2, limit=entryPrice * (1 + takeProfitPercent2 / 100))

if numberOfSteps >= 3

strategy.exit("Take Profit 3", from_entry="Long Position", qty_percent=takeProfitAmount3, limit=entryPrice * (1 + takeProfitPercent3 / 100))

if numberOfSteps >= 4

strategy.exit("Take Profit 4", from_entry="Long Position", qty_percent=takeProfitAmount4, limit=entryPrice * (1 + takeProfitPercent4 / 100))

if (strategy.position_size < 0)

entryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

if numberOfSteps >= 1

strategy.exit("Take Profit 1", from_entry="Short Position", qty_percent=takeProfitAmount1, limit=entryPrice * (1 - takeProfitPercent1 / 100))

if numberOfSteps >= 2

strategy.exit("Take Profit 2", from_entry="Short Position", qty_percent=takeProfitAmount2, limit=entryPrice * (1 - takeProfitPercent2 / 100))

if numberOfSteps >= 3

strategy.exit("Take Profit 3", from_entry="Short Position", qty_percent=takeProfitAmount3, limit=entryPrice * (1 - takeProfitPercent3 / 100))

if numberOfSteps >= 4

strategy.exit("Take Profit 4", from_entry="Short Position", qty_percent=takeProfitAmount4, limit=entryPrice * (1 - takeProfitPercent4 / 100))

相关推荐