策略概述

该策略是一个基于波浪趋势指标(Wave Trend)和分散投资(Dollar Cost Averaging)理念的智能交易系统。策略通过分析市场的波动趋势,在市场处于超卖区域时逐步建仓,在牛市确认时逐步获利了结。该策略结合了技术分析和风险管理的优点,能够在市场周期中持续稳定地积累仓位并获取收益。

策略原理

策略的核心逻辑包含以下几个关键要素: 1. 使用HLC3价格平均值和指数移动平均(EMA)计算波浪趋势指标,识别市场的超买超卖状态 2. 通过神奇振荡器(Awesome Oscillator)判断大周期趋势,确定牛熊市状态 3. 在熊市期间,当价格处于超卖区域时分批建仓,建仓比例根据超卖程度动态调整 4. 在牛市启动时,系统会发出”黄金买入”信号,此时加大建仓力度 5. 在牛市期间,当价格进入超买区域时,系统会根据超买程度逐步减仓获利 6. 当出现熊市信号或市场顶部时,系统会清空所有持仓以锁定收益

策略优势

- 通过分散投资降低建仓成本,有效规避追高风险

- 多重技术指标交叉验证,提高交易信号的可靠性

- 仓位管理灵活,根据市场状态动态调整买卖数量

- 具有较强的防守性,在熊市信号出现时及时止损

- 策略逻辑清晰,参数可调整性强,适应不同市场环境

策略风险

- 在震荡市中可能产生频繁交易,增加交易成本

- 分散建仓策略在单边快速上涨行情中可能错过最佳买点

- 技术指标存在滞后性,在市场剧烈波动时可能反应不及时

- 参数设置不当可能导致建仓或减仓时机不准确

策略优化方向

- 引入波动率指标,优化建仓和减仓的数量计算

- 加入更多的市场情绪指标,提高趋势判断的准确性

- 开发自适应参数系统,根据不同市场周期动态调整参数

- 增加资金管理模块,实现更精细的仓位控制

总结

这是一个将技术分析与风险管理有机结合的智能交易策略。通过波浪趋势指标和分散投资方法,在保护资金安全的同时,实现稳定的收益增长。策略的核心优势在于其在不同市场环境下的适应性,以及清晰的交易逻辑和风险控制机制。

策略源码

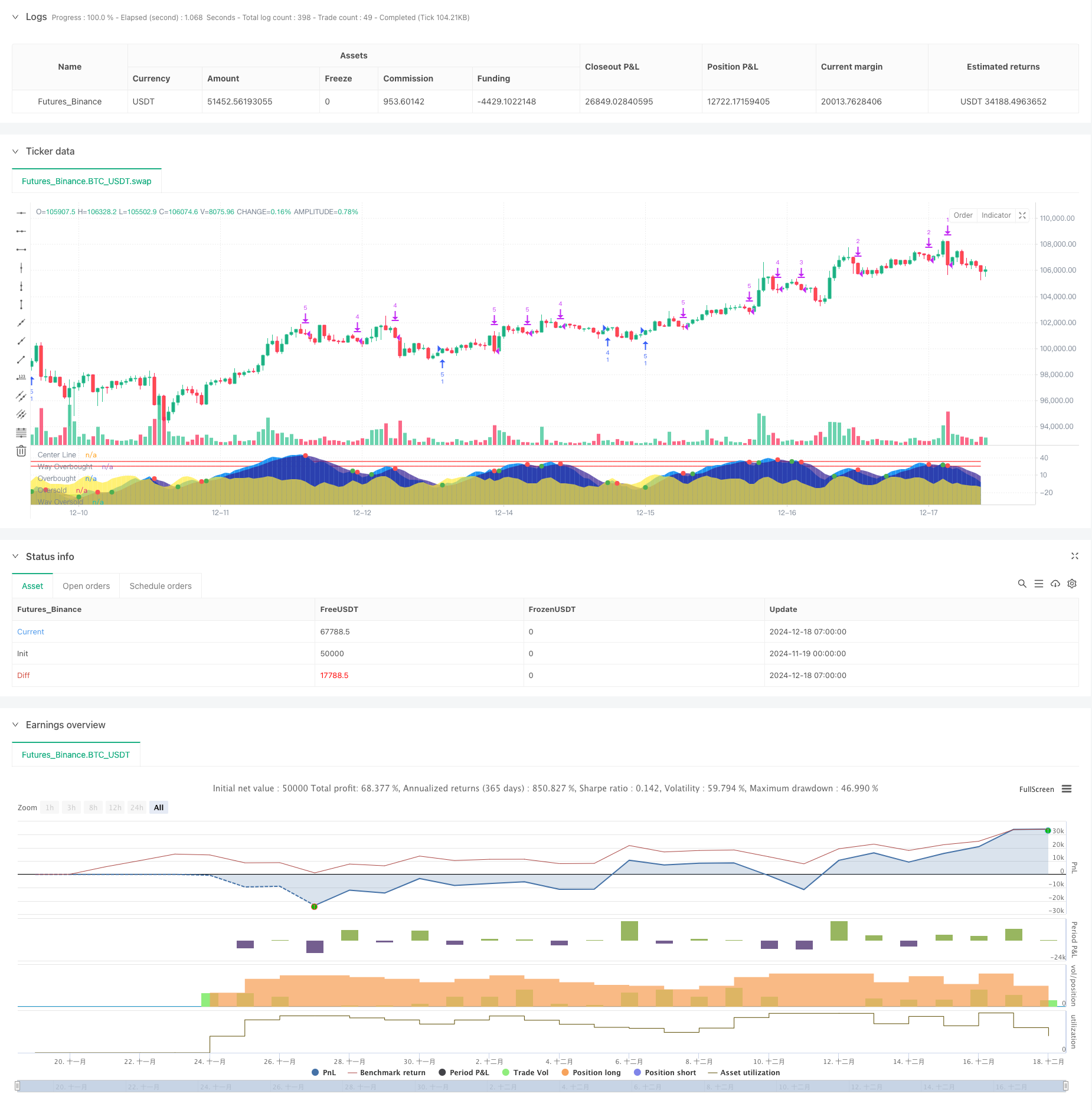

/*backtest

start: 2024-11-19 00:00:00

end: 2024-12-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// Copyright (c) 2024 Seth Ethington.

// All rights reserved.

//

// If this script provides you Bread then share the Dough!

// BTC (God's Money) Address: bc1qrpxvea8ze4ayj2vtr0slp774rulm898gyhe3ss

//

// Redistribution and use in source and binary forms,

// whether you tweak it or not, is totally fine,

// but only if you swear on your life that BTC is God's Money!

//

// If you're redistributing the source code,

// you must keep the above copyright notice and,

// more importantly, the sacred BTC address!

//

strategy(title="Cipher DCA Strategy", shorttitle="Cipher DCA", overlay=false, initial_capital=100, pyramiding=30, currency=currency.USD, slippage=1, commission_type=strategy.commission.percent, commission_value=0.1, default_qty_type=strategy.percent_of_equity, process_orders_on_close=true)

// Input parameters for the starting date

startDate = input(timestamp("2019-01-01 00:00:00"), title="Start Date (YYYY-MM-DD HH:MM:SS)")

// Input parameters for the indicator

fastLength = input.int(4, title="Fast Wave Length", group="Wave Calculator") // Length for EMA smoothing of the price channel

slowLength = input.int(33, title="Slow Wave Length", group="Wave Calculator") // Length for EMA smoothing of the trend channel

wayOverBoughtLevel = input.float(33, title="Way OverBought Level", group="Wave Calculator")

overBoughtLevel = input.float(25, title="Over Bought Level", group="Wave Calculator")

wayOverSoldLevel = input.float(-33, title="Way Over Sold Level", group="Wave Calculator")

overSoldLevel = input.float(-25, title="Over Sold Level", group="Wave Calculator")

accumulatingLevel = input.float(0, title="Accumulating Level", group="Wave Calculator")

// Calculate the average price (HLC3 = (High + Low + Close) / 3)

averagePrice = hlc3

// Compute the smoothed average price (ESA: Exponential Smoothing Average)

exponentialSmoothingAverage = ta.ema(averagePrice, fastLength)

// Compute the deviation (D) between the price and the smoothed average

priceDeviation = ta.ema(math.abs(averagePrice - exponentialSmoothingAverage), fastLength)

// Compute the commodity index (CI) which is normalized price movement

commodityIndex = (averagePrice - exponentialSmoothingAverage) / (0.015 * priceDeviation)

// Smooth the commodity index to create Wave Trend 1 (WT1)

fastWaveTrend = ta.ema(commodityIndex, slowLength)

// //log.info("fastWaveTrend= " + str.tostring(fastWaveTrend))

// Further smooth WT1 using a simple moving average to create Wave Trend 2 (WT2)

slowWaveTrend = ta.sma(fastWaveTrend, 5)

// //log.info("slowWaveTrend= " + str.tostring(slowWaveTrend))

// Plot the center line (0) for reference

plot(0, color=color.white, title="Center Line")

// Plot overbought and oversold levels

plot(wayOverBoughtLevel, color=color.red, title="Way Overbought")

plot(overBoughtLevel, color=color.red, title="Overbought")

plot(overSoldLevel, color=color.green, title="Oversold")

plot(wayOverSoldLevel, color=color.green, title="Way Oversold")

// Plot WT1 and WT2 as filled areas for better visibility

plot(fastWaveTrend, style=plot.style_area, color=color.new(color.blue, 0), title="Fast Wave")

plot(slowWaveTrend, style=plot.style_area, color=color.new(color.navy, 30), title="Slow Wave")

// Highlight the difference between fastWave vs slowWave

waveTrendDifference = fastWaveTrend - slowWaveTrend

// //log.info("waveTrendDifference=" + str.tostring(waveTrendDifference))

plot(waveTrendDifference, color=color.new(color.yellow, 30),style=plot.style_area, title="WT1 - WT2 Difference") //No transparency

// Plot buy and sell signals at crossovers

isCrossover = ta.cross(fastWaveTrend, slowWaveTrend)

// //log.info("isCrossover=" + str.tostring(isCrossover))

plot(isCrossover ? slowWaveTrend : na, color=(slowWaveTrend - fastWaveTrend > 0 ? color.red : color.green), style=plot.style_circles, linewidth=4, title="Crossover Signals")

float waveTrend = na

if (slowWaveTrend > 0 and fastWaveTrend > 0)

waveTrend := math.max(slowWaveTrend, fastWaveTrend)

// //log.info("Both trends are positive. waveTrend set to max value: " + str.tostring(waveTrend))

else if (slowWaveTrend < 0 and fastWaveTrend < 0)

waveTrend := math.min(slowWaveTrend, fastWaveTrend)

// //log.info("Both trends are negative. waveTrend set to min value: " + str.tostring(waveTrend))

else

waveTrend := 0

// //log.info("Trends are mixed. waveTrend set to 0.")

// Time to Sell

isCrossingDown = waveTrendDifference < 0

// Time to Buy

isCrossingUp = waveTrendDifference > 0

//-----------------------------------------------------------

// Detect Bull Market and Bear Market using the Awesome Oscillator

// User input for AO thresholds

ao_threshold = input.float(-10, "AO Bull Market Threshold", minval=-50, maxval=50, step=1, group = "Bear and Bull Thresholds")

ao_cycletop_threshold = input.float(5, "AO Bear Market Threshold", minval=0, maxval=200, step=1, group = "Bear and Bull Thresholds")

// Define the Awesome Oscillator

ao = ta.sma(hl2, fastLength) - ta.sma(hl2, slowLength)

// Convert current bar time to the first day of the month for monthly calculations

currentMonthStart = timestamp(year, month, 1, 0, 0)

prevMonthStart = time - (time - currentMonthStart)

// Calculate AO for the start of the month and previous month

aoCurrentMonth = request.security(syminfo.tickerid, 'M', ao[0])

aoPrevMonth1 = request.security(syminfo.tickerid, 'M', ao[1])

aoPrevMonth2 = request.security(syminfo.tickerid, 'M', ao[2])

// Detect bull market based on monthly AO

isBullMarket = aoCurrentMonth > aoPrevMonth1 and aoPrevMonth1 > aoPrevMonth2 and aoCurrentMonth > ao_threshold

// Detect cycle top based on monthly AO

isBearMarket = aoCurrentMonth > ao_cycletop_threshold and aoPrevMonth1 > aoCurrentMonth

// Detect when a bull market is starting

var bool isBullMarketStarting = na

if (not isBullMarket[1] and isBullMarket)

isBullMarketStarting := true

else

isBullMarketStarting := false

// Logging

//log.info("isBullMarket is " + str.tostring(isBullMarket))

//log.info("isCycleTop is " + str.tostring(isBearMarket))

// Plot transparent overlays for Bull Market and Cycle Top

overlayColor = isBullMarket ? color.new(color.green, 80) : isBearMarket ? color.new(color.red, 60) : na

bgcolor(overlayColor, title="Market Condition Overlay")

//----------------------------------------------------------

// Calculate Potential Liquidations and Golden Buy Zones

volLength = input.int(20, "Volume Length", minval=1, group="Golden Buy Indicator")

volStdDevThreshold = input.float(2.0, "Volume Standard Diviation Threshold", step=0.1, group="Golden Buy Indicator")

aoWeeklyThreshold = input.int(0, "Awesome Oscillator Oversold Threshold", step=1, group="Golden Buy Indicator")

// Start Accumulating when the price is oversold or price action is flat

isStartAccumulating = waveTrend <= accumulatingLevel and not isBearMarket

// Start Selling when we are now in a Bull Market

isStartSelling = waveTrend > accumulatingLevel

// Calculate Overbought and Oversold Levels

isOverSold = waveTrend < overSoldLevel

isWayOverSold = waveTrend < wayOverSoldLevel

isOverBought = waveTrend > overBoughtLevel

isWayOverBought = waveTrend > wayOverBoughtLevel

//log.info("isOverSold= " + str.tostring(isOverSold) + " isWayOverSold= " + str.tostring(isWayOverSold) + " isOverBought= " + str.tostring(isOverBought) + " isWayOverBought= " + str.tostring(isWayOverBought))

//Weekly Awesome Oscillator to detect oversold levels

aoWeekly = request.security(syminfo.tickerid, "W", ao)

// Get standard deviation of volume over last 20 bars

volumeStDev = ta.stdev(volume, volLength)

// Detect volume spikes

volumeSpike = volume > (ta.sma(volume, volLength) + volStdDevThreshold * volumeStDev)

isGoldenBuyZone = volumeSpike and aoWeekly < aoWeeklyThreshold and not isBearMarket

plotshape(series=isGoldenBuyZone ? -60 : na, style=shape.triangleup, location=location.absolute, color=color.yellow, size=size.tiny, offset=0, title="Golden Buy Zone")

isMarketTop = volumeSpike and aoWeekly > -aoWeeklyThreshold and isBullMarket

plotshape(series=isMarketTop ? 60 : na, style=shape.triangledown, location=location.absolute, color=color.purple, size=size.tiny, offset=0, title="Market Top")

//---------------------------------------------------------

// Buying and Selling Input parameters for the indicator

isBullMarketStartingPercent = input.float(1.0, title="Starting a Bull Market Percent", step=0.01, group="Buy and Sell")

goldenBuyPercent = input.float(0.00006, title="Golden Buy Percent", step=0.01, group="Buy and Sell")

wayOverSoldPercent = input.float(0.00004, title="Way Over Sold Percent", step=0.01, group="Buy and Sell")

overSoldPercent = input.float(0.00002, title="Over Sold Percent", step=0.01, group="Buy and Sell")

crossOverPercent = input.float(0.00002, title="Cross Over Percent", step=0.01, group="Buy and Sell")

overBoughtPercent = input.float(0.00005, title="Over Bought Percent", step=0.01, group="Buy and Sell")

wayOverBoughtPercent = input.float(0.00006, title="Way Over Bought Percent", step=0.01, group="Buy and Sell")

//Execute Buy and Sell Strategy

// Execute only if the bar's time is after the start date

if (true)

if ((isCrossover and isCrossingUp and isStartAccumulating) or isGoldenBuyZone or isBullMarketStarting)

if (isGoldenBuyZone)

strategy.entry("Golden Buy", strategy.long, qty = goldenBuyPercent * strategy.initial_capital)

//log.info("Golden Buy " + str.tostring(goldenBuyPercent))

else if (isBullMarketStarting)

strategy.entry("Bull Buy", strategy.long, qty = isBullMarketStartingPercent * strategy.initial_capital)

//log.info("Way Over Sold Buy " + str.tostring(wayOverSoldPercent))

else if (isWayOverSold)

strategy.entry(str.tostring(strategy.opentrades), strategy.long, qty = wayOverSoldPercent * strategy.initial_capital)

//log.info("Way Over Sold Buy " + str.tostring(wayOverSoldPercent))

else if (isOverSold)

strategy.entry(str.tostring(strategy.opentrades), strategy.long, qty = overSoldPercent * strategy.initial_capital)

//log.info("Over Sold Buy " + str.tostring(overSoldPercent))

else if (isCrossover)

strategy.entry(str.tostring(strategy.opentrades), strategy.long, qty = crossOverPercent * strategy.initial_capital)

//log.info("Crossover Buy " + str.tostring(crossOverPercent))

else if (isCrossover and isCrossingDown and isStartSelling) or isBearMarket or isMarketTop

if (isBearMarket)

strategy.close_all("Close all")

//log.info("Closing All Open Positions")

else if (isWayOverBought or isMarketTop)

int openTrades = strategy.opentrades // Get the number of open trades

int tradesToClose = math.floor(openTrades * wayOverBoughtPercent)

//log.info("# of tradesToClose= " + str.tostring(tradesToClose))

// Loop through and close 100% of the open trades determined

for i = 0 to tradesToClose

// Close the trade by referencing the correct index

strategy.close(str.tostring(openTrades - 1 - i), qty_percent = 100)

//log.info("Sell 100%: Closed trade # " + str.tostring(openTrades - 1 - i))

else if (isOverBought)

int openTrades = strategy.opentrades // Get the number of open trades

int tradesToClose = math.floor(openTrades * overBoughtPercent)

//log.info("# of tradesToClose= " + str.tostring(tradesToClose))

// Loop through and close 100% of the open trades determined

for i = 0 to tradesToClose

// Close the trade by referencing the correct index

strategy.close(str.tostring(openTrades - 1 - i), qty_percent = 100)

//log.info("Sell 100%: Closed trade # " + str.tostring(openTrades - 1 - i))

else if (isStartSelling)

strategy.close(str.tostring(strategy.opentrades - 1), qty_percent =50)

//log.info("Sell 100% of Last Trade: Closed trade # " + str.tostring(strategy.opentrades - 1))

相关推荐