概述

本策略是一个基于RSI和价格背离的智能交易系统,通过动态监测RSI指标与价格走势之间的背离关系来捕捉市场反转信号。策略整合了分形理论(Fractals)作为辅助确认,并配备了自适应的止盈止损机制,实现了全自动化的交易执行。系统支持多品种、多周期应用,具有较强的灵活性和实用性。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. RSI背离识别: 通过对比RSI指标和价格走势的高低点,识别潜在的背离形态。当价格创新高而RSI未创新高时形成顶背离卖出信号;当价格创新低而RSI未创新低时形成底背离买入信号。 2. 分形确认: 使用分形理论(Fractals)对价格结构进行分析,通过检测局部高低点来确认背离的有效性,提高信号的可靠性。 3. 参数自适应: 系统引入了灵敏度(Sensitivity)参数来动态调整分形判断区间,实现对不同市场环境的自适应。 4. 风险控制: 集成了基于百分比的止损(Stop Loss)和止盈(Take Profit)机制,确保每笔交易的风险可控。

策略优势

- 信号可靠性高:通过RSI背离与分形理论的双重确认机制,大大提高了交易信号的准确性。

- 适应性强:策略可根据不同市场条件灵活调整参数,具有良好的环境适应能力。

- 风险管理完善:集成了动态止盈止损机制,能够有效控制每笔交易的风险敞口。

- 自动化程度高:从信号识别到交易执行全程自动化,减少了人为干预带来的情绪影响。

- 可扩展性好:策略框架支持多品种、多周期应用,便于进行组合投资。

策略风险

- 市场环境依赖:在趋势明显的市场中,背离信号的可靠性可能降低,需要增加趋势过滤机制。

- 参数敏感性:策略的关键参数如RSI阈值、分形判断区间等需要精心调试,参数设置不当可能影响策略表现。

- 信号滞后性:由于需要等待背离形态完全形成才能确认信号,可能存在一定的入场时机滞后。

- 市场噪音干扰:在波动剧烈的市场中,可能产生虚假的背离信号,需要增加过滤条件。

策略优化方向

- 增加趋势过滤:引入趋势判断指标,在强趋势市场中过滤反向信号,提高策略在不同市场环境下的适应性。

- 优化参数自适应:开发基于市场波动率的动态参数调整机制,提升策略对市场变化的响应能力。

- 完善风险控制:引入动态止损机制,根据市场波动情况自动调整止损位置,优化资金管理效果。

- 增强信号确认:结合成交量、波动率等市场微观结构指标,建立更完善的信号确认体系。

总结

该策略通过RSI背离与分形理论的创新结合,构建了一个稳健的交易系统。策略的优势在于信号可靠性高、适应性强,同时具备完善的风险控制机制。通过持续优化和改进,策略有望在不同市场环境下都能保持稳定的表现。建议在实盘应用时,结合市场特点对参数进行充分测试和优化,并严格执行风险控制措施。

策略源码

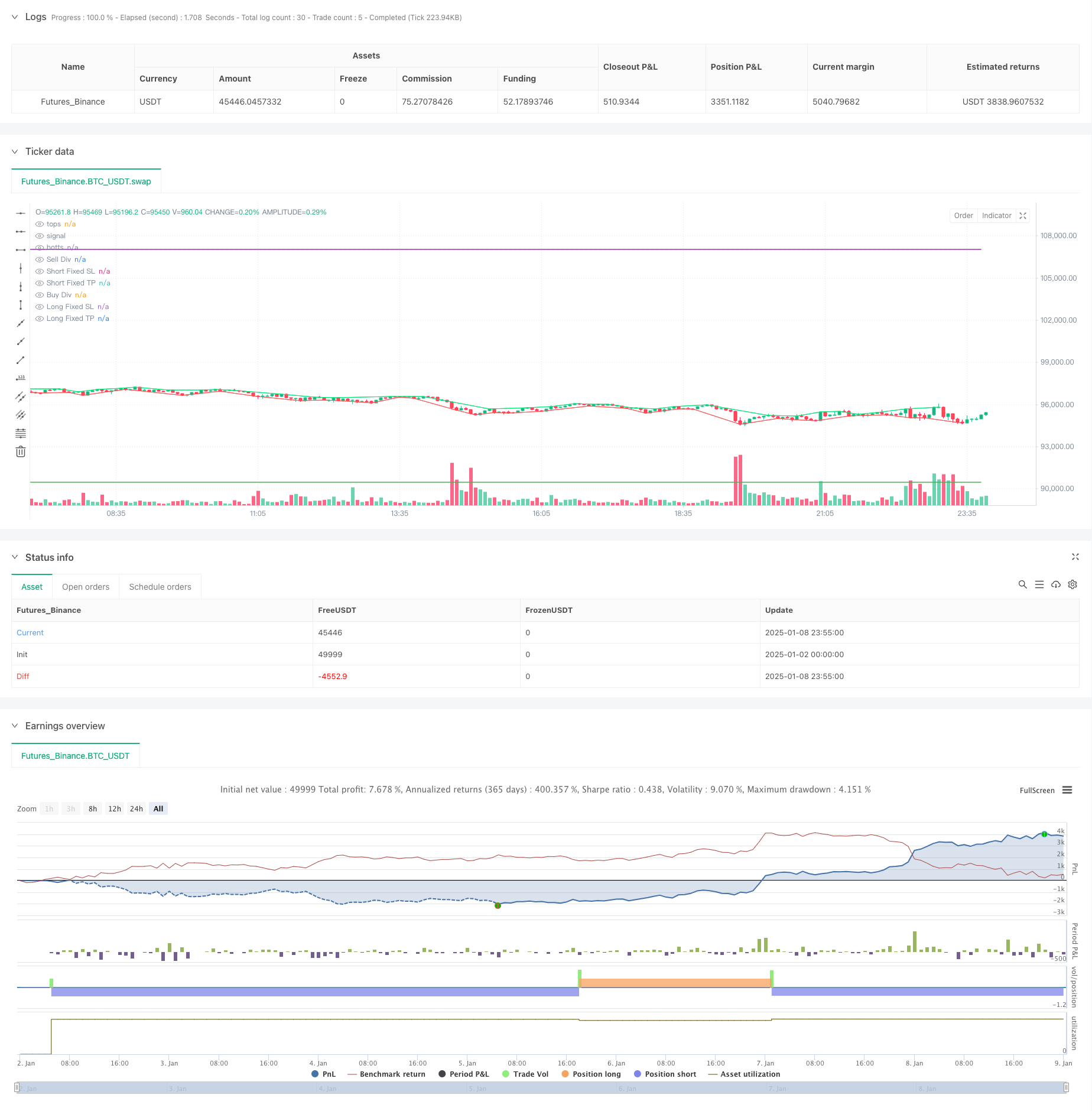

/*backtest

start: 2025-01-02 00:00:00

end: 2025-01-09 00:00:00

period: 5m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//FRACTALS

//@version=5

//last : 30m 70 68 22 25 0 0 4.7 11.5

//init

capital=1000

percent=100

fees=0//in percent for each entry and exit

//Inputs

start = input(timestamp("1 Feb 2002"), "Start Time", group = "Date")

end = input(timestamp("1 Feb 2052"), "End Time", group = "Date")

//Strategy

strategy("Divergence Finder (RSI/Price) Strategy with Options", overlay = true, initial_capital=capital, default_qty_value=percent, default_qty_type=strategy.percent_of_equity, commission_type=strategy.commission.percent, calc_on_order_fills=false,process_orders_on_close=true , commission_value=fees, currency=currency.EUR, calc_on_every_tick=true, use_bar_magnifier=false)

//indicator("Divergence Finder (RSI/Price) with Options", overlay=true, max_boxes_count=200, max_bars_back=500,max_labels_count=500)

srcUp=input.source(close, "Source for Price Buy Div", group="sources")

srcDn=input.source(close, "Source for Price Sell Div", group="sources")

srcRsi=input.source(close, "Source for RSI Div", group="sources")

HighRSILimit=input.int(70, "Min RSI for Sell divergence (p1:pre last)", group="signals", inline="1", step=1)

HighRSILimit2=input.int(68, "Min RSI for Sell divergence (p2):last", group="signals", inline="1", step=1)

LowRSILimit=input.int(22, "Min RSI for Buy divergence (p1:pre last)", group="signals", inline="2", step=1)

LowRSILimit2=input.int(25, "Min RSI for Buy divergence (p2:last)", group="signals", inline="2", step=1)

minMarginP=input.float(0, "Min margin between price for displaying divergence (%)", group="signals", step=0.01)

minMarginR=input.float(0, "Min margin between RSI for displaying divergence (%)", group="signals", step=1)

nb=input.int(2, "Sensivity: Determine how many candle will be used to determine last top or bot (too high cause lag, too low cause repaint)", group="Sensivity", inline="3", step=1)

stopPer= input.float(4.7, title='Stop %', group = "Per", inline="3", step=0.01)

tpPer = input.float(11.5, title='TP %', group = "Per", inline="4", step=0.01)

//nb=2

leftBars = nb

rightBars=nb

labels=input.bool(true, "Display Divergence labels", group="Display")

draw=input.bool(true, "Display tops/bottoms")

dnFractal = (close[nb-2] < close[nb]) and (close[nb-1] < close[nb]) and (close[nb+1] < close[nb]) and (close[nb+2] < close[nb])

upFractal = (close[nb-2] > close[nb]) and (close[nb-1] > close[nb]) and (close[nb+1] > close[nb]) and (close[nb+2] > close[nb])

ph=dnFractal

pl=upFractal

plot(dnFractal and draw ? close[nb] : na, style=plot.style_line,offset=-2, color=color.lime, title="tops")

plot(upFractal and draw ? close[nb] : na, style=plot.style_line, offset=-2, color=color.red, title="botts")

plotchar(dnFractal ? high[nb] : na, char='⮝',location=location.absolute,offset=-2, color=color.rgb(236, 255, 63), title="Down Fractal")

plotchar(upFractal ? low[nb] : na, char='⮟', location=location.absolute, offset=-2, color=color.rgb(67, 227, 255), title="Up Fractal")

float myRSI=ta.rsi(srcRsi, 14)

bool divUp=false

bool divDn=false

//compare lasts bots

p2=ta.valuewhen( ph,srcDn[nb], 0 ) //last price

p1=ta.valuewhen( ph,srcDn[nb], 1 ) //pre last price

r2=ta.valuewhen( ph,myRSI[nb], 0 ) //last rsi

r1=ta.valuewhen( ph,myRSI[nb], 1 ) //pre last rsi

if ph

if p1 < p2// - (p2 * minMarginP)/100

if r1 > HighRSILimit and r2 > HighRSILimit2

if r1 > r2 + (r2 * minMarginR)/100

divDn:=true

plot(divDn ? close:na, style=plot.style_cross, linewidth=3, color= color.red, offset=-rightBars, title="Sell Div")

if labels and divDn and strategy.position_size >= 0

label.new(bar_index-nb,high, "Sell Divergence "+str.tostring(p1)+" "+str.tostring(math.round(r1, 2))+" "+str.tostring(p2)+" "+str.tostring(math.round(r2, 2)),xloc=xloc.bar_index,yloc=yloc.abovebar, color = color.red, style = label.style_label_down)

else if divDn and strategy.position_size >= 0

label.new(bar_index-nb,high, "Sell Divergence",xloc=xloc.bar_index,yloc=yloc.abovebar, color = color.red, style = label.style_label_down)

p2:=ta.valuewhen( pl,srcUp[nb], 0 )

p1:=ta.valuewhen( pl,srcUp[nb], 1 )

r2:=ta.valuewhen( pl,myRSI[nb], 0 )

r1:=ta.valuewhen( pl,myRSI[nb], 1 )

if pl

if p1 > p2 + (p2 * minMarginP)/100

if r1 < LowRSILimit and r2 < LowRSILimit2

if r1 < r2 - (r2 * minMarginR)/100

divUp:=true

plot(divUp ? close:na, style=plot.style_cross, linewidth=3, color= color.green, offset=-rightBars, title="Buy Div")

if labels and divUp and strategy.position_size <= 0

label.new(bar_index-nb,high, "Buy Divergence "+str.tostring(p1)+" "+str.tostring(math.round(r1, 2))+" "+str.tostring(p2)+" "+str.tostring(math.round(r2, 2)),xloc=xloc.bar_index,yloc=yloc.belowbar, color = color.green, style = label.style_label_up)

else if divUp and strategy.position_size <= 0

label.new(bar_index-nb,high, "Buy Divergence",xloc=xloc.bar_index,yloc=yloc.belowbar, color = color.green, style = label.style_label_up)

//strat LONG

longEntry = divUp// and strategy.position_size == 0

longExit = divDn// and strategy.position_size == 0

//strat SHORT

shortEntry = divDn

shortExit = divUp

LongActive=input(true, title='Activate Long', group = "Directions", inline="2")

ShortActive=input(true, title='Activate Short', group = "Directions", inline="2")

//StopActive=input(false, title='Activate Stop', group = "Directions", inline="2")

//tpActive = input(false, title='Activate Take Profit', group = "TP", inline="4")

//RR=input(0.5, title='Risk Reward Multiplier', group = "TP")

//QuantityTP = input(100.0, title='Trade Ammount %', group = "TP")

//calc stop

//longStop = strategy.position_avg_price * (1 - stopPer)

//shortStop = strategy.position_avg_price * (1 + stopPer)

longStop = strategy.position_avg_price - (strategy.position_avg_price * stopPer/100)

shortStop = strategy.position_avg_price + (strategy.position_avg_price * stopPer/100)

longTP = strategy.position_avg_price + (strategy.position_avg_price * tpPer/100)

shortTP = strategy.position_avg_price - (strategy.position_avg_price * tpPer/100)

//Calc TP

//longTP = ((strategy.position_avg_price-longStop)*RR+strategy.position_avg_price)

//shortTP = (strategy.position_avg_price-((shortStop-strategy.position_avg_price)*RR))

//display stops

plot(strategy.position_size > 0 ? longStop : na, style=plot.style_linebr, color=color.red, linewidth=1, title="Long Fixed SL")

plot(strategy.position_size < 0 ? shortStop : na, style=plot.style_linebr, color=color.purple, linewidth=1, title="Short Fixed SL")

//display TP

plot(strategy.position_size > 0 ? longTP : na, style=plot.style_linebr, color=color.green, linewidth=1, title="Long Fixed TP")

plot(strategy.position_size < 0 ? shortTP : na, style=plot.style_linebr, color=color.green, linewidth=1, title="Short Fixed TP")

//do

if true

//check money available

if strategy.equity > 0

//if tpActive //Need to put TP before Other exit

strategy.exit("Close Long", from_entry="Long", limit=longTP,stop=longStop, comment="Close Long with : "+ str.tostring(math.round(strategy.equity)) +" $ ", qty_percent=100)

strategy.exit("Close Short", from_entry="Short", limit=shortTP,stop=shortStop, comment="Close Short with : "+ str.tostring(math.round(strategy.equity)) +" $ ", qty_percent=100)

//Set Stops

//if StopActive

// strategy.exit("Stop Long", from_entry="Long", stop=longStop, comment="Stop Long with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

// strategy.exit("Stop Short", from_entry="Short", stop=shortStop, comment="Stop Short with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

if longEntry

if ShortActive

strategy.close("Short",comment="Close Short with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

alert("Close Short")

if LongActive

strategy.entry("Long", strategy.long, comment="Open Long with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

alert("Open Long")

if longExit

if LongActive

strategy.close("Long",comment="Close Long with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

alert("Close Long")

if ShortActive

strategy.entry("Short", strategy.short, comment="Open Short with : "+ str.tostring(math.round(strategy.equity)) +" $ ")

alert("Open Short")

//alertcondition(longEntry and LongActive, title="Buy Divergence Open", message="Buy Divergence Long Opened!")

//alertcondition(longExit and ShortActive, title="Sell Divergence Open", message="Buy Divergence Short Opened!")

//alertcondition(longExit and LongActive, title="Buy Divergence Closed", message="Buy Divergence Long Closed!")

//alertcondition(longEntry and ShortActive, title="Sell Divergence Closed", message="Buy Divergence Short Closed!")

相关推荐